Vancouver, British Columbia--(Newsfile Corp. - January 21, 2026) - Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside" or the "Company") is excited to announce that it has used some of the recent capital raise, and more importantly, has doubled the size of the Jacket Property by optioning the Redtop property. The combined project will now be referred to as the "Red Jacket Project." The decision to acquire the Redtop property followed Riverside's initial exploration program in the later part of 2025. The Redtop property is contiguous with, and immediately north of Riverside's Jacket claims.

The Red Jacket is easily accessed via paved highway and then by logging road, approximately 15 km east of Clearwater and 115 km north-northeast of Kamloops in central British Columbia. The project is north of the Taesko Mines' feasibility-stage Yellowhead Copper Project, which hosts a large Cu-Zn-AG-Au reserve and is considered a potential near-term future mine. The Redtop property hosts at least three main outcropping and previously drilled polymetallic mineral occurrences and is located within a well mineralized prospective belt of volcanogenic massive sulphide ("VMS") deposits. These occurrences display classic features characteristic of the large Canadian deposits of this deposit type and are similar to Taseko's copper resource 10km to the south in the same Eagle Formation, Cambrian age geology.

The Company reviewed the historical work and expanded on historical soil sampling and trenching this autumn. This work outlines a 4 km long northwest-southeast trend that includes the Redtop, Snow and Sunrise showings. Riverside completed target sampling in late 2025 to validate mineralization in areas of past trenching and to strengthen confidence in the project's best-known zones, where 2026 exploration work can be done on the consolidated project. Riverside's results confirm the presence of meaningful polymetallic grades at surface supporting the view that the Red Top horizon merits systematic follow-up work to evaluate continuity and prioritize the most prospective sections for the next phases of exploration.

"Red Jacket is a compelling project in our British Columbia portfolio, and we have expanded our property footprint by acquiring the Redtop project," said John-Mark Staude, CEO of Riverside Resources. "Our 2025 sampling returned high-grade polymetallic results from historical trenches, reinforcing that the Redtop–Snow–Sunrise trend warrants drill testing and further expansion, particularly in light of Taseko's advanced-stage copper development project in the same geology immediately to the south. Red Jacket is positioned in a proven district that has seen significant past exploration and mining activity. We believe we are in a strong position to advance value generating work across the expanded claim package and pursue additional discoveries as we work to discover new mineral resources for the Riverside".

Red top deal terms:

The Redtop claims are located north of, and contiguous with, Riverside's Jacket claims. Riverside has signed an option agreement to acquire the claims from a private group called "Geo Exploration Scouts". The terms of the option agreement are summarized in the table below.

Table 1: Option terms of the Redtop Claims

| Completion Date |

| Cash ($) |

| Additive Expenditures ($)

|

| On signing of Definitive Agreement |

| 12,000

(paid) |

|

| 0 |

|

| At time of receiving approval of drill permit within 4 years (Approval Date) |

| 21,000 |

|

| 50,000 |

|

| One year after Approval Date |

| 27,000 |

|

| 100,000 |

|

| Two years after Approval Date |

| 45,000 |

|

| 300,000 |

|

| Three years after Approval Date |

| 75,000 |

|

| 300,000 |

|

| Total | $ | 180,000 |

| $ | 750,000 |

|

In addition to the cash and work expenditures, the Optionor will retain a 0.45% Net Smelter Returns Royalty, which is subject to $1,000,000 buyout. Riverside will have the first right of refusal on any sale or transaction involving the royalty. If an exploration permit cannot be obtained within 4 years of signing the definitive agreement, the project will be returned to optionor. No payments or work commitments will be required until a drill permit is acquired and all necessary agreements are in place to proceed with drilling and related exploration. The option agreement is subject to TSXV approval.

