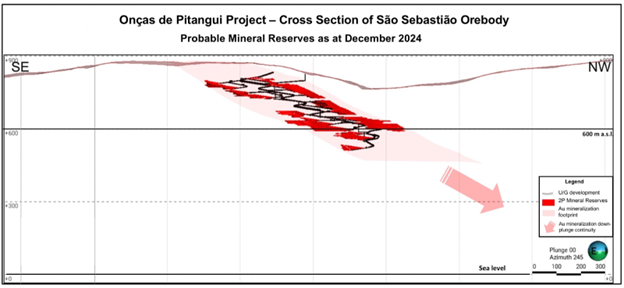

Proven and Probable Mineral Reserves and Measured, Indicated and Inferred Mineral Resources figures are reported for the Company's two operating mining and production complexes, MTL and Caeté, and for the Paciência complex (currently on care and maintenance) in the Iron Quadrangle Gold Province, Minas Gerais, Brazil. The MTL complex (currently suspended) is comprised of the Turmalina mine (orebodies A, B and C), the Faina zone, the Onças de Pitangui project as well as the Zona Basal and Pontal deposits. The Caeté complex is comprised of the Pilar mine (orebodies BA, BF, SW, LPA and TORRE), the Roça Grande mine (on care and maintenance) and the Córrego Brandão open-pit deposit. The Paciência complex is comprised of the Santa Isabel and Margazão mines (both on care and maintenance) and the Bahú deposit.

