VANCOUVER, British Columbia, Feb. 17, 2026 (GLOBE NEWSWIRE) -- GoldHaven Resources Corp. (“GoldHaven” or the “Company”) is pleased to report results from four diamond drill holes—COPE-PDH-005, 006, 007, and 008—representing the first-ever drilling completed on the Company’s high-priority West Gold-in-Soil Target at the Copeçal Gold Project, Mato Grosso, Brazil. Most significantly, hole COPE-PDH-008 has confirmed gold mineralization in unweathered bedrock beneath a deep saprolite weathering profile, validating the geological model that the Company’s robust 6-kilometre surface geochemical anomaly is underlain by an in-situ hydrothermal gold system.

Highlights

Key Bedrock Result — COPE-PDH-008 (Leads)

- 39.0 m* at 0.11 g/t Au from 58.0 m in unweathered granodiorite-gneiss — first-ever confirmation of in-situ bedrock gold at the West Target, including 3.0 m at 0.30 g/t Au

- 1.0 m at 1.69 g/t Au from 1.0 m in the same hole (near-surface saprolite) — high-grade structural shoot present to surface

- Sheeted quartz veining and structural deformation logged throughout the fresh rock interval — consistent with intrusion-related gold architecture of the Juruena Province

Program Overview

- Gold mineralization intersected in all four West Target holes; values substantially exceed local background across all intercepts

- Enhanced saprolite thickness (~60 m) at West Target may reflect preferential weathering of altered/structurally impacted zones related to underlying mineralization

- Bedrock confirmation resolves the key geological question at West Target: the 6-kilometre surface anomaly is sourced from an in-situ hydrothermal gold system

- Physical property testing of drill core and integrated IP/resistivity geophysics to directly inform orientation and targeting of follow-up drill holes

*(Drilled widths – true widths not known)

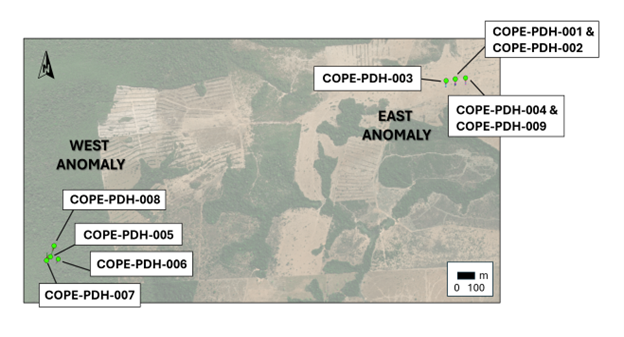

Figure 1. Location of diamond drill holes completed in the inaugural program testing the Copeçal Targets (East and West).

The program intersected geologically meaningful gold enrichment, with assay values substantially exceeding local background levels. The anomalous results confirm system fertility and enhance the prospectivity of the project, although additional work is required to determine continuity, grade distribution, and potential economic significance.

These results confirm the presence of anomalous gold mineralization across all holes drilled to date into the West Target and importantly demonstrate gold anomalism within unweathered bedrock for the first time at Copeçal.

Jon Hill,GoldHaven’s Country Manager in Brazil and AngloGold Ashanti’s former Exploration Manager, commented:

“Prior to this program, all gold mineralization at the West Target had been confined to saprolite. A key exploration question was whether mineralization extends into underlying bedrock. Hole PDH-008 provides the first evidence that it does, intersecting sheeted quartz veining within granodiorite-gneiss at 58 metres with anomalous gold. This is a meaningful technical milestone that enhances our understanding of the mineralizing system and supports continued drilling”.

