THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

HALIFAX, NS / ACCESS Newswire / November 24, 2025 / Axo Copper Corp. (TSXV:AXO) ("Axo Copper" or the "Company") is pleased to announce that it has entered into (i) a definitive purchase agreement (the "Purchase Agreement") on November 21, 2025 to acquire Sapuchi Minera S. de R.L. de C.V. ("Sapuchi Minera") from Osisko Development Corp. ("Osisko Development") (the "Transaction") and (ii) a share issuance agreement with OR Royalties International Ltd. ("OR International"), a wholly-owned subsidiary of OR Royalties Inc. (the "Share Issuance Agreement"). Sapuchi Minera holds a 100% economic interest in the San Antonio Gold Project ("San Antonio" or the "Project") located in Sonora State, Mexico. Upon closing of the Transaction, Sapuchi Minera and OR International have agreed to enter into an amended and restated stream agreement (the "Amended Stream Agreement"), as further described below, and subject to customary closing conditions relating thereto. All dollar amounts are in U.S. dollars, unless otherwise noted.

The consideration payable to Osisko Development under the Purchase Agreement consists of the issuance of, subject to adjustment in accordance with the terms of the Purchase Agreement, 15,305,536 common shares of Axo Copper ("Axo Shares"), or such other number of Axo Shares that would result in Osisko Development owning 9.99% of the issued and outstanding Axo Shares upon the completion of the Transaction and certain contingent payments, as described below. The consideration payable to OR International under the Share Issuance Agreement consists of the issuance of, subject to adjustment in accordance with the terms of the Purchase Agreement, 7,652,768 Axo Shares, or such other number of Axo Shares that would result in OR International owning 4.99% of the issued and outstanding Axo Shares upon the completion of the Transaction and certain contingent payments payable by Sapuchi Minera, as described below.

Jonathan Egilo, Axo Copper's CEO, commented: "We are excited to announce this transformational acquisition for Axo, and we welcome new supportive shareholders and partners in Osisko Development and OR International. All parties understand the deep value and high exploration upside that come with the San Antonio project, and we look forward to advancing the late-stage development project. The high-grade oxide resource and existing infrastructure represent a tremendous opportunity to accelerate first production, paving a path for future development of transition and sulphide material. With San Antonio paired with our existing La Huerta project, we couldn't be more excited for the future of Axo."

San Antonio Highlights

Category | Tonnes (Mt) | Au Grade (g/t) | Ag Grade (g/t) | Cont. Au (koz) | Cont. Ag (Moz) |

Total Indicated | 14.9 | 1.20 | 2.9 | 576 | 1.37 |

Total Inferred | 16.6 | 1.02 | 3.3 | 544 | 1.76 |

Table 1: Consolidated MRE across all deposits

Initial open-pit mineral resource estimate ("MRE") (effective June 24, 2022) totaled 576koz of gold in the indicated category and 544koz of gold in the inferred category, encompassing five deposits (Sapuchi, Golfo de Oro, California, Calvario, and High Life) along a 2.8 km strike length. The MRE is underpinned by a robust database of approximately 85,000 m of drilling inclusive of a +27,000 m drill campaign conducted in 2021. Over 90% of the contained resource metal is hosted in the Golfo de Oro, California and Sapuchi deposits.

Indicated resources are categorized by weathering zone as follows:

Oxide: 2.7 Mt at 0.89 g/t Au; 77 koz Au

Transition: 1.8 Mt at 1.02 g/t Au; 59 koz Au

Sulphide: 10.4 Mt at 1.31 g/t Au; 441 koz Au

Total Indicated: 14.9 Mt at 1.20 g/t Au; 576 koz Au

Inferred resources are categorized by weathering zone as follows:

Oxide: 4.6 Mt at 0.74 g/t Au; 111 koz Au

Transition: 2.1 Mt at 0.90 g/t Au; 61 koz Au

Sulphide: 9.8 Mt at 1.18 g/t Au; 371 koz Au

Total Inferred: 16.6 Mt at 1.02 g/t Au; 544 koz Au

Amended Metals Stream on San Antonio

The key terms of the Amended Stream Agreement, the form of which has been substantially agreed to by the parties, are set out below:

The designated percentage of payable gold and silver ounces will be 7.15%.

The transfer payments for gold and silver deliveries will be 30% of the spot prices.

Up to an aggregate of $8,550,000 of contingent payments to OR International, payable in gold deliveries and subject to the 30% transfer payment, upon achieving certain production milestones. These payments include $2,850,000 in gold ounces at each of the 50,000 ounce, 100,000 ounce, and 150,000 ounce gold production milestones.

About San Antonio

The San Antonio Gold Project is a brownfield open-pit opportunity located in Sonora, Mexico, with a history as a past-producing oxide copper mine from 2011 to 2018. Osisko Development acquired the Project in 2020 and has since focused on evaluating and advancing its gold potential through extensive drilling and metallurgical testing. Osisko Development completed a 2021 drill program that contributed to the initial MRE announced in June 2022, supported by the NI 43-101 Technical Report prepared by Micon International Limited. The MRE highlights five key deposits - Sapuchi, Golfo de Oro, California, Calvario, and High Life - spanning a hydrothermal breccia system with mineralization up to 300 meters deep.

