TSX:WDO

TORONTO, Jan. 29, 2015 /CNW/ - Wesdome Gold Mines Ltd. (TSX-WDO) is pleased to announce significant increases in mineral reserves for its 100%-owned Eagle River and Mishi gold mines, located west of Wawa, Ontario. Mineral reserves and resources estimates are updated as at December 31, 2014.

HIGHLIGHTS

- Eagle River Proven and Probable reserves increase 57% to 265,000 ounces at an average grade of 10.1 gAu/tonne

- Mishi Proven and Probable surface mineable reserves increase 8% to 121,000 ounces at an average grade of 2.1 gAu/tonne

- Reserve blocks remain open to expansion

- Significant increases in definition drilling are planned in 2015, particularly at the open pit Mishi mine to further expand mineral reserves and mineral resources.

Rolly Uloth, President, commented "In 2014, we modestly increased drilling and dramatically increased mineral reserves. This work demonstrates the potential of the recently discovered parallel structures which, along with the mine's main producing structure remain open laterally and at depth. In 2015 the Company will focus on demonstrating the long term potential of our producing mines in this camp. So far in this regard we have accomplished significant reserve increases net of depletion, upgraded resources to reserves, increased milling capacity, and validated the new parallel zones. These building blocks put the Company in a position of strength to capitalize on our internal growth prospects and see forward well beyond five years. Importantly, reserves demonstrate high grades with fully diluted underground grades of over 10 grams per tonne, and open pit grades over 2 grams per tonne. These grades provide both a strong defense and natural hedge should gold prices unexpectedly decline and represent tremendous upside margin leverage at current or improved gold prices."

Mr. George Mannard, VP Exploration, added, "It is important to note that after 20 years of production, underground exploration at Eagle River has been relatively shallow with the deepest drilling to date intersecting high grade mineralization at 1,300 metres, and the deepest production level currently at 836 metres. The parallel zone structures remain open laterally and at depth, and they represent exploration targets and internal expansion opportunities for many years to come."

MINERAL RESERVES AND RESOURCES

| MINERAL RESERVES * |

|

|

|

| Dec 31, 2014 | Dec 31, 2013 |

Mine | Category | Tonnes | Grade | Contained Gold |

|

|

| (gAu/tonne) | (ounces) |

|

|

|

|

|

Eagle River | Proven | 141,000 | 8.5 | 39,000 | 41,000 |

| Probable | 675,000 | 10.4 | 226,000 | 128,000 |

| Proven + Probable | 816,000 | 10.1 | 265,000 | 169,000 |

|

|

|

|

|

|

Mishi | Proven | 159,000 | 2.4 | 12,000 | 16,000 |

| Probable | 1,627,000 | 2.1 | 109,000 | 96,000 |

| Proven + Probable | 1,786,000 | 2.1 | 121,000 | 112,000 |

|

|

|

|

|

|

TOTAL |

|

|

| 386,000 | 281,000 |

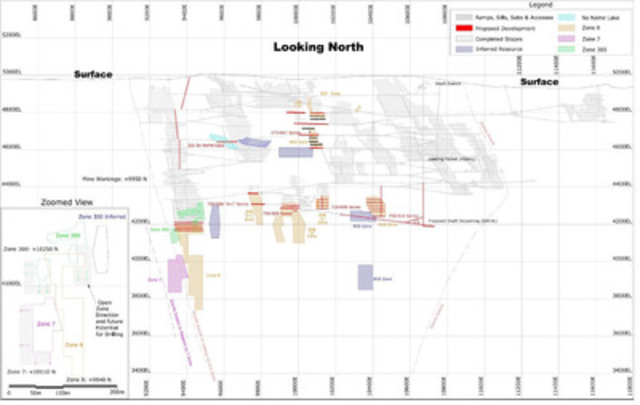

At the Eagle River Mine reserves increased 57%, net of depletion. Previous Indicated Resources and a portion of Inferred Resources were converted to reserves through detailed drilling and development work. Both the recently discovered No 7 and 300 Zones stood up well to definition drilling and remain open in all directions. The development drift to the 300 zone is 30 metres from completion allowing for rapid incorporation into the near term mine plan. Mineralization in the mine's main 8 Zone structure remain open at depth.

At Mishi, the current plan demonstrates a life-of-mine stripping ratio of less than 3:1. Open Pit reserves increased 8%, net of depletion, with the addition of a western extension. Mineralization remains open to the east and west. Surface exploration and delineation drilling in 2015 is designed to extend known mineralization and further increase near-surface mineralization in a systematic manner.

In 2014, considerable work was undertaken to improve the efficiency and capacity of our milling operations. While the mill performed admirably in 2014 as compared to past years, an expansion of the Mishi Open Pit reserves may provide much larger quantities of ore for the existing plant. Drilling planned at Mishi in 2015 will provide the basis to analyze the future potential for a much larger throughput plant. With reserves of 386,000 ounces at our operating mines, we can now look out well beyond a 5-year time horizon.

