- EXCELLENT PEA RESULTS MAINTAINED: FIRST 22 YEARS OF PRODUCTION AT 27.4%

Cg AND LOW OPERATING EXPENSES AT $390/TONNE

- CONFERENCE CALL WILL BE HELD TODAY AT 2PM EST

MONTREAL, Dec. 5, 2013 /CNW/ - Mason Graphite Inc. ("Mason Graphite" or

the "Company") (TSX.V: LLG; OTCQX: MGPHF) is pleased to announce

significant resource growth in an updated mineral resource estimate for

its 100%-owned Lac Guéret graphite project in northeastern Quebec.

Highlights from the updated mineral resource estimate

-

Measured & Indicated ("M&I") mineral resources increased 658% from 7.6

million tonnes ("Mt") to 50 Mt

-

Inferred mineral resources increased from 2.8 Mt to 11.9 Mt

-

Overall M&I grade of 15.6% Cg; the main parameters of the preliminary

economic assessment for the Lac Guéret project (the "PEA") are still

valid: 22 years of production at 27.4% with a low stripping ratio at

0.76:1 and low operating costs at $390/tonne

-

Enlarged mineral resource could lead to optimized pit design and

improved economics

Large increase in Mineral Resources

The new mineral resource estimate, as calculated by Roche Ltd.

Consulting Group ("Roche''), includes assay data from 170 holes

(approximately 26,500 metres) drilled in the GC Zone and now totals

50,024,000 tonnes grading 15.6% Cg, including 6,672,000 tonnes grading

32.4% Cg, in the Measured and Indicated categories and 11,861,000

tonnes grading 17.1% Cg, including 2,637,000 tonnes grading 30.5% Cg,

in the Inferred category (See Table 1 below). The enlarged mineral

resource envelope offers opportunities to further optimize the mine

plan and the project's economics as set out in the PEA in the next

phase of technical studies.

"We are very pleased to see the success of our 2012 drilling program

materialize in this updated mineral resource estimate", commented

Benoît Gascon, President and CEO of Mason Graphite. "We expect the

scale of growth of our project to positively impact what is already

expected to be an economical project. Results from the Lac Guéret

Project continue to reinforce our belief in the world-class potential

of this asset."

Table 1 - December 5, 2013 - Updated Mineral Resource Estimate, GC Zone

| Categories | Unit | Tonnes | Grade (Cg) |

|

|

| Measured (M) |

U1/U2 (5 to 25 % Cg)

U3 (> 25 % Cg)

|

4,052,000

465,000

|

13.4%

33.8%

|

| All units | 4,517,000 | 15.5%

|

| Indicated (I) |

U1/U2 (5 to 25 % Cg)

U3 (> 25 % Cg)

|

39,300,000

6,207,000

|

13.0%

32.3%

|

| All units | 45,507,000 | 15.6%

|

| M + I |

U1/U2 (5 to 25 % Cg)

U3 (> 25 % Cg)

|

43,352,000

6,672,000

|

13.0%

32.4%

|

| All units | 50,024,000 | 15.6% |

|

|

| Inferred |

U1/U2 (5 to 25 % Cg)

U3 (> 25 % Cg)

|

9,224,000

2,637,000

|

13.3%

30.5%

|

| All units | 11,861,000 | 17.1% |

| Note: | A cut-off grade of 5% Cg was used for this mineral resource estimate. |

|

| See additional notes on mineral resource estimation methodology at the

end of this news release. |

Excellent PEA Results Maintained

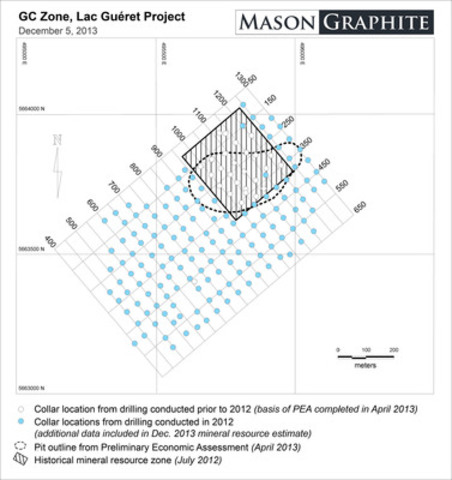

On April 22, 2013, Mason Graphite reported positive results in the PEA

for the Lac Guéret project, which included 22 years of production at

27.4% Cg considering a strip ratio of 0.76:1 and operating costs of

$390 per tonne. This technical study used data from the previous July

2012 mineral resource estimate, which covers only a small portion of

the updated mineral resource area (see Figure 1).