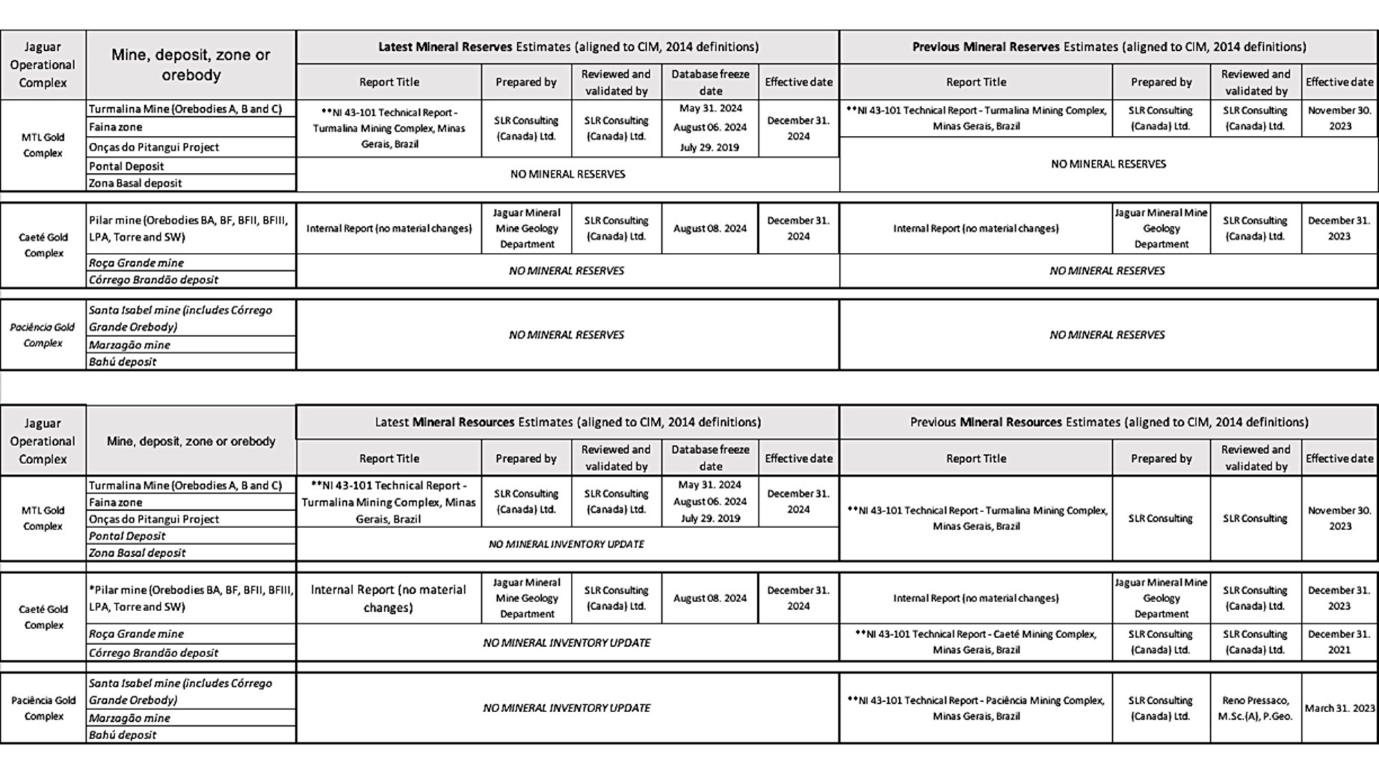

The Mineral Resources and Mineral Reserves reported herein and respective changes in inventory were consolidated based on estimates sourced from the technical reports listed in Table 3. CIM (2014) definitions were followed for Mineral Reserves estimates.

The location map in Figure 1 indicates the location of the Company's production complexes and respective mines and deposits. The Mineral Rights are situated inside a 60 km radius from Belo Horizonte, the state capital of Minas Gerais, Brazil.

Mineral Reserves

The Company's Proven and Probable Mineral Reservesas at December 31, 2024, increased by 63% to 764 koz, net of mining depletion, mainly due to the addition of 284 koz of Mineral Reserves from the Onças de Pitangui project (see bar chart in Figure 2).

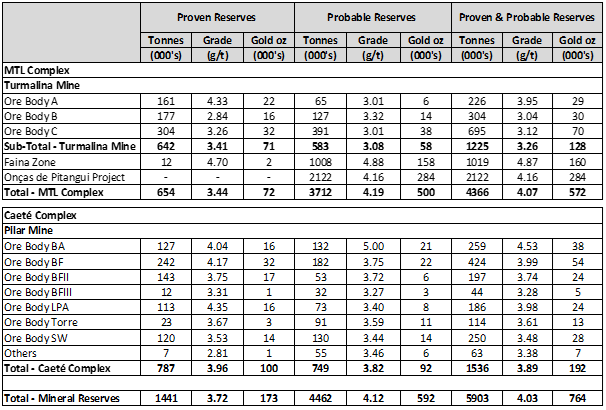

Detailed information of the Company's current consolidated Mineral Reserves inventory, as at December 31, 2024, is shown in Table 1 at the end of this release.

MTL Complex Mineral Reserves

A total of 572 koz of Mineral Reserves are attributed to the MTL complex Mineral Reserves, distributed among the Turmalina mine Orebodies A, B, & C, the Faina zone and the Onças de Pitangui project.

