CALGARY, March 25, 2014 /CNW/ - Yangarra ResourcesLtd. ("Yangarra" or the "Company") (TSX-V:YGR) releases its 2013 financials and reserves.

2013 Financial and Operating Highlights

During the year ended December 31, 2013 the Company completed the

following significant milestones:

-

Average daily production was 2,206 boe/d, a 15% increase from 2012.

-

Funds flow from operations were $26 million ($0.21 per share - basic), a

76% increase from 2012.

-

Earnings before interest, taxes, depletion & depreciation, amortization

and changes in commodity contracts ("EBITDA") was $27 million.

-

Operating costs, including $1.26/boe of transportation costs, were

$7.56/boe.

-

Operating netback of $36.18 per boe, a 42% increase from the $25.48 per

boe reported in 2012.

-

G&A costs of $2.06/boe, which represents an 18% decrease from 2012.

-

Royalties at 5% of oil and gas revenue.

- $1.2 million of realized hedging gains.

-

Fourth quarter 2013 production was 2,764 boe/d with funds flow from

operations of $8 million ($0.06 per share - basic).

-

Total capital expenditures were $47 million versus $19.8 million in

2012. With the equity raise late in 2013 the Company accelerated the

fourth quarter capital expenditures to $26 million.

-

As at December 31, 2013, the Company had a current bank debt,

subordinated debt and working capital deficit, excluding mark to market

on commodity contracts and flow-through share obligations, of $44.6

million compared to $36.3 million at December 31, 2012.

-

The annualized fourth quarter debt to cash flow ratio was 1.4 : 1.

Reserve Report Highlights:

-

Increased proved plus probable reserves by 39% to 17.5 million barrels

of oil equivalent and proved reserves by 32% to 9.4 million barrels of

oil equivalent.

-

Proved plus probable reserves, net present value discounted at 10% ("NPV

10") at December 31, 2013 was $251.1 million, an increase of 50%

compared to December 31 2012.

-

Replaced 2013 production by 283% on a proved basis and 614% on a proved

plus probable basis.

-

Achieved finding and development costs including changes in future

capital, of $14.07/boe ($8.18 excluding changes in future capital) on

proved plus probable reserves and $17.58/boe on proved ($15.25

excluding changes in future capital).

-

Generated a finding and development recycle ratio of 2.57 times on

proved plus probable reserves including changes in future capital (4.42

times excluding changes in future capital) based on the Company's 2013

operating netback of $36.18 per barrel of oil equivalent.

-

Reserve life index of 16.0 years on a total proved plus probable basis

based on the Company's December, 2013 production rate of 3,000 boe/d.

-

Future development costs (proved plus probable) of $125 million which is

2.5 times the 2014 capital budget.

-

Net Asset Value of $206 million as at December 31, 2013, which is $1.40

per common share.

Operations Update

During the first quarter of 2014 the Company drilled 6 gross (5.9 net)

wells in the Cardium formation. A total of 4 gross (3.9 net) wells were

put on production during the quarter with the final 2 (2.0 net)

expected to be on stream at quarter end. The Company experienced 11

days of shut-in production (approximately 1,200 boe/d) due to the

TransCanada pipeline rupture near Rocky Mountain House and an

additional 150 boe/d average for the quarter of Keyera curtailments at

other facilities. The Company expects first quarter production to be

approximately 2,800 boe/d and full year guidance remains at 3,200

boe/d. The Company will continue to drill through break-up as

conditions permit, with 6 gross (5.2 net) wells planned for the second

quarter.

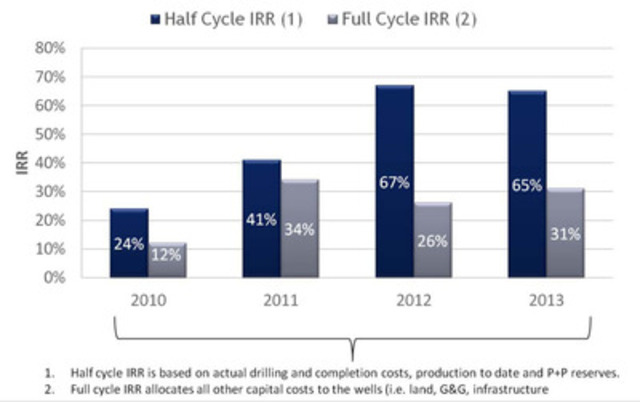

President's Message to Shareholders

Yangarra is currently drilling its 71st horizontal well in Central Alberta. The experience gained by drilling

this many wells with the team we have put in place over the past four

years has been key to reducing costs to a point where we are top

decile in drilling and completions, operating costs and G&A costs. We

are currently concentrating on "oilier" targets in the Cardium and

Glauconite horizons where we have significant inventory. We also have

a large undrilled inventory in "gassier" Cardium, Glauconite and Rock

Creek zones that we will drill as natural gas prices continue to

improve. These "gassier" targets are extremely "liquids rich", however,

the "oilier" targets still command higher internal rates of return

(IRR). Half cycle IRR's in 2013 were 65%, re-cycle ratios were 2.57

(P+P including changes in future capital) in 2013 and annual production

growth is forecast to be 45% in 2014.