Significant Drill Results

Significant results from the four diamond holes drilled at the West Target in Q4-2025 are summarized in Table 1 below. Hole COPE-PDH-008 is presented first as the material bedrock confirmation result. All intervals are reported as down-hole lengths; true widths are not yet known. A reporting cut-off of 0.10 g/t Au has been applied with a minimum 1.0 m interval width.

| Hole ID | From (m) | Width (m) | Au (g/t) | Best 1m (g/t) | Host Rock / Notes |

| COPE-PDH-008 | 1.0 | 1.0 m | 1.69 | — | Saprolite (near-surface) |

| COPE-PDH-008 | 58.0 | 39.0 m | 0.11 | 0.30 over 3.0 m | Sheeted Qtz veins in granodiorite-gneiss (BEDROCK) |

| COPE-PDH-006 | 21.0 | 7.0 m | 0.46 | 1.21 over 1.0 m | Sheeted Qtz veins in gneiss (saprolite) |

| COPE-PDH-007 | 8.0 | 28.0 m | 0.14 | 1.04 over 1.0 m | Gneiss (saprolite) |

| COPE-PDH-005 | 0.0 | 30.0 m | 0.16 | 0.20 over 22.0 m | Sheeted Qtz veins in gneiss (saprolite) |

Table 1. Significant intersections reported from diamond holes COPE-PDH-005,006, 007, and 008.

(Drilled widths – true widths not known)

Geological Context

Regional Setting — Juruena Gold Province

The Copeçal Project is situated within the Juruena Gold Province (also known as the Juruena Magmatic Arc), a Paleoproterozoic orogenic belt recognized for hosting multiple gold deposit styles including mesothermal shear-related deposits, intrusion-related gold systems, porphyry-style mineralization, and epithermal occurrences. The Company’s tenements cover 3,681 hectares in a geologically favourable setting within this historically productive mineral province, which hosts G-Mining’s Tocantinzinho deposit—recently commissioned as a commercial gold producer—as well as porphyry-style (Serabi, Jacá) and epithermal-style (X1, Aura) occurrences.

Mineralization within the region is commonly associated with: (i) structurally controlled hydrothermal systems; (ii) quartz veining and phyllic alteration; and (iii) sulphide assemblages that may include pyrite, chalcopyrite, and locally bornite. These regional characteristics inform the ongoing interpretation of the alteration and structural assemblages observed at Copeçal.

West Target

Sheeted quartz vein systems hosted in granodiorite-gneiss represent the dominant gold-bearing architecture in the Juruena Gold Province, where structurally controlled vein stockworks have been identified as the primary mineralizing environment across multiple producing and development-stage deposits in the region. The intersection of this lithological and structural assemblage in unweathered bedrock at Copeçal West is consistent with the Company’s geological model for an intrusion-related gold system at depth.

The presence of narrow high-grade intervals (1.21 g/t, 1.04 g/t, and 1.69 g/t Au over 1 m) within broader anomalous envelopes across three separate holes is consistent with structurally controlled gold shoots of the type that define economic ore shoots in sheeted vein systems across the province. Follow-up drilling will be designed to intersect these structural targets directly, guided by integrated geophysical and alteration data.

Drill holes 005 through 008 encountered a substantially thicker saprolite weathering profile than the East Target holes, extending to approximately 60 m downhole. While no visible sulphides were observed in fresh core, the following features were systematically logged in the granodiorite-gneiss host rock in PDH-008:

- Sheeted quartz veins and veinlets in granodiorite-gneiss, tentatively interpreted as a sheeted vein system consistent with intrusion-proximal gold mineralizing environments in the Juruena Province

- Shearing, folding, and phyllic alteration throughout the bedrock interval

- Structural deformation features consistent with a hydrothermal conduit system

The Company further notes that the enhanced saprolite thickness at the West Target may reflect preferential weathering of altered and/or structurally impacted zones associated with potential underlying mineralization. This observation is being integrated into the geophysical targeting programme for follow-up drilling.