Historical Exploration Work

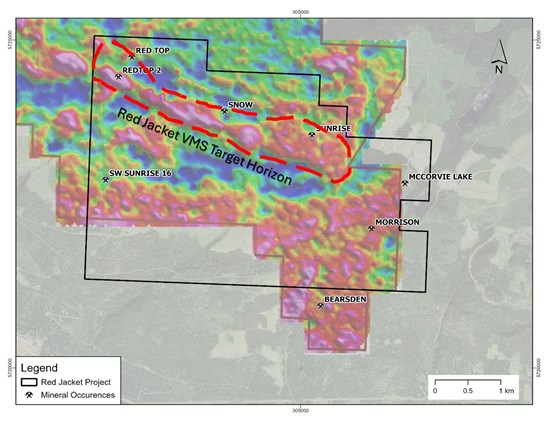

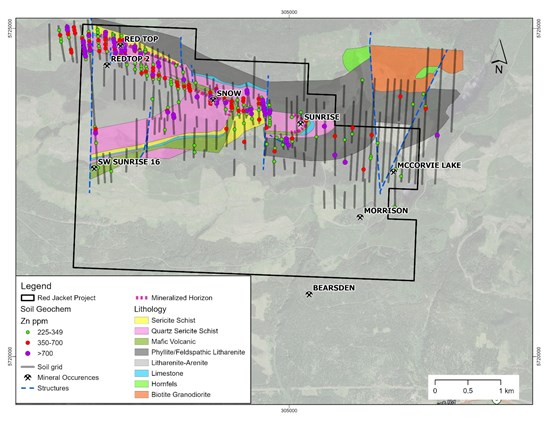

The historical geochemistry, geology and geophysics, including that on the optioned claims, continues to add value for the Company. This builds on key work completed by companies such as Placer Dome, and precedes the work by Taseko, which now controls the large copper resource, reserve and feasibility-staged property to the south. At Red Jacket, the combined and integrated historical soil sampling surveys confirm the continuity of the known mineralized bands, and can be traced consistently within a defined belt over 4km long northwest-southeast horizon that includes the known MinFile showings: Redtop, Snow and Sunrise (Figure 2). The prospective horizon hosting these showings has received minimal drill testing and the entire length of the horizon is considered a target. Historical work by Placer Dome Inc. shows a zinc-in-soil anomaly enveloping the areas of known mineralization, similar to the Yellowhead deposit in its early exploration history. This linear, southeast trending anomaly is roughly parallel to a potassium enrichment zone shown in the K% and eTH/eK radiometric images (Figure 1). In addition, the north-trending linear magnetic highs noted on the Total Magnetic Intensity image are likely showing mafic dikes and/or structures. Together, the airborne detailed magnetics help in refining targets, and the coincident soil anomalies provide immediate areas of interest with district-scale potential. Linking the historical showings with the consolidated land package positions the Company to advance systematic work aimed at unlocking value for shareholders.

Figure 1: Radiometric Map K% of the Red Jacket project with the red northwest high showing the outcropping and very near surface potassic anomaly associated with the VMS style alteration and multiple mineral showings that have high grade base metals in trenches and dumps but with very limited shallow drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/281008_b05683e404ba7b91_002full.jpg

2025 Riverside Samples

Riverside collected samples before snowfall ended the program, and Riverside can now return early in the spring to continue follow-up work on the Redtop claims, supported by high-grade assay results. The sampling confirmed the historical range of high-grade values in the area of past trenching that are easily accessible by recent logging roads. These areas include zones affected by pine beetle tree kill, which has created extensive new exposures that were not available even a decade ago. Three main showings were sampled during the autumn field work, while the actual Redtop showing already had snow cover and will be a priority target for early 2026 field work.

Table 2: Riverside Grab samples from the Sunrise and Snow trenches.

| Sample | Au (ppb) | Ag (ppm) | Pb (%) | Zn (%) | Cu (%) | Showing |

| 472167 | 866 | 176 | 1.11 | 2.38 | 0.11 | Sunrise |

| 472168 | 513 | 86.9 | 0.63 | 0.65 | 0.04 | Sunrise |

| 472169 | 454 | 128 | 0.76 | 23.00 | 0.04 | Sunrise |

| 472170 | 714 | 22.1 | 0.14 | 24.40 | 0.03 | Sunrise |

| 472171 | 345 | 217 | 2.78 | 0.65 | 0.43 | Snow |

*Grab samples were taken in November of 2025 by Riverside Personnel.Grab samples by their nature are selected samples and the results for these selected samples may not reflect underlying mineralization.

The area of the Sunrise Occurrence contains at least six trenches, showing multiple thin bands of semi-massive to massive sulphide hosted in quartz-sericite schist. Bedding at Sunrise dips shallowly (<10°) to the east, as the showing is located in the nose of the anticline. Four samples were collected and assayed from the Sunrise trenches, with elements from the four samples returning up to 1.1% lead, up to 24% Zn, up to 0.1% Cu, and up to 128 g/t Ag and 0.8 g/t Au (Table 1).

The Snow Showing comprises of a small trench that hosts shallowly north-dipping, rusty quartz-sericite schist. A poorly exposed semi-massive sulphide layer of unknown thickness is present locally with a cherty component. This occurrence also features crosscutting, chalcopyrite-bearing veinlets. One sample was collected and assayed in 2025 that returned: 0.4% Cu, 2.8% Pb, 0.7% Zn, 0.3 g/t Au, and 217 g/t Ag (Table 1).

