NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

TORONTO, Feb. 02, 2026 (GLOBE NEWSWIRE) -- Future Mineral Resources Inc. (“Future Mineral” or the “Company”) (TSX: FMR) is pleased to announce that the Company has entered into a share purchase agreement dated February 2, 2026 (the “Agreement”) to acquire the remaining 52% ownership interest in its flagship nickel–zinc–lead project in Poland (the “Project”), which is expected to consolidate FMR’s 100% ownership of one of Europe’s most compelling, high-potential polymetallic exploration assets. The transaction is anticipated to position Future Mineral with full strategic control at a time of strengthening base-metal markets and growing demand for critical minerals essential to electrification and industrial growth.

The Agreement was entered into with Forbes EV Metals Inc. (the “Target”) and its shareholders, many of whom are current or former directors and officers of the Company (collectively, the “Vendors”), pursuant to which Future Mineral intends to indirectly acquire (the “Acquisition”) the remaining 52% interest in the Project through the purchase of 100% of the issued and outstanding shares of the Target, which owns 52% of Ferrite Resources Polska sp. z o.o. (“Ferrite Polska”), a private company incorporated under the laws of Poland.

The Project is comprised of the Szklary nickel deposit and the Dabrowka zinc–lead deposit, both located in Poland’s established mining corridor (Fig. 1). Future Mineral acquired an initial 48% interest in the Project in June 2025; closing of the Acquisition will complete the consolidation. For more information about the 48% acquisition, please see the Company’s press release dated June 26, 2025, a copy of which is available on the Company’s SEDAR+ profile at www.sedarplus.ca.

A Transformational European Asset

Szklary Nickel Project

- Historic production: 3.5 Mt at 1–2.5% Ni (Michael Mlynarczyk 2022: NI 43-101 Technical Report on the Szklary Slaskie, Grochowa Braszowice Nickel Property, Lower Silesia, Poland. Redstone Exploration Services. (“Mlynarczyk 2022)

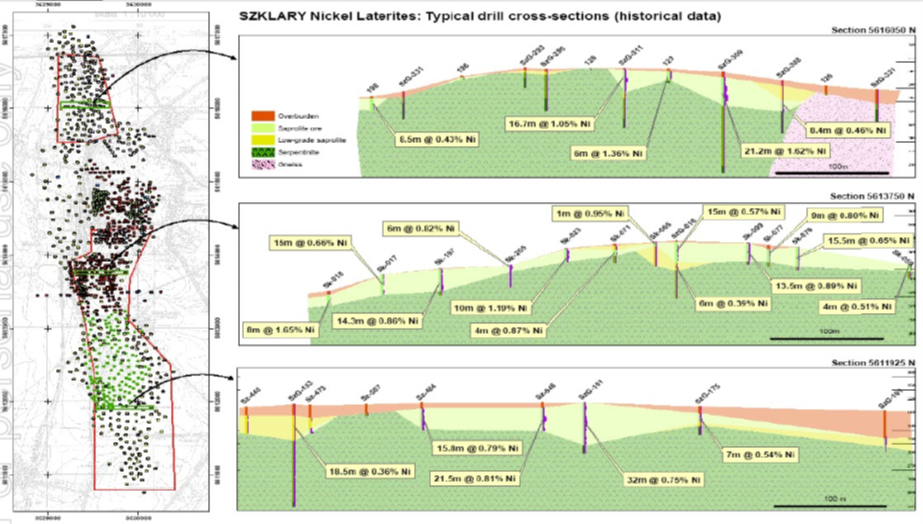

- Extensive historical drilling: ~2,500 holes (Fig. 2)

- Historic JORC inferred resource: 16.8 Mt @ 0.60% Ni for 94,000 tonnes of contained Ni (Alan Lockett 2008: First JORC reported Resource for Szklary Nickel Project. See announcement to the Australian Stock Exchange (“ASX”) dated July 29, 2008). However, this resource estimate only covers about 3.7 km of the 6 km of strike length of the Szklary Hills, which (as is understood) was within the 2 mineral permits held by the applicable company at the time, and which did not include the central part of the mineral trend that had to be excised from the estimate owing to the uncertainty regarding historic mining activity that took place there (see Northern Mining Limited’s announcement to the Australian Stock Exchange dated 29 July 2008).

- In the Mlynarzyk 2022 report prepared for Ferrite Resources Pty Ltd, the person from which FMR acquired its initial 48% interest in the Project, no mineral resource nor reserve estimates were established on the Szklary Śląskie, Grochowa‐Braszowice project area. Several historic estimates have been carried out by Polish state organizations based on historic drilling programs, but these cannot be considered as JORC or NI 43‐101 compliant resources or reserves. However, near-surface mineralisation has been detected within 20 m of surface in soft rock (saprolite).

