Highlights

Drilling Results

Step-out drilling at Minto North continues to expand the footprint of mineralization in this zone beyond the current resource model to the south and to the north, including:

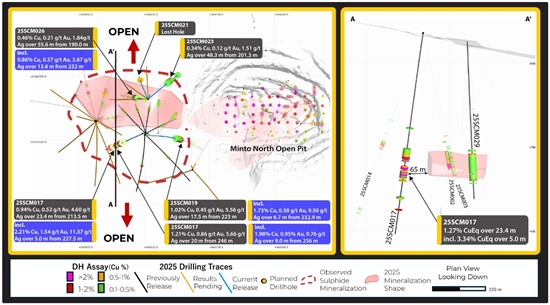

2.21% Cu, 1.54 g/t Au and 11.37 g/t Ag (3.45% CuEq) over 5.0 m within a thicker zone of mineralization grading 0.94% Cu, 0.52 g/t Au, and 4.60 g/t Ag over 23.4 m; and 1.98% Cu 0.95 g/t Au, and 9.76 g/t Ag (2.77% CuEq) over 9.0 m within another thick zone of mineralization grading 1.21% Cu, 0.86 g/t Au, and 5.66 g/t Ag over 20.0 m, both within drill hole 25SCM017. These two significant intercepts occur within a continuous zone of elevated copper from 213.5 m to 266.0 m.

1.73% Cu, 0.58 g/t Au and 9.5 g.t Ag (2.24 % CuEq) over 6.7 m within a thicker zone of mineralization grading 1.02% Cu. 0.47 g/t Au and 5.56 g/t Ag over 17.5 m in drill hole 25SCM019.

Drilling at Ridgetop confirms mineralization and width within an under-drilled portion of the open pit resource and identifies additional stacked mineralized zones beneath the current 2025 MRE open pit.

Drilling Program Update

Drilling will recommence on January 23 with two drill rigs with another two rigs to start on January 28. Four rigs will drill the remaining ~18,000 m until the completion of the planned 50,000 m.

Selkirk Copper will display drill core from its 2025 exploration program at the AME Roundup Core Shack on Monday January 26 to Tuesday January 27. The core display will include intervals referenced in previous news releases, focussing at the Minto North and Ridgetop zones. The Company looks forward to engaging with technical attendees and industry participants during the conference.

Leadership Team Update

- We are pleased to announce the appointment of Leif Bailey as Director, Exploration & Geoscience who will assist the team in advancing all aspects of Selkirk Copper's geoscience-focused exploration activities in the core property area as well as across Selkirk Copper's extensive district mineral claims.

Vancouver, British Columbia and Pelly Crossing, Yukon--(Newsfile Corp. - January 22, 2026) - Selkirk Copper Mines Inc. (TSXV: SCMI) (FSE: IO20) ("Selkirk Copper" or the "Company") is pleased to provide a program update and announce new assay results from the on going 50,000 m drill program at the Minto Mine in Yukon, Canada.

Drilling was paused for the holiday break following the safe completion of 32,026 m in 121 drill holes. New results reported in this release include assays from multiple drill holes completed at the Minto North west zone and the Ridgetop zone, both of which continue to demonstrate strong grade continuity.

M. Colin Joudrie, President & CEO, commented: "New assay results from our 50,000 m planned drill program continue to reinforce our view that the Minto North west zone has meaningful expansion potential and that mineralization in the Ridgetop zone is of the grade and thickness we anticipated. I am pleased to see the exploration and drill teams back on site to complete the balance of the program, encouraged that we continue to attract high quality and experienced personnel such as Leif Bailey to the Selkirk Copper team, and that we are making steady progress on the Trade-Off Study work. The first half of 2026 is shaping up to be a very productive period for Selkirk Copper supported by strong copper, gold, and silver prices to start off the New Year."

2026 Drill Program Update

Drilling will resume January 23, 2026, with additional results continuing to be released as assays are received and validated. Table 1 summarizes meters and holes by zone that have been completed thus far.