Figure 2: Bedrock geology and locations of showings sampled by Riverside with high grades of Ag, Zn, Pb, and Cu with the lines from historical Zinc-in-soil sample grid completed by Placer Dome Inc. Riverside integrating data to move toward drill targeting and potentially running ground geophysics.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/281008_b05683e404ba7b91_003full.jpg

Geological Setting

The property is situated within the pericratonic Kootenay Terrane in the southeastern Cordillera, immediately outboard (west) of ancestral North America. This terrane is composed primarily of lower to mid-Paleozoic sedimentary and volcanic rocks and is correlative with the productive Yukon-Tanana Terrane in Alaska and the Yukon Territory. More specifically, the area is underlain by Lower Cambrian to Mississippian deformed and metamorphosed sedimentary and volcanic rocks of the Eagle Bay Assemblage. The assemblage has been intruded by the Upper Devonian to Permian felsic Raft and Baldy batholiths. Devonian to Permian mafic volcanic and intrusive rocks of the Fennell Formation have been thrust over the western part of the assemblage. Government mapping shows the property to be underlain by the "EBQ" unit of the Eagle Bay Assemblage, possibly of Lower Cambrian age. The Eagle Bay is the assemblage that hosts Taseko Mines' copper reserves and feasibility-staged property at Yellowhead. Eagle Bay has been a mining target and productive geologic VMS unit and Riverside has targeted this unit and specific horizons for this mineral option acquisition. The mineral occurrences on adjacent or nearby properties within the Eagle Bay Assemblage may not be reflected on the Company controlled properties. Further exploration work will continue during H1 of 2026 on the Company property.

Regional VMS Context

VMS deposits are abundant within the Eagle Bay Assemblage and adjacent rocks:

- The Chu Chua Cyprus-type deposit occurs in the nearby Fennell Formation and has an inferred mineral resource of 2.29 Mt @ 2.11% Cu, 0.30% Zn, 9.99 g/t Ag and 0.50 g/t Au.1

- Samatosum is a stockwork zone mined by Inmet Mining between 1989 and 1992; the deposit totaled 0.63 Mt grading 1035 g/t Ag, 1.2% Cu, 1.7% Pb, 3.6% Zn and 1.9 g/t Au.2

- The Rea deposit contains two massive sulphide lenses with a combined resource of 0.38 Mt @ 0.33% Cu, 2.2% Pb, 2.3% Zn, 6.1 g/t Au and 69.4 g/t Ag.3

- The Homestake deposit is largely contained in barite lenses, with estimated resources in 1973 of 1.01 Mt @ 240 g/t Ag, 2.5% Pb, 4.0% Zn, and 0.55% Cu.4

- The Harper Creek metamorphosed VMS deposit (817 Mt @ 0.28% Cu, 0.03 g/t Au and 1.3 g/t Ag) is located in the Eagle Bay Assemblage approximately 15 km southeast of the property and known as the Yellowhead.5

The Property has seen intermittent exploration and was examined by two major companies, INCO and Placer Dome Inc. INCO undertook geological mapping, soil sampling, ground magnetometer and limited VLF surveying in 1977; this was their only program on the Property. Placer completed extensive soil geochemistry and lesser EM, magnetics and geological mapping from 1983 to 1989. They drilled four short holes but recommended drilling an additional 13 holes which were never drilled. Other work on the Property over the years has not been systematic. The Property is considered under-explored and ready for progressing work, particularly with the recent logging that has increased the access and exposures.

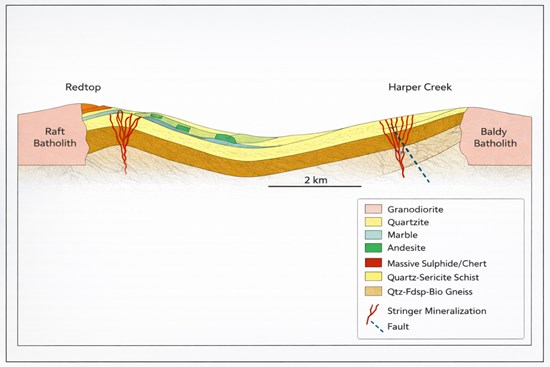

The Harper Creek deposit, 10 km to the southeast, is part of the Eagle Bay Formation's metavolcanic and metasedimentary rocks. Geologically, it lies on the western margin of the Omineca Belt within the Kootenay Terrane. The mineralization is found within tabular zones in various phyllites and quartzites, including quartz-sericite, chloritic, carbonaceous phyllite, and sericitic quartzite. Mineralization occurs as disseminations and patches along rock foliations, and within quartz and quartz-carbonate veins. It is associated with minor sphalerite, galena, arsenopyrite, molybdenite, tetrahedrite-tennantite, bornite, and cubanite, with occurrences of magnetite.

