Shares Issued: 151,402,324

THUNDER BAY, ON, Jan. 28, 2014 /CNW/ - PREMIER GOLD MINES LIMITED ("Premier" or "the Company") (TSX:PG) is pleased to announce the results of independent Preliminary Economic

Assessment Studies ("PEA") on the Company's 100%-owned Hardrock and

Brookbank Deposits in Northwestern Ontario. The PEA Studies were

prepared by Stantec Mining with contributions from BBA Inc., InnovExplo

Inc. and Micon International Limited, and completed in accordance with

National Instrument 43-101 ("NI 43-101"). The technical report with

respect to both PEA's will be filed on the Company's website and on

SEDAR within 45 days. The Company has also scheduled a conference call and webcast for

investors and analysts at 1:30 p.m. (Eastern Time) Tuesday, January 28,

2014. Details for the call can be found at the bottom of this press

release.

The Hardrock PEA Study was prepared as an open-pit only mining project

related solely to the mineral resources reported on October 29th, 2013 by the Company (press release "Premier Gold Releases Updated

Mineral Resource Estimate On Hardrock Deposit"), for the Hardrock

Project (a part of the Trans-Canada Property) some 260 kilometres by

highway northeast of Thunder Bay, Ontario just south of Geraldton.

The Brookbank PEA Study was prepared as a combined open-pit and

underground mining project related solely to the mineral resources

reported on December 19th, 2012 by the Company (press release "Premier Gold Releases Trans-Canada

Property Resource Estimates On Four Deposits") for the Brookbank

Deposit. Brookbank is located some 77 kilometres by road and highway

west of the Hardrock Deposit.

Highlights of the 2014 PEA Studies (all currency amounts in Canadian

dollars unless otherwise stated) include:

Hardrock Project Estimates

- Average annual gold production during the first 8 years of 253,100

ounces with life of mine "LOM" (15 years) annual production of 202,700 ounces

(including low-grade stockpiles).

- Average grade over the first 8 years of 1.50 grams per tonne gold "g/t

Au" with a LOM average grade of 1.18 g/t Au (including low-grade

stockpiles).

- Initial processing of 10,000 tonnes per day "tpd", expanding to 18,000 tpd in Year 3.

- Pre-production capital costs of $410.6 million including $83 million for contingency.

- Pre-tax net present value "NPV" (at a 5% discount rate) of $519 million

at US$1250 gold.

- Pre-tax internal rate of return "IRR" of 23.0% and a 3.5 year payback at

US$1250 gold.

Brookbank Project Estimates

- Pre-tax NPV (at 5% discount rate) of $76 million and IRR of 30.7% at

US$1250 gold when rock is trucked to Hardrock versus stand alone processing option.

- Average annual gold production during LOM (7 years) of 48,700 ounces.

Ewan Downie, President and CEO of Premier Gold Mines stated, "The

completion of these PEA's represent a significant milestone for our

technical teams and a very high quality and achievable opportunity for

our shareholders. Economics compare favourably to peer projects and

Premier is well-financed to move the projects aggressively through to

feasibility."

Hardrock Project

Mineral Resources Used In PEA

The Hardrock PEA study assumes that open pit mining only will be used

for resource extraction.This was judged to be the quickest and least risky proposition of

converting resource to reserves and execution. The mineral resource

estimate, as reported on October 29, 2013, excluded the impact of mining dilution, which is the incidence of

waste rock extracted together with mineralized material.

For the PEA, open pit mining dilution is calculated as 5% at 0 g/t gold.

Open pit resources have been calculated assuming a material loss of 5%.

With an open pit cut-off grade of 0.35 g/t gold, the resulting tonnages

and grades for the open pit conceptual mine plan, including planned

low-grade stockpiles, is shown in Table 1.

Table 1 Diluted Open Pit Mineral Resources Used in Hardrock PEA Study

| Cut-off Category |

Resource

Category | Tonnes (Mt) | Gold (Au)

Grade (g/t) | Au Ounces

(Moz) |

Open Pit (O/P)

| Indicated

Inferred | 64.663

24.669 | 1.18

1.18 | 2.454

0.938 |

The Hardrock PEA is preliminary in nature and it includes inferred

mineral resources that are considered too speculative geologically to

have the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty that

the Hardrock PEA will be realized.

