ROAD TOWN, British Virgin Islands, Dec. 08, 2025 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (NASDAQ: AUGO, B3: AURA33) (“Aura” or the “Company”) is pleased to announce the results of the Feasibility Study for the Era Dorada Project (“Era Dorada” or “Project”, which project was previously known as the Cerro Blanco Project) prepared in accordance with S-K 1300. Era Dorada will be an underground gold mine with anticipated production of 111 koz GEO for the first 4 years of full production with additional potential production upside. The technical report (the “Technical Report”) titled “Feasibility Study for the Era Dorada Project, located in Jutiapa, Guatemala, near the town of Asunción Mita and border with El Salvador” was prepared by Ausenco and Snowden Optiro (Brazil).In January 2025, Aura completed the acquisition of Bluestone Resources Inc. (“Bluestone”), which was the 100% owner of Era Dorada (or Cerro Blanco as it was known then). Please see our press release dated January 13, 2025, for additional information on the acquisition.

Highlights:

- Exclusive Indicated Mineral Resources of 523 thousand GEO, assuming 2.46 million tonnes at 6.61 grams per tonne gold equivalent.

- Proven and Probable Mineral Reserves of 1.75 million GEO, assuming 8.75 million tonnes at 6.23 grams per tonne gold equivalent.

- Total production of approximately 1.75 million GEO over 16.8 years Life of Mine (“LOM”).

- Average production of approximately 111koz GEO for the first 4 years.

- Total initial implementation capex of approximately US$382million with a payback in approximately 2.82 years after the beginning of the operation.

- After-tax Net Present Value (“NPV”) of US$1,344.5 million when using the weighted average consensus gold prices for the projected period of US$ 3,177 per ounce.

- After-tax Project IRR of 35.6% when using the weighted average consensus gold prices for the projected period.

- US$993/oz average Cash Cost and 1,178/Oz AISC cost.

Main assumptions used for the base:

- Gold price (per ounce): US$ 3,177

- Silver price (per ounce): US$ 37.2

- Exchange average rate (GTC/USD): 7.6

- Guatemalan Government Royalty: (% of gross revenues): 5%

- Income taxes: 25%

- Discount rate: 5%

Rodrigo Barbosa, President and CEO of Aura, stated: "With Borborema now in commercial production and the MSG acquisition successfully closed, we are pleased to publish the Feasibility Study (FS) for Era Dorada – the project we acquired earlier this year. The new FS, incorporating new metal prices and an optimized mine plan, delivers Reserves of 1.75 million GEO, average annual production of 111,000 GEO during the first four years, an after-tax leveraged IRR of 68%, an after-tax NPV of US$ 2.17 billion at spot prices $ 4,200 / Oz, and very competitive AISC in the first industry quartile at US$1,178/oz during the LOM. This fully licensed underground project requires a manageable Initial Capex of US$ 382 million. We are working closely with local authorities and government agencies to advance Era Dorada consistent with applicable environmental and social standards, aligned with our Aura 360 culture. This Feasibility Study is another clear example of our disciplined growth strategy in action – and more projects are in the pipeline.”

Era Dorada Project overview

The Project is located in southeast Guatemala, in the Department of Jutiapa, approximately 160 km by road from the capital, Guatemala City and approximately 9 km west of the border with El Salvador. The nearest town to the Project is Asunción Mita, a community of about 18,500 people situated approximately 7 km west of the Project. The exploitation license covers 15.25 km2 and lies entirely in the municipality of Asunción Mita. Era Dorada is not considered to be a property material to Company for purposes of S-K 1300.

The Era Dorada Project site is accessible year-round via the Pan-American Highway (CA1) through Asunción Mita, with flat to rolling hill topography. The climate is tropical dry forest, with elevations of 450–560 masl, a wet season from May to October, 1,350 mm annual rainfall, temperatures ranging from 10°C to 41°C, 2,530 mm annual pan evaporation, and 62% average humidity. The site is near communities, including Asunción Mita (18,500 population). No prior mining exists in the area, but the closure of Goldcorp’s Marlin Mine in 2017 provides access to trained Guatemalan labor. The project plans to hire locally, with training costs included in the budget.

