Highlights

- Hole 25MN-042 returned 5.22 g/t gold over 36.82 metres ("m"), including 19.86 g/t gold over 4.88 m.

- Hole 25MN-043 returned 0.36 g/t gold over 32.16 m and 9.03 g/t gold over 7.01 m, including 41.21 g/t gold over 1.37 m.

- Hole 25MN-041 returned 0.58 g/t gold over 16.15 m.

- 11 holes pending assays, totalling 3,924 m, have been completed and are pending assay results.

Vancouver, British Columbia--(Newsfile Corp. - February 11, 2026) - Scorpio Gold Corp. (TSXV: SGN) (OTCQB: SRCRF) (FSE: RY9) ("Scorpio Gold", or the "Company") is pleased to announce results from three holes from its 2025 drilling program at the Manhattan District Project ("Manhattan"), Nevada, USA: from the Phase Two program (25MN-041 through 25MN-043). The results are tabulated in Table 1 and discussed below. Scorpio Gold has drilled 44 drill holes to date from its Phase Two diamond drilling program, 25MN-011 through 25MN-045 and 26MN-046 through 26MN-054, for a grand total of 14,324 m. With the results herein, Scorpio Gold has reported assays on 33 of these (25MN-011 through 25MN-043), totalling 10,406 m, and assays are pending from 11 holes (25MN-044 through 25MN-045 and 26MN-046 through 26MN-054), totalling 3,924 m. The pending results will be reported as they come available and the holes are discussed briefly below.

"Results from our current three-rig diamond drilling program continue to reinforce the presence of strong grades along the main mineralized trend at Manhattan. As the program advances, we will continue stepping out along the Reliance Trend with the objective of adding ounces ahead of the next resource update. We have also planned several more aggressive step-outs designed to rapidly test the broader strike potential of the system, including pending results from exploration drill holes targeting new areas such as Black Mammoth," stated Harrison Pokrandt, Vice President of Exploration.

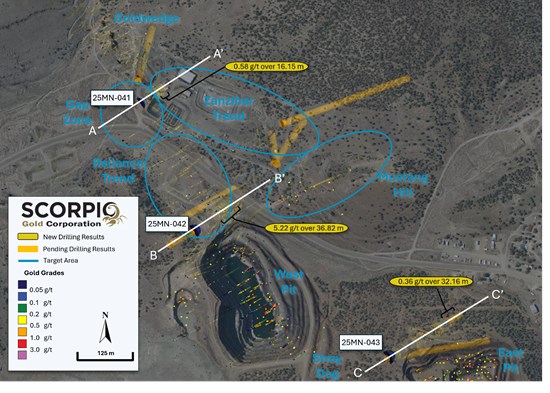

One hole was drilled along the Reliance Trend (25MN-042), one hole was drilled in the Gap Zone (25MN-041), and one hole was drilled in the East Pit area (25MN-043), see Figure 1. These holes were designed to add Inferred category resource blocks in areas where drill density was insufficient to categorise them as Inferred in the June 2025 estimate. The holes tested laterally and below the Inferred Resource Constraining Pit ("IRCP"), modelled at a gold price of USD $2,500 with a 0.3 g/t gold only cutoff grade, along with other inputs including: mill recovery of 90%, 50 degree pit slope angle for in-situ rock, mining costs of $3.00 per tonne for both ore and waste, milling costs of $15.00 per tonne processed, general administration cost of $3.50 per tonne processed and 2% royalty costs, and ore loss and dilution not applied. For further details see "Mineral Resource Estimate and NI 43-101 Technical Report, Manhattan Property, Nye County, Nevada" with an effective date of June 4, 2025, on Scorpio Gold's website, here.

Figure 1. Surface Plan Map of drill results with highlights noted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/283520_4a9139074452eb74_002full.jpg

Drill Hole ID

Hole Depth | Target

Azimuth / Dip | From (m) | To (m) | Intercept¹ (m) | Gold (g/t) |

| 25MN-041 | Gap Zone | 11.43 | 17.37 | 5.94 | 0.32 |

| 203 m | 055° / -55° | 50.29 | 56.39 | 6.10 | 0.77 |

|

| 79.25 | 108.20 | 28.96 | 0.28 |

|

| 111.86 | 128.02 | 16.15 | 0.58 |

| 25MN-042 | Reliance Trend | 92.13 | 105.37 | 13.23 | 0.26 |

| 269 m | 055° / -45° | 115.00 | 119.36 | 4.36 | 2.14 |

|

| 127.01 | 163.83 | 36.82 | 5.22 |

| including | 154.23 | 159.11 | 4.88 | 19.86 |

|

| 167.21 | 175.56 | 8.35 | 0.22 |

|

| 189.80 | 197.42 | 7.62 | 0.44 |

| 25MN-043 | East Pit | 207.42 | 239.57 | 32.16 | 0.36 |

| 276 m | 060° / -45° | 268.53 | 275.54 | 7.01 | 9.03 |

| including | 271.42 | 272.80 | 1.37 | 41.21 |

| ¹ Intervals contain no more than 3 continuous metres grading less than 0.1 g/t gold, high grade samples were capped at 70 g/t gold. |

Table 1. Results from the current batch of drill holes. Note: There is insufficient geological information to estimate a true width for the drill intercepts reported.