Mineral resources are not mineral reserves and do not have demonstrated

economic viability. All figures are rounded to reflect the relative

accuracy of the estimate. All assays have been capped where

appropriate.

Mining

The Hardrock PEA assumes the processing of an average 10,000 tonnes per

day of material during the first two (2) years of production, followed

by an expansion to 18,000 tonnes per day in Year 3 for the remainder of

the mine life (13 years), from a combination of direct process open pit

material and stockpile reclaiming operations.

The open pit mine and stockpiling reclaim plan is a 15-year plan that

utilizes a stockpile strategy to maximize grade to the mill and mines

to an ultimate depth of 460 metres below surface.

The Hardrock open pit is designed as a conventional surface mining

operation blasting 30 million tonnes of material per year in the first

two years of operations and 45 million tonnes per year thereafter. The

primary equipment fleet would consist of up to two 27 m3 hydraulic shovels, one 15 m3 hydraulic shovel, one 18 m3 wheel loader, 150 and 250 tonne-class haul trucks, and a fleet of

support equipment. Production drilling will be carried out by up to

five diesel-powered track-mounted units on 203 mm holes. Operating

bench heights of 10 metres have been assumed for mining operations.

Over the life of the open pit, a total of 391 million tonnes of waste

rock and overburden material would be moved. During the pre-production

period, 1.6 million tonnes of overburden and waste rock would be

removed as part of development work. Waste rock-to-mill-feed operating

strip ratio are expected to average 5.37 during mining operations and

4.38 over the life of the mine (including low grade stockpiles and

overburden).

Open pit mining operating costs include mine supervision, drilling,

blasting, loading, hauling, services, dumps, roads and maintenance

costs. These costs were evaluated using data from other similar

projects and from budget quotes provided by suppliers. An extra 38% was

added to the salaries to account for benefits, and depending on the

job, bonuses were also included. Table 2 presents a summary of the

estimated operating costs. A maximum of 207 direct positions have been

estimated for mining requirements based on past experience and industry

averages.

Table 2 Summary by Total, Per Tonne Mined & Per Tonne Milled of

Estimated Hardrock Operating Costs

| Cost Centre | Total

Pre-Production

Cost | Total

Production | Total

Project

Cost | Unit Cost Per

Tonne Mined | Unit Cost

Per Tonne Milled |

|

|

| Technical services |

|

|

|

|

|

|

Engineering

|

$440,000.00

|

$17,113,000.00

|

$17,553,000.00

|

$0.04

|

$0.20

|

|

Geology

|

$477,000.00

|

$30,161,000.00

|

$30,638,000.00

|

$0.07

|

$0.34

|

| Mining cost |

|

|

|

|

|

|

Mine supervision

|

$460,000.00

|

$21,279,000.00

|

$21,739,000.00

|

$0.05

|

$0.24

|

|

Drilling

|

$433,000.00

|

$76,744,000.00

|

$77,177,000.00

|

$0.16

|

$0.86

|

|

Blasting

|

$865,000.00

|

$151,550,000.00

|

$152,415,000.00

|

$0.32

|

$1.71

|

|

Loading

|

$230,000.00

|

$44,939,000.00

|

$45,169,000.00

|

$0.10

|

$0.51

|

|

Hauling

|

$551,000.00

|

$247,663,000.00

|

$248,214,000.00

|

$0.52

|

$2.77

|

|

Services

|

$630,000.00

|

$81,360,000.00

|

$81,990,000.00

|

$0.18

|

$0.92

|

|

Dumps & Roads

|

$266,000.00

|

$59,178,000.00

|

$59,444,000.00

|

$0.13

|

$0.67

|

|

Maintenance

|

$1,081,000.00

|

$216,002,000.00

|

$217,083,000.00

|

$0.47

|

$2.43

|

|

Total | $5,433,000.00 | $945,989,000.00 | $951,422,000.00 | $2.04 | $10.65 |

Metallurgy & Processing

Recent metallurgical testing conducted during 2013 on open-pit resource

material served as a basis for the milling flowsheet developed by BBA.