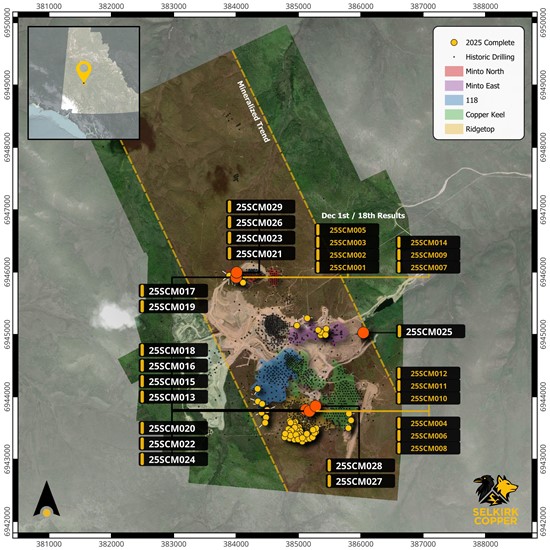

The upcoming program is focused on the Minto East, Copper Keel, Ridgetop and Minto North zones (Figure 1). Drilling will continue to support the ongoing engineering trade-off studies, test expansion of known mineralized zones, and target strategic resource conversion.

Additionally, the Company has completed a comprehensive compilation and re-evaluation of historical geophysical surveys in the vicinity of the Minto Mine. Several new brownfield and greenfield targets have been identified for follow-up drill testing. Testing of greenfield targets north of the current infrastructure and testing newly interpreted regional structures coincident with geophysical anomalies, will be carried out within the remaining portion of the 50,000 m drill program.

Table 1: Drilling by Zone

| Zone | Holes completed | Meters drilled |

| Minto North | 28 | 8,979 |

| Ridgetop | 58 | 11,911 |

| Minto East | 15 | 5,406 |

| Copper Keel | 7 | 1,990 |

| 118 | 13 | 3,740 |

| Total | 121 | 32,026 |

Figure 1: Plan view of the Minto Mine showing surface projections of mineralization zones (Ridgetop, Copper Keel, 118, Minto East and Minto North), relative to 2025 drill collars (yellow circles).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/281227_scfigure1.jpg

Drill Results

Minto North

Drilling at the Minto North west zone, outlined in Figure 2, continues to expand the footprint of a high-grade, laterally continuous copper-gold-silver system. To the south, 25SCM017 stepped-out 60m from historical drilling and intersected two significant intervals, measuring 23.38 m and 20.0 m, within a broader zone measuring 52.5 m in thickness. To the north, 25SCM026 stepped-out 65m from historical drilling and intersected a significant interval measuring 55.6 m in thickness. These intervals approximate the true thickness of the Minto North west mineralized zone, as evidenced by steeply dipping drill holes and the sub-horizontal geometry of the mineralization in this area. Based upon these results, the Minto North west zone has been identified as one of the thickest mineralized lenses that has been discovered within the Minto Mine area.

Mineralization in the Minto North west zone comprises bornite and chalcopyrite hosted with foliated and strongly deformed granodiorite. Mineralization occurs within assimilation zone (ASMZ) and migmatitic (MIGM) lithologies characterized by increasing foliation intensity, magnetite alteration, and elevated sulphide content. The highest grades (e.g., 25SCM017 with a 5.0 m interval of 2.21% Cu, 1.54 g/t Au and 11.37 g/t Ag; 3.45% CuEq) are associated with an elevated ratio of bornite to chalcopyrite and more intensely foliated rock.

The Company has completed additional drilling at the Minto North west zone to expand upon the footprint of mineralization in this area. Additional results will be released as assays are received and validated.

Figure 2: Plan View (right) of the Minto North west zone, and cross-section view (left) looking west. Sulphide mineralization observed in drilling extends the N-S strike direction to 208 meters (dashed outline) compared to the previously modelled 105 meter strike length (red shaded shape).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/281227_scfigure2.jpg