The block model that was created for the mineral resource update was

provided to Met-Chem Canada Inc. ("Met-Chem''), the firm responsible

for the completion of the PEA. Met-Chem was able to verify and confirm

that conclusions of the PEA are still relevant and valid for the

updated model.

The Company expects the scale and grade of the new mineral resource to

positively affect the project economics in the next phase of technical

studies.

An updated NI 43-101 technical report outlining the procedures for

estimation of the mineral resource estimate presented herein will be

filed on SEDAR within 45 days of the date of this press release.

Future Mineral Growth Potential

The new mineral resource estimate is based on drill data from the GC

Zone, which represents only one of two mineralized zones identified on

the Lac Guéret property to date.

GC Zone

A total of 170 holes totalling approximately 26,500 metres have been

drilled in this area. The GC Zone has a strike length of approximately

1.2 kilometres and the new mineral resource estimate has almost doubled

the width of the deposit to about 600 metres. The mineral envelope

remains open in all directions and the company expects further growth

with additional drilling.

GR Zone

To date, only 18 holes totalling approximately 2,300 metres have been

drilled in this zone, which is located less than one kilometre north of

the GC Zone. The GR Zone is currently defined on an area spanning about

1 kilometre by 110 metres.

Mineral Resource Estimation Methodology

The Mineral Resource estimation for the GC Zone is based on geological

observations and geochemical data modelization involving the following

rock subdivisions: Unit 1 is defined by a content of 5-10 % Cg; Unit 2

by 10-25 % Cg; and Unit 3 by 25 % Cg or more. Waste has less than 5 %

Cg. Units 1 and 2, appearing similar in texture, have been regrouped

during the interpretation. Unit 2 now ranges from 5 to 25 % Cg.

The GC Zone database includes 4 channels sampled trenches (approximately

900 meters) in addition to 170 NQ size diamond core holes drilled prior

to December 15th, 2012 (approximately 26,500 meters) for a total of 18,182 samples.

Resources were classified as Measured, Indicated or Inferred based on

information spacing and the confidence to the geological continuity of

mineralization in accordance to the CIM guidelines. Only material

located within a pit shell generated from an optimized mining scenario

run under Whittle software is included in this mineral resources

estimate. This scenario is assuming an overall pit slope of 45°, an

operating cost of $69.00 US per tonne milled (including mining and

milling costs), a 100 % mining recovery, no mining dilution and a

conservative selling price of $1,525 US/tonne of concentrate at 93.7 %

Cg.

Drill holes cross sections and plan views were interpreted to construct

three-dimensional wireframe models using the geochemical analyses and

geological descriptive logs with a nominal cut-off of 5% Cg under GEMS

software. No capping value was applied to the assays. Assay intervals

were composited to 3 meter lengths from the raw Cgr assay values and

grades were estimated using ordinary Kriging. Search ellipsoids were

defined in a plane that parallels the average bedding trend

characterized by an azimuth of 50o and a plunge of 40o. Anisotropy was interpreted in semi variogram and set to 60 meters

along the x axis, 40 meters along the y and 50 meters along the z axis.

The block model was defined by block size of 3 meters long by 3 meters

wide by 3 meters thick, rotated 40 degrees counter clockwise in

alignment to the main geological trend over a total of 425 columns, 265

rows and 110 level and covers a strike length of 960 meters to a

maximal depth of 253 meters below the highest surface point. The final

mineral resources which are located inside the optimised pit reach 205

meters below surface (maximum depth of optimised pit). From unit types,

the following densities were assigned to the blocks: U1-U2 (5-25% Cg)=

2.94 g/cm3, U3 (>25% Cg)= 2.88 g/cm3, Waste (0-5% Cg)= 2.92 g/cm3.