The highlights of the process flowsheet include:

-

Primary crushing and two-stage grinding;

-

Gravity recovery;

-

Whole-rock carbon-in-leach circuit;

-

Cyanide destruction;

- Carbon stripping, electro-winning, and smelting to produce gold doré.

Major equipment for the initial process facility includes a gyratory

crusher sized for 18,000 tpd, a 32' x 14' semi-autogenous ("SAG") mill

and a 20' x 30.5' ball mill. Mill feed would be ground to a P80 of 75 µm before entering a gold leaching circuit. Major requirement

related to the 3rd year expansion to 18,000 tonnes per day include additional crushing,

ball milling, solid-liquid separation units and leach capacity.

Metallurgical recoveries for gold over the life of the mine are

expected to average 89.6%. No by-product credits are anticipated.

Table 3 Estimated Mill Operating Expenses per Tonne Milled

| Cost Centre | 10,000 TPD | 18,000 TPD |

Reagents

|

$ 3.11

|

$ 3.03

|

Consumables

|

$ 3.73

|

$ 3.24

|

Personnel

|

$ 1.68

|

$ 1.06

|

Utilities

|

$ 4.07

|

$ 3.76

|

|

TOTAL

|

$ 12.59

|

$ 11.09

|

The estimated mill operating expenses were based on available reagent

consumptions and additions from testwork, local manpower costs, and

industry standards where applicable. A breakdown of the mill operating

expenses is shown in Table 3. A roster total of 62 workers (increasing

to 71 with the 18,000 tpd expansion) is established for the milling and

assay lab requirements based on past experience and industry averages.

An electrical power cost of $0.08/kWh is assumed for this study.

Infrastructure

The Hardrock Project benefits from world-class infrastructure, services

and available labour within several communities in the immediate area.

The project site is located only 260 km from Thunder Bay, Ontario

(population 108,000), a few kilometres south of Geraldton, Ontario

(population 1,893) and at 32 kilometres west of Longlac (population

1,388) all within the Municipality of Greenstone, and the Long Lac

#58/Ginoogaming (population 600) First Nation Reserves. It resides

along the Trans-Canada Highway and is accessible year-round. The

Trans-Canada natural gas pipeline passes close to the site. Finally,

some infrastructure will need to be relocated to accommodate the

project.

Infrastructure is anticipated to include:

-

Plant site and haul roads, gate house, parking, bus station and weigh

station;

-

Administration building, including all services; engineering, geology,

administration, environment, health and safety, mine supervision, fire

fighting, emergency office (ERT) and human resources;

-

9 door open pit garage and warehouse;

-

Assay lab;

-

Electrical surface infrastructure;

-

Emulsion plant;

-

Fuel storage facilities;

-

Fresh water supply and fire protection;

-

Dewatering and water contact treatment plant;

-

Sewage treatment;

-

One tailings pond;

-

Power to the project supplied by an existing 115-kV transmission line

connected to the provincial grid;

A total of 65 workers have been estimated for the general and

administrative expense (G&A) requirements based on past experience and

industry averages. The G&A costs include, for the operation,

administrative personnel, general office supplies, safety and training

supplies, contracted consultant services, insurance, permits property

taxes, security, camp, building maintenance, environment management,

geology, engineering and all indirect cost. Estimated annual G&A costs

are summarized in Table 4.

Table 4 Annual G&A Cost Estimate for the Hardrock Mine

|

|

Total

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

11

|

12

|

13

|

14

|

15

|

|

Open Pit G&A (M$)

|

48.8

|

4.0

|

4.0

|

4.0

|

4.0

|

4.0

|

3.9

|

3.9

|

3.9

|

3.9

|

3.9

|

3.9

|

3.9

|

1.5

|

0.0

|

0.0

|

|

General G&A (M$)

|

129.5

|

9.2

|

9.7

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

9.8

|

5.7

|

3.5

|

3.4

|

|

Owner Indirects (M$)

|

9.0

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

0.6

|

The base price for the fuel used in calculations is $1.00/ litre.

