Vancouver, British Columbia--(Newsfile Corp. - January 29, 2026) - Galiano Gold Inc. (TSX: GAU) (NYSE American: GAU) ("Galiano" or the "Company") is pleased to report the latest results of the 2025 Abore drilling program, which was completed in December 2025 at the Asanko Gold Mine ("AGM") in Ghana, West Africa. Multiple intercepts demonstrate continuity of high-grade zones and step out drilling confirms new high-grade mineralization up to 200 meters ("m") below previous holes. These results demonstrate the robustness of Abore's underground potential and will be included in the maiden Abore underground Mineral Resource estimate expected to be released in February 2026.

This News Release highlights results from the expanded Abore Phase 2 drilling campaign announced in November of 20251 designed to prove continuity of known mineralization, as well as to test for continuations of the Abore mineralizing system at depths up to 200m below previous drilling. The AGM exploration team successfully completed the 11,000m program in December 2025, enabling all results to be included in the upcoming Abore Mineral Resource update.

Selected Drill Highlights (see notes 3,4,5 from Table 1):

- Hole ABDD25-431: 14.2 grams per tonne ("g/t") gold ("Au") over 15m from 231m

- Hole ABDD25-444: 4.4 g/t Au over 30m from 306m

- Hole ABDD25-453: 30.4 g/t Au over 4m from 500m

- Hole ABDD25-428: 2.5 g/t Au over 45m from 213m

- Hole ABDD25-429: 4.7 g/t Au over 24m from 151m

- Hole ABDD25-448: 3.0 g/t Au over 11m from 480m and 3.4 g/t Au over 15m from 496m and 2.5 g/t Au over 27m from 529m

- Hole ABDD25-443: 2.3 g/t Au over 23m from 401m

- Hole ABDD25-447: 2.3 g/t Au over 19m from 247m

Chris Pettman, Galiano's Vice President of Exploration, stated: "These latest results conclude an extremely successful year of discovery at Abore in 2025 that has seen the deposit emerge as a key growth target for the AGM. This latest phase of drilling highlights that the Abore mineralizing system is much larger than previously believed and remains open as we continue to step out and intersect mineralization at depth. I am also proud of the AGM exploration team as they were able to safely and efficiently deliver these 11,000m within six weeks, in time for inclusion in the upcoming maiden underground Mineral Resource."

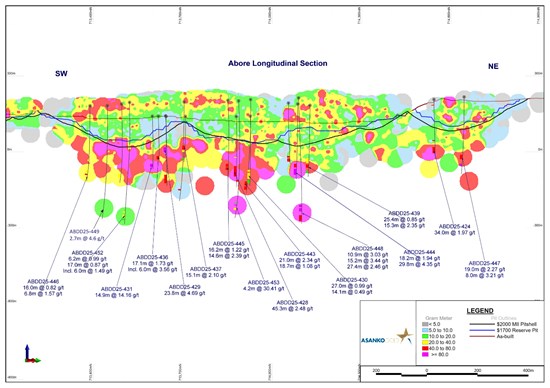

Figure 1: Long section through the Abore deposit showing gram meter contours of Au intercepts with highlights of current drilling labelled.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_001full.jpg

Current Abore Drilling Results

High-Grade Continuity

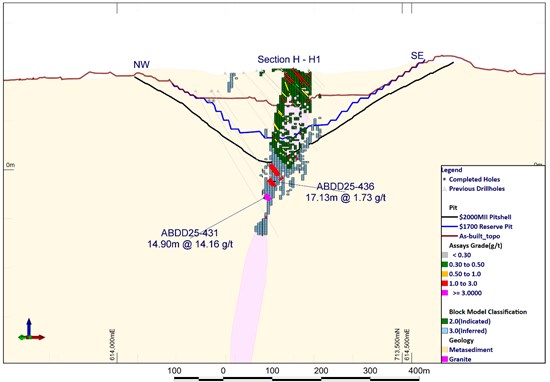

Infill drilling at Abore South pit has returned multiple high-grade intercepts, which further confirm the robust nature and continuity of high-grade mineralization in this zone. Highlighted intercepts include:

- 24m @ 4.7 g/t Au from 151m in hole ABDD25-429

- 15m @ 14.2 g/t Au from 223m in hole ABDD25-431

- 17m @ 1.7 g/t including 6m @ 3.6 g/t Au from 196m in hole ABDD25-436

- 15m @ 2.1 g/t Au from 122m in hole ABDD25-437

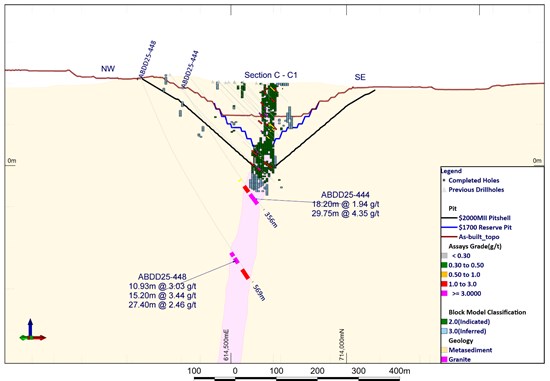

At Abore Main pit, current drilling has both infilled and expanded the known high-grade zones with multiple intercepts of high-grade mineralization, increasing the vertical extent of the Main pit ore shoot by at least 50m. Additionally, hole ABDD25-444 returned intercepts of 30m @ 4.4 g/t Au from 306m and 18m @ 1.95 g/t Au from 282m. These intercepts are particularly encouraging as they occur north of a known and typically barren structural break in the host granites and display the same alteration, veining and sulphide related mineralization that characterizes the highest grade mineralization in other areas of the deposit.

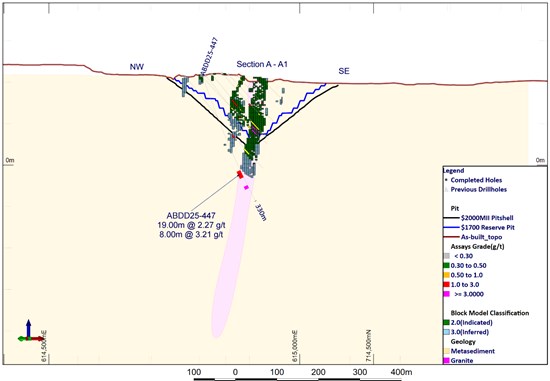

Two infill holes at Abore North pit also intersected strong mineralization with hole ABDD25-424 returning 34m @ 2.0 g/t Au from 254m, and hole ABDD25-44 returning 19m @ 2.3 g/t Au from 247m and 8m @ 3.2 g/t Au from 287m, further demonstrating the potential for growth of the high-grade zone at the northern end of the Abore deposit.

Step Out Drilling at Depth

As part of this phase of drilling, four step out holes were drilled to test for the extensions of the Abore mineralizing system up to 200m below previous drilling. All four holes intersected mineralization, with two holes below Abore Main pit returning significant high-grade intercepts. Hole ABDD25-448 intersected 11m @ 3 g/t Au from 480m, 15m @ 3.4 g/t Au from 496m and 27m @ 2.5 g/t Au from 529m and hole ABDD25-453 returned 4m @ 30.4 g/t Au from 500m, as well as 26m of lower grade mineralization.

Hole ABDD25-452 was drilled to similar depths below Abore South pit and intersected 50m of the Abore granite which is the primary host of Abore mineralization. The intercept carries a lower grade zone of mineralization ranging from 0.9 g/t Au to 1.5 g/t Au, but is characterized by high density quartz veining, brecciation, alteration, and sulphides that is typically associated with Abore style mineralization.

These results are highly encouraging as they demonstrate that the Abore system and associated high-grade mineralization remains open at depth across the entire 1.8 kilometres of strike length of the Abore deposit.

2026 Exploration

Following a very successful 2025 program, exploration efforts at the AGM in 2026 will be focused on supporting a revised Life of Mine plan and Mineral Reserve and Mineral Resource update anticipated in 2027. An initial 2026 exploration budget of $17 million has been approved by the Galiano Board of Directors.

Exploration activities will be heavily focussed on delivering near term value through Mineral Resource and Mineral Reserve growth within the brownfields space, while simultaneously continuing to advance the greenfields generative portfolio at the AGM with early stage work and drill testing at numerous high priority regional targets.

The necessary drill rigs and crews were secured ahead of the end of 2025, allowing the 2026 exploration program to begin quickly in the first week of January 2026. Drilling is already underway at Abore, with four rigs currently active. An additional three to four rigs will be added as an infill drilling program at Esaase is expected to commence later in the first quarter of 2026.