In addition to our operating mines, Wesdome's resource base is complemented by significant indicated and inferred gold resources found on its 100% owned Val d'Or, Quebec properties and the large Moss Lake deposit near Thunder Bay, Ontario. For details regarding these non-operating assets please review 43-101 technical disclosure available at www.wesdome.com or www.sedar.com.

| ADDITIONAL MINERAL RESOURCES * |

|

|

|

| Dec 31, 2014 | Dec 31, 2013 |

Mine | Category | Tonnes | Grade | Contained Gold |

|

|

| (gAu/tonne) | (ounces) |

Eagle River | Inferred | 292,000 | 8.5 | 80,000 | 105,000 |

|

|

|

|

|

|

Mishi Open Pit | Indicated | 3,688,000 | 2.1 | 248,000 | 248,000 |

| Inferred | 764,000 | 2.4 | 59,000 |

|

|

|

|

|

|

|

Mishi Underground | Indicated | 567,000 | 4.5 | 82,000 | 82,000 |

| Inferred | 437,000 | 5.8 | 81,000 | 81,000 |

|

|

|

|

|

|

TOTAL | Indicated |

|

| 330,000 | 374,000 |

| Inferred |

|

| 220,000 | 245,000 |

The Company is a Producing Issuer as per national Instrument 43-101 section 5.3. |

|

* All Mineral Reserves and Mineral Resources estimates have been made in accordance with the Standards of the Canadian Institute of Mining, Metallurgy and Petroleum and National Instrument 43-101 and assume a gold price of $1,400CDN per ounce. |

|

All Mineral Resources are in addition to Mineral Reserves. |

|

Mineral Resources are not in the current mine plan and therefore do not have demonstrated economic viability. |

|

As per section 4.2 (b)(ii) of National Instrument 43-101, the change in mineral reserves and resources for the Eagle River and Mishi mines does not constitute a material change in the affairs of the Company. For the Eagle River mine refer to the Technical Report filed on SEDAR, dated December, 2005, by Strathcona Mineral Services Ltd. |

|

All mineral reserves and resources at Eagle River employ a 1.5m minimum width, a 3.0 gAu/tonne minimum grade for continuity and include 1.0m of external dilution. |

|

The Mishi mine Mineral Resource estimates were completed by InnovExplo Inc. in a 43-101 Technical Report dated August 25, 2010, and filed on SEDAR. The initial Mishi Mineral Reserves estimates were compiled in a 43-101 Report by InnovExplo Inc. dated January 12, 2011, and also filed on SEDAR. |

|

At Mishi, proven reserves include broken ore, stockpiles and the remainder of two 5 metre benches in progress. (Bench 2990 and 2995). A 1.0 gAu/tonne cut-off grade is employed. |

|

Mishi resources are based on InnovE xplo's 2010 model employing a 1.0 gAu/tonne cut-off grade. This has been adjusted to reflect production, broken ore and stockpiles mined from 2012 to 2014. Actual ore mined and milled reconciles very well with the block model. This is clearly a robust and reliable model to date and is carried forward subject to production reconciliation. |

|

Qualified Persons for the Mineral Reserves and Mineral Resources estimates as per 43-101 are as follows: |

|

Eagle River: George N. Mannard, P.Geo., Vice President Exploration, Wesdome Gold Mines Ltd. |

|

Mishi: |

| Reserves: | Daniel Lapointe, P.Geo., Chief Geologist, and George Mannard, P.Geo., Vice President Exploration, both Wesdome Gold Mines Ltd. |

| Resources: | Based on a Resource Estimate by Karine Brosseau, P.Eng. and Carl Pelletier, P.Geo., InnovExplo Inc., independent consultants, dated August 25, 2010. This estimate has been reconciled to 2012, 2013 and 2014 production and stockpiles by Daniel Lapointe, P.Geo., Chief Geologist, Wesdome Gold Mines Ltd. |

ABOUT WESDOME

Wesdome Gold Mines Ltd. is in its 28th year of continuous gold mining operations in Canada that employ a profit growth approach. The Company is currently producing from its Eagle River and Mishi gold mines in Wawa, Ontario, which have earned consistent free cash flow during times of low gold prices. Wesdome's corporate goal is to build a profitable, long-life, sustainable gold mining Company with modest initial capital costs. This strategy has enabled the Company to acquire strategic property and infrastructure assets in two politically stable and historically proven mining camps. Wesdome has significant upside through ownership of its two other properties, the Kiena Mine Complex in Val d'Or, Quebec and the Moss Lake gold deposit located 100 kilometres west of Thunder Bay, Ontario. These assets are being explored and evaluated to be developed in the appropriate gold price environment. The Company has approximately 110.9 million shares issued and outstanding and trades on the Toronto Stock Exchange under the symbol "WDO".

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances, management's estimates or opinions should change, except as required by securities legislation. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. The Company has included in this news release certain non-IFRS performance measures, including, but not limited to, mine operating profit, mining and processing costs and cash costs. Cash costs per ounce reflect actual mine operating costs incurred during the fiscal period divided by the number of ounces produced. These measures are not defined under IFRS and therefore should not be considered in isolation or as an alternative to or more meaningful than, net income (loss) or cash flow from operating activities as determined in accordance with IFRS as an indicator of our financial performance or liquidity. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow.

SOURCE Wesdome Gold Mines Ltd.

Image with caption: "Composite Longitudinal Section Eagle River Mine. (CNW Group/Wesdome Gold Mines Ltd.)". Image available at: http://photos.newswire.ca/images/download/20150129_C7991_PHOTO_EN_11604.jpg

please contact: Lindsay Carpenter Dunlop, Vice President, Investor Relations, 416-360-3743 ext. 25, ldunlop@wesdome.com; George Mannard, P.Geo., Vice President, Exploration, 416-360-3743 ext. 22; 8 King St. East, Suite 811, Toronto, ON, M5C 1B5, Toll Free: 1-866-4-WDO-TSX, Phone: 416-360-3743, Fax: 416-360-7620, Website: www.wesdome.com