A recent farm-in was negotiated in which the Company added significant

acreage to its Cardium inventory. Yangarra has been active at crown

land sales and has been successful closing deals with industry to add

additional future drilling locations. The Company has added two future

drilling locations for every location drilled in each of the past four

years and we have visibility to do the same going forward.

Yangarra is focused on adding shareholder value and to properly gauge

this we have calculated full-cycle rates of return, presented below

which we believe is more indicative of value creation. All capital

costs for each year are included in this calculation including land,

infrastructure, geological work, etc. The chart shows the impact of

focusing on returns rather than focusing on growth.

According to Yangarra's 2013 year end engineering report the Company is

valued at $1.40 per share (2P (pre-tax) at PV 10, net of debt). The

financing late last year provided the necessary liquidity to achieve

the outstanding reserve additions generated by the Company in the

fourth quarter of 2013. There is significant additional intrinsic value

not booked in the reserve report in our 53,000 acres (including farm-in

acreage) of undeveloped Cardium and Glauconite land and for our 39,040

acre net Duvernay land position.

TD Bank recently opined that liquids rich Duvernay lands may be worth

$2,000 - $4,000 per acre in Pembina/Willesden Green which positions our

shareholders with great option value in this rapidly developing play.

Yangarra has recently retained the services of two experienced shale

professionals to develop the asset with plans in progress to drill a

vertical strata-graphic test well.

I would like to thank the shareholders for their support. I thank my

colleagues at Yangarra for their ongoing dedication to the development

of the Company. They have delivered seamless, reliable operations and

demonstrated their ability to quickly interpret, react and adapt to the

technical results of our development drilling efforts. I also wish to

take this opportunity to thank my fellow directors for their support

and leadership.

Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

2012

|

|

|

Year ended

|

|

|

|

|

Q4

|

|

|

Q3

|

|

|

Q4

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

| Statements of Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum & natural gas sales

|

|

$

|

11,087,956

|

|

$

|

9,372,931

|

|

$

|

4,842,343

|

|

$

|

34,726,657

|

|

$

|

21,327,157

|

|

$

|

20,742,259

|

|

Net income (loss) for the period (before tax)

|

|

$

|

1,576,908

|

|

$

|

39,646

|

|

$

|

(2,409,766)

|

|

$

|

4,146,706

|

|

$

|

21,174

|

|

$

|

4,872,697

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the period

|

|

$

|

750,851

|

|

$

|

11,330

|

|

$

|

340,623

|

|

$

|

2,585,699

|

|

$

|

(217,712)

|

|

$

|

1,385,698

|

|

Net income (loss) per share - basic and diluted

|

|

$

|

0.01

|

|

$

|

0.00

|

|

$

|

0.00

|

|

$

|

0.02

|

|

$

|

(0.00)

|

|

$

|

0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Statements of Cash Flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds flow from (used in) operating activities

|

|

$

|

7,975,588

|

|

$

|

6,378,207

|

|

$

|

3,168,328

|

|

$

|

25,648,666

|

|

$

|

14,588,405

|

|

$

|

16,341,180

|

|

Funds flow from (used in) operating activities per share - basic and

diluted

|

|

$

|

0.06

|

|

$

|

0.05

|

|

$

|

0.03

|

|

$

|

0.21

|

|

$

|

0.12

|

|

$

|

0.15

|

|

Cash from (used in) operating activities

|

|

$

|

10,757,178

|

|

$

|

3,683,552

|

|

$

|

4,163,347

|

|

$

|

27,077,123

|

|

$

|

17,016,431

|

|

$

|

6,664,849

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Statements of Financial Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment

|

|

$

|

152,971,016

|

|

$

|

135,892,343

|

|

$

|

121,842,378

|

|

$

|

152,971,016

|

|

$

|

121,842,378

|

|

$

|

119,374,219

|

|

Total assets

|

|

$

|

169,798,021

|

|

$

|

154,773,403

|

|

$

|

138,894,114

|

|

$

|

169,798,021

|

|

$

|

138,894,114

|

|

$

|

141,291,043

|

|

Working Capital (deficit), excluding MTM on commodity contracts

|

|

$

|

36,794,243

|

|

$

|

42,594,542

|

|

$

|

(36,301,842)

|

|

$

|

36,794,243

|

|

$

|

(36,301,842)

|

|

$

|

(34,028,162)

