Vancouver, British Columbia--(Newsfile Corp. - January 21, 2026) - Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) ("Kenorland" or the "Company") is pleased to report a grassroots gold discovery at the Opinaca Project (the "Project"), located in the James Bay region of Quebec. Kenorland is the current operator and holds a 3% net smelter return ("NSR") royalty on the Project, which is 100% owned by Targa Exploration Corp. ("Targa"). Assays from all 8 drill holes completed in the campaign, totaling in 3,665 metres of drilling, are reported herein.

Drill Highlights:

- Discovery of widespread gold mineralisation intersected in 7 of 8 drill holes over a 4-km target area with no prior drilling or known mineral occurrences.

- High-grade intercepts include hole 25OPDD007 of 3.65m at 13.88 g/t Au, including 0.30m at 166.14 g/t Au with +10 specs of visible gold (VG), and 25OPDD006 that returned 4.79m at 2.39 g/t Au, including 0.70m at 14.80 g/t Au.

- Broad zones of gold mineralisation across three fences including; 70.55m at 0.17 g/t Au (incl. 8.10m at 0.38 g/t Au) in 25OPDD004; 16.85m at 0.69 g/t Au (incl. 3.25m at 2.23 g/t Au) in 25OPDD003; and 16.00m at 0.43 g/t Au (incl. 1.50m at 3.13 g/t Au) in 25OPDD008.

- Mineralisation style analogous to the regionally significant, intrusion-related, Cheechoo gold deposit*.

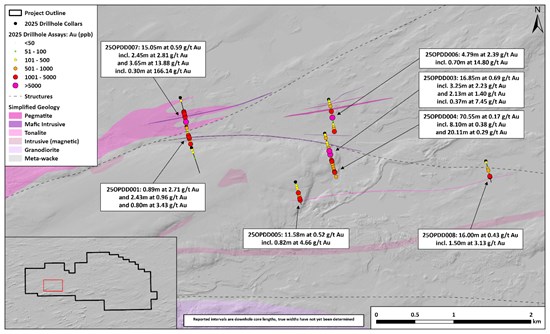

Figure 1. Plan map of Opinaca drilling with highlights from this press release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/281017_73f31684540f2899_001full.jpg

Discussion of Results

The 2025 fall drill program represents the first-ever drilling at the Project, following two years of systematic exploration. Prior to this program, no historical drilling or documented gold occurrences had been reported within the target area. The maiden drill program comprised eight (8) diamond drillholes totaling 3,665 metres, designed to test a 4-km-wide area located at the head of an extensive gold-in-till and heavy mineral concentrate (HMC) gold grain anomaly, as well as anomalous rock samples returning up to 6.67 g/t Au identified through prospecting.

Widespread gold mineralisation was intersected across the target area along three separate drill fences. Mineralisation is hosted within all lithologies including felsic tonalitic intrusives with moderate to strong albite alteration, moderately to strongly deformed meta-wacke, felsic pegmatite and fine-grained mafic intrusive units. Foliation-parallel quartz-feldspar-biotite ± arsenopyrite veins associated with gold cross-cut all lithologies.

The spatial association of gold with albite-altered tonalites, quartz-feldspar veinlets, arsenopyrite, and pegmatites is similar to the Cheechoo gold deposit* (Sirios Resources), also located in the James Bay region, underscoring the potential for a significant intrusion-related gold system at the Opinaca Project.

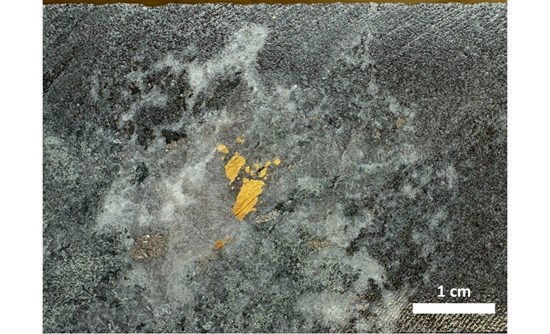

Figure 2. 166.14 g/t Au quartz-amphibole-arsenopyrite-gold vein from 25OPDD007, 459.85-460.15m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/281017_73f31684540f2899_002full.jpg

Results from each of the three drill fences are summarized below:

- Western Fence: Targeted up-ice of a gold grain in till anomaly in proximity to an interpreted NE trending structure. 3.65m at 13.88 g/t Au including 0.30m at 166.14 g/t Au was intersected in 25OPDD007 with +10 specs of visible gold (VG), associated with a quartz-amphibole-arsenopyrite vein in meta-wacke. Drillhole 25OPDD007 also returned 15.05m at 0.59 g/t Au including 2.45m at 2.81 g/t Au hosted in albite-altered tonalite.