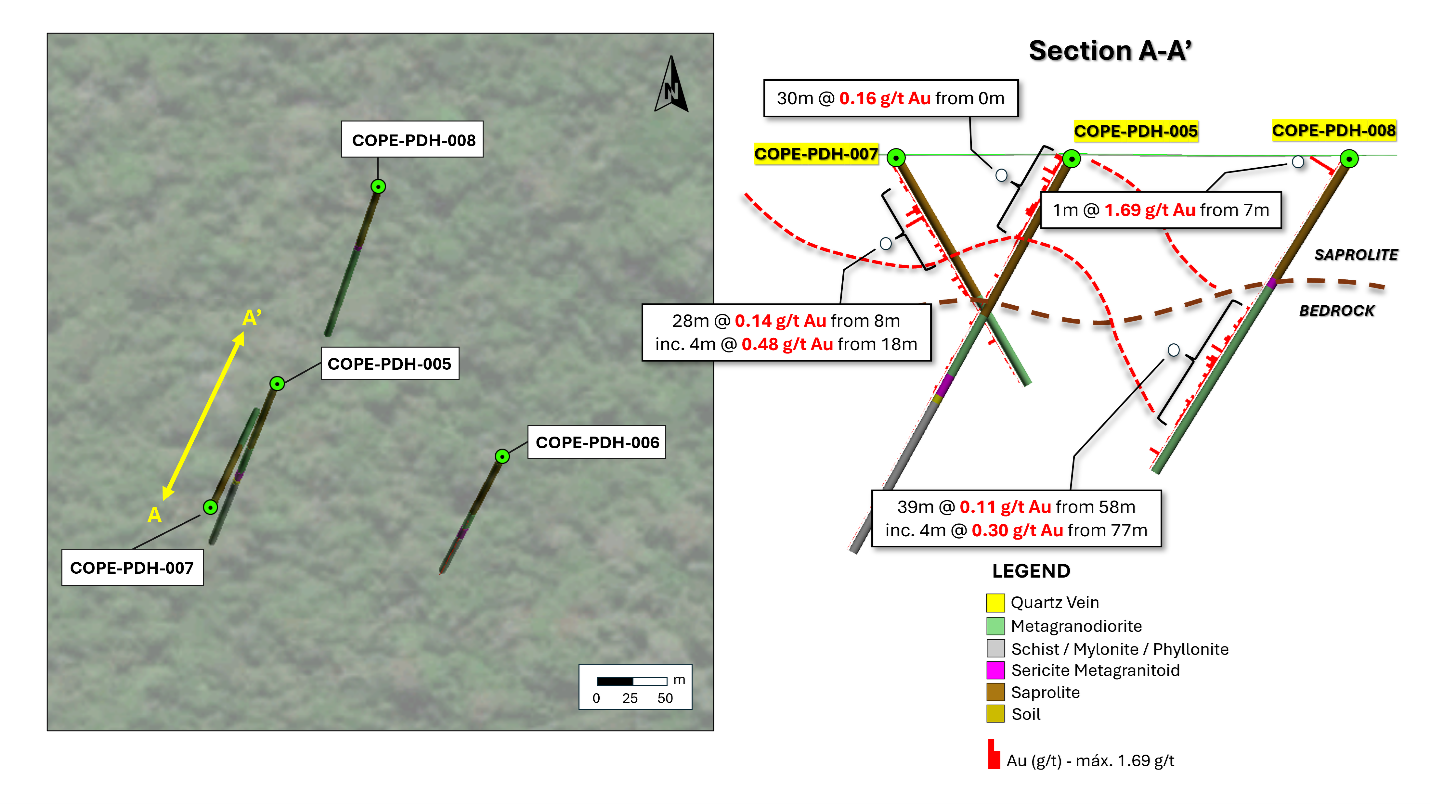

Figure 2. Significant intersections reported from diamond holes COPE-PDH-005, 006,007, and 008.