|

|

Subordinated Debt

|

|

$

|

7,786,632

|

|

$

|

-

|

|

$

|

-

|

|

$

|

7,786,632

|

|

$

|

-

|

|

$

|

-

|

|

Non-Current Liabilities

|

|

$

|

7,523,351

|

|

$

|

13,971,180

|

|

$

|

12,274,710

|

|

$

|

7,523,351

|

|

$

|

(12,274,710)

|

|

$

|

(9,752,766)

|

|

Shareholders equity

|

|

$

|

95,583,587

|

|

$

|

82,022,213

|

|

$

|

79,689,765

|

|

$

|

95,583,587

|

|

$

|

(79,689,765)

|

|

$

|

(76,627,244)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares - basic

|

|

|

127,219,336

|

|

|

121,718,245

|

|

|

121,711,723

|

|

|

123,101,587

|

|

|

120,663,095

|

|

|

105,960,324

|

|

Weighted average number of shares diluted

|

|

|

128,322,269

|

|

|

121,987,009

|

|

|

121,711,723

|

|

|

123,101,587

|

|

|

120,663,095

|

|

|

113,781,122

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

2012

|

|

|

Year Ended

|

|

|

|

|

Q4

|

|

|

Q3

|

|

|

Q4

|

|

|

2013

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Daily production volumes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas (mcf/d)

|

|

|

8,303

|

|

|

6,983

|

|

|

4,607

|

|

|

6,583

|

|

|

5,586

|

|

|

Oil (bbl/d)

|

|

|

683

|

|

|

547

|

|

|

418

|

|

|

556

|

|

|

350

|

|

|

NGL's (bbl/d)

|

|

|

605

|

|

|

450

|

|

|

304

|

|

|

422

|

|

|

341

|

|

|

Royalty income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas (mcf/d)

|

|

|

405

|

|

|

299

|

|

|

956

|

|

|

557

|

|

|

1,273

|

|

|

|

Oil (bbl/d)

|

|

|

1

|

|

|

1

|

|

|

(7)

|

|

|

1

|

|

|

3

|

|

|

|

NGL's (bbl/d)

|

|

|

24

|

|

|

26

|

|

|

57

|

|

|

37

|

|

|

77

|

|

|

Combined (boe/d 6:1)

|

|

|

2,764

|

|

|

2,238

|

|

|

1,700

|

|

|

2,206

|

|

|

1,914

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum & natural gas sales - Gross

|

|

$

|

11,087,956

|

|

$

|

9,372,931

|

|

$

|

4,842,343

|

|

$

|

34,726,657

|

|

$

|

21,327,157

|

|

Royalty income

|

|

|

177,335

|

|

|

195,468

|

|

|

216,693

|

|

|

1,108,750

|

|

|

2,024,819

|

|

Commodity contract settlement

|

|

|

271,387

|

|

|

(326,435)

|

|

|

535,585

|

|

|

1,181,080

|

|

|

907,863

|

|

Total sales

|

|

|

11,536,678

|

|

|

9,241,964

|

|

|

5,594,621

|

|

|

37,016,487

|

|

|

24,259,839

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty expense

|

|

|

(557,278)

|

|

|

(701,597)

|

|

|

(3,370)

|

|

|

(1,796,832)

|

|

|

(1,057,597)

|

|

Petroleum & natural gas sales - Net

|

|

$

|

10,979,400

|

|

$

|

8,540,367

|

|

$

|

5,591,251

|

|

$

|

35,219,655

|

|

$

|

23,202,242

|

|

Change in fair value of contracts

|

|

$

|

(2,217,286)

|

|

$

|

(2,411,102)

|

|

$

|

(209,267)

|

|

$

|

(6,928,607)

|

|

$

|

3,889,986

|

|

Total Revenue - Net of royalties

|

|

$

|

8,762,114

|

|

$

|

6,129,265

|

|

$

|

5,381,984

|

|

$

|

28,291,048

|

|

$

|

27,092,228

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pricing Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

|

2012

|

|

|

|

Year Ended

|

|

|

|

|

|

Q4

|

|

|

|

Q3

|

|

|

|

Q4

|

|

|

|

2013

|

|

|

|

2012

|

| Realized Pricing (Including commodity contracts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil ($/bbl)

|

|

$

|

|

85.56

|

|

$

|

|

96.51

|

|

$

|

|

83.76

|

|

$

|

|

92.08

|

|

$

|

|

84.09

|

|

|

NGL ($/bbl)

|

|

$

|

|

52.08

|

|

$

|

|

53.33

|

|

$

|

|

25.09

|

|

$

|

|

54.32

|

|

$

|

|

46.78

|

|

|

Gas ($/mcf)

|

|

$

|

|

3.92

|

|

$

|

|

3.05

|

|

$

|

|

3.02

|

|

$

|

|

3.53

|

|

$

|

|

2.49

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized Pricing (Excluding commodity contracts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil ($/bbl)

|

|

$

|

|

84.98

|

|

$

|

|

102.99

|

|

$

|

|

77.78

|

|

$

|

|

90.93

|

|

$

|

|

83.07

|

|

|

NGL ($/bbl)

|

|

$

|

|

51.45

|

|

$

|

|

60.77

|

|

$

|

|

18.27

|

|

$

|

|

52.91

|

|

$

|

|

45.92

|

|

|

Gas ($/mcf)

|

|

$

|

|

3.67

|

|

$

|

|

2.57

|

|

$

|

|

2.94

|

|

$

|

|

3.25

|

|

$

|

|

2.23

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil Price Benchmarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