Ridgetop

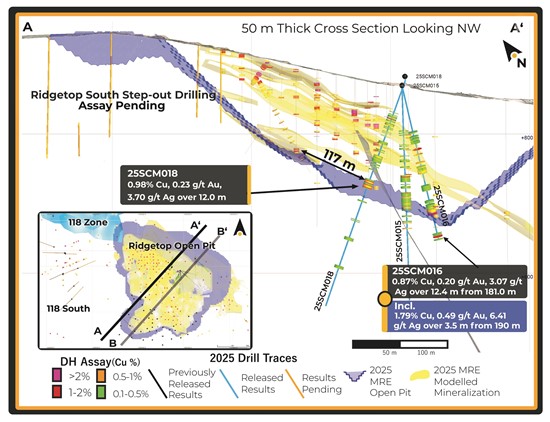

Results from the Ridgetop zone focus on an under-drilled portion of the open-pit resource situated between the well-defined shallow western pit (<150 m depth) and a higher-grade, deeper zone to the east. Drill holes 25SCM016 and 25SCM018 intercepted moderate to low-grade mineralization coincident with the stacked mineralized lens model. Importantly, both holes intersected an additional deeper, previously unmodelled zone, returning 0.87% Cu, 0.20 g/t Au and 3.07 g/t Ag (1.05% CuEq) over 12.35 m in 25SCM016, and 0.98% Cu, 0.23 g/t Au and 3.70 g/t Ag (0.97% CuEq) over 12.0 m in 25SCM018 (Figure 3).

This drilling demonstrates potential to successfully convert waste to ore within planned pits, in areas with no previous drilling, which will improve the economics of future pit designs. Additionally, the discovery of new, higher-grade lenses at depth demonstrates the continued expansion potential at Ridgetop. As a result, targeted drilling at Ridgetop will remain a priority as the Company advances engineering and trade-off studies.

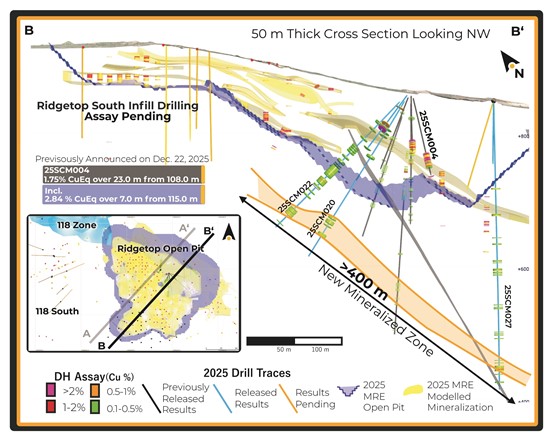

Stepping to the southeast, drill holes 25SCM020, 25SCM022, and 25SCM027 identified another new mineralized lens beneath the existing 2025 MRE open pit design1, further demonstrating the stacked nature of mineralized lenses throughout the Minto deposit area (Figure 4). A renewed focus on structural fabrics, mineralogy, and physical property measurements is helping refine our understanding of the key controls on mineralization, allowing us to more effectively map continuous zones and better target the higher-grade pockets within them.

Figure 3: Cross-section A-A', 50 m thick, looking NW of the Ridgetop open pit resource (yellow shapes).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/281227_scfigure3.jpg

Figure 4: Cross-section B-B', 50 m thick, looking NW of the Ridgetop open pit resource (yellow shapes).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11605/281227_scfigure4.jpg

The location, azimuth, dip and depth of hole of this new drilling is summarized in Table 2 and significant intervals is summarized in Table 3.

Table 2: Collar Locations and Header Information

| Hole ID | Easting | Northing | Azi | Dip | EOH | Zones |

| 25SCM013 | 385177 | 6943771 | 252 | -72 | 150 | Ridgetop |

| 25SCM014 | Previously Released Dec 22, 2025 |

|

|

|

| 25SCM015 | 385121 | 6943792 | 0 | -88 | 309 | Ridgetop |

| 25SCM016 | 385121 | 6943792 | 0 | -74 | 324 | Ridgetop |

| 25SCM017 | 383997 | 6945916 | 240 | -76 | 372 | Minto North |

| 25SCM018 | 385124 | 6943795 | 210 | -70 | 348 | Ridgetop |

| 25SCM019 | 384001 | 6945911 | 92 | -68 | 420 | Minto North |

| 25SCM020 | 385177 | 6943771 | 192 | -56 | 268.5 | Ridgetop |

| 25SCM021 | 384009 | 6945994 | 335 | -55 | 101 | Minto North |

| 25SCM022 | 385177 | 6943771 | 204 | -45 | 294 | Ridgetop |

| 25SCM023 | 384009 | 6945994 | 0 | -90 | 282 | Minto North |

| 25SCM024 | 385177 | 6943771 | 179 | -45 | 285 | Ridgetop |

| 25SCM025 | 385275 | 6943850 | 0 | -90 | 507 | Minto East |

| 25SCM026 | 384009 | 6945994 | 270 | -82 | 474 | Minto North |

| 25SCM027 | 385275 | 6943850 | 0 | -90 | 435 | Ridgetop |

| 25SCM028 | 385275 | 6943850 | 137 | -69 | 351 | Ridgetop |

| 25SCM029 | 384009 | 6945994 | 50 | -75 | 348 | Minto North |

Table 3: Significant Interval Table

| Hole ID | From | To | Length (m) | Cu % | Au g/t | Ag g/t | CuEq % | Lith | Zone |