Capital & Operating Costs

Open pit pre-production capital costs require a minimal overburden and

waste stripping component as the bedrock material to be mined is

already exposed on surface. The breakdown of open pit pre-production,

sustaining capital costs and mill expansion are summarized in Tables 5

and 6 respectively.

Table 5 Hardrock Pre-Production Capital Costs Estimate

| Capital Cost | Pre-Production

($ millions) |

|

Processing Plant (phase 1)

|

$193.2

|

|

Infrastructure and Earthwork

|

$52.7

|

|

Pre-Stripping and Owner's cost

|

$15.4

|

|

Tailings and Water Pipeline

|

$23.7

|

|

Indirects

|

$42.4

|

|

Contingency

|

$83.2

|

| Total Pre-Production Cost | $410.6 |

Table 6 Hardrock Sustaining and Mill Expansion Capital Costs

Estimate

| Capital Cost | LOM Sustaining

($ millions) | Mill Expansion

($ millions) |

|

Processing Plant (phase 2)

|

-

|

$105.1

|

|

Infrastructure and Earthwork

|

$38.5

|

-

|

|

Open Pit Equipment

|

$120.1

|

-

|

|

Tailings and Water Pipeline

|

$42.0

|

$9.0

|

|

Indirects

|

-

|

$18.9

|

|

Contingency

|

-

|

$33.2

|

| Total Cost | $200.6 | $166.2 |

The cash cost profiles on a per ounce and per tonne basis for the

Hardrock Project are summarized in Table 7 and Table 8 respectively.

Table 7 Hardrock Cash Cost Per Ounce Summary

| Cash Cost Summary (oz) | Years 1-8

($/oz) | LOM (Years 1-12)

Without stockpile

($/oz) | LOM (Years 1-15)

($/oz) |

|

Mining

|

291.06

|

320.80

|

302.77

|

|

Processing

|

261.26

|

294.51

|

329.38

|

|

G&A

|

56.17

|

61.40

|

61.60

|

|

Refining

|

4.00

|

4.00

|

4.00

|

| Cash Cost | 612.48 | 680.71 | 697.75 |

|

Royalties

|

39.35

|

39.35

|

39.35

|

| Total Cash Costs | 651.84 | 720.06 | 737.11 |

|

Sustaining Costs

|

85.78

|

69.35

|

66.03

|

| All-in Sustaining Costs | 737.62 | 789.41 | 803.14 |

Table 8 Hardrock Cash Cost Per Tonne Summary

| Cash Cost Summary (t) | Years 1-8

($/t) | LOM (Years 1-12)

Without stockpile

($/t) | LOM (Years 1-15)

($/t) |

|

Mining

|

12.62

|

12.24

|

10.30

|

|

Processing

|

11.32

|

11.24

|

11.21

|

|

G&A

|

2.43

|

2.34

|

2.10

|

|

Refining

|

0.18

|

0.16

|

0.14

|

| Cash Cost | 26.55 | 25.98 | 23.75 |

|

Royalties

|

1.70

|

1.50

|

1.34

|

| Total Cash Costs | 28.25 | 27.48 | 25.09 |

|

Sustaining Costs

|

3.72

|

2.65

|

2.25

|

| All-in Sustaining Costs | 31.97 | 30.13 | 27.34 |

Community

Premier is a proud member of the local Greenstone communities,

participating in a number of local events, initiatives and boards. The

company's community relations office provides members of the public

with the opportunity to engage with the company directly, outside of

regular communications, mailings, and open houses. Additionally,

Premier also has a site office, multiple staff residence properties and

extensive local staff.

Premier regularly engages with local Aboriginal communities, and is

proud of the relationship that has and continues to develop. Premier

utilizes personnel from local Aboriginal communities on the Hardrock

Project, such as representatives from each community as part of the

environmental monitoring team.

Environment

A formal environmental baseline work program has been ongoing since

2011. Since 2013, Premier began more extensive regional monitoring and

assessment work that was undertaken to gain a thorough understanding of

the current environmental conditions in the region, including the

impacts of the Trans-Canada Highway on this former industrial site.