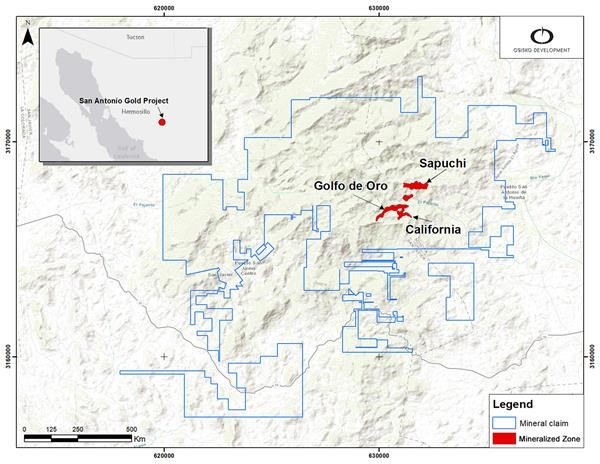

Figure 1: Aerial plan view map of the San Antonio Project showing the five main deposits (Sapuchi, Golfo de Oro, California, Calvario, and High Life) and mineral concessions

Figure 1: Aerial plan view map of the San Antonio Project showing the five main deposits (Sapuchi, Golfo de Oro, California, Calvario, and High Life) and mineral concessions

Osisko Development drilled extensively for gold, adding to historical data, and developed plans to put the Project into production starting with near-surface oxides at the Sapuchi deposit. A Manifestación de Impacto Ambiental ("MIA") permit application was submitted in 2021 under the previous Mexican administration, but it was withdrawn in 2022. In the interim, Osisko Development processed existing stockpiles using cyanide heap leaching from Q1 2022 to Q3 2023, achieving first gold sales in July 2022 and totaling 13,591 ounces sold by September 2023.

The Project's main deposits are as follows (as of the 2022 MRE):

Sapuchi deposit:

Indicated: 1.9 Mt oxide at 0.85 g/t Au (53 koz Au), 1.4 Mt transition at 1.04 g/t Au (47 koz Au), and 2.1 Mt sulphide at 0.94 g/t Au (62 koz Au), totaling 162 koz Au

Inferred: 3.2 Mt oxide at 0.74 g/t Au (75 koz Au), 1.6 Mt transition at 0.92 g/t Au (48 koz Au), and 2.8 Mt sulphide at 0.92 g/t Au (84 koz Au), totaling 208 koz Au

Golfo de Oro deposit:

Indicated: 0.2 Mt oxide at 1.07 g/t Au (7 koz Au), 0.1 Mt transition at 1.19 g/t Au (6 koz Au), and 5.3 Mt sulphide at 1.46 g/t Au (249 koz Au), totaling 262 koz Au

Inferred: 0.5 Mt oxide at 0.80 g/t Au (12 koz Au), 0.2 Mt transition at 0.93 g/t Au (5 koz Au), and 5.7 Mt sulphide at 1.29 g/t Au (237 koz Au), totaling 254 koz Au

California deposit:

Indicated: 0.6 Mt oxide at 0.93 g/t Au (17 koz Au), 0.2 Mt transition at 0.79 g/t Au (6 koz Au), and 3.1 Mt sulphide at 1.31 g/t Au (130 koz Au), totaling 153 koz Au

Inferred: 0.4 Mt oxide at 0.68 g/t Au (8 koz Au), 0.1 Mt transition at 0.85 g/t Au (4 koz Au), and 1.1 Mt sulphide at 1.27 g/t Au (46 koz Au), totaling 58 koz Au

Smaller contributions come from the Calvario and High Life deposits. Overall, the oxide zones (which metallurgical testing suggests are amenable to heap leaching) represent about 25% of the total ounces, with the deeper transition and sulphide material offering additional upside.