Summary of Key Results for the Era Dorada Feasibility Study

| ERA DORADA GOLD PROJECT1 | Years 1-4 | Life of Mine (16.8 years) |

| Average Plant Feed Grade (g Au/t & g Ag/t) | 7.6 g/t Au & 28.3 g/t Ag | 6.0 g/t Au & 28.2 g/t Ag |

| Weighted Average Annual Gold Production (koz) | 111 | 104 |

| Average Recovery (%) | 96% for Au & 85% Ag | 96% for Au & 85% Ag |

| Total Payable Gold (koz gold) | 428 | 4,852 |

| Average Cash Costs (US$/oz) | 1,107 | 993.1 |

| Average AISC2 (US$/oz) | 1,617 | 1,178 |

Notes:

- Considering Royalties

Financial Key Performance Indicators (“KPIs”) expected for the Project

Main assumptions:

- Gold price: US$ 3,177/oz

- Silver price: US$ 37.2/oz

- Exchange average rate (GTC/USD): 7.6

- Discount rate: 5%

| | | | Gold prices (US$/oz) | |

| Unleveraged | | 2,383 (-25%) | 3,177

| 4,200 (Spot) |

| After-tax NPV | US$ million | 655

| 1.344,5

| 2,175.3

|

| After-tax simple payback (after Start-Up) | years | 4.5

| 2.82

| 2.31

|

| After-tax IRR | % p.a. | 21.5%

| 35.6%

| 46.6%

|

Sensitivity analyses were conducted in order to simulate project financial performance according to different scenarios of gold price, as well as capital structure with debt on total capital. The table below indicates expected results considering an upfront debt of US$ 191 million to partially fund the construction capex.

| | | | Gold prices (US$/oz) | |

| Leveraged | | 2,383 (-25%) | 3,177

| 4,200 (Spot) |

| After-tax simple payback (after Start-Up) | Years | 4.78

| 2.91

| 2.15

|

| After-tax IRR | % p.a. | 26.5%

| 49.8%

| 68.4%

|

Geology, Mineralization and Drilling

The deposit at the Era Dorada Project is considered to be a classic mesothermal/orogenic gold deposit type in a sheared and deformed Archaean to Proterozoic greenstone belt sequence comprised of metamorphosed volcanic‐sedimentary rocks units intruded by slightly younger post‐tectonic igneous bodies.

The Era Dorada deposit is hosted within a sequence of banded arkosic metapelitic schists, subjected to upper‐amphibolite facies regional metamorphism.

The mineralization types are strongly controlled by regional structure with secondary structures providing the preferred host for gold mineralization. In addition to the main mineralized zone, several thinner sub-parallel zones with gold mineralization are identified. Two distinct gold mineralization types are identified in drill cores: 1) disseminated free gold, and 2) gold in association with sulphide mineralization represented by pyrrhotite, chalcopyrite, pyrite, sphalerite, and galena. Additionally, the sulphide mineralization was observed in the outer contact between chert boudins and schist along with or associated with schist foliation.

The main Era Dorada ore body has overall dimensions of approximately 600 meters in the down-dip direction, 3,500 meters along the strike, and averages of 50 meters in thickness in the central and 30 meters in thickness in the southern and northern portions. The Era Dorada deposit is located within a NE-SW trending shear zone and displays a penetrative NNE‐trending fabric, dipping southeast at around 40 degrees. The ore body is open down dip beyond current Inferred Mineral Resources.

The Era Dorada deposit has been drilled out at nominal drill spacing approximately 50m x 50m. A total of 303 diamond drill holes and 921 reverse circulation (“RC”) holes totaling 109,090m were drilled between 1979 and 2022. The property drilling database contains 74,038 sample intervals within the drilling database used in support of mineral resources.

Data Verification

Garth Kirkham (Kirkham Geosystems), a QP of Mineral Resources and Geology performed data verification and validation procedures on the drilling database prior to modeling and reviewed the geological, drilling, and Au analytical data which was used to support Mineral Resources. Additionally, he conducted a site visit to the Project, reviewing geology, drill core, sample storage and security, as well conducted interviews with site personnel. It is the QP’s opinion that the raw drilling data used for estimating Mineral Resources has been adequately reviewed and any identified potential risks are accounted for in resource classified, in-line with S-K 1300 guidelines.