| 25SCM013 | 49.93 | 50.47 | 0.54 | 9.19 | 0.01 | 0.75 | 9.20% | ASMZ | RT |

| 127.95 | 133.8 | 5.85 | 0.37 | 0.06 | 0.80 | 0.42% | ASMZ |

|

| 25SCM015 | 129.11 | 138 | 8.89 | 0.41 | 0.05 | 0.86 | 0.45% | ASMZ | RT |

| 158 | 165 | 7 | 0.29 | 0.06 | 1.20 | 0.35% | ASMZ |

|

| 169.87 | 179 | 9.13 | 0.40 | 0.08 | 2.02 | 0.48% | ASMZ |

|

| 25SCM016 | 181 | 193.35 | 12.35 | 0.87 | 0.20 | 3.07 | 1.05% | MIGT | RT |

| Incl. | 189.88 | 193.35 | 3.47 | 1.79 | 0.49 | 6.41 | 2.21% | MIGT |

|

| 225 | 226.93 | 1.93 | 1.53 | 0.32 | 6.86 | 1.83% | ASMZ |

|

| 25SCM017 | 213.5 | 236.88 | 23.38 | 0.94 | 0.52 | 4.60 | 1.37% | MIGT/ASMZ | MN |

| Incl. | 227.5 | 232.5 | 5 | 2.21 | 1.54 | 11.37 | 3.45% | MIGT |

|

| 235 | 236.88 | 1.88 | 2.42 | 0.98 | 14.29 | 3.28% | ASMZ |

|

| 246 | 266 | 20 | 1.21 | 0.86 | 5.66 | 1.90% | ASMZ |

|

| Incl. | 256 | 265 | 9 | 1.98 | 0.95 | 9.76 | 2.77% | ASMZ |

|

| 25SCM018 | 121.45 | 123 | 1.55 | 0.90 | 0.25 | 3.06 | 1.11% | ASMZ | RT |

| 158 | 170 | 12 | 0.98 | 0.23 | 3.70 | 0.97% | MIGT |

|

| 25SCM019 | 208 | 221 | 13 | 0.40 | 0.08 | 1.16 | 0.47% | ASMZ | MN |

| 223 | 240.49 | 17.49 | 1.02 | 0.47 | 5.56 | 1.42% | ASMZ |

|

| Incl. | 232.85 | 239.5 | 6.65 | 1.73 | 0.58 | 9.50 | 2.24% | ASMZ |

|

| 25SCM020 | No Significant Intercept | RT |

| 25SCM021 | Lost Hole | MN |

| 25SCM022 | No Significant Intercept | RT |

| 25SCM023 | 201.3 | 249.61 | 48.31 | 0.34 | 0.12 | 1.51 | 0.44% | ASMZ | MN |

| 25SCM024 | 79.2 | 83.3 | 4.13 | 0.99 | 0.22 | 3.54 | 0.94% | ASMZ | RT |

| 25SCM025 | No Significant Intercept | ME |

| 25SCM026 | 190 | 245.6 | 55.6 | 0.46 | 0.21 | 1.84 | 0.63% | MIGT | MN |

| Incl. | 232 | 245.6 | 13.6 | 0.86 | 0.57 | 3.67 | 1.31% | MIGT |

|

| 25SCM027 | 399 | 404.5 | 5.53 | 0.57 | 0.13 | 3.77 | 0.70% | MIGT | RT |

| 25SCM028 | 178.4 | 183.2 | 4.82 | 0.83 | 0.45 | 4.94 | 1.21% | MIGT | RT |

| 224 | 229 | 5 | 0.42 | 0.10 | 1.24 | 0.51% | ASMZ |

|

| 25SCM029 | 250 | 261 | 11 | 0.49 | 0.15 | 2.75 | 0.62% | MIGT | MN |

| At the Minto North zone, the flat laying to shallowly dipping nature of the mineralized zones suggest that true widths are typically >90% of the reported drill intersection length. At Ridgetop, true widths are approximate 85-90% of reported drill intersection lengths. |