The zone remains open in length and at depth.

Conference Call Details

A conference call will be hosted today, December 5, 2013, at 2:00 pm

EST, by the senior management of the Company to discuss the new mineral

resource estimate.

The dial-in numbers are:

+1 416 340 2216 (Toronto and International)

+1 866 223 7781 (North American Toll Free)

There will be a replay of this call, which will last until end of day

December 12, 2013. The replay call in numbers are 905-694-9451 (Toronto

and International), or 800-408-3053 (North American Toll Free). The

conference ID number 2808861 will serve as the password for the replay.

Quality Control and Assurance

Analyses for this drilling campaign were carried out by AGAT

Laboratories Ltd. in Mississauga, Ontario, a company independent from

Mason Graphite, exercising a thorough Quality Control and Assurance

program (QA/QC) with Mason Graphite personnel inserting one blank, two

standards and one duplicate every 100 samples. AGAT Laboratories are

accredited ISO/IEC 17025 by the Standards Council of Canada (SCC).

Carbon as graphite ("Cg") assays reported in this press release were

obtained by using the LECO analytical technique ASTM E1915-07A with a

detection limit of 0.01% Cg. Drill holes were sampled over an average

of 1.5 meter intervals.

Control analyses were performed by Consortium de Recherche Appliquée en

Traitement et Transformation des Substances Minérales (''COREM'') of

Quebec City.

Qualified Persons

The resource estimate was prepared by Roche, a company independent from

Mason Graphite. Edwards Lyons, P.Geo. from Tekhne Research, and Martin

Perron from Roche, are independent Qualified Persons as defined by

National Instrument 43-101. Mr. Lyons and Mr. Perron have reviewed and

approved the technical information pertaining to the mineral resource

estimate in this news release.

Mary-Jean Buchanan, Eng. M.Env., of Met-Chem Canada Inc., an independent

Qualified Person as defined by National Instrument 43-101, has reviewed

and approved the technical information pertaining to the PEA in this

news release.

Yves Caron, P. Geo., M.Sc., Director of the Geology and Exploration for

Mason Graphite, and Jean L'Heureux, Eng., Mason Graphite's Executive

Vice-President of Process Development, both Qualified Persons as

defined by National Instrument 43-101, have reviewed and approved the

scientific and technical content of this press release.

About Mason Graphite

Mason Graphite is a Canadian mining company focused on the exploration

and development of its 100% owned Lac Guéret graphite property, located

in northeastern Québec. The property hosts a National Instrument 43-101

compliant Mineral Resource featuring 50,024,000 tonnes grading 15.6%

Cg, including 6,672,000 tonnes at 32.4% Cg, in the Measured and

Indicated categories and 11,861,000 tonnes at 17.1% Cg, including

2,637,000 tonnes at 30.5% Cg, in the Inferred category. Excellent

potential exists for further mineral growth. A Preliminary Economic

Assessment study was completed on a historic 7.6Mt mineral resource

from July 2012 which features 22 years of production at 27.4% Cg and a

pre-tax internal rate of return of 33.7% (see technical report issued

by the Company on June 6, 2013). The Company's senior management team

possesses significant graphite expertise from their experience at

Timcal/Imerys, including Benoit Gascon, CPA, CA, who held executive

positions for 20 years, including over 6 years as President and CEO;

Jean L'Heureux, Eng., Executive Vice-President, Process Development,

with over 20 years of experience; and Luc Veilleux, CPA, CA, Chief

Financial Officer and Executive Vice-President, with 8 years of

experience. Timcal, now owned by Imerys, is one of the largest graphite

producers in the world.

For more information about Mason Graphite, visit www.masongraphite.com or contact info@masongraphite.com.

