GRAND BAIE, MAURITIUS, July 03, 2025 (GLOBE NEWSWIRE) -- Alphamin Resources Corp. (AFM:TSXV, APH:JSE AltX)( “Alphamin” or the “Company”) is pleased to provide an operational update as follows:

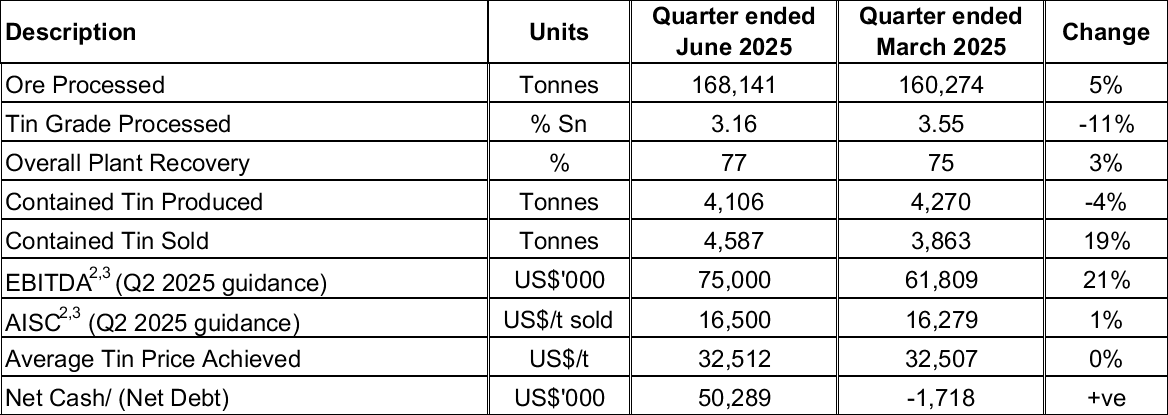

- Q2 2025 contained tin production of 4,106 tonnes following a phased operational restart on 15 April 2025 (Q1 2025: 4,270 tonnes)

- Contained tin sales of 4,587 tonnes for the quarter, up 19% from the prior period

- Q2 2025 EBITDA2,3 guidance of US$75m (Q1 2025 actual: US$62m)

- Strong cash flow generation with Net Cash increasing by US$52m from the prior quarter to US$50m

- First exploration drill hole at Mpama South since the restart intersected visible mineralisation

Operational and Financial Summary for the Quarter ended June 20251

__________________________________________________________________________________________

1Information is disclosed on a 100% basis. Alphamin indirectly owns 84.14% of its operating subsidiary to which the information relates.2Q2 2025 EBITDA and AISC represent management’s guidance. 3This is not a standardized financial measure and may not be comparable to similar financial measures of other issuers.See “Use of Non-IFRS Financial Measures” below for the composition and calculation of this financial measure.

Operational and Financial Performance

Contained tin production of 4,106 tonnes for the quarter ended June 2025 was below the targeted quarterly production of 5,000 tonnes due to the impact of the temporary cessation of operations on 13 March 2025 related to security concerns and the phased restart from 15 April 2025. The months of May and June 2025 recorded contained tin production of 3,361 tonnes which was in line with the annualised target of 20,000 tonnes. The processing facilities performed well and above target – overall plant recoveries averaged 77% during the quarter (Q1: 75%).

Q2 2025 contained tin sales of 4,587 tonnes was recorded against production of 4,106 tonnes as the sales backlog from Q1 was cleared. The average tin price achieved was in line with the prior quarter at US$32,512/t – the tin price is currently trading at around US$33,700/t.

Q2 2025 AISC per tonne of tin sold is estimated at US$16,500 (Q1: US$16,279) which is higher than under normal operating conditions due to the impact of the operational stop on 13 March 2025 and subsequent restart during the second half of April 2025. Operating expenditures included fixed costs and payroll for the full quarter as well as care and maintenance and mine restart costs while tin production recommenced in a phased manner from 15 April 2025.

EBITDA guidance for Q2 2025 is US$75m, 21% higher than the previous quarter’s actual of US$62m. This increase is primarily due to additional tin sales during Q2 2025 which included clearing of the backlog experienced during the prior quarter.

The Company had US$110m in cash at 30 June 2025 after settlement of its FY2024 final DRC tax payment of US$38m at end April 2025, a reduction of its overdraft balance by US$14m to US$39m and payment of the first FY2025 provisional DRC tax instalment of US$14m. The Net Cash position of US$50m improved by US$52m from a Net Debt position of US$2m the prior quarter. During Q2 2025, the Company recommenced utilisation of a portion of its tin prepayment arrangement with offtaker Gerald Metals.

Exploration update

Alphamin’s exploration strategy focuses on three key objectives:

- Increase the Mpama North and Mpama South Resource base and life of mine

- Discover the next tin deposit in close proximity to the Bisie mine

- Ongoing grassroots exploration in search of remote tin deposits on the large prospective land package

Exploration drilling at Mpama North and Mpama South re-commenced during Q4 2024.

Mpama South

A single rig surface drilling campaign at Mpama South targeting both down-dip, up-dip and strike extensions is underway with four holes completed to date. The first two holes to the far south of the current mineralised zone designed to test the lower grade southern extents did not intersect visual tin mineralisation. The subsequent holes were planned 50-80m below the current resource boundary and at depth. The first of these holes (BGH191A) intercepted multiple narrow cassiterite veins 82m below the current Resource boundary over three zones of 9.04 m, 0.86m and 1.04m that potentially extends the mineralised system. The next two of these drillholes (BGH192 and BGH193) were completed with BGH192 intersecting visible cassiterite veins and BGH193 not intersecting any visible cassiterite. Hole BGH194 was drilled and completed during Q2 2025 and intercepted visible cassiterite veins further north of BGH193 and below the current Resource.