ASMZ = Assimilation Zone; MIGT = Migmatite

RT = Ridgetop; MN = Minto North |

CuEq Calculation:

CuEq = ((Cu% × CuP × RCu × 2204.62)+(Au g/t ÷ 31.1035 × AuP × RAu) + (Ag g/t ÷ 31.1035 × AgP × RAg ))/(CuP × RCu × 2204.62)

Where:

CuP/AuP/AgP = US$ commodity prices of $4.25/lb Cu, $2500/oz Au, $29/oz Ag; RCu = Cu Recovery = 98%; RAu = Au Recovery = 85%; RAg= Ag Recovery = 85%

Recoveries as estimated from historical mineral processing results. |

Leadership Team Update

We are pleased to announce that Leif Bailey, a professional geoscientist with 20 years of experience and a passion for exploration and discovery, has joined Selkirk Copper's exploration team as Director Geoscience & Exploration. Mr. Bailey's expertise spans the exploration and mining life-cycle, including grassroots exploration, development studies, and underground mining operations, and across a diversity of deposit types and commodities. His previous work includes exploration projects throughout North America, with a focus on copper-gold deposits in Northern BC, Yukon, and Alaska.

Mr. Bailey has a track-record of delivering value through successful exploration, and also through delivery of targeted geoscience and orebody knowledge initiatives for development projects and mining operations. Prior to joining Selkirk Copper, Mr. Bailey provided leadership within a multi-disciplinary technical team at the Galore Creek Cu-Au-Ag Project, a joint-venture partnership between Teck Resources Limited and Newmont Corporation. In this role, he was part of the team recognized in 2023 with the AME David Barr Award for Leadership and Innovation in Mineral Exploration Health & Safety.

Mr. Bailey is a registered Professional Geologist (P.Geo., EGBC) and holds an M.Sc. in Geology from the University of British Columbia. In his master's degree, Mr. Bailey completed a comprehensive study of the White Gold deposit, located nearby to Minto, and was part of a research initiative focused on understanding the geological framework for mineral deposits in West-Central Yukon.

Issuance of Options in Selkirk Copper Mines Inc.

The Company further announces that it has granted an aggregate of 400,000 stock options (the "Options") to certain employees and consultants of the Company pursuant to its stock option plan (the "Stock Option Plan") subject to the approval of the TSX Venture Exchange. Each Option entitles the holder to acquire one common share of the Company at an exercise price of $0.71 per share for a period of ten years from the date of grant. The Options will vest as to 25% on the date of grant, with the balance vesting in equal quarterly instalments thereafter annually from the date of grant. The Company also announces that it has cancelled an aggregate of 56,250 incentive stock options in accordance with the terms of the Stock Option Plan.

Marketing Campaign Service Agreements

The Company also announces it has entered into a service agreement with Native Ads Inc. ("Native Ads") in connection with a digital advertising campaign, pursuant to which Native Ads will provide the Company with services which include sponsored articles and other advertising development, ad campaign analytics, and media buying and distribution services. The digital advertising campaign is planned for the six-month term of the agreement, or until budget exhaustion, with a total campaign budget of US$250,000. The majority of the campaign budget will be disbursed by Native Ads in order to satisfy its obligations under the agreement. The Company and Native Ads act at arm's length, and Native Ads has no present interest, directly or indirectly, in the Company or its securities.

In addition, the Company also announces that it has entered into an online marketing agreement with Maximus Strategic Consulting Inc. ("Maximus"). Pinnacle Digest and PinnacleDigest.com are business names of Maximus. Maximus has agreed to produce and distribute, through the email newsletter and YouTube channel of PinnacleDigest.com, a video highlighting the Company and its Minto copper-gold-silver mine. Additionally, all the Company's news releases during the term of the online marketing agreement will be featured in Pinnacle Digest's weekly email newsletter.