Mineral Resource Estimates

The mineral resource estimate is based upon the reasonable prospect of eventual economic extraction based on continuity and underground mining shapes, using estimates of operating costs and price assumptions. The “reasonable prospects for eventual economic extraction” were tested using stope optimizations performed using Datamine Studio UG v.2.57TM based on reasonable prospects of eventual economic assumptions, as shown in below

Metal prices are based on long-term three-year forecast consensus financial institution estimates published by CIBC (Canadian Imperial Bank of Commerce).

ParametersUsedforStopeOptimization and Cut-off Grade

Parameter

| Unit

| RPEEE UG Mining Method |

| LH | MCF |

| Gold price | US$/oz Au | 2500

|

| Project Parameters | |

| Process Recovery | % | 96.00%

|

| Payable metal | % | 99.92%

|

| TC/RC | US$/oz Au | 2.21

|

| Royalty | |

| Royalty NSR | % of NSR | 1.05%

|

| Guatemalan Gov't Royalty (Gross) | % total payable metals revenue | 1.00%

|

| OPEX Estimates | |

| Mining | US$/t milled | 100 | 115

|

| Processing | US$/t milled | 32 | 32

|

| Site Services | US$/t milled | 18 | 18

|

| G&A | US$/t milled | 20 | 20

|

| Total OPEX estimate | US$/t milled | 170 | 185

|

| Cut-off Grade | |

| In-situ cut-off Au grade | g/t | 2.25 | 2.45

|

Source: Snowden Optiro, 2025.

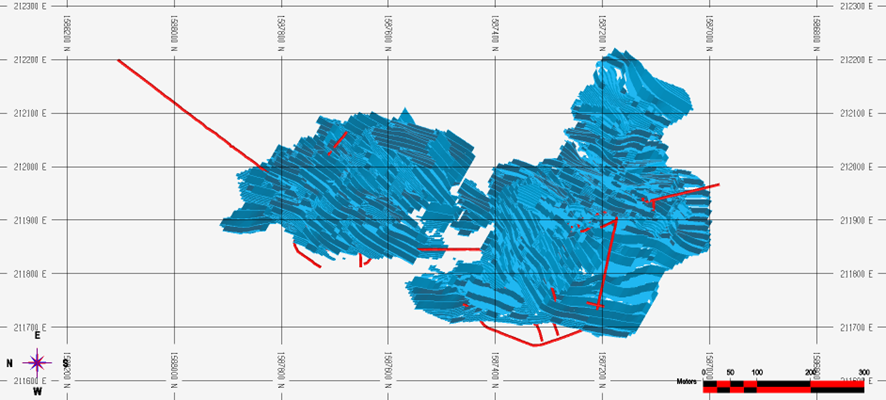

Figure below illustrates the gold block model along with the “reasonable prospects of eventual economic extraction” underground mining shapes.

PlanViewofGoldBlockModelwithReasonableProspects OptimizedMine Shapes with Existing Underground Ramps (Source: Kirkham , 2025)

Table below shows tonnage and grade in the Era Dorada deposit and includes all domains at a 2.25 g Au/t cut-off grade.

| Category | Tonnes (kt) | Grade (Au g/t) | Grade (Ag g/t) | Grade (AuEq g/t) | Contained Gold (koz) | Contained Silver (koz) | Contained AuEq (koz) |

| Indicated | 2,460 | 6.36 | 22.76 | 6.61 | 503 | 1,801 | 523 |

| Inferred | 736 | 5.94 | 19.22 | 6.16 | 141 | 455 | 146 |

Notes:

The mineral resource statement is subject to the following:

- Exclusive Mineral Resources are reported in in accordance with S-K 1300.

- Mineral resource estimates have been prepared by Garth Kirkham, P.Geo., a Qualified Person as defined by SK-1300.

- The Mineral Resource estimate is reported on a 100% ownership basis.

- Underground mineral resources are reported at a cut-off grade of 2.25 g Au/t. Cut-off grades are based on a assumed metal prices of US$ 2,500/oz gold and US$ 28/oz silver, and assumed metallurgical recovery, mining, processing, and G&A costs.

- Mineral Resources are reported without applying mining dilution, mining losses, or process losses.

- Resources are constrained within underground shapes based on reasonable prospects of economic extraction, in accordance with SK-1300. Reasonable prospects for economic extraction were met by applying mining shapes with a minimum mining width of 2.0 m, ensuring grade continuity above the cut-off value, and by excluding non-mineable material prior to reporting.