West Texas Intermediate ("WTI") (US$/bbl)

|

|

$

|

|

97.46

|

|

$

|

|

105.81

|

|

$

|

|

88.22

|

|

$

|

|

97.97

|

|

$

|

|

94.21

|

|

|

Edmonton (C$/bbl)

|

|

$

|

|

86.58

|

|

$

|

|

103.65

|

|

$

|

|

83.99

|

|

$

|

|

93.11

|

|

$

|

|

87.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Natural Gas Price Benchmarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AECO gas (Cdn$/GJ)

|

|

$

|

|

3.15

|

|

$

|

|

2.82

|

|

$

|

|

3.06

|

|

$

|

|

3.65

|

|

$

|

|

2.79

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign Exchange |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S./Canadian Dollar Exchange

|

|

$

|

|

0.953

|

|

$

|

|

0.963

|

|

$

|

|

1.009

|

|

$

|

|

0.971

|

|

$

|

|

1.000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Netback Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

|

|

2012

|

|

|

|

|

Year Ended

|

|

|

|

|

|

Q4

|

|

|

|

|

Q3

|

|

|

|

|

Q4

|

|

|

|

|

2013

|

|

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Price

|

|

$

|

|

44.67

|

|

|

$

|

|

43.94

|

|

|

$

|

|

34.39

|

|

|

$

|

|

44.59

|

|

|

$

|

|

31.74

|

|

|

Royalty income

|

|

|

|

0.70

|

|

|

|

|

0.95

|

|

|

|

|

1.39

|

|

|

|

|

1.38

|

|

|

|

|

2.89

|

|

|

Royalty expense

|

|

|

|

(2.19)

|

|

|

|

|

(3.41)

|

|

|

|

|

(0.02)

|

|

|

|

|

(2.23)

|

|

|

|

|

(1.51)

|

|

|

Production costs

|

|

|

|

(6.20)

|

|

|

|

|

(5.45)

|

|

|

|

|

(9.65)

|

|

|

|

|

(6.30)

|

|

|

|

|

(6.81)

|

|

|

Transportation costs

|

|

|

|

(1.27)

|

|

|

|

|

(1.47)

|

|

|

|

|

(0.95)

|

|

|

|

|

(1.26)

|

|

|

|

|

(0.84)

|

|

Operating netback

|

|

$

|

|

35.70

|

|

|

$

|

|

34.56

|

|

|

$

|

|

25.16

|

|

|

$

|

|

36.18

|

|

|

$

|

|

25.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G&A and other (excludes non-cash items)

|

|

|

|

(2.07)

|

|

|

|

|

(1.76)

|

|

|

|

|

(2.25)

|

|

|

|

|

(2.06)

|

|

|

|

|

(2.52)

|

|

|

Finance expenses

|

|

|

|

(2.59)

|

|

|

|

|

(2.32)

|

|

|

|

|

(2.65)

|

|

|

|

|

(2.32)

|

|

|

|

|

(2.13)

|

|

Cash flow netback

|

|

|

|

31.04

|

|

|

|

|

30.49

|

|

|

|

|

20.26

|

|

|

|

|

31.80

|

|

|

|

|

20.82

|

|

|

Depletion and depreciation

|

|

|

|

(15.96)

|

|

|

|

|

(18.05)

|

|

|

|

|

(18.52)

|

|

|

|

|

(17.50)

|

|

|

|

|

(20.67)

|

|

|

Impairment

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

(19.82)

|

|

|

|

|

-

|

|

|

|

|

(5.76)

|

|

|

Gain on sale of property and equipment

|

|

|

|

-

|

|

|

|

|

-

|

|

|

|

|

4.15

|

|

|

|

|

-

|

|

|

|

|

0.93

|

|

|

Accretion

|

|

|

|

(0.16)

|

|

|

|

|

(0.15)

|

|

|

|

|

(0.14)

|

|

|

|

|

(0.18)

|

|

|

|

|

(0.13)

|

|

|

Stock-based compensation

|

|

|

|

-

|

|

|

|

|

(0.38)

|

|

|

|

|

-

|

|

|

|

|

(0.36)

|

|

|

|

|

(0.71)

|

|

|

Unrealized gain (loss) on financial instruments

|

|

|

|

(8.72)

|

|

|

|

|

(11.71)

|

|

|

|

|

(1.34)

|

|

|

|

|

(8.60)