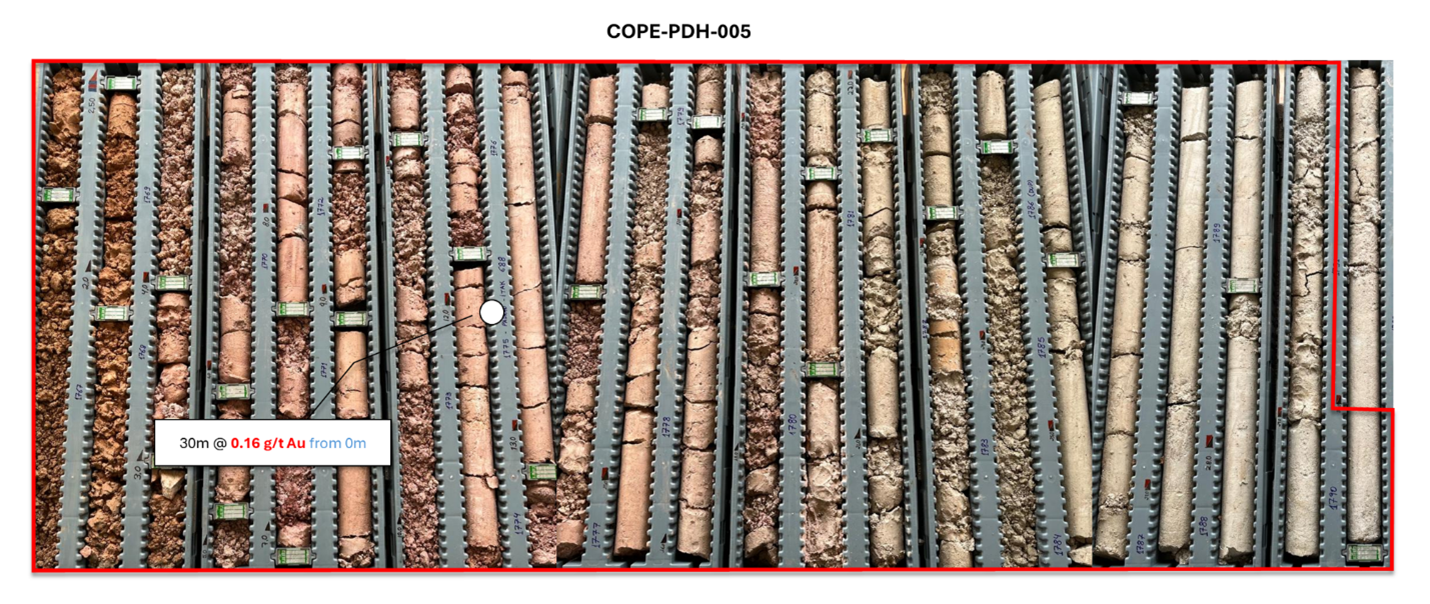

Figure 3. Image of core from the significant gold in saprolite intersection reported from diamond hole COPE-PDH-007 from 8.00 – 34.00m drilled interval. (30m @ 0.16 g/t Au)