Priority Resource and Reserve Growth Programs

Abore

An aggressive program of 30,000m of drilling is planned at Abore in 2026 with three primary goals:

- Continue to grow the underground Mineral Resource through step out drilling to at least 200m below the maiden Mineral Resource, expected to be released in February 2026.

- Selective infill drilling to prove continuity of mineralization and convert and upgrade Mineral Resource categories in support of a potential maiden underground Mineral Reserve in 2027.

- Flexibility to step out and test for mineralization at deeper elevations based on results as drilling progresses.

Esaase

A phased program of infill drilling is planned for Esaase through 2026 which is designed to convert existing open pit Mineral Resources from Inferred to Indicated category to significantly increase the Esaase Mineral Reserve and support planning of potential future open pit expansions.

- Phase 1 of drilling, consisting of approximately 9,000m focused on the main Esaase pit, is scheduled to commence in February 2026.

- Results from Phase 1 will inform the potential continuation of the Esaase program up to an additional four phases to be completed in 2026 ahead of the 2027 Mineral Resource and Mineral Reserve update in 2027.

Background

Abore is located approximately 13 kilometers north of the AGM's processing plant, directly along the haul road, and has current Measured and Indicated Mineral Resources of 638,000 ounces at 1.24 g/t Au and Inferred Mineral Resources of 78,000 ounces at 1.17 g/t Au, as published in the Company's most recent Mineral Reserve and Mineral Resource estimates effective December 31, 20242.

The Abore deposit sits along the Esaase shear corridor, which also hosts the Esaase deposit, and forms part of the northeast striking Asankrangwa gold belt. The geology of Abore is characterized by a sedimentary sequence composed primarily of siltstones, shales and thickly bedded sandstones that has been intruded by a granite, which lies parallel to the shear and dipping steeply to the northwest. The majority of mineralization is constrained to the granite, hosted in west dipping quartz vein areas developed primarily along the eastern margin of the granite/sediment contact.

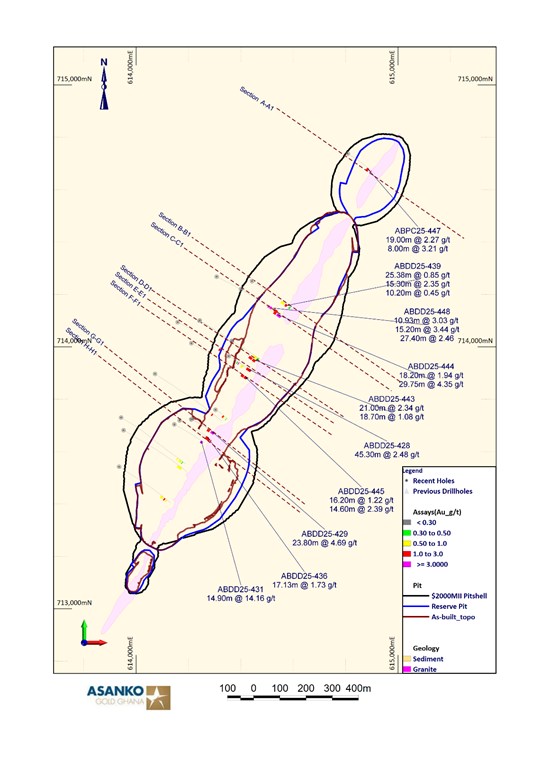

Figure 2: Abore plan map showing current drilling locations and highlighted intercepts. Select cross sections (A,C,D,E,F,G,H shown with brown lines above) are included in this press release. Additional cross sections are available on Galiano's website: https://galianogold.com/operations/exploration/

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_002full.jpg

Figure 3: Cross section A-A1 showing holes ABDD25-447 at Abore North pit, demonstrating continuation of high-grade mineralization below the existing Mineral Resource.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_003full.jpg

Figure 4: Cross section C-C1 through Abore Main pit. New high-grade mineralization intercepted immediately below the existing Mineral Resource in hole ABDD25-444 and high-grade mineralization intercepted in ~200m step out at depth in hole ABDD25-448.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_004full.jpg