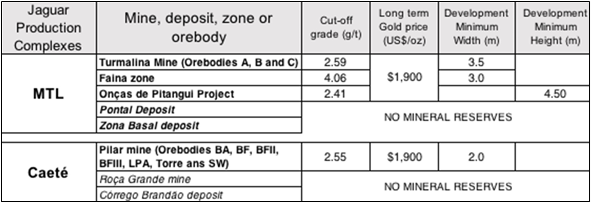

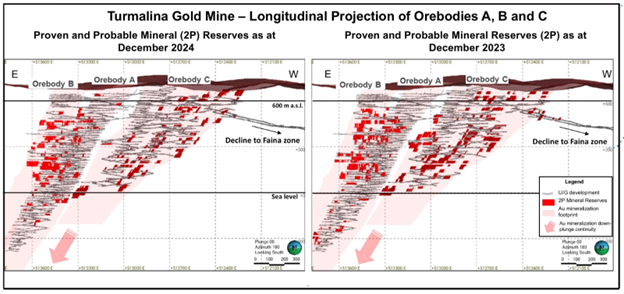

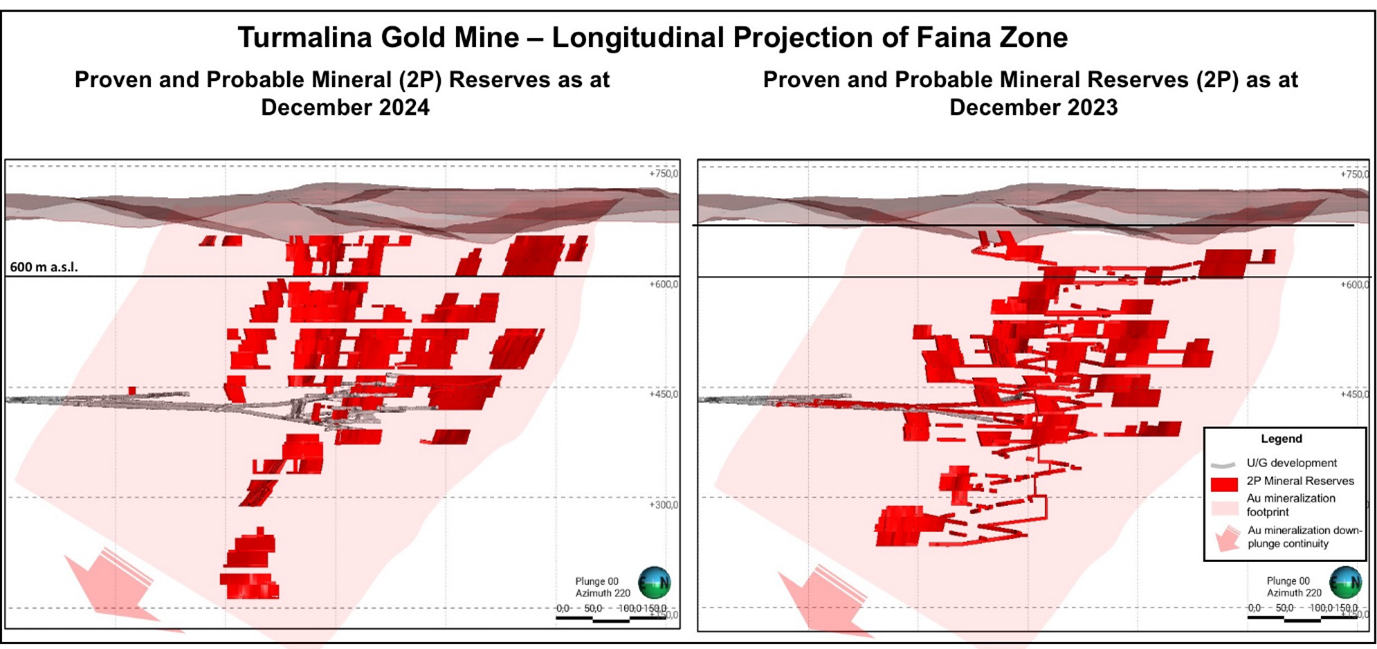

Longitudinal sections shown in Figures 3, 4 and 5 illustrate the spatial distribution of the Mineral Reserves and actual or planned development associated to the Turmalina mine, the Faina zone and the Onças de Pitangui project.

The current Mineral Reserves inventory resulted from the following add-ons and depletions in 2024:

Mineral Reserves were estimated by Jaguar staff, reviewed and validated by SLR's Qualified Persons.

Turmalina mine

The current Proven and Probable Mineral Reserves of 128 koz (1,255 kt @ 3.26 g/t Au) for Orebodies A, B, & C represent a net decrease of 16 koz from the Mineral Reserves established in December 2023 resulting from:

The Turmalina mine 2P Mineral Reserves are distributed among the following orebodies:

Faina zone

The Faina zone hosts a total of 160 koz (1,019 kt @ 4.87 g/t Au) of Proven and Probable Mineral Reserves. The Mineral Reserve addition of 27 koz attributed to the re-categorization of Mineral Resources exposed by the underground development and infill drilling that took place in 2024. The addition was offset by the production of 4 koz in 2024, resulting in a net increase of 22 koz compared to the prior year.

Onças de Pitangui project

NI 43-101 Technical Report - Turmalina Mining Complex, Minas Gerais, Brazil, by SLR Consulting (Canada) Ltd. (SLR), includes an update of Probable Mineral Reserves totalling 284 koz (2,122kt @ 4.16 g/t Au) at the Onças de Pitangui project.

Figure 3. Long Sections showing year-over-year changes in Turmalina mine Mineral Reserves 2024 vs 2023

Figure 4. Long Sections showing year-over-year changes of the Faina zone Mineral Reserves

2024 vs 2023

Figure 5. Cross Section showing the Onças de Pitangui project Reserves as at December 31, 2024