|

|

|

|

|

5.55

|

|

|

Deferred income tax

|

|

|

|

(3.25)

|

|

|

|

|

(0.14)

|

|

|

|

|

17.59

|

|

|

|

|

(1.94)

|

|

|

|

|

(0.34)

|

|

Net Income (loss) netback

|

|

$

|

|

2.95

|

|

|

$

|

|

0.06

|

|

|

$

|

|

2.18

|

|

|

$

|

|

3.21

|

|

|

$

|

|

(0.31)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

|

|

|

2012

|

|

|

|

|

Year Ended

|

|

Cash Additions

|

|

|

|

Q4

|

|

|

|

|

Q3

|

|

|

|

|

Q4

|

|

|

|

|

2013

|

|

|

|

|

2012

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land, acquisitions and lease rentals

|

|

$

|

|

(261,263)

|

|

|

$

|

|

307,274

|

|

|

$

|

|

240,777

|

|

|

$

|

|

184,606

|

|

|

$

|

|

734,910

|

|

Drilling and completion

|

|

|

|

18,958,090

|

|

|

|

|

6,725,516

|

|

|

|

|

6,679,886

|

|

|

|

|

35,705,499

|

|

|

|

|

19,727,708

|

|

Geological and geophysical

|

|

|

|

170,565

|

|

|

|

|

417,101

|

|

|

|

|

337,060

|

|

|

|

|

756,870

|

|

|

|

|

1,002,064

|

|

Equipment

|

|

|

|

1,490,863

|

|

|

|

|

1,036,654

|

|

|

|

|

1,758,120

|

|

|

|

|

7,595,294

|

|

|

|

|

2,812,328

|

|

Other Asset Additions

|

|

|

|

100,771

|

|

|

|

|

80,681

|

|

|

|

|

|

|

|

|

|

318,233

|

|

|

|

|

171,521

|

|

|

|

$

|

|

20,459,026

|

|

|

$

|

|

8,567,226

|

|

|

$

|

|

9,015,843

|

|

|

$

|

|

44,560,502

|

|

|

$

|

|

24,448,531

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposition of Property and Equipment

|

|

$

|

|

-

|

|

|

$

|

|

-

|

|

|

$

|

|

(4,650,000)

|

|

|

$

|

|

-

|

|

|

$

|

|

(4,650,000)

|

|

Net Capital Additions

|

|

$

|

|

20,459,026

|

|

|

$

|

|

8,567,226

|

|

|

$

|

|

4,365,843

|

|

|

$

|

|

44,560,502

|

|

|

$

|

|

19,798,531

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration & evaluation assets additions

|

|

$

|

|

2,461,506

|

|

|

$

|

|

-

|

|

|

$

|

|

-

|

|

$

|

|

|

2,461,506

|

|

|

$

|

|

-

|

Oil and Gas Reserves

The following tables summarize certain information contained in the

independent reserves report prepared by AJM Deloitte as of December 31,

2013. The report was prepared in accordance with definitions, standards

and procedures contained in the Canadian Oil and Gas Evaluation

Handbook ("COGE Handbook") and National Instrument 51-101, Standards of

Disclosure for Oil and Gas Activities ("NI 51-101").

Summary of Oil and Gas Reserves

(based on forecast price and costs)

| Reserves Category |

|

|

| Light and

Medium Oil

(Mbbl) |

|

|

|

|

| Natural Gas

Liquids

(Mbbl) |

|

|

|

|

| Natural

Gas

(MMcf) |

|

|

|

|

|

W.I.

Gross

|

|

Co.Share

Gross

|

|

Net

|

|

W.I.

Gross

|

|

Co.Share

Gross

|

|

Net

|

|

W.I.

Gross

|

|

Co.Share

Gross

|

|

Net

|

|

Proved Developed Producing

|

|

988

|

|

993

|

|

820

|

|

711

|

|

754

|

|

539

|

|

12,095

|

|

13,209

|

|

11,130

|

|

Proved Developed Non-Producing

|

|

215

|

|

216

|

|

194

|

|

65

|

|

67

|

|

53

|

|

1,634

|

|

1,679

|

|

1,511

|

|

Proved Undeveloped

|

|

1,276

|

|

1,289

|

|

1,118

|

|

866

|

|

923

|

|

705

|

|

14,806

|

|

16,304

|

|

14,351

|

| Total Proved |

| 2,479 |

| 2,498 |

| 2,132 |

| 1,642 |

| 1,744 |

| 1,297 |

| 28,535 |

| 31,192 |

| 26,992 |

|

Probable

|

|

2,392

|

|

2,401

|

|

2,031

|

|

1,308

|

|

1,357

|

|

1,010

|

|

24,227

|

|

25,590

|

|

22,739

|

| Total Proved Plus Probable |

| 4,871 |

| 4,899 |

| 4,163 |

| 2,950 |

| 3,101 |

| 2,307 |

| 52,762 |

| 56,782 |

| 49,731 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reserves Category |

|

| Total BOE

as at December 31, 2013

(Mboe) |

|

| Total BOE

as at December 31, 2012

(Mboe) |

|

|

|

|

W.I.