The Company's engagement of Maximus will run for a period of four months, beginning on January 22, 2026. The Company has paid Maximus a one-time fee of C$150,000 (plus GST) for the services. Maximus' business address is 300 - 1550 5 St. SW Calgary, Alberta. T2R 1K3, email address is support@pinnacledigest.com. Maximus currently owns 133,929 common shares in the capital of the Company. Maximus is an arm's-length party to the Company. The Company will not issue any securities or options to purchase securities to Maximus as compensation for its services.

QAQC Procedures and Data Validation

The Company is drilling NQ sized core. Following data collection, core is cut along the long axis, with half of the core going to the lab for chemical analysis and the remaining half kept in sequence as record. The half core samples are packaged with the corresponding sample tag id and sealed. All sampling is conducted by Selkirk Copper Mines Inc. and subject to Company standard internal quality control and quality assurance (QAQC) programs which include the insertion of certified reference material, coarse blank materials, and field duplicate analysis, on top of the standard laboratory QAQC procedures to monitor contamination during preparation and analytical accuracy and precision. QAQC insertion rates approximate 15% of all samples at set intervals. For the 2025 program all samples were sent to ALS Laboratory's prep laboratory in Whitehorse, YK, then shipped to ALS Vancouver for gold fire assay and four-acid multi-element analysis. All samples are prepared by crushing rock to 70% passing 2mm screen, then splitting a 250g sub-sample using a riffle splitter before being pulverized 85% passing 75 microns. Gold is analyzed by 30 g Fire Assay (Au-AA23) with atomic absorption (AAS) analysis followed by gravimetric finish for overlimit results. Copper is analyzed by four-acid digest (ME-ICP61) with inductivity coupled plasma - atomic emission spectroscopy (ICP-AES) finish. If Cu overlimit results are triggered a second four-acid digest for high grade copper (Cu-OG62) is conducted. For any samples where oxide copper minerals are identified, a sulphuric acid leach (Cu-AA05) analysis with AAS finish is performed. ALS Vancouver holds an ISO/IEC 17025 standard accreditation.

QAQC results are reviewed open receipt of results. Overall QAQC results show strong analytical performance across Cu, Au, and Ag datasets. All control standards are within acceptable tolerance, with no significant outliers or systematic bias observed.

Primary intervals are reported as drill core length, with true widths estimated to be approximately 90% of core lengths, based on the sub-horizontal to shallow dipping nature of the modelled mineralized zones.

Mineral Resource Details

The following table (Table 4) summarizes the current Minto Mineral Resource:

Table 4: Global Mineral Resource Estimate for the Minto Project (Effective Date: April 7, 2025)

| Type | Cut | Class | ROM | In Situ Grade | Metal |

| (CDN$) |

| Tonnage (000) | NSR (CDN$) | Cu (%) | Au (gpt) | Ag (gpt) | Ox Ratio | ASCu (%) | Cu (Mlbs) | Au (Koz) | Ag (Koz) |

| OP | $30 | Indicated | 6,085 | $89.11 | 0.897 | 0.274 | 2.9 | 0.15 | 0.163 | 120.3 | 53.7 | 560.4 |

| Inferred | 9,496 | $73.71 | 0.702 | 0.162 | 2.4 | 0.07 | 0.057 | 146.9 | 49.3 | 738.4 |

| UG | $80 | Indicated | 6,504 | $183.90 | 1.489 | 0.636 | 5.6 | 0.06 | 0.090 | 213.5 | 132.9 | 1,167.6 |

| Inferred | 14,162 | $156.85 | 1.281 | 0.539 | 4.9 | 0.06 | 0.075 | 399.9 | 245.4 | 2,229.6 |

| Total | Varies as Above | Indicated | 12,588 | $138.08 | 1.203 | 0.461 | 4.3 | 0.10 | 0.125 | 333.8 | 186.6 | 1,728.0 |

| Inferred | 23,658 | $123.48 | 1.048 | 0.387 | 3.9 | 0.07 | 0.068 | 546.8 | 294.7 | 2,968.1 |

| Notes | - The MRE has been completed by Sue Bird of Moose Mountain Technical Services (MMTS).

- Resources are reported using the 2014 CIM Definition Standards and were estimated using the 2019 CIM Best Practices Guidelines.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Metal prices of US$2000/oz Au, US$23/oz Ag, US$4.00lb Cu.