- Metallurgical recoveries reported as the average over the life of mine and are assumed to be 96% Au and 85% Ag, respectively.

- Bulk density is estimated by lithology and averages 2.47, 2.57 and 2.54 g/cm3 for the Salinas, Mita and mineralized vein domains, respectively.

- Mineral resources are classified as Indicated, and Inferred based on geological confidence and continuity, spacing of drill holes, and data quality.

- Effective date of the mineral resource estimate is November 30, 2025.

- Tonnage, grade, and contained metal values have been rounded. Totals may not sum due to rounding.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Source: Kirkham, 2025.

Mineral Reserve Estimates

Era Dorada Mineral ReserveEstimateusing2.82gAueq/tCutoff

| ERA DORADA PROJECT PROVEN AND PROBABLE (P&P) MINERAL RESERVES |

Reserve

Classification | Tonnage (kt) | Au grade (g/t) | Au metal

(koz) | Ag grade

(g/t) | Ag metal

(koz) | Au Eq grade

(g/t) | Au Eq metal (koz) |

| Proven | 30 | 5.35 | 5 | 22.59 | 22 | 5.60 | 5 |

| Probable | 8,717 | 6.01 | 1,684 | 20.39 | 1,144 | 6.23 | 1,746 |

| Proven + Probable | 8,747 | 6.01 | 1,689 | 20.40 | 1,166 | 6.23 | 1,751 |

Notes:

- The Mineral Reserve was estimated and classified in accordance with the USA S-K 1300 standards.

- Mineral Reserve have an effective date of November 30, 2025. The Qualified Person for the estimate is Ruy Lacourt, B.Sc. Mining Engineering, MSc., Registered Member of the SME, an Associate of Snowden Optiro.

- The Mineral Reserve was estimated using metal prices of US$2,000/oz Au and US$25/oz Ag, and metallurgical recoveries of 96% Au and 85% Ag. Underground mining costs were assumed as US$100/t (Long Hole mining) and US$115/t (Cut-and-Fill mining), with processing, site services and G&A costs as of US$32/t, US$18/t and US$20/t, respectively. Royalties comprise 2.05% NSR to the previous owners plus a 5.0% gross government royalty. Cutoff grades in gold equivalent are 2.82g/t for underground Long Hole mining and 3.07g/t for Cut-and-fill.

- Proven Mineral Reserve is only related to existing stockpile in Era Dorada Project since no-in situ Mineral Resources classified as Measured.

- The formula for gold equivalent: Au eq = Au grade + 0.011 * Ag grade.

- The Mineral Reserve is presented on a 100% ownership basis fully attributable to Aura Minerals.

- Tonnages and grades have been rounded in accordance with reporting guidelines. Tonnages are rounded to the nearest 1,000 t, metal grades are rounded to two decimal places. Tonnage and grade are in metric units; contained gold and silver are reported as thousands of troy ounces. Totals may not sum due to rounding.

The deposit will be accessed via two existing main declines servicing the South and North zones, supplemented by additional ramps. Sublevels are spaced 20 m vertically. A panel geometry is adopted, consisting of four sublevels with 20m plus a sill pillar with 20m (total panel height 100 m) to cover approximately 300m of extension in depth, with the sill pillars recovered late in the mine life.

The mine infrastructure includes mine dewatering from surface to control the effects of high groundwater temperature and modular refrigeration plants to secure suitable working conditions underground.

Mine Plan

The Era Dorada deposit will be mined using underground methods, with production derived from a combination of sublevel long hole (LH) stoping as the dominant method, mechanized cut-and-fill (CF) in geotechnically or geometrically constrained areas, and minor room-and-pillar. Long hole stoping is expected to contribute approximately 98.5% of total metal production, with MCF contributing approximately 1.2% and room-and-pillar approximately 0.1%. The selection of mining methods reflects the orebody geometry, vein continuity and dip, and geomechanical constraints, with LH preferred for safety, productivity, and cost effectiveness where conditions allow its application.

Optimization, stope shape generation, mine design, and scheduling were undertaken by Snowden Optiro: optimized stopes shapes were generated under defined geometric and geotechnical constraints, screened for economic value for method-specific gold equivalent cutoff grades, and integrated with the development design. Long hole stopes were configured as longitudinal or transverse depending on vein thickness and continuity, with transverse LH applied in zones exceeding 20 m thickness. The LH stopes will be backfilled using cemented paste fill or cemented rockfill (CRF). Cut-and-fill stopes will be mined in breast stoping and overhand lifts with preferentially cemented backfill providing rock support and a working floor.