Project Economics

Key economic performance metrics are summarized in Table 9 on both a

pre-tax and after-tax basis. A range of gold prices (US$) are shown

for sensitivity purposes only. At US$1250 gold price, the Hardrock

open pit project has a pre-tax Internal Rate of Return (IRR) of 23.0%

(19.% after-tax), a pre-tax NPV (discounted at 5%) of some $519 million

($359 million after-tax) and a payback of 3.5 years on a pre-tax basis

(3.9 years on an after-tax basis).

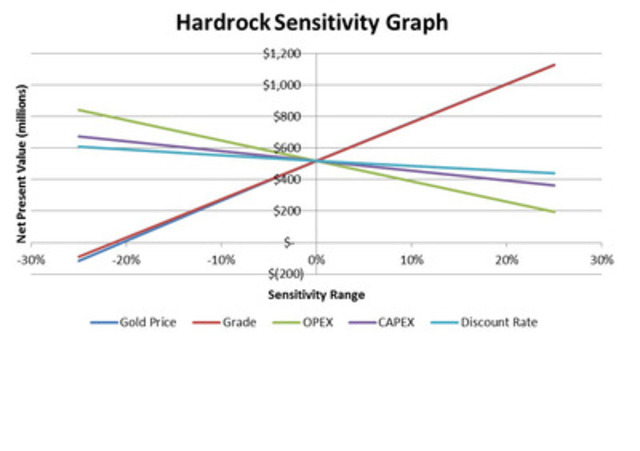

Table 10 is a spider graph representing the sensitivity of the change of

any one variable over a range of percentage difference versus the base

case. Of the five variables measured, changes in grade and gold price

have the greatest impact on the NPV (pre-tax) of the project.

Table 9 Pre-tax and After-tax IRR, NPV & Payback Summary

| Pre-tax | US$1050 | US$1250 | US$1450 |

| IRR (%) | 10.3% | 23.0% | 33.6% |

| NPV5% (CA$M) | 128 | 519 | 909 |

| Payback (Years) | 6.2 | 3.5 | 2.8 |

|

|

|

|

|

| After-tax | US$1050 | US$1250 | US$1450 |

| IRR (%) | 8.2% | 19.0% | 27.7% |

| NPV5% (CA$M) | 72 | 359 | 633 |

| Payback (Years) | 7.2 | 3.9 | 2.9 |

Exchange Rate CAN$1.00 = US$ 0.95

Opportunities & Risks

Opportunities to improve Hardrock Project economics include the

following:

-

The Hardrock PEA is based on the August 9, 2013 mineral resource cut-off

date and does not include subsequent infill drilling of some 45,000

metres completed to the end of 2013.

-

The next resource update is planned for Q2/2014 and will include a more

refined underground voids model which could potentially contribute

resource tonnes and ounces previously included at zero grade.

-

Infill assays of previously unsampled drill core will improve the

confidence of the grade estimate in some areas.

-

Refining the litho-structural model by incorporating information gleaned

from historic drilling (not assay data) will improve confidence in the

model constraints.

-

Follow-up drilling in the North Wall area could bring additional mineral

resources into the optimized pit.

-

Completing an underground study to further enhance project economics.

-

Potential improvement in metallurgical recovery

Risks requiring mitigation strategies include:

-

Management of construction/engineering and procurement schedules, costs,

and cost containment.

-

Operating risks related to recruitment and training of open-pit

workforce.

-

Currency risk relating to equipment purchases denominated in US

currency.

-

Permitting risk

Next Steps

Technical

-

Complete infill drill program for revised mineral resource estimate in

2014.

-

Proceed with baseline environmental work for completion by summer 2014

(ongoing monitoring work forecasted for life of mine.

-

Optimization work (testing and engineering) for minimizing capital and

operating costs.

-

Detailed engineering work for final feasibility.

Exploration

-

Renewed focus on regional targets and new deposit discovery.