Gross

|

|

|

Co.Share

Gross

|

|

|

Net

|

|

|

W.I.

Gross

|

|

|

Co.Share

Gross

|

|

|

Net

|

|

Proved Developed Producing

|

|

|

3,715

|

|

|

3,949

|

|

|

3,214

|

|

|

2,076

|

|

|

2,381

|

|

|

2,042

|

|

Proved Developed Non-Producing

|

|

|

552

|

|

|

563

|

|

|

499

|

|

|

433

|

|

|

443

|

|

|

386

|

|

Proved Undeveloped

|

|

|

4,610

|

|

|

4,929

|

|

|

4,215

|

|

|

4,039

|

|

|

4,338

|

|

|

3,765

|

| Total Proved |

|

| 8,877 |

|

| 9,441 |

|

| 7,928 |

|

| 6,548 |

|

| 7,163 |

|

| 6,193 |

|

Probable

|

|

|

7,738

|

|

|

8,023

|

|

|

6,831

|

|

|

5,058

|

|

|

5,356

|

|

|

4,473

|

| Total Proved Plus Probable |

|

| 16,615 |

|

| 17,464 |

|

| 14,759 |

|

| 11,606 |

|

| 12,518 |

|

| 10,667 |

| Notes to table: |

|

(1)

|

Total values may not add due to rounding.

|

|

(2)

|

BOEs are derived by converting gas to oil equivalent in the ratio of six

thousand cubic feet of gas to one barrel of oil (6 Mcf:1 bbl).

|

|

(3)

|

"Working Interest Gross" reserves are the Company's working interest

(operating or non-operating) share before deducting royalty obligations

and without including any royalty interests of the Company.

|

|

(4)

|

"Company Share Gross" reserves are the Company's working interest

(operating or non-operating) share and before deducting royalty

obligations but including any royalty interests of the Company.

|

|

(5)

|

"Net" Reserves are the Company's working interest (operating or

non-operating) share after deduction of royalty obligations plus any

royalty interests of the Company.

|

|

|

|

Summary of Net Present Values of Future Net Revenue (Before Tax)

(based on forecast price and costs)

|

|

|

| As At December 31, 2013(2) |

|

| As At

December 31,

2012 (3) |

| Reserves Category |

|

| 0.0%

(M$) |

|

| 5.0%

(M$) |

|

| 10.0%

(M$) |

|

| 10%

(M$) |

|

|

Proved Developed Producing

|

|

|

112,355

|

|

|

92,026

|

|

|

78,259

|

|

|

45,271

|

|

|

Proved Developed Non-Producing

|

|

|

19,832

|

|

|

16,499

|

|

|

14,239

|

|

|

4,992

|

|

|

Proved Undeveloped

|

|

|

105,640

|

|

|

75,062

|

|

|

54,859

|

|

|

49,387

|

|

| Total Proved |

|

| 237,827 |

|

| 183,587 |

|

| 147,357 |

|

| 99,650 |

|

|

Probable

|

|

|

257,412

|

|

|

156,838

|

|

|

103,791

|

|

|

67,357

|

|

| Total Proved Plus Probable |

|

| 495,239 |

|

| 340,425 |

|

| 251,148 |

|

| 167,381 |

|

| Notes to table: |

|

(1)

|

Total values may not add due to rounding.

|

|

(2)

|

Forecast pricing used is based on AJM Deloitte published price forecasts

effective December 31, 2013.

|

|

(3)

|

Forecast pricing used is based on AJM Deloitte published price forecasts

effective December 31, 2012.

|

|

(4)

|

Cash flows include the effects of the current Alberta Royalty Framework.

The estimated future net reserves are stated before deducting future

estimated site restoration costs and are reduced for future abandonment

costs and estimated capital for future development associated with the

reserves.

|

|

(5)

|

It should not be assumed that the net present values of future net

revenues estimated by AJM Deloitte represent fair market value of the

reserves. There is no assurance that the forecast price and cost

assumptions will be attained and variances could be material.

|

|

|

|

| Reserve Definitions: |

|

(a)

|

"Proved" reserves are those reserves that can be estimated with a high

degree of certainty to be recoverable. It is likely that the actual

remaining quantities recovered will exceed the estimated proved

reserves.

|

|

(b)

|

"Probable" reserves are those additional reserves that are less certain

to be recovered than proved reserves. It is equally likely that the

actual remaining quantities recovered will be greater or less than the

sum of the estimated proved plus probable reserves.

|

|

(c)

|

"Developed" reserves are those reserves that are expected to be

recovered from existing wells and installed facilities or, if

facilities have not been installed, that would involve a low

expenditure (e.g. when compared to the cost of drilling a well) to put

the reserves on production.