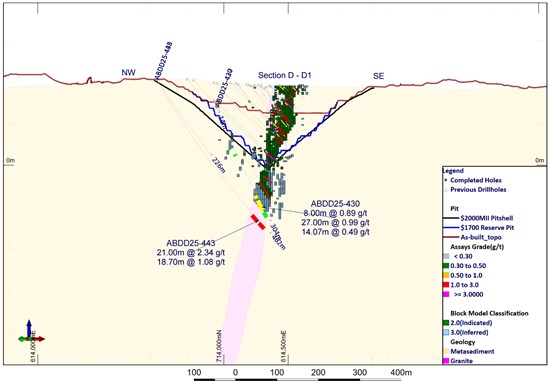

Figure 5: Cross section D-D1 through Abore Main pit showing holes ABDD25-430 and ABDD25-443 demonstrating the new vertical extension of the Main pit ore shoot below previous drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_005full.jpg

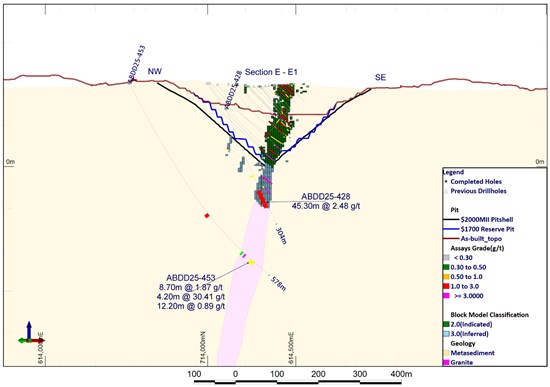

Figure 6: Cross section E-E1 showing the extension of the Main pit ore shoot in hole ABDD25-428 and mineralization in Abore granite intercepted in step hole ABDD25-453.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_006full.jpg

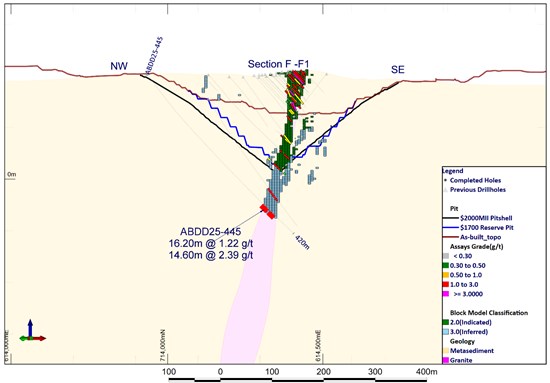

Figure 7: Cross section F-F1 showing extension of main pit ore shoot below previous drilling in hole ABDD25-445.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_007full.jpg

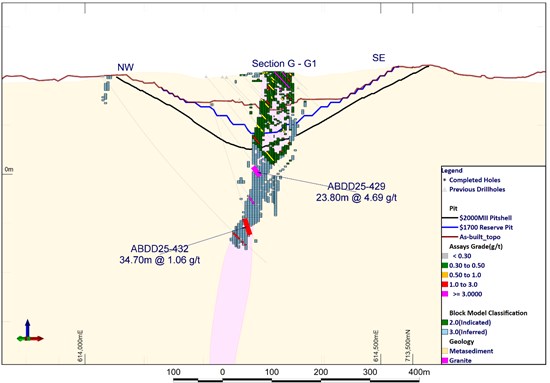

Figure 8: Cross section G-G1 at Abore South pit showing infill hole ABDD25-429 demonstrating good continuity of high-grade mineralization within the Abore south pit ore shoot and hole ABDD25-432.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_008full.jpg

Figure 9: Cross section H-H1 through Abore South pit showing infill holes ABDD25-436 and ABDD25-431 demonstrating good continuity of mineralization within the Abore South ore shoot.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3796/282009_5c9bbf7b7492ab60_009full.jpg