Community and Environment

-

Complete the baseline environmental and optimization work (testing and

engineering) necessary to ensure a successful environmental assessment

process.

-

Submission of a project description is anticipated in spring 2014 to

federal and provincial governments to begin the formal environmental

assessment processes. This will comprise baseline environmental

information collected over past years, comprises formal public and

aboriginal consultation periods and helps ensure a mine design that

avoids and mitigates environmental impacts.

Qualified Persons

Each of the following individuals is a "qualified person" for the

purposes of NI 43-101. All scientific and technical information in

this press release in respect of the Hardrock Project or the Hardrock

PEA is based upon information prepared by or under the supervision of

such individuals.

Stantec

Michel St. Laurent, P. Eng., (Mining & Environment)

Fiona Christianson, M.Sc. (Environment)

BBA Inc.

Julie Fournier, ing. (Metallurgy & Processing)

InnovExplo Inc.

Carl Pelletier, B.Sc., P.Geo. and Karine Brousseau, P.Eng. (Resource

Estimate)

Sylvie Poirier, ing. (Mining)

Brookbank Project

Mineral Resources Used In PEA

The Brookbank PEA study assumes that open pit and underground mining

will be used for resource extraction. The mineral resource estimate as

reported on December 19, 2012 excludes the impact of mining dilution,

which is the incidence of waste rock extracted together with

mineralized material. For the PEA, open pit mining dilution is

calculated as 25% at 0.22 g/t gold. Open pit resources have been

calculated assuming a material loss of 10%.

Underground excess mining dilution is calculated as 15% at 0.00 g/t gold

after a 27.6% planned internal dilution at 2.5g/t gold. Underground

mining also assumes a material loss of 10%. With open pit and

underground cut-off grades of 1.52 g/t gold (before dilution and mill

recovery) and 4.50 g/t gold respectively, the resulting tonnages and

grades for the open pit and underground conceptual mine plan is shown

in Table 11.For the purpose of this study, it has been assumed that the ore would be

processed at a future Hardrock mill.

Table 11 Diluted Open Pit & Underground Mineral Resources Used for

Brookbank PEA Study

| Deposit | Cut-off

Category | Resource

Category | Tonnes (Mt) | Gold (Au) Grade (g/t) | Au Ounces (Moz) |

Brookbank |

Open Pit

|

Indicated (I)

|

0.503

|

2.31

|

0.037

|

|

Underground

|

Indicated (I)

|

1.659

|

6.25

|

0.333

|

Mineral resources are not mineral reserves and do not have demonstrated

economic viability. All figures are rounded to reflect the relative

accuracy of the estimate. All assays have been capped where

appropriate.

Mining

The Brookbank PEA assumes the processing of an average 900 tonnes per

day of material from open pit and underground sources during the life

of the mine. Open pit mining (average grade of 2.31 g/t gold) would be

conducted for a period of 2.5 years at 600 tonnes per day in the

beginning of the mine life followed by underground mining operations

(average grade of 6.25 g/t gold) at up to 900 tonnes per day for a

period of 6 years. The waste rock-to-mill-feed operating strip ratio

averages 5 to 1 over the life of the open pit.

Underground mining operations would be accessed via a single portal and

main ramp from surface. The operation would utilize longitudinal

longhole stoping (25-metre sub-levels), with consolidated and

unconsolidated rockfill as a mining method and require up to 4,000

metres of pre-preproduction and sustaining capital development and

some 7,000 metres of operating lateral development (waste and silling)

over the life of the mine.

Metallurgy & Processing

Based on available historical information and test work at Brookbank,

the proposed process flowsheet determined by BBA remains similar to the

historical flowsheet. It includes primary and secondary crushing,

single-stage grinding, CIL, cyanide destruction, carbon stripping,

electrowinning, and refining. As such, Brookbank material would also

be amenable to the proposed Hardrock flowsheet.

A trade-off study was conducted which determined that transporting

Brookbank material to Hardrock for processing and gold recovery

significantly enhances the Brookbank PEA economics when compared to a

stand-alone milling complex for Brookbank rock. No additional

processing facilities are anticipated at Hardrock to facilitate the

Brookbank rock milling.