- Central Fence: Drilling undercut multiple anomalous boulder samples at surface. Drillhole 25OPDD006 returned 4.79m at 2.39 g/t Au including 0.70m at 14.80 g/t Au in meta-wacke. Holes 25OPDD003 and 25OPDD004 returned 16.85m at 0.69 g/t Au including 3.25m at 2.23 g/t Au and 70.55m at 0.17 g/t Au including 8.10m at 0.38 g/t in meta-wacke with folded quartz-feldspar-biotite-arsenopyrite veinlets.

- Eastern Fence: One drill hole targeted up-ice of a till geochemical anomaly; 25OPDD008 intersected 16.00m at 0.43 g/t Au incl. 1.50m at 3.13 g/t Au in meta-wacke.

Table 1: Table of assay results from the maiden drill program

| HOLE ID | From (m) | To (m) | Interval (m) | Au (g/t) |

| 25OPDD001 |

| 160.63 | 161.52 | 0.89 | 2.71 |

| And | 189.92 | 192.35 | 2.43 | 0.96 |

| And | 216.20 | 217.00 | 0.80 | 3.43 |

| 25OPDD002 | No Significant Results |

| 25OPDD003 |

| 309.15 | 326.00 | 16.85 | 0.69 |

| Incl. | 315.75 | 319.00 | 3.25 | 2.23 |

| And | 349.47 | 356.45 | 6.98 | 0.40 |

| And | 377.87 | 380.00 | 2.13 | 1.40 |

| Incl. | 377.87 | 378.24 | 0.37 | 7.45 |

| 25OPDD004 |

| 115.74 | 186.29 | 70.55 | 0.17 |

| Incl. | 132.16 | 140.26 | 8.10 | 0.38 |

| And | 310.50 | 323.61 | 13.11 | 0.21 |

| And | 333.50 | 353.61 | 20.11 | 0.29 |

| 25OPDD005 |

| 303.50 | 305.50 | 2.00 | 1.16 |

| And | 329.00 | 340.58 | 11.58 | 0.52 |

| Incl. | 337.80 | 338.62 | 0.82 | 4.66 |

| 25OPDD006 |

| 80.74 | 88.00 | 7.26 | 0.21 |

| And | 217.50 | 221.50 | 4.00 | 0.37 |

| And | 326.50 | 331.29 | 4.79 | 2.39 |

| Incl. | 330.00 | 330.70 | 0.70 | 14.80 |

| 25OPDD007 |

| 269.05 | 273.50 | 4.45 | 0.93 |

| Incl. | 271.55 | 273.50 | 1.95 | 1.96 |

| And | 283.60 | 298.65 | 15.05 | 0.59 |

| Incl. | 284.90 | 287.35 | 2.45 | 2.81 |

| And | 310.20 | 318.00 | 7.80 | 0.33 |

| And | 357.60 | 364.50 | 6.90 | 0.64 |

| Incl. | 363.00 | 364.50 | 1.50 | 2.24 |

| And | 394.10 | 422.55 | 28.45 | 0.16 |

| And | 459.35 | 463.00 | 3.65 | 13.88 |

| Incl. | 459.85 | 460.15 | 0.30 | 166.14 |

| 25OPDD008 |

| 285.00 | 301.00 | 16.00 | 0.43 |

| Incl. | 294.00 | 295.50 | 1.50 | 3.13 |

† Assay intervals reported are core lengths, true widths have not been determined.

Table 2. Drill hole location and collar table of reported drill from the maiden drill program

| HOLE ID | Easting (NAD 83) | Northing (NAD 83) | Elevation (m) | Depth (m) | Dip | Azimuth |

| 25OPDD001 | 556423 | 5891755 | 369.1 | 450.00 | -45 | 166 |

| 25OPDD002 | 556490 | 5891481 | 385.7 | 449.15 | -45 | 164 |

| 25OPDD003 | 558212 | 5891668 | 364.2 | 420.00 | -45 | 165 |

| 25OPDD004 | 558280 | 5891395 | 388.2 | 450.00 | -48 | 165 |

| 25OPDD005 | 557834 | 5891039 | 408.5 | 411.00 | -45 | 165 |

| 25OPDD006 | 558264 | 5892105 | 372.2 | 573.00 | -46 | 166 |

| 25OPDD007 | 556344 | 5892129 | 380.7 | 519.00 | -46 | 166 |

| 25OPDD008 | 560296 | 5891309 | 388.3 | 393.00 | -46 | 164 |

The visible gold (VG) sample observed in drillhole 25OPDD007 from 459.85 to 460.15 m originally assayed >1,000 g/t Au by standard fire assay (FA530). The sample was subsequently re-assayed using both high-grade fire assay (FA501) and metallic screen fire assay (FS652). The high-grade fire assay returned 2,328 g/t Au, while the metallic screen assay returned 166.14 g/t Au.

