Vancouver, British Columbia--(Newsfile Corp. - February 17, 2026) - Galloper Gold Corp. (CSE: BOOM) (OTC Pink: GGDCF) (the "Company" or "Galloper") is pleased to announce it has retained the services of P&E Mining Consultants Inc to immediately initiate work on an updated NI43-101 compliant Mineral Resource Estimate (MRE) of it's 100% owned Lunch Pond South Extension (LPSE) gold resource.

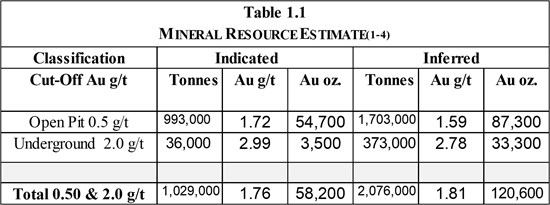

The Glover Island property covers an area of 116.6km2 and contains the LPSE gold resource. Gold Indicated and Inferred in the LPSE resource was delineated by Mountain Lake Minerals Ltd. in 2017. Grade and tonnage for this deposit are stated as:

1) A 0.5g/t Au cut-off open-pit mine design with a 1.72g/t Au average within 993,000t indicated resource, and with a 1.59g/t average within a 1,703,000t inferred resource.

2) A 2.0g/t Au cut-off underground mine design with a 2.99g/t Au average with 36,000t indicated resource, and with a 2.78g/t Au average within a 373,000t inferred resource.

See Table 1.1 below from: Puritch, E. and Barry, J., 2017. Technical Report and Resource Estimate on the Glover Island Property, Grand Lake Area, West-Central Newfoundland, Canada for Mountain Lake Minerals Ltd. NI-43-101& NI-43-101F1 Technical Report.

The 2017 LPSE mineral resource was performed using a value US$1,210 per ounce, and the current update is being performed in a significantly increased gold valuation environment.

Galloper Gold's CEO Mr. Hratch Jabrayan commented: "Updating the MRE on the LPSE Resource is an important step to advancing and progressing the Glover Island Project. The project has benefited from a significant gold valuation increase since 2017. Assessing the economic potential with a renewed and updated MRE will help us to progress the technical component of the project. Results from this exercise are expected in Q2 2026."

An updated MRE will provide a reinterpreted economic ore zone with revised grade constraints, estimation and pit-shell geometry. Galloper Gold has engaged P&E Mining Consultants Inc. (P&E), who performed the 2017 MRE, for this development exercise. P&E are independent qualified consultants and will prepare the updated MRE within the parameters of the NI43-101 Standards of Disclosure for Mineral Projects.

*Technical information regulating the material disclosure regarding the LPSE resource (also available from July 31, 2025 News Release):

The aforementioned technical report is considered relevant as no exploration work has been performed on the LPSE deposit since the report's production and release. The reliability of the historical estimate is considered valid per study and consideration of the report's findings.

The LPSE deposit is located at the south-western portion of an 11 km mineralized corridor known as the Glover Island Trend (GIT). This prospective GIT is host to 17 gold, base metal, nickel, and polymetallic minerals prospects. In addition, numerous gold anomalies cross several rock types adjacent to a major tectono-structural break known as the Cabot Fault. Adding to the prospectivity of the GIT, The Ming Mine, Tilt Cove Mines, Nugget Pond Mine and Pine Cove Mine are situated strike-north on this fault on the Baie Verte peninsula showing the prolific mineralized nature of this major structure on which the Glover Island property sits.

The historic LPSE resource table below highlights the mineral resource estimate from 2017:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11683/283616_table1.jpg

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. It is noted that no specific issues have been identified as yet.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

(4) The 0.5 g/t and 2.0 g/t Au respective open pit and underground Mineral Resource cut-off grades for LPSE were derived from the approximate May 30/17 two year trailing average Au price of US$1,210/oz. and US$/C$ exchange rate of 0.76, 95% process recovery, $20/t process cost, $3/t open pit mining cost, $75 underground mining cost and $5/t G&A cost.

Disclaimer: Parameters and assumptions for the values listed above can be sourced from the Puritch and Barry, 2017 Technical Report referenced above. The work necessary to upgrade/verify the resource estimate has not been performed to date. The work required to affect the upgrading and verification of the resource involves drill-core and assay analysis, modelling of lithological intersections and assay data, and confirmation of select historical drill-holes via drill-hole twinning to compare twinned results with historical results, and a statistical analysis of the results to determine accuracy and reliability of historical data.

A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The issuer of this press release is not treating the estimate as current.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Bryan Sparrow, P.Geo., Vice President for Galloper Gold. Mr. Sparrow is the Qualified Person responsible for the scientific and technical information contained herein under National Instrument 43-101 standards.

About Galloper Gold Corp.

Galloper Gold Corp. is focused on mineral exploration in central Newfoundland on its Glover Island exploration project. The property comprises 466 mining claims on 13 mineral licences covering 116.6sqkm (11,660 Ha). Historic exploration efforts produced the LPSE Resource which is wholly controlled by Galloper Gold Corp.

For more information please visit www.GalloperGold.com and the Company's profile on SEDAR+ at www.sedarplus.ca.

On behalf of the Board of Directors,

Mr. Hratch Jabrayan

CEO and Director

Galloper Gold Corp.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with mineral exploration generally, risks related to capital markets, risks related to the state of financial markets or future metals prices and the other risks described in the Company's publicly filed disclosure.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283616

© 2026 Canjex Publishing Ltd. All rights reserved.