Infrastructure

The Brookbank Project benefits from world-class infrastructure, services

and available labour within several communities in the immediate area.

The project site is located only 232 kilometres from Thunder Bay,

Ontario (population 108,000) and 28 kilometres northeast of Beardmore,

Ontario (population 400) within the Municipality of Greenstone. It

resides 12 kilometres from the Trans-Canada Highway and is accessible

by road year-round.

Infrastructure at the Brookbank Project is anticipated to include, among

other things, the following facilities:

-

Plant site and haul roads, gate house, parking, bus station and weigh

station;

-

Separate administration building, compressor building;

-

Assay lab, core shack, surface shop;

-

Mine maintenance garage, warehouse;

-

Fuel storage facilities; power distribution;

-

Fresh water supply and fire protection;

-

Sewage treatment;

-

Coarse and fine material storage pads;

-

Non-acid generating waste storage;

Power to the project supplied by electric transmission line connected to

the provincial grid.

Capital & Operating Costs

Total pre-production and sustaining capital cost estimates for both the

open pit and underground portions of the Brookbank Project are

summarized in Table 12.

Table 12 Pre-production and Sustaining Estimated Capital Costs for

Brookbank Open-pit & Underground Mines

| Capital Cost | All LOM

($ millions) |

|

Surface Infrastructure

|

20.3

|

|

Vertical and Horizontal Development

|

33.6

|

|

Underground Infrastructure

|

3.9

|

|

Mobile Equipment

|

21.5

|

|

Indirects

|

6.7

|

|

Contingency

|

20.6

|

| Total Capital Cost | 106.6 |

The estimated cash cost profile for the Brookbank Project is summarized

in Table 13. Operating expenses shown below reflect a blend of

Brookbank and Hardrock operation at a nominal 18,000 tpd.

Table 13 Cash Cost Summary for Brookbank Open-pit & Underground

Mines

| Cash Cost Summary | LOM

($/t) | LOM

($/oz) |

|

Mining

|

32.46

|

205.71

|

|

Processing

|

11.24

|

71.23

|

|

Surface Haulage

|

14.76

|

93.54

|

|

G&A

|

38.68

|

245.09

|

|

Refining

|

0.63

|

4.00

|

| Total Cash Costs | 97.77 | 619.57 |

Community

Premier continues to operate a local office in Beardmore, and has

conducted community meetings as well as outreach efforts to local

Aboriginal communities. While these have been preliminary in nature,

Premier is anticipating continued engagement throughout the development

of this project.

Environment

Environmental information to support a Project Definition and Closure

Plan for the Brookbank site has been collected since 2011. Existing

data consists of quarterly surface water quality and terrestrial and

aquatic wildlife studies.

Project Economics

As alluded to in the Metallurgy and Processing sub-section of this

document, trade-off studies were performed which confirmed that

transporting Brookbank rock material some 77 kilometres to an existing

processing facility at Hardrock realized the greatest economic benefit

for the Brookbank Project.

Key economic performance metrics are summarized in Table 14 on both a

Pre-tax and After-tax basis. A range of gold prices (US$) are shown

for sensitivity purposes only. At US$1250 gold price, the Brookbank

open pit and underground mining project has a pre-tax Internal Rate of

Return (IRR) of 30.7% (24.7% after-tax), a pre-tax NPV (discounted at

5%) of some $76 million ($52 million after-tax) and a payback of 4.3

years on a pre-tax basis (4.4 years on an after-tax basis).

Table 14 Pre-tax and After-tax IRR, NPV & Payback for the Brookbank

Project

Pre-tax |

US$1050 |

US$1250 |

US$1450 |

IRR (%) |

14.0% |

30.7% |

43.6% |

NPV5% (CA$M) |

$29 |

$76 |

$139 |

Payback (Years) |

5.3 |

4.3 |

3.7 |

|

|

|

|

After-tax |

US$1050 |

US$1250 |

US$1450 |

IRR (%) |

9.4% |

24.7% |

38.1% |

NPV5% (CA$M) |

$11 |

$52 |

$87 |

Payback (Years) |

5.6 |

4.4 |

3.8 |

Exchange Rate CAN$1.00 = US$ 0.95

Opportunities & Risks

Opportunities to improve Brookbank Project economics include the

following:

-

Infill assays of previously unsampled drill core will improve the

confidence of the grade estimate in some areas

-

Refining the litho-structural to improve confidence in the model

constraints.