Stay Connected: Twitter:@MasonGraphiteFacebook:/MasonGraphite

Cautionary Statements

This press release contains "forward-looking information" within the

meaning of Canadian securities legislation. All information contained

herein that is not clearly historical in nature may constitute

forward-looking information. Generally, such forward-looking

information can be identified by the use of forward-looking terminology

such as "plans", "expects" or "does not expect", "is expected",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of

such words and phrases or state that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of the Company

to be materially different from those expressed or implied by such

forward-looking information, including but not limited to: (i) volatile

stock price; (ii) the general global markets and economic conditions;

(iii) the possibility of write-downs and impairments; (iv) the risk

associated with exploration, development and operations of mineral

deposits; (v) the risk associated with establishing title to mineral

properties and assets; (vi) the risks associated with entering into

joint ventures; (vii) fluctuations in commodity prices; (viii) the

risks associated with uninsurable risks arising during the course of

exploration, development and production; (ix) competition faced by the

resulting issuer in securing experienced personnel and financing; *

access to adequate infrastructure to support mining, processing,

development and exploration activities; (xi) the risks associated with

changes in the mining regulatory regime governing the resulting issuer;

(xii) the risks associated with the various environmental regulations

the resulting issuer is subject to; (xiii) risks related to regulatory

and permitting delays; (xiv) risks related to potential conflicts of

interest; (xv) the reliance on key personnel; (xvi) liquidity risks;

(xvii) the risk of potential dilution through the issue of common

shares; (xviii) the Company does not anticipate declaring dividends in

the near term; (xix) the risk of litigation; and (xx) risk management.

Forward-looking information is based on assumptions management believes

to be reasonable at the time such statements are made, including but

not limited to, continued exploration activities, no material adverse

change in metal prices, exploration and development plans proceeding in

accordance with plans and such plans achieving their stated expected

outcomes, receipt of required regulatory approvals, and such other

assumptions and factors as set out herein. Although the Company has

attempted to identify important factors that could cause actual results

to differ materially from those contained in the forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such forward-looking information. Such forward-looking

information has been provided for the purpose of assisting investors in

understanding the Company's business, operations and exploration plans

and may not be appropriate for other purposes. Accordingly, readers

should not place undue reliance on forward-looking information.

Forward-looking information is made as of the date of this press

release, and the Company does not undertake to update such

forward-looking information except in accordance with applicable

securities laws.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. The estimate of mineral resources may be materially

affected by environmental, permitting, legal, title, taxation,

sociopolitical, marketing, or other relevant issues.

The quantity and grade of reported inferred mineral resources in this

news release are uncertain in nature and there has been insufficient

exploration to define these inferred mineral resources as indicated or

measured mineral resources and it is uncertain if further exploration

will result in upgrading them to indicated or measured mineral

resources.

The PEA is preliminary in nature and includes Inferred Mineral

Resources, which are considered too geologically speculative to have

mining and economic considerations applied to them that would enable

them to be categorized as mineral reserves. Mineral resources that are

not mineral reserves do not have demonstrated economic viability. There

is no certainty that the reserves development, production, and economic

forecasts on which the PEA is based will be realized.

Neither TSX Venture Exchange nor its Regulation Services Provider (as

that term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this release.

SOURCE Mason Graphite Inc.

Image with caption: "Figure 1 - GC Zone, Lac Guéret Project. (CNW Group/Mason Graphite Inc.)". Image available at: http://photos.newswire.ca/images/download/20131205_C7936_PHOTO_EN_34529.jpg

<p> For more information about Mason Graphite, visit <a href="http://www.masongraphite.com">www.masongraphite.com</a> or contact: </p> <p> Investor Relations<br/> <a href="mailto:info@masongraphite.com">info@masongraphite.com</a> </p> <p> Simon Marcotte, Vice-President Corporate Development<br/> +1 (416) 861-5822 </p> <p> Benoît Gascon, President & CEO </p> <p> Greater Montreal Office<br/> 3030 Le Carrefour blvd. Suite 600<br/> Laval QC H7T 2P5 </p> <p> Toronto Office<br/> 65 Queen Street West, Suite 800<br/> Toronto, ON M5H 2M5 </p>