Table 1: Current Abore Drilling Intercepts Table3,4,5

| Hole ID | From (m) | To (m) | Width (m) | Grade

(g/t Au) | Intercept Description |

| ABDD25-424 | 28.5 | 31.5 | 3.0 | 2.5 | 3.0m @ 2.5 g/t |

| and | 215.0 | 219.0 | 4.0 | 1.2 | 4.0m @ 1.2 g/t |

| and | 254.0 | 288.0 | 34.0 | 2.0 | 34m @ 2.0 g/t |

| ABDD25-428 | 173.2 | 177.0 | 3.9 | 0.6 | 3.9m @ 0.6 g/t |

| and | 213.0 | 258.3 | 45.3 | 2.5 | 45.3 @ 2.5 g/t |

| ABDD25-429 | 151.2 | 175.0 | 23.8 | 4.7 | 23.8m @ 4.7 g/t |

| ABDD25-430 | 123.0 | 128.0 | 5.0 | 0.3 | 5.0m @ 0.3 g/t |

| and | 234.0 | 242.0 | 8.0 | 0.9 | 8.0m @ 0.9 g/t |

| and | 247.0 | 274.0 | 27.0 | 1.0 | 27.0m @ 1.0 g/t |

| and | 279.1 | 293.2 | 14.1 | 0.5 | 14.1m @ 0.5 g/t |

| ABDD25-431 | 223.1 | 238.0 | 15.0 | 14.2 | 15.0m @ 14.2 g/t |

| ABDD25-432 | 241.7 | 276.4 | 34.7 | 1.1 | 34.7m @ 1.1 g/t |

| ABDD25-436 | 196.2 | 213.3 | 17.1 | 1.7 | 17.1m @ 1.7 g/t |

| ABDD25-437 | 121.7 | 136.7 | 15.1 | 2.1 | 15.1m @ 2.1 g/t |

| and | 140.3 | 147.5 | 7.2 | 0.8 | 7.2m @ 0.8 g/t |

| and | 172.0 | 177.8 | 5.8 | 0.5 | 5.8m @ 0.5 g/t |

| ABDD25-439 | 248.6 | 274.0 | 25.4 | 0.9 | 25.4m @ 0.9 g/t |

| and | 280.7 | 296.0 | 15.3 | 2.4 | 15.3m @ 2.4 g/t |

| and | 311.8 | 322.0 | 10.2 | 0.5 | 10.2 m @ 0.5 g/t |

| ABDD25-440 | 371.0 | 395.2 | 24.2 | 0.7 | 24.2m @ 0.7 g/t |

| ABDD25-441 | 397.0 | 400.0 | 3.0 | 0.8 | 3.0m @ 0.8 g/t |

| and | 437.0 | 444.0 | 7.0 | 1.2 | 7.0m @ 1.2 g/t |

| ABDD25-443 | 401.0 | 422.0 | 21.0 | 2.3 | 21.0m @ 2.3 g/t |

| and | 426.3 | 445.0 | 18.7 | 1.1 | 18.7m @ 1.1 g/t |

| ABDD25-444 | 263.0 | 266.0 | 3.0 | 0.8 | 3.0m @ 0.8 g/t |

| and | 281.8 | 300.0 | 18.2 | 1.9 | 18.2m @ 1.9 g/t |

| and | 306.3 | 336.1 | 29.8 | 4.4 | 29.8m @ 4.4 g/t |

| ABDD25-445 | 337.8 | 354.0 | 16.2 | 1.2 | 16.2m @ 1.2 g/t |

| and | 357.1 | 371.7 | 14.6 | 2.4 | 14.6m @ 2.4 g/t |

| ABDD25-446 | 320.0 | 336.0 | 16.0 | 0.8 | 16.0m @ 0.8 g/t |

| and | 342.2 | 349.0 | 6.8 | 1.6 | 6.8m @ 1.6 g/t |

| and | 355.0 | 360.7 | 5.7 | 0.7 | 5.7m @ 0.7 g/t |

| ABDD25-447 | 247.0 | 266.0 | 19.0 | 2.3 | 19.0m @ 2.3 g/t |

| and | 287.0 | 295.0 | 8.0 | 3.2 | 8.0m @ 3.2 g/t |

| ABDD25-448 | 480.1 | 491.0 | 10.9 | 3.0 | 10.9m @ 3.0 g/t |

| and | 496.0 | 511.2 | 15.2 | 3.4 | 15.2m @ 3.4 g/t |

| and | 529.0 | 556.4 | 27.4 | 2.5 | 27.4m @ 2.5 g/t |

| ABDD25-452 | 507.8 | 514.0 | 6.2 | 1.0 | 6.2m @ 1.0 g/t |

| and | 524.0 | 541.0 | 17.0 | 0.9 | 17.0m @ 0.9 g/t |

| and | 546.0 | 551.0 | 5.0 | 0.5 | 5.0m @ 0.5 g/t |

| ABDD25-453 | 366.3 | 375.0 | 8.7 | 1.9 | 8.7m @ 1.9 g/t |

| and | 491.0 | 496.0 | 5.0 | 0.3 | 5.0m @ 0.3 g/t |

| and | 500.0 | 504.2 | 4.2 | 30.4 | 4.2m @ 30.4 g/t |

| and | 519.0 | 531.2 | 12.2 | 0.9 | 12.2m @ 0.9 g/t |

Notes:

3. Intervals reported are hole lengths with true width estimated to be 80%-90%.

4. Intervals are not top cut and are calculated with the assumptions of > 0.5 g/t and < 3m of internal waste.

5. All samples are taken from diamond core.

Qualified Person and QA/QC

Chris Pettman, P. Geo, Vice President Exploration of Galiano, is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has supervised the preparation of the scientific and technical information that forms the basis for this news release. Mr. Pettman is responsible for all aspects of the work, including the Data Verification and Quality Control/Quality Assurance programs and has verified the data disclosed, by reviewing all data and supervising its compilation. There are no known factors that could materially affect the reliability of data collected and verified under his supervision. No quality assurance/quality control issues have been identified to date. Mr. Pettman is not independent of Galiano.

Certified Reference Materials and Blanks are inserted by Galiano into the sample stream at the rate of 1:14 samples. Field duplicates are collected at the rate of 1:30 samples. All samples have been analyzed by Photon assay by Intertek Minerals Ltd. ("Intertek") in Tarkwa, Ghana with standard preparation methods. ChrysosTM Photon assay uses high energy X-ray to activate gold nuclei in a large sample ca. 500g. Photon assay uses a larger sample, thus the variance on the sampling error is less. Crushing the sample to 2-3mm is required in many cases. Photon assay tends to have a higher detection limit than fire assay (0.02ppm). Intertek does its own introduction of QA/QC samples into the sample stream and reports them to Galiano for double checking. Higher grade samples are re-analyzed from pulp or reject material or both. Intertek is an international company operating in 100 countries and is independent of Galiano. It provides testing for a wide range of industries including the mining, metals, and oil sectors.

About Galiano Gold Inc.

Galiano is focused on creating a sustainable business capable of value creation for all stakeholders through production, exploration and disciplined deployment of its financial resources. The Company owns and operates the Asanko Gold Mine, which is located in Ghana, West Africa. Galiano is committed to the highest standards for environmental management, social responsibility, and the health and safety of its employees and neighbouring communities. For more information, please visit www.galianogold.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements and information contained in this news release constitute "forward-looking statements" within the meaning of applicable U.S. securities laws and "forward-looking information" within the meaning of applicable Canadian securities laws, which we refer to collectively as "forward-looking statements". Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future conditions and courses of action. All statements and information other than statements of historical fact may be forward looking statements. In some cases, forward-looking statements can be identified by the use of words such as "seek", "expect", "anticipate", "budget", "plan", "estimate", "continue", "forecast", "intend", "believe", "predict", "potential", "target", "may", "could", "would", "might", "will" and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook.

Forward-looking statements in this news release include, but are not limited to statements regarding the Company's expectations and timing with respect to current and planned drilling programs at Abore, and the results thereof; the potential to optimize and/or expand the Abore Reserve pit and the resulting impact on mineral reserves and ore delivery; the Company's belief in the potential of Abore; the Company's plan to report a maiden underground Mineral Resource at Abore, and the Company's plans to update the mineral resources and mineral reserves. Such forward-looking statements are based on a number of material factors and assumptions, including, but not limited to: development plans and capital expenditures; the price of gold will not decline significantly or for a protracted period of time; the accuracy of the estimates and assumptions underlying mineral reserve and mineral resource estimates; the Company's ability to raise sufficient funds from future equity financings to support its operations, and general business and economic conditions; the global financial markets and general economic conditions will be stable and prosperous in the future; the ability of the Company to comply with applicable governmental regulations and standards; the mining laws, tax laws and other laws in Ghana applicable to the AGM will not change, and there will be no imposition of additional exchange controls in Ghana; the success of the Company in implementing its development strategies and achieving its business objectives; the Company will have sufficient working capital necessary to sustain its operations on an ongoing basis and the Company will continue to have sufficient working capital to fund its operations; and the key personnel of the Company will continue their employment.