The Harper Creek Fault separates the deposit into east and west domains. The west domain's mineralization is hosted within three horizons of volcanic and volcaniclastic units. Mineral Reserves: According to a January 2020 NI 43-101 Taseko Mines technical report, the proven and probable mineral reserves are estimated at 817 million tonnes at a 0.17% copper cut-off grade. The average grades are: Copper (Cu): 0.28%; Gold (Au): 0.030 g/t; Silver (Ag): 1.3 g/t. The project is planned as a large open-pit mine with a 25-year life and a processing capacity of 90,000 tonnes of ore per day. Further technical specifications are available in the Technical Report on the Mineral Reserve Update at the Yellowhead Copper Project on the Taseko Mines website.

Figure 3: Schematic North – South Cross section of the North Thompson River valley showing the relationship between the Red Jacket (north side) and Harper Creek Deposit (southern side near the Baldy Batholith).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/281008_b05683e404ba7b91_004full.jpg

Qualified Person & QA/QC:

Sample preparation was completed at ACT Labs located in Kamloops, British Columbia. ACT Labs is ISO/IEC 17025:2017 and ISO 9001:2015 certified laboratory. The "1A2-ICP fire assay" and "1E3 aqua regia" analytical protocols were used on the assay samples. Elements of interest obtained by this method include silver, copper, molybdenum, lead and zinc, amongst others. Aqua regia ICP-OES" refers to a two-step analytical technique used to dissolve solid samples using aqua regia and then analyze the resulting liquid for its elemental composition using Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES).

The scientific and technical data contained in this news release pertaining to the Project was reviewed and approved by Freeman Smith, P.Geo, a non-independent qualified person to Riverside Resources who is responsible for ensuring that the information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Capital Markets

Riverside has engaged Horizon Capital Markets Corp. (the "Service Provider"), a Vancouver-based investor relations consulting firm, to provide investor relations services to the Company. The Service Provider and its principal, Eric Negraeff, hold an interest, directly or indirectly, in common shares of the Company and may have an interest in participating in future equity financing or acquiring additional securities through market purchases. The engagement is for a minimum of six months commencing on January 15, 2026, with the Service Provider acting as part-time investor relations provider. The Service Provider will be paid a fee of $3,500 per month. The Service Provider and the Company are unrelated and unaffiliated entities save for the securities holdings of the Service Provider. In connection with the Listing, the engagement of the Service Provider will be subject to the approval of the Exchange.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has a solid balance sheet with over $6,000,000 cash, no debt and tight share structure with a strong portfolio of gold-silver and copper assets and royalties in North America. Further information about Riverside is available on the Company's website at www.rivres.com.

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., "expect", "estimates", "intends", "anticipates", "believes", "plans"). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

References:

1. https://newport-exploration.com/wp-content/uploads/2022/01/Newport_ChuChua_2021_NI43-101.pdf

2. Samatosum is a past producing polymetallic volcanogenic massive sulphide deposit located approximately 60 km northeast of Kamloops, British Columbia, Canada. Historical production records indicate that approximately 0.63 Mt of ore were mined between 1989 and 1992 grading 1,035 g/t Ag, 1.2% Cu, 1.7% Pb, 3.6% Zn and 1.9 g/t Au (British Columbia MINFILE No. 082M 244). This historical information is provided for background purposes only and the issuer has not independently verified the data. https://minfile.gov.bc.ca/summary.aspx?minfilno=082M++244

3. The Rea deposit resource of approximately 0.38 Mt grading 0.33% Cu, 2.2% Pb, 2.3% Zn, 6.1 g/t Au and 69.4 g/t Ag is considered a historical estimate reported by Sean Bailey, Suzanne Paradis and Stephen Johnston, 2000, Geological Survey of Canada Current Research 2000-A, and has not been verified by the current Qualified Person; it does not conform to current CIM (2014) Definition Standards and is not being treated as a current mineral resource. https://publications.gc.ca/collections/Collection-R/GSC-CGC/M44-2000/M44-2000-A15E.pdf

4. The Homestake deposit hosts a historical estimate of 1.01 million tonnes grading 240 g/t Ag, 2.5% Pb, 4.0% Zn, and 0.55% Cu, as reported by Kamad Silver Co. Ltd. in 1973. The mineralization is described as largely contained in barite lenses within the Eagle Bay Assemblage. The reader is cautioned that this estimate is historical in nature and does not comply with NI 43-101standards. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The issuer is not treating the historical estimate as current mineral resources or mineral reserves. https://minfile.gov.bc.ca/Summary.aspx?minfilno=082M++025

5. NI 43-101 Technical Report can be found on www.sedarplus.ca under Taseko Mines Limited July 10, 2025.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281008

© 2026 Canjex Publishing Ltd. All rights reserved.