Completed hole summaries, reported results, see Figure 1:

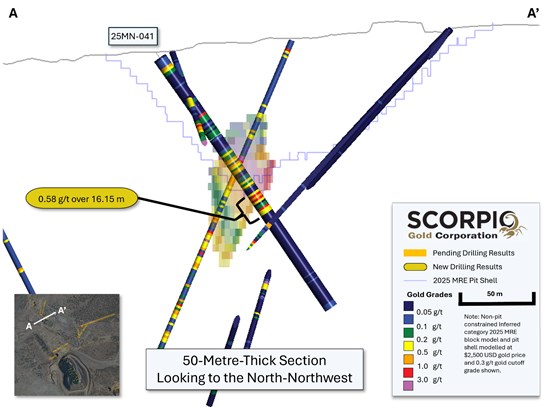

25MN-041: contained three intervals, all hosted in meta-sedimentary fine grained clastic units, of 5.94 m, 6.10 m, and 28.96 m, grading 0.32 g/t gold, 0.77 g/t gold, 0.28 g/t gold, 0.58 g/t gold respectively. One interval, hosted in limestone, of 16.15 m grading 0.58 g/t gold overlies and is adjacent to the volcanic tuff/caldera contact. See Figure 2, section A to A'.

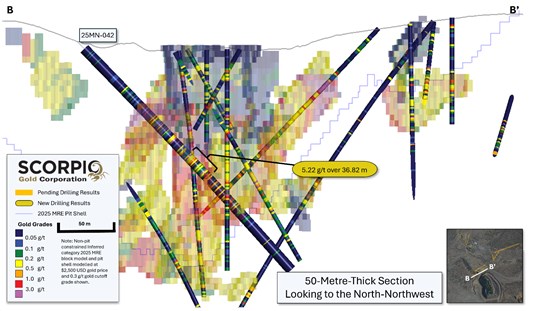

25MN-042: contained five intervals, all hosted in meta-sedimentary fine grained clastic and limestone units, of 13.23 m, 4.36 m, 36.82 m, 8.35 m, and 7.62 m, grading 0.26 g/t gold, 2.14 g/t gold, 5.22 g/t gold, 0.22 g/t gold, and 0.44 g/t gold respectively. The 36.82 m length interval includes 4.88 m grading 19.86 g/t gold. See Figure 3, section B to B'.

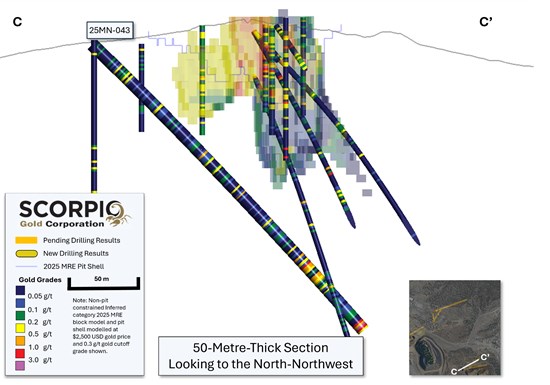

25MN-043: contained two intervals, all hosted in meta-sedimentary fine grained clastic and quartzite units, of 32.16 m and 7.01 m, grading 0.36 g/t gold and 9.03 g/t gold respectively. The later interval includes 1.37 m grading 41.21 g/t gold and is open to depth. See Figure 4, section C to C'.

Figure 2. Section A-A', along trace of hole 25MN-041, showing gold grades with reported intervals highlighted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/283520_4a9139074452eb74_003full.jpg

Figure 3. Section B-B', along trace of holes 25MN-042, showing gold grades with reported intervals highlighted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/283520_4a9139074452eb74_004full.jpg

Figure 4. Section C-C', along trace of hole 25MN-043, showing gold grades with reported intervals highlighted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/283520_4a9139074452eb74_005full.jpg

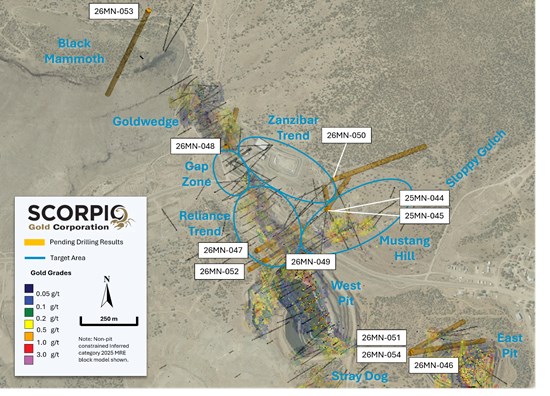

Completed hole summaries, assays pending, see Figure 5:

25MN-044: drilled near Mustang Hill, to the north, to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

25MN-045: drilled near Mustang Hill, to the north-northeast to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

26MN-046: drilled directly north of the historic East Pit, to test for a northerly extension of a westerly mineralised fault splay. A 50 m step-out from drill hole 25MN-043.