The discrepancy between these results is interpreted to reflect a strong nugget effect related to the coarse-grained nature of the gold, as well as the limited sample mass available for metallic screen analysis. For reporting purposes, the metallic screen fire assay result of 166.14 g/t Au has been used in this press release (Table 1), as it is considered the more representative analytical method.

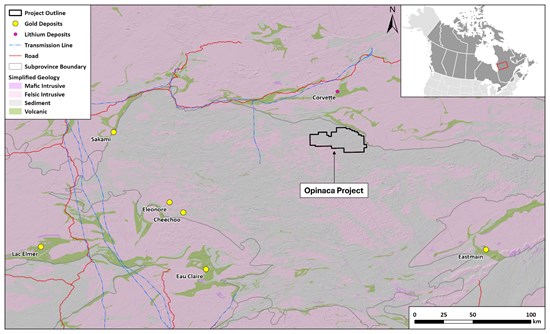

Figure 3. Opinaca Project location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/281017_73f31684540f2899_003full.jpg

*Cheechoo gold deposit: Open-Pit Indicated 35.0Mt at 1.12 g/t (1.26Moz Au); Open-Pit Inferred 38.2Mt at 1.01 g/t (1.24Moz Au); Underground Inferred 4.5Mt at 3.09 g/t (0.45Moz Au). Source: PLR Resources, Mineral Resource Estimate Update for the Cheechoo Project, 07/01/2025. Available at: www.sirios.com.

The mineral resources and reserves discussed for Cheechoo are not located on the Opinaca Project. The Company has not verified this information and it is not being treated as current mineral resources or reserves of the Company. The information is provided for geological context only.

About the Opinaca Project

The Opinaca Project is located in the James Bay region of Quebec, approximately 50 km south of the all-season Trans-Taiga Road and regional hydroelectric infrastructure. The Project was originally staked by Kenorland and subsequently vended to Targa in exchange for equity consideration and 3% NSR royalty.

Originally evaluated for lithium potential, Kenorland initiated a regional till sampling program in 2023 that led to the discovery of two significant and distinct gold anomalies characterized by elevated Au-As-W-Sb geochemical signatures. These results highlighted the potential for an orogenic gold system on the property and represented the first documented mineral exploration on the Opinaca ground.

Subsequent claim staking expanded the property in the up-ice direction to cover potential bedrock source areas, resulting in a consolidated land position totaling 85,267 hectares. Follow-up work in 2024 included infill till sampling, expanded grid coverage, and the collection of 10 kg heavy mineral concentrate samples for gold grain analysis. This work outlined a continuous ~7 km east-west prospective gold trend, with elevated and spatially coherent gold grain counts consistently observed down-ice from the interpreted source area.

Additional work in September 2024 included tighter-spaced HMC sampling and extensive boulder prospecting, which returned anomalous gold values (>0.1 g/t Au) from multiple lithologies, including up to 6.67 g/t Au from a laminated quartz vein boulder. In June 2025, a heliborne magnetic-VLF survey identified a 4 km-long magnetic feature coincident with the core of the gold geochemical footprint, further refining structural and geological targets.

Qualified Person

Cédric Mayer, M.Sc., P.Geo. (OGQ #02385), Senior Project Geologist at Kenorland, "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to Bureau Veritas Commodities ("BV") laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program were carried out by BV. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

FA501 and FS652 were additionally completed on the VG sample. FA501 consists of a 2g aliquot taken from the original pulverized sample and analyzed by fire assay, with appropriate certified reference materials and replicate assays included to monitor analytical accuracy and precision. FS652 is a metallic screen fire assay method, in which a 500 g split of the sample is screened to 106 μm. A 50 g split from both the plus and minus size fractions is analyzed by fire assay with lead (Pb) collection and gravimetric finish. A duplicate analysis is performed on the minus fraction. The final gold (Au) grade is calculated based on the measured proportions of the plus and minus fractions from the original 500 g split.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSXV: KLD) is a well-financed mineral exploration company focused on project generation and early-stage exploration in North America. Kenorland's exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a 4% net smelter return royalty on the Frotet Project in Quebec, which is owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada Ltd. in 2020, which contains an Inferred Mineral Resource of 14.5 Mt at 5.47 g/t Au for 2.55 Moz of gold. Kenorland is based in Vancouver, British Columbia, Canada.

Further information can be found on the Company's website www.kenorlandminerals.com.

On behalf of the Board of Directors of Kenorland Minerals,

Zach Flood

President, CEO & Director

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

This news release may contain information about adjacent properties on which the Company does not have an interest. The Qualified Person has not verified the information, and it is not necessarily indicative of the mineralisation on the Project.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281017

© 2026 Canjex Publishing Ltd. All rights reserved.