- There is anticipated significant upside from untested deeper sulphide zones, requiring deeper diamond or RC drilling holes to penetrate through the saprolite zone overlaying the potential sulphides.

Figure 1: Map showing Szklary and Dabrowka projects in southern Poland

Figure 2: Compilation of historic drilling data at Szklary Śląskie prepared by Northern Mining Limited (see Northern Mining Limited’s, ASX news release dated July 2008) displaying the high density of drillholes at Szklary.

Future Mineral intends to complete ~30 confirmatory drill holes to validate and expand historical estimates. Ferrite Polska has proposed a 24‐month program for an initial phase of reconnaissance and exploration at the Szklary Śląskie, Grochowa‐Braszowice property, which includes various geophysical surveys, an environmental baseline study, and an expected increase to the existing JORC‐compliant mineral resources at Szklary.

Dabrowka Zinc–Lead Project

- Located 25 km north of Katowice

- Existing shaft infrastructure and shallow access (to ~90 m below surface)

- Planned 27 drill holes to build on historical work

- Two Zn Pb horizons at 40–50 m and 80–100 m below surface

Built-In Infrastructure Advantages

- Two operating smelters within 20 km

- Road and rail access

- Recognized room-and-pillar mining methods

- Low-risk magnetic separation processing

Upcoming Catalysts

- Completion of the Acquisition

- Drilling at both Szklary and Dabrowka

- Resource confirmation and expansion

- License renewals - the Szklary and Dabrowka claims are scheduled to expire in March and April 2026, respectively; however, a renewal process has been initiated, and the Company is confident that extensions will be secured

Acquisition Terms

On closing, Future Mineral will:

- pay an aggregate of $2.6 million to the Vendors; and

- enter into a 36-month operating agreement with Forbes & Manhattan, Inc. at $50,000 per month.

Closing of the Acquisition remains subject to the satisfaction of customary conditions precedent, including, inter alia, any requisite approval of the Toronto Stock Exchange, completion of the Amended Offering (defined below), the provision of legal opinions concerning certain corporate matters and title, and other closing conditions customarily found in transactions similar to the Acquisition. The Acquisition and Amended Offering are expected to close in early 2026.

Private Placement Update

The Company has also amended the terms (the “Amended Offering”) of its previously announced non-brokered private placement financing (the “Initial Offering”), which now consist of the following:

- Up to 15 million common shares at $0.30 per share

- Gross proceeds of up to $4.5 million

- Removal of all warrants and finder warrants

- Expanded use of net proceeds to include satisfaction of all or a portion of the purchase price payable in connection with the Acquisition (provided all applicable closing conditions have been satisfied otherwise duly waived

- all other terms of the Initial Offering remain unchanged

For certainty, closing of the Amended Offering is not conditional on completion of the Acquisition. For more information about the Initial Offering, please see the Company’s press release dated January 7, 2026, a copy of which is available on the Company’s SEDAR+ profile.

About the Project

Szklary Nickel Project – Historic European Deposit with Recognized Endowment and Expansion Potential

The Szklary mine, located in Lower Silesia, Poland, is a historic European mining district of significance, renowned for both gemstone and nickel production spanning more than six centuries (see https://link.springer.com/article/10.1007/s13563-021-00269-0).

Gemstone Heritage

Chrysoprase mining in the Szklary region dates back to the 14th century, with the deposit becoming famous for producing high-quality apple-green chrysoprase, a rare gem-quality nickel-bearing chalcedony. The material was highly prized by Frederick the Great and European royalty, and for centuries Szklary was regarded as one of the most important chrysoprase sources in Europe—and potentially the world.

Transition to Industrial Nickel Production

While early activity focused on gemstone recovery, organized nickel mining began around 1890, marking Szklary’s transition into a significant industrial metal producer. Mining operations continued until 1983, utilizing a combination of underground shafts reaching depths of approximately 100 metres, and later open-pit mining methods introduced in 1935, when operations were managed by the Krupp company.

Geological Context

The Szklary deposit is hosted within a serpentinite massif, where nickel-bearing fluids associated with weathering processes formed both nickel mineralization and the distinctive chrysoprase gemstone. This geological setting underpins the Project’s dual historical importance as both a gemstone locality and a nickel producer and supports ongoing exploration potential at depth.