The foregoing list of assumptions cannot be considered exhaustive.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and you are cautioned not to place undue reliance on forward-looking statements contained herein. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this news release, include, but are not limited to: mineral reserve and mineral resource estimates may change and may prove to be inaccurate; metallurgical recoveries may not be economically viable; life of mine estimates are based on a number of factors and assumptions and may prove to be incorrect; actual production, costs, returns and other economic and financial performance may vary from the Company's estimates in response to a variety of factors, many of which are not within the Company's control; inflationary pressures and the effects thereof; the AGM has a limited operating history and is subject to risks associated with establishing new mining operations; sustained increases in costs, or decreases in the availability, of commodities consumed or otherwise used by the Company may adversely affect the Company; adverse geotechnical and geological conditions (including geotechnical failures) may result in operating delays and lower throughput or recovery, closures or damage to mine infrastructure; the ability of the Company to treat the number of tonnes planned, recover valuable materials, remove deleterious materials and process ore, concentrate and tailings as planned is dependent on a number of factors and assumptions which may not be present or occur as expected; the Company's mineral properties may experience a loss of ore due to illegal mining activities; the Company's operations may encounter delays in or losses of production due to equipment delays or the availability of equipment; outbreaks of COVID-19 and other infectious diseases may have a negative impact on global financial conditions, demand for commodities and supply chains and could adversely affect the Company's business, financial condition and results of operations and the market price of the common shares of the Company; the Company's operations are subject to continuously evolving legislation, compliance with which may be difficult, uneconomic or require significant expenditures; the Company may be unsuccessful in attracting and retaining key personnel; labour disruptions could adversely affect the Company's operations; recoveries may be lower in the future and have a negative impact on the Company's financial results; the lower recoveries may persist and be detrimental to the AGM and the Company; the Company's business is subject to risks associated with operating in a foreign country; risks related to the Company's use of contractors; the hazards and risks normally encountered in the exploration, development and production of gold; the Company's operations are subject to environmental hazards and compliance with applicable environmental laws and regulations; the effects of climate change or extreme weather events may cause prolonged disruption to the delivery of essential commodities which could negatively affect production efficiency; the Company's operations and workforce are exposed to health and safety risks; unexpected costs and delays related to, or the failure of the Company to obtain, necessary permits could impede the Company's operations; the Company's title to exploration, development and mining interests can be uncertain and may be contested; geotechnical risks associated with the design and operation of a mine and related civil structures; the Company's properties may be subject to claims by various community stakeholders; risks related to limited access to infrastructure and water; risks associated with establishing new mining operations; the Company's revenues are dependent on the market prices for gold, which have experienced significant recent fluctuations; the Company may not be able to secure additional financing when needed or on acceptable terms; the Company's shareholders may be subject to future dilution; risks related to changes in interest rates and foreign currency exchange rates; risks relating to credit rating downgrades; changes to taxation laws applicable to the Company may affect the Company's profitability and ability to repatriate funds; risks related to the Company's internal controls over financial reporting and compliance with applicable accounting regulations and securities laws; risks related to information systems security threats; non-compliance with public disclosure obligations could have an adverse effect on the Company's stock price; the carrying value of the Company's assets may change and these assets may be subject to impairment charges; risks associated with changes in reporting standards; the Company may be liable for uninsured or partially insured losses; the Company may be subject to litigation; damage to the Company's reputation could result in decreased investor confidence and increased challenges in developing and maintaining community relations which may have adverse effects on the business, results of operations and financial conditions of the Company and the Company's share price; the Company may be unsuccessful in identifying targets for acquisition or completing suitable corporate transactions, and any such transactions may not be beneficial to the Company or its shareholders; the Company must compete with other mining companies and individuals for mining interests; the Company's growth, future profitability and ability to obtain financing may be impacted by global financial conditions; the Company's common shares may experience price and trading volume volatility; the Company has never paid dividends and does not expect to do so in the foreseeable future; the Company's shareholders may be unable to sell significant quantities of the Company's common shares into the public trading markets without a significant reduction in the price of its common shares, or at all; and the risk factors described under the heading "Risk Factors" in the Company's Annual Information Form.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in, or incorporated by reference in, this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

1 See press release "Galiano Gold Advances Toward a Maiden Underground Resource at Abore with Additional High-Grade Results Encountered Including 4.7 g/t Au over 28m and 3.5 g/t Au over 17m" dated November 17, 2025.

2 See press release "Galiano Gold Announces 2025 Guidance and Provides Mineral Reserve and Mineral Resource Update" dated January 28, 2025.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282009

© 2026 Canjex Publishing Ltd. All rights reserved.