Caeté Complex Mineral Reserves

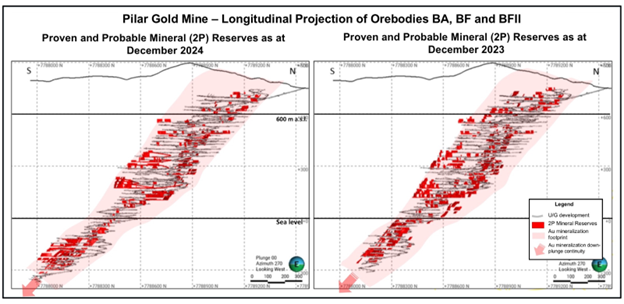

Pilar mine

Infill and step-out drilling and geological model reinterpretation executed in 2024 at the Pilar mine resulted in the addition of 43 koz to the Pilar mine mineral inventory. This addition was offset by the extraction of 45 koz in 2024. As a result, the updated estimates of the Pilar mine Mineral Reserves total an amount of 192 koz (1536 kt @ 3.89 g/t Au), a 2 koz net decrease in the 2P Mineral Reserve categories if compared to the 194 koz (1,906 Kt @ 3.17 g/t Au) of 2P Mineral Reserves.

Mineral Reserves at the Pilar mine are divided between Orebody BA (38 koz, 259 kt @ 4.53 g/t Au), Orebodies BFs (106 koz, 850 kt @ 3.89 g/t Au), Orebody SW (28 koz, 250 kt @ 3.48 g/t Au), Orebody Torre (13 koz, 114 kt @ 3.61 g/t Au) and others (7 koz, 63 kt @ 3.38 g/t Au).

The Longitudinal sections shown in Figure 6 illustrate the spatial distribution of the Mineral Reserves and actual development at the Pilar mine.

Figure 6. Long Section showing year-over-year changes in Pilar mine Mineral Reserves 2024 vs 2023

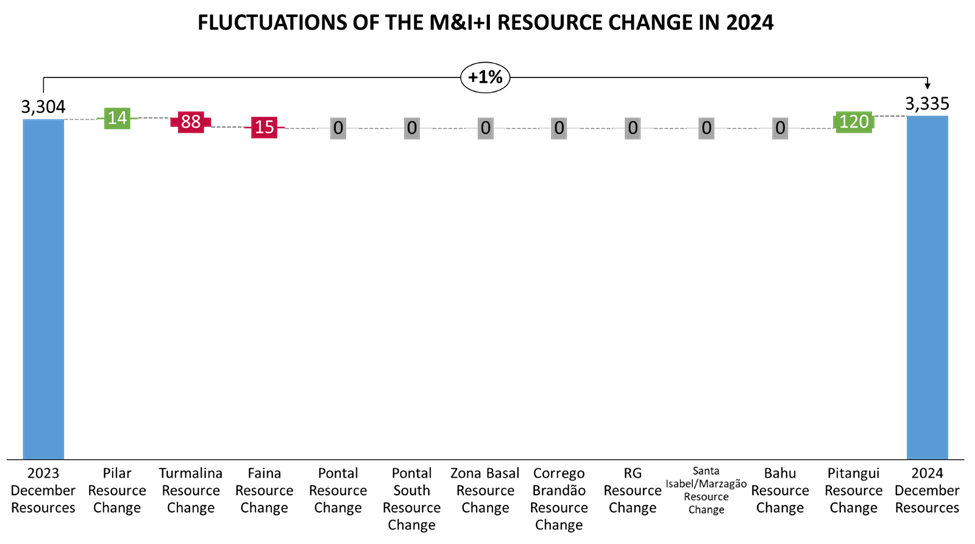

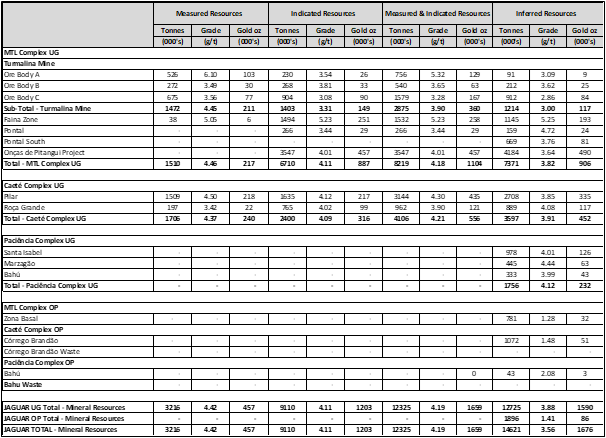

The Company's consolidated Mineral Resources as at December 31, 2024, include both the updated Mineral Resources for the Pilar and Turmalina mines, Faina zone, as well as for the Onças de Pitangui project, along with the unchanged Mineral Resources from previous disclosures for the Pontal and Zona Basal deposits, the Roça Grande, Santa Isabel and Marzagão mines, and the Córrego Brandão and Bahu deposits.