- Recognized Nickel Endowment Szklary is a historic European nickel district with documented production of 3.5 Mt at 0.79% Ni and a JORC-compliant historical inferred resource of 32.9 Mt at 0.70% Ni, providing a strong foundation for resource confirmation and expansion.

- Shallow, Accessible Mineralization Nickel mineralization is exposed within the first 20 metres below surface, supporting potential low-strip, near-surface mining scenarios and efficient early-stage development.

- Untested Depth Potential

Historic mining and drilling were largely focused on shallow zones. Sulphide mineralization at depth remains largely unexplored, presenting meaningful upside through modern exploration techniques. - Infrastructure Advantage

Located in southern Poland’s established mining corridor, Szklary benefits from two operating smelters within 20 km, existing road and rail access, and proximity to skilled labor—significantly reducing development risk and capital intensity. - Attractive Jurisdiction

Poland offers a stable, mining-friendly regulatory framework within the European Union, with clear permitting processes and strong support for strategic metals critical to electrification and energy security. - Centuries of Mining Validation

Continuous mineral extraction since the 14th century, including over 90 years of industrial nickel production, provides compelling proof of geological continuity and mineral fertility. - Strategic Metal Exposure

Nickel is a critical input for batteries, stainless steel, and electrification infrastructure, positioning Szklary as a strategically relevant European source at a time of growing regional supply constraints.

Note: a qualified person (as such term is defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”)) has not done sufficient work to classify the historical estimates described above as current mineral resources or mineral reserves and the Company is not treating the historical estimate as current mineral resources or mineral reserves.

Target Summary Financial Information

As of the date hereof, other than the Project and as noted below, neither the Target nor Ferrite Polska hold any other material assets, nor do they have any profits, liabilities, or losses. Ferrite Polska has liabilities of approximately 911,000 euros, approximately 800,000 of which is owed to Forbes. For clarity, the financial information contained in this paragraph is unaudited.

An officer and a director of the Company together hold 4.5% of the securities of the Target to be acquired by the Company pursuant to the Acquisition; therefore, the Acquisition as it relates to the involvement of such persons constitutes a “related party transaction” within the meaning of Multilateral Instrument 61-101 - Protection of Minority Shareholders in Special Transactions (“MI 61-101”). The Company intends to rely on applicable exemptions from the formal valuation and minority approval requirements in Sections 5.5(a) and 5.7(1)(a), respectively, of MI 61-101. No new insiders are anticipated to be created, nor is there expected to be any change of control, as a result of the Acquisition.

Qualified Person

The scientific and technical information contained herein has been reviewed and approved by Dr. Andreas Rompel, Pr.Sci.Nat, FSAIMM, one of the Vendors and a director of the Company who is a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Future Mineral

Future Mineral is a mining company focused on acquiring and advancing brownfield, development-stage and early production-stage mining projects in the Americas and Europe.

Future Mineral Resources Inc.

On behalf of the Board

“Fred Leigh”, Chief Executive Officer

info@sulliden.com

(416) 861-2267

Cautionary statement regarding forward-looking information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements with respect to the Acquisition, the Project, and the Amended Offering, including the proposed use of proceeds, the anticipated closing dates, and the size of the Amended Offering, the Company’s ability to complete the Acquisition and Amended Offering, the renewal process respecting the two claims comprising the Project and the Company’s intentions to conduct exploratory activities at the Project, and other matters related thereto. Forward looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limit to: receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future mineral prices and market demand; accidents, labour disputes and shortages; risks inherent in the mining industry; and other risks described in the public disclosure of the Company which is available under the profile of the Company on SEDAR+ at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE TSX HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OF THIS NEWS RELEASE.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Photos accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/283ccb35-af03-4009-8c90-76606c308bb7

https://www.globenewswire.com/NewsRoom/AttachmentNg/7ddde544-e689-4aed-b83e-cfcf849f36b9

https://www.globenewswire.com/NewsRoom/AttachmentNg/b52205ca-6143-4b2b-ba39-dff43016ba61

Figure 1

Map showing Szklary and Dabrowka projects in southern Poland

Figure 2

Compilation of historic drilling data at Szklary Śląskie prepared by Northern Mining Limited (see Northern Mining Limited’s, ASX news release dated July 2008) displaying the high density of drillholes at Szklary.

Szklary Nickel Project – Historic European Deposit with Recognized Endowment and Expansion Potential

Szklary Nickel Project – Historic European Deposit with Recognized Endowment and Expansion Potential

© 2026 Canjex Publishing Ltd. All rights reserved.