Mpama North

A single rig exploration campaign of geological fan drilling from underground at Mpama North on the northern open extensions of the mineralised zone started in Q4 2024. This campaign was aimed at better understanding the geological structure in this area. These eight holes totalling 1,525m, intersected a number of chlorite alteration zones associated with tin mineralisation as well as minor cassiterite veins. One hole in particular intersected wide zones of massive sulphides which are frequently used as a hanging wall marker horizon potentially indicating further cassiterite mineralisation at depth.

The next drill holes at Mpama North are targeting an extension to mineralisation at depth along strike to the north. The first of these drillholes (MNUD008A) was completed in early January 2025 and intersected a thick chlorite altered zone of visual tin cassiterite approximately 20m north of the previously most northerly Resource drillhole and some 200m below the bottom of the current mining echelon. The second of these planned drillholes (MNUD009) also intersected a thick zone of significant visual tin cassiterite a further ~20m north of drillhole MNUD008A. The third drillhole on strike was completed in Q1 2025 without a visual cassiterite intersection.

The Company will be flying a dedicated surface drill rig to site to commence with drilling for extensions of the Mpama North deposit at depth.

The Company expects to release external laboratory assays for exploration drilling to date during Q3 2025.

Amendments to Constitution

The Company has filed an amended Constitution with the Registrar of Companies (Mauritius) that contains certain changes to its Constitution relating to the election, appointment and removal of directors and the declaration and payment of dividends, to clarify these provisions and enhance the Company’s corporate governance. The amendments were overwhelmingly approved by shareholders by special resolution at the Company’s annual general and special meeting held on June 18, 2025 (the “Meeting”). Full details of the amendments are contained in the Company’s management information circular dated May 8, 2025 furnished in connection with the Meeting and a copy of the full amended Constitution will be filed under the Company’s profile on SEDAR+ at www.sedarplus.ca once the filing is approved by the Registrar.

Qualified Persons

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering (Mining), is a qualified person (QP) as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release other than in the section “Exploration update”. He is a Principal Consultant and Director of Bara Consulting Pty Limited, an independent technical consultant to the Company.

Mr. Jeremy Witley, Pr. Sci. Nat., BSc. (Hons) Mining Geology, MSc (Eng), is a qualified person (QP) as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in the section “Exploration update”. He is Head of Mineral Resources at the MSA Group (Pty) Ltd and is an independent technical consultant to the Company.

_________________________________________________________________________________________

FOR MORE INFORMATION, PLEASE CONTACT:

Maritz Smith

CEO

Alphamin Resources Corp.

Tel: +230 269 4166

E-mail: msmith@alphaminresources.com

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Forward-looking statements contained herein include, without limitation, Q2 2025 EBITDA and AISC guidance, the timing of expected receipt of external lab assays for exploration samples and the intention to source a dedicated surface drill rig for Mpama North. Such statements reflect the current views of the Company with respect to future events and are subject to certain risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. Such factors include, without limitation: uncertainties regarding logistics and the timing of supplier responses to orders; uncertainties with respect to social, community and environmental impacts, adverse political events and risks of security related incidents which may impact the operation, outbound roads used to transport product and consumables or the safety of our people, uncertainties regarding the legislative requirements in the Democratic Republic of the Congo which may result in unexpected fines and penalties and tax payments; the speculative nature of mineral exploration and development as well as “Risk Factors” included elsewhere in Alphamin’s public disclosure documents filed on and available at www.sedarplus.ca.

USE OF NON-IFRS FINANCIAL PERFORMANCE MEASURES

This announcement refers to the following non-IFRS financial performance measures:

EBITDA

EBITDA is profit before net finance expense, income taxes and depreciation, depletion, and amortization. EBITDA provides insight into our overall business performance (a combination of cost management and growth) and is the corresponding flow driver towards the objective of achieving industry-leading returns. This measure assists readers in understanding the ongoing cash generating potential of the business including liquidity to fund working capital, servicing debt, and funding capital and exploration expenditures and investment opportunities.

This measure is not recognized under IFRS as it does not have any standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other issuers. EBITDA data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

CASH COSTS

This measures the cash costs to produce and sell a tonne of contained tin. This measure includes mine operating production expenses such as mining, processing, administration, indirect charges (including surface maintenance and camp and head office costs), and smelting, refining and freight, distribution and royalties. Cash Costs do not include depreciation, depletion, and amortization, reclamation expenses, capital sustaining, borrowing costs and exploration expenses. On mine costs, exclusive of stock movement, are calculated on a cost per tonne produced basis, off mine costs are calculated on a cost per tonne sold basis.

AISC

This measures the cash costs to produce and sell a tonne of contained tin plus the capital sustaining costs to maintain the mine, processing plant and infrastructure. This measure includes the Cash Cost per tonne and capital sustaining costs together divided by tonnes of contained tin produced. All-In Sustaining Cost per tonne does not include depreciation, depletion, and amortization, reclamation, borrowing costs, foreign exchange gains and losses, exploration expenses and expansion capital expenditures.

Sustaining capital expenditures are defined as those expenditures which do not increase payable mineral production at a mine site and excludes all expenditures at the Company’s projects and certain expenditures at the Company’s operating sites which are deemed expansionary in nature.

NET CASH/ NET DEBT

Net Cash demonstrates how our debt is being managed and is defined as cash and cash equivalents less total current and non-current portions of interest-bearing debt and lease liabilities.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

© 2026 Canjex Publishing Ltd. All rights reserved.