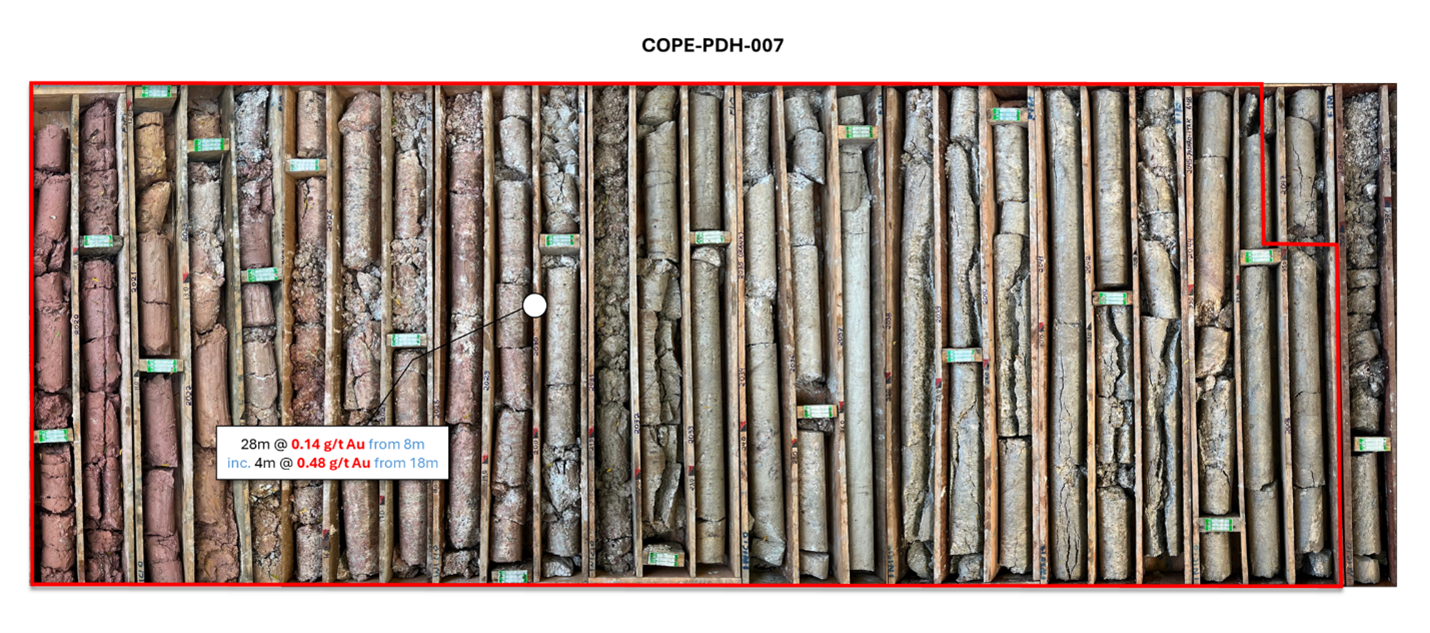

Figure 4. Image of core from the significant gold in saprolite intersection reported from diamond hole COPE-PDH-007 from 8.00 – 34.00m drilled interval. (28m @ 0.14 g/t Au)

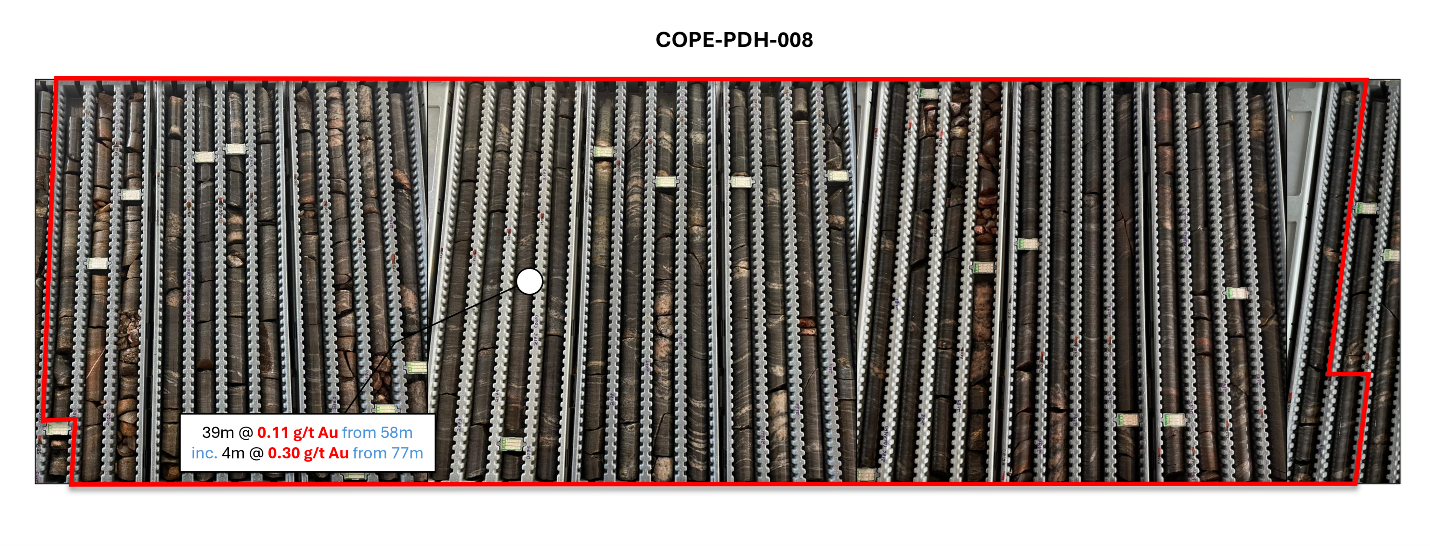

Figure 5. Image of core from the significant gold in bedrock intersection reported from diamond hole COPE-PDH-008 from 58.00 to 97.00 drilled interval. (38m @ 0.11 g/t Au)