Consolidated Measured and Indicated Mineral Resources decreased by 1% to 1,659 koz (12,325 kt @ 4.19 g/t Au), net of mining depletion. Inferred Mineral Resources increased by 3% to 1,676 koz (14,621 kt @ 3.56 g/t Au) which is a 48 koz net increase over the prior year.

Mineral Resources were estimated by Jaguar staff, reviewed and validated by SLR's Qualified Persons.

Detailed information of the Company's current consolidated Mineral Resources inventory as at December 23, 2024, is shown in Table 2 at the end of this release.

Figure 7. Graph showing the changes in M&I + I Resource Inventory in 2024 according to the estimation's updates and respective material sources.

MTL Complex

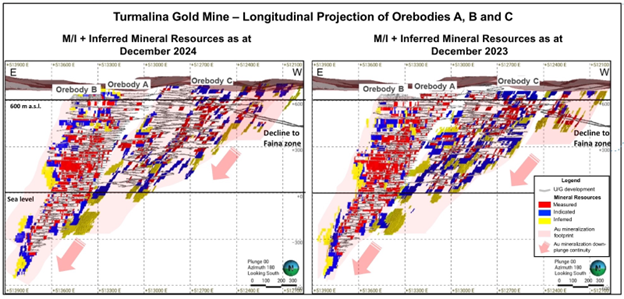

Consolidated MTL complex (Measured and Indicated) Mineral Resources underground are reported as 1,104koz (8,219 kt @ 4.18 g/t Au) and Inferred Mineral Resources underground are reported as 906 koz (7,371 kt @ 3.82 g/t Au). Open pit Inferred Mineral Resources are reported as 32kozs (781 kt @ 1.28 g/t Au). The consolidated Mineral Resources are subdivided as follows:

Underground Mineral Resources

The year-over-year changes in the Mineral Resources distribution at the Turmalina mine are illustrated in the longitudinal sections shown in Figures 8, 9 and 10.

Open Pit Mineral Resources

Zona Basal deposit Inferred Mineral Resources (Open Pit) are reported as 32 koz, (781 kt @ 1.28 g/t Au), unchanged since the initial estimates prepared by SLR reported in Technical Report on the Turmalina Complex, Minas Gerais, Brazil with effective date of November 30, 2023.

Figure 8. Long Section of the Turmalina mine's Mineral Resources year-over-year changes (2024 vs. 2023).

Figure 9. Long Section of the Faina zone Mineral Resources year-over-year changes (2024 vs. 2023).

Figure 10. Cross Section of the Onças de Pitangui project Mineral Resources year-over-year changes (2024 vs. 2023).

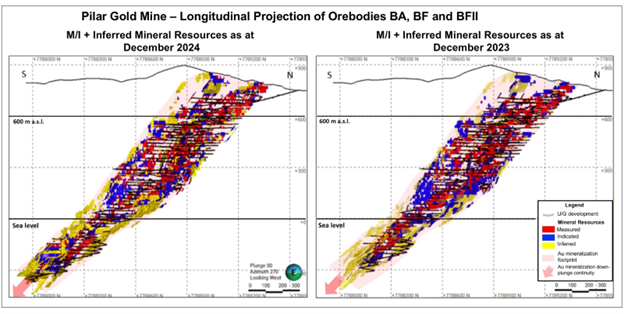

The Pilar mine was the only source of Mineral Resources inventory changes at the Caeté Complex. The Mineral Resources estimates of the Pilar mine were prepared by Jaguar on site mine geology department under the coordination of the corporate geologists and mining engineers. The database and procedures were revised by the SLR qualified persons.

The year-over-year changes in the Mineral Resources distribution at the Pilar mine are illustrated in the longitudinal section shown in Figure 11.

Consolidated Caeté complex (Measured and Indicated) Mineral Resources Underground are reported as 556koz (4,106 kt @ 4.21 g/t Au) and Inferred Mineral Resources Underground are reported as 452 koz (3,597 kt @ 3.91 g/t Au) and Open Pit are reported as 51kozs (1,072 kt @ 1.48 g/t Au) subdivided as follows:

Underground Mineral Resources

Open Pit Mineral Resources

Figure 11. Long Section showing year-over-year changes of the Pilar mine Mineral Resources 2024 vs. 2023.