26MN-047: drilled as a 50 m step out on drill hole 25MN-042 to the north northwest, on the Reliance Trend.

26MN-048: drilled at Goldwedge to test the faulted contact zone between caldera volcanics and older sedimentary units that host the current Inferred Mineral Resource.

26MN-049: drilled directly north of the historic West Pit, along the Reliance Trend, a 50 m step-out to the southwest and at depth from drill hole 25MN-042.

26MN-050: exploration hole drilled along a structure recognised in the company's recently completed magnetic survey northwest of Mustang Hill, in a newly recognised are called Sloppy Gulch where a circular 1km diameter gold in soils anomaly defined at 100ppm gold where newly discovered historic workings were found.

26MN-051: drilled directly north of the historic East Pit, to test for a northerly extension of a westerly mineralised fault splay. A 50 m step-out to the southeast from drill hole 26MN-046.

26MN-052: drilled directly north of the historic West Pit, along the Reliance Trend, a 50 m step-out to the southwest from drill hole 26MN-049.

26MN-053: the first deep penetrating exploration hole at the peripheral Black Mammoth prospect, targeting the extension of the Reliance Trend where it intersects the Caldera Margin, as it extends northwest of Goldwedge.

26MN-054: drilled directly north of the historic East Pit, to test for a northerly extension of a westerly mineralised fault splay. A 50 m step-out to the northeast from drill hole 26MN-046.

Figure 5. Location and surface traces of completed holes with assays pending, with modelled structures and current Inferred Mineral Resource Block Model2.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9779/283520_4a9139074452eb74_006full.jpg

QA/QC

HQ sized diamond drill core samples were cut in halves, then bagged and secured with security tags to ensure integrity during transportation to the Reno, NV, Paragon Geochemical facility for preparation. For quality assurance ("QA"), unmarked coarse blanks, unmarked certified reference materials, and requested laboratory duplicates were inserted into the sampling sequence. QA samples were systematically inserted into each batch of samples, amounting to approximately 10% of the run of samples. Samples were analyzed for gold using method PA-AU02 (~500 g), a two-cycle PhotonAssayTM analysis of crushed material (70% passing 2 mm). All Paragon Geochemical facilities comply with ISO 17025:2017.

About the Manhattan District

Manhattan, located in the Walker Lane Trend of Nevada, USA, is road accessible and lies approximately 20 kilometers south of the operating Round Mountain Gold Mine, which has produced more than 15 million ounces of gold. For the first time, the Company has consolidated Manhattan's past-producing mines under a single entity that holds valuable permitting and water rights. Historically, Manhattan has produced approximately 700,000 ounces of gold from high-grade placer and lode operations dating from the late 1890s through to the mid-2000s.¹ The maiden mineral resource estimate (the "Maiden MRE") covering the Goldwedge and Manhattan Pit areas of Manhattan is comprised of 18,343,000 tonnes grading 1.26 g/t gold for a total of 740,000 oz contained gold in the inferred category.²

A historical mineral resource estimate (the "Historical MRE") covers the Black Mammoth, April Fool, Hooligan, Keystone, and Jumbo areas of Manhattan and comprises 1,652,325 tonnes grading 5.89 g/t gold for a total of 303,949 oz contained gold.³ The deposit is interpreted as a low-sulfidation, epithermal, gold-rich system situated adjacent to the Tertiary-aged Manhattan caldera in the Southern Toquima Range of Nevada. A "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

Notes

- Adjacent Properties: The Company has no interest in, or rights to, any of the adjacent properties mentioned, including the Round Mountain Gold Mine, and exploration results on adjacent properties are not necessarily indicative of mineralization on the Company's properties. Any references to exploration results on adjacent properties are provided for information only and do not imply any certainty of achieving similar results on the Company's properties.

- Historical Data: This news release includes historical information that has been reviewed by the Company's qualified person. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this presentation. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Third-Party Mineral Projects: These deposits are cited solely for geological context. The Company cautions that these properties are not necessarily adjacent to, nor does the Company or have any interest in or control over them. Although certain geological features may be similar, there is no assurance that mineralization comparable to these deposits will be discovered on any of the Company's properties. Information regarding the aforementioned deposits is taken from publicly available sources and technical reports believed to be reliable but has not been independently verified by the Company. The Company encourages readers to exercise appropriate caution when evaluating these data and/or results.