Next Steps:

The Company has identified the following integrated work programme to advance Copeçal West toward systematic resource-stage exploration:

- Physical property measurements (density, resistivity, chargeability) on drill core from all nine holes in the inaugural programme, to calibrate historical IP/resistivity geophysical datasets against drill-confirmed mineralized intervals. This will directly inform the orientation and targeting of follow-up holes designed to intersect structural targets identified by the geophysical response at depth.

- Comprehensive multi-element geochemical data review and detailed alteration characterization across all West Target holes, to define mineralization vectors and refine the structural model.

- Review of structural controls and foliation orientations logged in PDH-008 fresh core to determine optimal drill azimuth and inclination for targeting sheeted vein shoots.

- Integration of AngloGold Ashanti historical datasets (auger/air-core drilling, geophysical surveys, soil geochemistry, 2010–2016) with new drill core data to define priority follow-up drill corridors within the 6-kilometre anomaly.

- Pending East Target sulphide assay results from COPE-PDH-004 and COPE-PDH-009 will be considered alongside the West Target bedrock confirmation in planning the next drill phase.

Rob Birmingham, CEO of GoldHaven Resources, commented:

“These latest drill results represent a major milestone for the Copeçal Project,” stated Rob Birmingham, CEO of GoldHaven Resources. “For the first time, we have confirmed gold anomalism in fresh bedrock beneath the thick saprolite profile that previously masked the system. Importantly, these are the first holes ever drilled at the Western Target, and the results provide strong confidence that the robust surface geochemical anomaly is sourced from an underlying mineralized system. We are highly encouraged by the emerging geological picture and can now plan follow-up drilling aimed at vectoring toward the core of what we believe could be a large and significant gold system.”

About the Copeçal Gold Project: A Brief History

The Copeçal Gold Project is strategically situated within the Alta Floresta Gold Province, a historically productive region that has yielded substantial gold discoveries since the late 1970s. GoldHaven’s tenements cover a total of 3,681 hectares in a geologically favourable setting within the Juruena Gold Province of Brazil.

Figure 6: Location of the Copeçal Gold Project within Alta Floresta gold province, with competitor locations.

The Juruena Gold Province, also known as the Juruena Magmatic Arc, is an orogenic belt highly prospective for mesothermal shear-related and intrusion-related gold deposits, such as G-Mining’s Tocantinzinho deposit. Additionally, the region hosts recently identified porphyry-style deposits (e.g., Serabi, Jaca) and epithermal-style deposits (e.g., X1, Aura). The presence of multiple deposit styles, along with the confirmation of large-scale gold deposits in the Juruena Province of Brazil, underscores the significant potential of the Copeçal Gold Project.

Recent exploration programs, including geochemical soil sampling, drone-mounted magnetometry surveys, and historical drilling data, indicate the presence of multiple gold-bearing structures. Notably, AngloGold Ashanti previously conducted systematic exploration on the property from 2010 to 2016, including auger and air-core drilling, geophysical surveys, and rock geochemistry, identifying multiple zones of anomalous gold mineralization.

The Copeçal Gold Project benefits from extensive historical work, with AngloGold Ashanti’s exploration confirming gold and arsenic anomalies, indicative of significant mineralization potential. Soil sampling grids and follow-up auger drilling in key areas revealed consistent gold values over wide zones, further supporting the presence of a substantial mineralized system.

About GoldHaven Resources Corp.