|

|

(d)

|

"Developed Producing" reserves are those reserves that are expected to

be recovered from completion intervals open at the time of the

estimate. These reserves may be currently producing or, if shut-in,

they must have previously been on production, and the date of

resumption of production must be known with reasonable certainty.

|

|

(e)

|

"Developed Non-Producing" reserves are those reserves that either have

not been on production, or have previously been on production, but are

shut in, and the date of resumption of production is unknown.

|

|

(f)

|

"Undeveloped" reserves are those reserves expected to be recovered from

known accumulations where a significant expenditure (for example, when

compared to the cost of drilling a well) is required to render them

capable of production. They must fully meet the requirements of the

reserves classification (proved, probable, possible) to which they are

assigned.

|

|

(g)

|

The Net Present Value (NPV) is based on AJM Deloitte Forecast Pricing

and costs. The estimated NPV does not necessarily represent the fair

market value of our reserves. There is no assurance that forecast

prices and costs assumed in the AJM Deloitte evaluations will be

attained, and variances could be material.

|

|

|

|

Finding and Development Costs ("F&D")

Yangarra's F&D costs for 2013, 2012 and the three year average are

presented in the tables below. The costs used in the F&D calculation

are the capital costs related to: land acquisition and retention;

drilling; completions; tangible well site; tie-ins; and facilities,

plus the change in estimated future development costs as per the

independent reserve report. Acquisition costs are net of any proceeds

from dispositions of properties. Due to the timing of capital costs

and the subjectivity in the estimation of future costs, the aggregate

of the exploration and development costs incurred in the most recent

financial year and the change during that year in estimated future

development costs generally will not reflect total finding and

development costs related to reserve additions for that year. The

reserves used in this calculation are Company net reserve additions,

including revisions.

Proved Finding & Development Costs ($ millions)

|

|

|

| 2013 |

|

| 2012 |

|

| 2011 - 2013 |

|

Capital expenditures

|

|

| 47.0 |

|

|

19.8

|

|

|

130.8

|

|

Change in future capital

|

|

| 7.2 |

|

|

23.8

|

|

|

41.3

|

|

Total capital for F&D

|

|

| 54.2 |

|

|

43.6

|

|

|

172.1

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserve additions, net production (Mboe)

|

|

| 3,083 |

|

|

2,409

|

|

|

8,005

|

|

|

|

|

|

|

|

|

|

|

|

|

Proved F&D costs - including future capital ($/boe)

|

|

| 17.58 |

|

|

18.09

|

|

|

21.50

|

|

Proved F&D costs - excluding future capital ($/boe)

|

|

| 15.25 |

|

|

8.22

|

|

|

15.85

|

|

|

|

|

|

|

|

|

|

|

|

| Proved Recycle Ratio |

|

|

|

|

|

|

|

|

|

|

|

Including future capital

|

|

| 2.06 |

|

|

1.41

|

|

|

|

|

|

Excluding future capital

|

|

| 2.37 |

|

|

3.10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proved plus Probable Finding & Development Costs ($ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| 2013 |

|

| 2012 |

|

| 2011 - 2013 |

|

Capital expenditures

|

|

| 47.0 |

|

|

19.8

|

|

|

130.8

|

|

Change in future capital

|

|

| 33.9 |

|

|

35.7

|

|

|

78.3

|

|

Total capital for F&D

|

|

| 80.9 |

|

|

55.5

|

|

|

209.1

|

|

|

|

|

|

|

|

|

|

|

|

|

Reserve additions, net production (Mboe)

|

|

| 5,750 |

|

|

4,459

|

|

|

13,141

|

|

|

|

|

|

|

|

|

|

|

|

|

Proved plus Probable F&D costs - including future capital ($/boe)

|

|

| 14.07 |

|

|

12.45

|

|

|

15.91

|

|

Proved plus Probable F&D costs - excluding future capital ($/boe)

|

|

| 8.18 |

|

|

4.44

|

|

|

9.96

|

|

|

|

|

|

|

|

|

|

|

|

| Proved plus Probable Recycle Ratio |

|

|

|

|

|

|

|

|

|

|

|

Including future capital

|

|

| 2.57 |

|

|

2.05

|

|

|

|

|

|

Excluding future capital

|

|

| 4.42 |

|

|

5.74

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Asset Value ("NAV")

|

As at December 31, 2013 ($ millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present Value of Proved plus Probable Reserves, before tax (discounted

at 10%)

|

|

|

|

$

|

|

251.1

|

|

Total Debt

|

|

|

|

|

|

(44.6)

|

|

|

|

|

|

|

|

|

| Net Asset Value |

|

|

| $ |

| 206.5 |

|

|

|

|

|

|

|

|

|

Common shares outstanding at year end

|

|

|

|

|

|

147.1

|

|

|

|

|

|

|

|

|

| Net asset value per share |

|

|

| $ |

| 1.40 |

| Notes to tables: |

|

(1)

|

The preceding table shows what is customarily referred to as a "produce

out" net asset value calculation under which the current value of

Yangarra's reserves would be produced at the AJM Deloitte forecast

future prices and costs. The value is a snapshot in time as at

December 31, 2013 and is based on various assumptions including

commodity prices and foreign exchange rates that vary over time. In

this analysis, the present value of the proved and probable reserves is

calculated at a before tax 10 percent discount rate.