-

Follow-up drilling in at Cherbourg and Foxear to delineate mineral

resources

Risks requiring mitigation strategies include:

-

Management of construction/engineering and procurement schedules, costs,

and cost containment.

-

Operating risks related to recruitment and training of open-pit and

underground workforces.

-

Currency risk relating to equipment purchases denominated in US

currency.

-

Permitting risk

Next Steps

Technical

-

Optimization work (testing and engineering) for minimizing capital and

operating costs

Exploration

-

Renewed focus on regional targets and new deposit discovery

Community and Environment

-

Premier intends to continue to engage with the local Beardmore and

Aboriginal communities on its plans for the Brookbank project. These

will include open houses, direct communications and bilateral

engagements.

Qualified Persons

Each of the following individuals is a "qualified person" for the

purposes of NI 43-101. All scientific and technical information in

this press release in respect of the Brookbank Project or the Brookbank

PEA is based upon information prepared by or under the supervision of

such individuals.

Stantec

Michel St. Laurent, P. Eng., (Mining & Environment)

Helga Sonnenberg (Environment)

BBA Inc.

Julie Fournier, ing. (Metallurgy & Processing)

Micon International Limited

Messrs Alan J. San Martin, MAusIMM(CP) and Charley Murahwi, P.Geo,

FAusIMM. (Resource Estimation)

Live Conference Call and Webcast Access Information

North American callers please dial: 1-888-231-8191

Local and international callers please dial: 647-427-7450

TAPED REPLAY: 416-849-0833 or 1-855-859-2056

Reference number: 49097250

Available until February 28, 2014 at midnight

WEBCAST URL: A live audio webcast will be available at: www.premiergoldmines.com

Premier Gold Mines Limited is one of North America's leading exploration and development companies

with a high-quality pipeline of gold projects focused in proven, safe

and accessible mining jurisdictions in Canada and the United States.

The Company is well financed with a portfolio of advanced-stage assets

in world class gold mining districts such as Red Lake and Geraldton in

Ontario and the most prolific gold trends in Nevada.

This Press Release contains certain information that may constitute

"forward-looking information" under applicable Canadian securities

legislation. Forward-looking information includes, but is not limited

to, statements about strategic plans, including future operations,

future work programs, capital expenditures, discovery and production of

minerals, price of gold and currency exchange rates, timing of

geological reports and corporate and technical objectives.

Forward-looking information is necessarily based upon a number of

assumptions that, while considered reasonable, are subject to known and

unknown risks, uncertainties, and other factors which may cause the

actual results and future events to differ materially from those

expressed or implied by such forward-looking information, including the

risks inherent to the mining industry, adverse economic and market

developments and the risks identified in Premier Gold's annual

information form under the heading "Risk Factors". There can be no

assurance that such information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not place

undue reliance on forward-looking information. All forward-looking

information contained in this press release is given as of the date

hereof and is based upon the opinions and estimates of management and

information available to management as at the date hereof. Premier Gold

disclaims any intention or obligation to update or revise any

forward-looking information, whether as a result of new information,

future events or otherwise, except as required by law.

SOURCE Premier Gold Mines Limited

Image with caption: "Table 10 - Hardrock Sensitivity Analysis of Significant Parameters (CNW Group/Premier Gold Mines Limited)". Image available at: http://photos.newswire.ca/images/download/20140128_C5557_PHOTO_EN_35946.jpg

<p> Ewan Downie, President & CEO<br/> Phone: 807-346-1390<br/> Fax: 807-346-1381<br/> e-mail: <a href="mailto:Info@premiergoldmines.com">Info@premiergoldmines.com</a> <br/> Web Site: <a href="http://www.premiergoldmines.com">www.premiergoldmines.com</a> </p>