GoldHaven Resources Corp. is a Canadian junior exploration Company focused on acquiring and exploring highly prospective land packages in North and South America. The Company’s projects include (i) the flagship Magno Project, a district-scale polymetallic property adjacent to the historic Cassiar mining district in British Columbia; (ii) the Three Guardsman Project, which exhibits significant potential for copper and gold-skarn mineralization; (iii) the Copeçal Gold Project, a drill-ready gold project located in Mato Grosso, Brazil with a 6km strike of anomalous gold in soil samples; and (iv) three critical mineral projects with extensive tenement packages totalling 123,900 hectares: Bahia South, Bahia North and Igautu projects located in Brazil.

Qualified Person:

The scientific and technical information in this news release has been reviewed and approved by Jonathan Victor Hill, B.Sc. (Hons), FAusIMM, a Qualified Person as defined by NI 43-101 and Country Manager of GoldHaven Resources Corp. Mr. Hill is not independent of the Company.

On Behalf of the Board of Directors

Rob Birmingham, Chief Executive Officer

For further information, please contact:

Rob Birmingham, CEO

www.GoldHavenresources.com

info@goldhavenresources.com

Office Direct: (604) 629-8254

The CSE and Information Service Provider have not reviewed and does not accept responsibility for the accuracy or adequacy of this release.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Often, but not always, forward-looking information and information can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Actual future results may differ materially. In particular, this news release contains forward-looking information relating to the Company and the Property. The forward-looking information reflects management's current expectations based on information currently available and are subject to a number of risks and uncertainties that may cause outcomes to differ materially from those discussed in the forward-looking information. Such risk factors may include, among others, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation and environmental regulation; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; competition for, among other things, skilled personnel and supplies; incorrect assessments of the value of acquisitions; geological, technical, processing and transportation problems; changes in tax laws and incentive programs; failure to realize the anticipated benefits of acquisitions and dispositions; and the other factors. Although the Company believes that the assumptions and factors used in preparing the forward-looking information are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will occur in the disclosed time frames or at all. Factors that could cause actual results or events to differ materially from current expectations include: (i) adverse market conditions; and (ii) other factors beyond the control of the Company. New risk factors emerge from time to time, and it is impossible for the Company’s management to predict all risk factors, nor can the Company assess the impact of all factors on Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking information. The forward-looking information included in this news release are made as of the date of this news release and the Company expressly disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which are available on the Company’s profile at www.sedarplus.ca.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a3f39740-8898-4748-8843-f4c907201204

https://www.globenewswire.com/NewsRoom/AttachmentNg/a324c52d-0909-4051-925d-5de24daefedb

https://www.globenewswire.com/NewsRoom/AttachmentNg/04e62591-db55-43c1-96c7-2ab84dba7feb

https://www.globenewswire.com/NewsRoom/AttachmentNg/4d613b90-b6eb-47a1-bc31-ce9179824422

https://www.globenewswire.com/NewsRoom/AttachmentNg/0a0b58ce-fe31-4099-90fb-d2414ada50e9

https://www.globenewswire.com/NewsRoom/AttachmentNg/369f5c21-a01d-47cb-977f-ebed573ebb1b

Figure 1

Location of diamond drill holes completed in the inaugural program testing the Copeçal Targets (East and West).

Figure 2

Significant intersections reported from diamond holes COPE-PDH-005, 006,007, and 008.

Figure 3

Image of core from the significant gold in saprolite intersection reported from diamond hole COPE-PDH-007 from 8.00 – 34.00m drilled interval. (30m @ 0.16 g/t Au)

Figure 4

Figure 4. Image of core from the significant gold in saprolite intersection reported from diamond hole COPE-PDH-007 from 8.00 – 34.00m drilled interval. (28m @ 0.14 g/t Au)

Figure 5

Image of core from the significant gold in bedrock intersection reported from diamond hole COPE-PDH-008 from 58.00 to 97.00 drilled interval. (38m @ 0.11 g/t Au)

Figure 6

Location of the Copeçal Gold Project within Alta Floresta gold province, with competitor locations.

© 2026 Canjex Publishing Ltd. All rights reserved.