- Mineral Resource Estimate (MRE): All scientific and technical information relating to Manhattan pertaining to Maiden MRE contained in this news release is derived from the Technical Report dated October 23, 2025 (with an effective date of June 4, 2025) titled "Mineral Resource Estimate and NI 43-101 Technical Report" (the "Technical Report") prepared by Matthew R. Dumala, P.Eng (BC) of Archer Cathro Geological (US) Ltd., Patrick Loury, M.Sc., CPG (AIPG) of Daniel Kunz & Associates, Annaliese Miller, LG (WA) of Geosyntec Consultants, Inc. and Art Ibrado, PhD, PE (AZ) of Fort Lowell Consulting PPLC. The information contained herein in respect of the Maiden MRE is subject to all of the assumptions, qualifications and procedures set out in the Technical Report and reference should be made to the full text of the Technical Report, a copy of which has been filed with the applicable securities regulators and is available under the Company's profile on www.sedarplus.ca.

- Historical MRE: A Qualified Person has not done sufficient work to make the Historical MRE current, and the Company is not treating the Historical MRE as current.

- The Company considers the Historical MRE relevant as it demonstrates the presence of significant gold mineralization across multiple zones within Manhattan; however, its reliability is uncertain because it was prepared prior to the adoption of the current CIM Definition Standards and current QA/QC practices. The Historical MRE provides limited disclosure of assumptions, parameters, estimation methods, cutoff grades, and QA/QC protocols, and therefore these cannot be fully verified by the Company. The categories used in the historical estimate predate, and are not directly comparable to, current CIM Definition Standards, and the Company is not treating the Historical MRE as a current Mineral Resource Estimate. To upgrade and verify the Historical MRE in order to make it a current Mineral Resource Estimate, the Company would be required to undertake confirmatory drilling, modern QA/QC sampling, validation and digitization of historical datasets and updated geological modeling followed by the preparation of a new Mineral Resource Estimate in accordance with CIM Definition Standards and NI 43-101. The Company encourages readers to exercise appropriate caution when evaluating the Historical MRE.

- All scientific and technical information relating to Manhattan pertaining to the Historical MRE contained in this news release is derived from the Technical Report dated May 1997 titled "Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County" (the "Historical Technical Report") prepared by New Concept Mining, Inc. The information contained herein in respect of the Historical MRE is subject to all the assumptions, qualifications and procedures set out in the Historical Technical Report and reference should be made to the full text of the Historical Technical Report.

- References: (1) Strachan, D. G., and Master, T. D., 2005: Update and Revision of the Gold Wedge Project Development, Nye County. Report prepared for Nevada; Royal Standard Minerals, Inc. and dated March 31, 2005; (2) Dumala, M. R., and Lowry, P., 2025: Mineral Resource Estimate and NI 43-101 Technical Report, Manhattan Property, Nye County, Nevada. Report prepared for Scorpio Gold Corporation and dated October 23, 2025 (with an effective date of June 4, 2025); and (3) Berry, A., and Willard, P., 1997: "Exploration and Pre-Production Mine Development, Manhattan District Project, Nye County". Report prepared for New Concept Mining, Inc. and dated May 1997.

Qualified Person

The scientific and technical information in this news release has been reviewed, verified and approved by Thomas Poitras, P. Geo., Chief Geologist of Scorpio Gold, a "Qualified Person", as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Verification included review of laboratory certificates, review of field logs and chain-of-custody records, inspection of blank/standard/duplicate performance, and review of collar and down-hole survey data. No limitations or failures to verify were identified.

About Scorpio Gold Corp.

Scorpio Gold holds a 100% interest in the Manhattan District located in the Walker Lane Trend of Nevada, USA. Scorpio Gold's Manhattan District is ~4,780-hectares and comprises the advanced exploration-stage Goldwedge Mine, with a 400 ton per day maximum capacity gravity mill, and four past-producing pits that were acquired from Kinross in 2021 (see news release dated March 25, 2021). The consolidated Manhattan District presents an exciting late-stage exploration opportunity, with over 140,000 metres of historical drilling, significant resource potential, and valuable permitting and water rights.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

ON BEHALF OF THE BOARD OF SCORPIO GOLD CORPORATION

Forward-Looking Statements

This news release contains statements that constitute "forward-looking statements." Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements in this news release include, among others, statements relating to the timing, scope and interpretation of assay results; potential for resource growth; the potential continuity, extent and characteristics of mineralization along the Reliance Trend, Gap Zone, Zanzibar Trend and Mustang Hill; the intended follow-up exploration activities and timing of future disclosures, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283520

© 2026 Canjex Publishing Ltd. All rights reserved.