|

|

(2)

|

The 2013 total debt, excludes non-cash items (MTM on commodity contracts

and flow through share obligations).

|

|

|

|

Advance Notice Bylaw

Yangarra is announcing that its Board of Directors approved the adoption

of an advance notice by-law (the "Advance Notice By-law"). Among other

things, the Advance Notice By-law fixes a deadline by which

shareholders must submit a notice of director nominations to Yangarra

prior to any annual or special meeting of shareholders where directors

are to be elected and sets forth the information that a shareholder

must include in the notice for it to be valid.

The Advance Notice By-law is similar to the advance notice requirements

adopted by many other Canadian public companies. Specifically, the

Advance Notice By-law requires advance notice to the Corporation in

circumstances where nominations of persons for election as a director

of Yangarra are made by shareholders other than pursuant to (i) a

requisition of a meeting made pursuant to the provisions of the

Business Corporations Act (Alberta) (the "Act"), or (ii) a shareholder

proposal made in accordance with the provisions of the Act.

In the case of an annual meeting of shareholders, notice to the

Corporation must be given not less than 30 or more than 65 days prior

to the date of the annual meeting. In the event that the annual meeting

is to be held on a date that is less than 50 days after the date on

which the first public announcement of the date of the annual meeting

was made, notice may be given not later than the close of business on

the 10th day following such public announcement.

In the case of a special meeting of shareholders (which is not also an

annual meeting), notice to the Corporation must be given not later than

the close of business on the 15th day following the day on which the

first public announcement of the date of the special meeting was made.

The Advance Notice By-law is effective immediately. At the next meeting

of shareholders of the Corporation, shareholders will be asked to

confirm and ratify the Advance Notice By-law. The full text of the

Advance Notice By-law is available under Yangarra's profile at www.sedar.com.

Annual General Meeting of Shareholders

The Company's Annual General and Special Meeting of Shareholders is

scheduled for 10:00 AM on Tuesday May 27, 2014 in the Tillyard

Management Conference Centre, Main Floor, 715 5th Avenue SW, Calgary,

AB.

Year End Disclosure

The Company's Annual Report (financial statements, notes to the

financial statements and management's discussion and analysis) will be

filed on SEDAR (www.sedar.com) and be available on the Company's website (www.yangarra.ca).

Additional reserve information as required under NI 51-101 will be

included in the Company's Annual Information Form which will be filed

on SEDAR by April 30, 2014.

Natural gas has been converted to a barrel of oil equivalent (Boe) using

6,000 cubic feet (6 Mcf) of natural gas equal to one barrel of oil

(6:1), unless otherwise stated. The Boe conversion ratio of 6 Mcf to 1

Bbl is based on an energy equivalency conversion method and does not

represent a value equivalency; therefore Boe's may be misleading if

used in isolation. References to natural gas liquids ("NGLs") in this

news release include condensate, propane, butane and ethane and one

barrel of NGLs is considered to be equivalent to one barrel of crude

oil equivalent (Boe). One ("BCF") equals one billion cubic feet of

natural gas. One ("Mmcf") equals one million cubic feet of natural

gas.

Certain information regarding Yangarra set forth in this news release,

including management's assessment of future plans, operations and

operational results may constitute forward-looking statements under

applicable securities law and necessarily involve risks associated with

oil and gas exploration, production, marketing and transportation such

as loss of market, volatility of prices, currency fluctuations,

imprecision of reserves estimates, environmental risks, competition

from other producers and ability to access sufficient capital from

internal and external sources. As a consequence, actual results may

differ materially from those anticipated in the forward-looking

statements.

The initial production rates discussed in this press release are not

necessarily indicative of long-term performance or of ultimate recovery

due to high initial decline rates.

All reference to $ (funds) are in Canadian dollars.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as

that term is defined in the Policies of the TSX Venture Exchange)

accepts responsibility for the adequacy and accuracy of this release.

SOURCE Yangarra Resources Ltd.

Image with caption: "1) Half cycle IRR is based on actual drilling and completion costs, production to date and P+P reserves. 2) Full cycle IRR allocates all other capital costs to the wells (i.e. land, G&G, infrastructure) (CNW Group/Yangarra Resources Ltd.)". Image available at: http://photos.newswire.ca/images/download/20140325_C6908_PHOTO_EN_38294.jpg