Production Schedule

The mine scheduling was developed subject to operational constraints including maximum annual development advance of circa 8,500 m, plant throughput limits, paste and Cemented Rockfill placement and curing cycles and mine dewatering requirements below the water table.

The Life-of-mine mine plan targets a production rate as of 1,600 tonnes per day extending for 18 years from 2026 to 2043, with higher metal output scheduled in the early years through prioritized development of higher-grade areas of the mine.

Mining starts in May 2026 and follows a ramp-up to meet the commercial production of the plant in October 2027 achieving +100koz in 2028 and 2029, +120koz from 2030 to 2032 and +100koz through the remainder of the mine life.

Processing

Based on the information and metallurgical test results, Era Dorada gold-silver mineralization is considered amenable to gravity concentration followed by cyanide leaching. The process plant will consist of a 1600 tons/day, one stage crushing, SAG mill and pebble crusher, ball mill, leach, CIP, elution, electrowinning circuit, all of which are well-known, conventional, processing unit operations.

The process plant is designed for treatment of 1,600 tons/day or 72.5 tons/hour based on 8,059 hours per annum or 92% availability. The crushing section design is based on 70% availability, and the gold room availability is set one melt per week. The process plant is designed to operate with two shifts per day and 365 days per year and will produce doré bars.

Engineering, Procurement and Construction Management

Basic engineering and detailed engineering for earthmoving as well as the engineering design for the mine is completed. Detailed engineering for the initial areas to be built is ongoing. The BID to hire the ECM is underway.

Feasibility Study Preparation

Aura retained AUSENCO and Snowden Optiro to jointly prepare with the Aura project and technical services team a Feasibility Study on the Era dorada Project. The Technical Report provides the underground Feasibility Study.

Qualified Persons

The technical content of this press release has been reviewed and approved by the qualified persons who were involved with preparation of the Era Dorada Feasibility study: Garth Kirkham, P.Geo (Kirkham Geosystem), Ruy Lacourt, B.Sc. Mining Engineering, MSc., Registered Member of the SME, an Associate of Snowden Optiro. Robert Raponi, P. Eng., Ausenco, (Toronto, Canada)

Qualified persons are not aware of any known political, legal, environmental or other risks that could materially affect the project development.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a company focused on the development and operation of gold and base metal projects in the Americas. The company's six operating assets include the Minosa gold mine in Honduras; the Almas, Apoena, and Borborema and MSG gold mines in Brazil; and the Aranzazu copper, gold, and silver mine in Mexico. Additionally, the company owns Era Dorada, a gold project in Guatemala; Tolda Fria, a gold project in Colombia; and three projects in Brazil: Matupá, which is under development; São Francisco, which is in care and maintenance; and the Carajás copper project in the Carajás region, in the exploration phase.

For further information, please visit Aura’s website at www.auraminerals.com

Forward-Looking Information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”), which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as “plans,” “expects,” “is expected,” “budget,” “scheduled,” “estimates,” “forecasts,” “intends,” “anticipates,” or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control, could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the most recent Annual Information Form on file with certain Canadian provincial securities regulatory authorities and the 424(b) prospectus filed with the United States Securities and Exchange Commission for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, volatility in the prices of gold, copper and certain other commodities, changes in debt and equity markets, the uncertainties involved in interpreting geological data, increases in costs, environmental compliance and changes in environmental legislation and regulation, interest rate and exchange rate fluctuations, general economic conditions and other risks involved in the mineral exploration and development industry. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements. All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The press release includes forward-looking statements relating, but not limited to, the following: the preparation and filing of the Era Dorada Feasibility Study and the timing of same; collaboration with local authorities and governmental agencies; economic viability of Era Dorada; evaluation of alternative mining methods for Era Dorada; the operation of Era Dorada; and mineral resource estimates.

The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9ec511f1-80cd-41ce-84d5-25483c447b44

Contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

Figure 1

Plan View of Gold Block Model with Reasonable Prospects Optimized Mine Shapes with Existing Underground Ramps (Source: Kirkham , 2025)

© 2026 Canjex Publishing Ltd. All rights reserved.