GEOLOGICAL AND OPERATIONAL CONTEXT

MTL Complex

The MTL Complex underground operations consist of several geological structures grouped into three orebodies - Orebodies A, B, C (the Turmalina mine) - and the Faina zone, where production began in 2024 through underground development.

Orebody A, responsible for the bulk of the Turmalina mine accumulated production estimated in 870 recovered koz, is folded and steeply east dipping, with a strike length of approximately 250 m to 300 m, and average thickness of six metres. Underground development has exposed approximately 1,100 vertical metres of Orebodies A and B mineralization along a robust down-plunge continuity.

Orebody B includes three narrow, lower grade lenses positioned in the foot-wall, parallel to Orebody A. Orebody B mineralization has been outlined along a strike length of approximately 350 m to 400 m and to the same depths of Orebody A.

Orebody C is a series of northwest striking, lenses generally of lower grade located to the southwest in the structural footwall of Orebody A. Orebody C has replaced Orebody A as the Complex's principal production source. Mineralization has been outlined along a strike length of approximately 800 m to 850 m, to depths of 750 m below surface.

Orebodies A, B and C from Turmalina mine and the Pilar mine (Caeté Complex) share similar strong structural controls of the mineralization with the major gold mines known in the Iron Quadrangle Gold Province, well known for their reduced strike length compared to very deep, continuous down-plunge continuities.

Explored in the past through diamond drilling, the Faina zone is an orebody currently under development constituted by a series of offset striking parallel structures extending from surface to depth.

The focus of mining at Turmalina is shifting from Orebodies A and B to Orebody C and Faina zone. Orebody C continues to grow with successful conversion of Resources to Reserves. In addition to the development initiated at the Faina zone in 2024, the recent re-categorization of the Onças de Pitangui project Mineral Resources that resulted in 284 koz of Probable reserves will contribute to the MTL complex production growth.

The Pontal and Zona Basal deposits are unchanged from the previous year's estimates.

Caeté Complex

The Pilar Mineral Reserve 2024 inventory remained almost the same if compared to 2023 due to the gradual reduction in drilling activities and the depletion of 26 koz attributed to Orebody SW, located in the opposed limb of the major structure that hosts the Pilar mine mineralization resulting from geological modelling parameters.

No changes of the Mineral Resources inventories were reported in 2025 in the Roça Grande mine and the Córrego Brandão deposit.

Paciência Complex

No changes in Mineral Resources inventories were reported in 2024 in the Santa Isabel and Marzagão mines, and the Bahú deposit.

Table 1. Consolidated Mineral Reserves as at December 31, 2024

1. CIM (2014) definitions were followed for Mineral Reserves.

2. The released underground Mineral Reserves estimations include the Turmalina and Pilar mines the Faina zone, and Onças de Pitangui project.

3. Cut-off grades and constraints employed in the estimate such as minimum width and eventual minimum height for underground development and stopping are indicated in Table 4

4. Bulk density is 2.85 t/m3.

5. The Exchange rate of R$5.20 / US$1.00 was applied to all the estimates.

6. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

7. Numbers may not add due to rounding.

Table 2. Consolidated Mineral Resources as at December 31, 2024

1. CIM (2014) definitions were followed for the classification of Mineral Resources.

2. The released Mineral Resources estimations include the Turmalina, Pilar, Roça Grande, Santa Isabel and Marzagão mines, the Faina zone, Pontal deposit, and Onças de Pitangui project underground Mineral Resources and the Zona Basal deposit, the Bahu and Córrego Brandão open-pit zones Mineral Resources.

3. Mineral Resources are inclusive of the Mineral Reserves at the Turmalina and Pilar mines, the Faina zone and Onças de Pitangui project.

4. Drill hole and channel samples assay results freeze dates are indicated in Table 5.

5. Freeze dates for depletion purposes relative to mining and forecast production volumes are shown in Table 5.

6. Long-term gold price applied to the Mineral Resources estimations are informed in Table 5.

7. Cut-off grades and constraints employed in the estimate such as minimum width and eventual minimum height for underground Mineral Resources and pit optimizations using Lerchs-Grossmann algorithm for open pit Mineral Resources estimations are indicated in Table 5.

8. The Exchange rate of R$5.20 / US$1.00 was applied to all the estimates.

9. Numbers may not add due to rounding.

Table 3. List of NI 43-101 Technical Reports and Internal Reports Employed to Support the Mineral Reserves and Resources Figures

Table 4. Development Parameters and Economic Premises Employed in the Mineral Reserves Estimates