- For the NSR calculations: a currency exchange rate of 0.72 US$ per $CA; 95% payable Cu, 88% payable Au and 70% payable Ag; offsite costs (refining, transport and insurance) of US$256.18/dmt; royalties of 1.5% NSR.

- Recoveries are as follows:

- CuRec = 95.5%+1.07*Cu%-113*ASCu/TCu, with a maximum of 98%

- AuRec = 20.99*Augpt + 62.01, with a maximum of 95%

- AgRec = 69.4+1.9*Aggpt, with a maximum of 85%

- These inputs result in the following NSR and CuEq equations:

NSR = CA$4.73*CuRec*Cu%*22.0462 + (CA$2400.60*AuRec*Augpt + CA$21.45*AgRec*Aggpt)/31.10348

CuEq = NSR/(Cu*CuRec*22.0462)- The Mineral Resource has been confined by a "reasonable prospects of eventual economic extraction" pit or underground shape using the 100% base case NSR for the Ridgetop and Area 118 open pits and by a confining shape for the underground.

- Mining costs are CA$4.10/tonne for open pit, CA$45.42/tonne for underground, Processing costs are CA$30/tonne milled and G&A costs are CA$20.81/tonne milled.

- Pit slope angles are assumed at 45º.

- The specific gravity of the deposit has been assigned based on domain as between 2.578 and 2.849 based on sg measurements in the Minto deposit.

- Ox Ratio = ASCu/Total Cu.

- Numbers may not add due to rounding.

- OP denotes Open Pit; UG denotes Underground

|

References

1 See 2025-08-06 Technical Report "NI 43-101 2025 Mineral Resource Estimate Update for the Minto Property, Yukon, Canada" effective date 2025-04-07 filed by Venerable Ventures Ltd., available on SEDAR+ (sedarplus.ca).

Technical aspects of this news release have been reviewed, verified and approved by Stacie Jones-Clark, P.Geo., Vice President Exploration of Selkirk Copper Mines Inc., who is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Selkirk First Nation

Selkirk First Nation is centered in Pelly Crossing, a community in central Yukon, 280km north of Whitehorse. They are a self-governing First Nation, having signed its Final and Self-Government Agreements in 1997. Selkirk owns 4,740 square kilometers of Settlement Land, including 2,408 square kilometers where Selkirk owns both the surface and subsurface. Selkirk First Nation is one of three self-governing Northern Tutchone First Nations in the Yukon. The Selkirk First Nation, indirectly, holds a controlling equity stake in Selkirk Copper.

About Selkirk Copper

Selkirk Copper is a well-financed, newly formed company with a controlling interest held by the Selkirk First Nation through its wholly owned subsidiary, that, in partnership with the Selkirk First Nation, is completing a thorough exploration drilling campaign and a restart and redevelopment plan for the former Minto copper-gold-silver mine based on best-in-class environmentally sustainable mining, development and reclamation practice. Selkirk Copper controls 26,850 hectares of prospective mineral claims located in the Minto-Carmacks copper belt as well as significant open-pit and underground infrastructure, a 4,100 tonne per day processing plant, 400-person camp, water treatment facilities, numerous ancillary buildings, and mobile equipment centered on the former Minto copper-gold-silver mine. Selkirk Copper's mineral tenure, operation infrastructure, access roads and powerline, is located on or adjacent to Lands of the Selkirk First Nation much of which is surrounded by prospective Selkirk First Nation Category A Lands.

Selkirk Copper Mines Inc. is listed on the TSX Venture Exchange under the symbol TSXV: SCMI and has a secondary listing on the Frankfurt Exchange under the symbol FSE: IO20.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. When used in this news release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words, or variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this news release include information relating to: the remainder of the Company's drill program and integrating results into ongoing trade-off studies, the business plans and objectives of the Company. Such forward-looking information is based on the Company's expectations, estimates and projections as at the date of this news release.

By their nature, forward-looking statement involve known and unknown risks, uncertainties and other factors, which may cause actual result, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: the potential inability of the Company to continue as a going concern, risks associated with potential governmental and/or regulatory action with respect to the Company's operations, the potential inability of the Company to implement its business plan going forward. Such statements and information reflect the current view of the Company and are based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's ability to execute on its business plans. The Company has also assumed that no significant events will occur outside the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281227

© 2026 Canjex Publishing Ltd. All rights reserved.