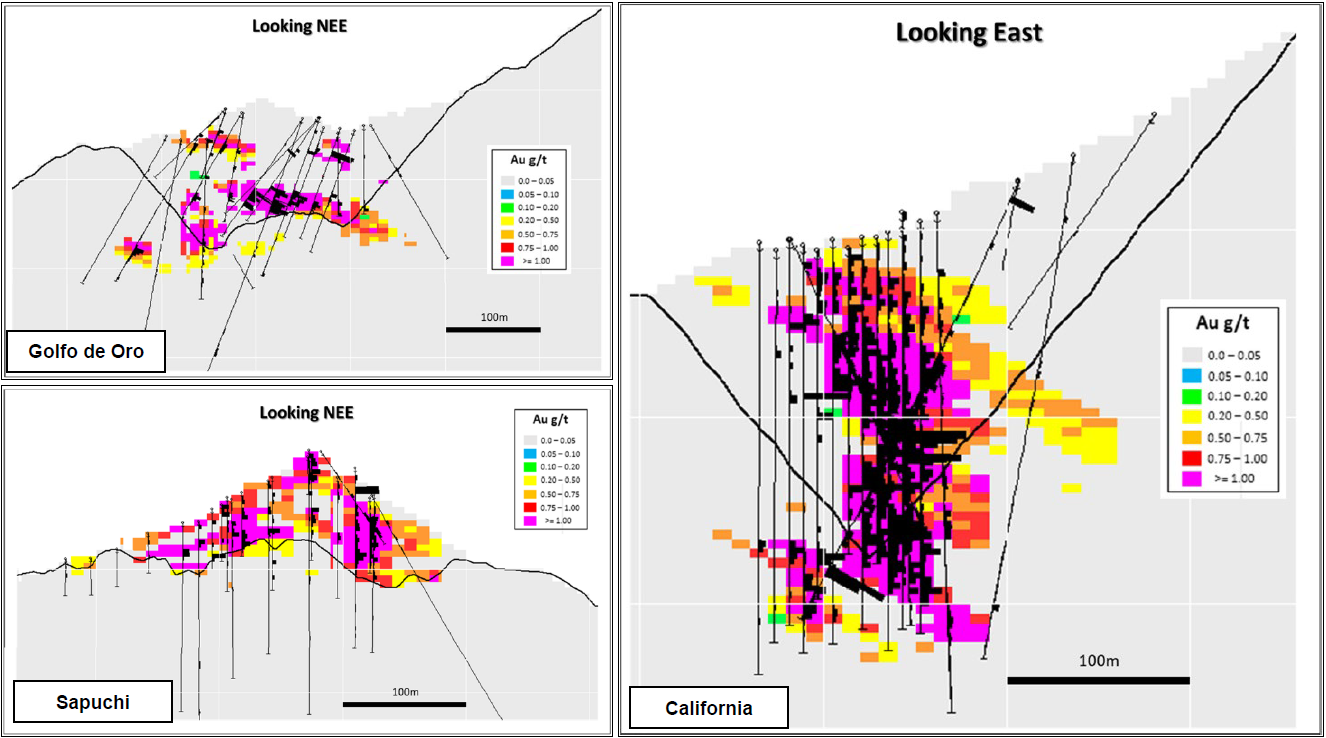

Figure 2: Typical sections of the resource block model for Golfo de Oro, California and Sapuchi deposits with pit outline shown (optimized using a gold price of $1,750 per ounce)

Figure 2: Typical sections of the resource block model for Golfo de Oro, California and Sapuchi deposits with pit outline shown (optimized using a gold price of $1,750 per ounce)

Metallurgical testing on the Sapuchi deposit (2021-2022 by Forte Analytical and SGS Mineral Services Canada) confirms strong recoveries for oxide material via heap leaching, with bottle roll tests showing gold extractions up to 80-90% in oxides, supporting low-cost processing methods. The 2021-2022 metallurgical testing on transition and sulphide material at Sapuchi largely align with findings from historical metallurgical testing of transition and sulphide material at the Gulfo de Oro and California deposits, which suggest strong recoveries when crushed and mill agitated tank leached.

The Project benefits from robust infrastructure, including access via paved highways, on-site power from the national grid, water rights, an operational camp for up to 200 personnel, administrative buildings, and existing heap leach facilities that were successfully used for stockpile processing.

Figure 3: On site processing facilities inclusive of a carbon-in-column plant

Figure 3: On site processing facilities inclusive of a carbon-in-column plant

Transaction Details

In accordance with the terms of the Purchase Agreement, Axo Copper will acquire from Osisko Development all the issued and outstanding shares of Sapuchi Minera, which has a 100% economic interest in the Project. The consideration payable to Osisko Development under the Purchase Agreement consists of the issuance of such number of Axo Shares that would result in Osisko Development owning 9.99% of the issued and outstanding Axo Shares upon the completion of the Transaction. In addition, following the completion of the Transaction, Osisko Development will be entitled to the following contingent payments: (i) a cash payment equal to 70% of any Mexican value-added tax refund due and owing to Sapuchi Minera in respect of any period of time ending on or before the completion of the Transaction; (ii) contingent payments of up to $4,000,000 in the aggregate, payable as follows: (A) $2,000,000 payable in cash or Axo shares, at Axo's option, upon the filing of a feasibility study on the San Antonio property prepared in accordance with NI 43-101, and (B) $2,000,000 payable in cash or Axo Shares, at Osisko Development's option, upon the first gold pour being completed at the San Antonio property; and (iii) in the event that Axo Copper completes one or more equity financings that result in aggregate gross proceeds of at least $10,000,000, Axo Copper will issue to Osisko Development such number of Axo Shares that would result in Osisko Development retaining its 9.99% interest in Axo Copper on the initial $10,000,000 raised.

In accordance with the terms of the Share Issuance Agreement, in consideration for entering into the Amended Stream Agreement, Axo Copper will issue to OR International such number of Axo Shares that would result in OR International owning 4.99% of the issued and outstanding Axo Shares upon completion of the Transaction. In addition, following the completion of the Transaction, in the event that Axo Copper completes one or more equity financings that result in aggregate gross proceeds of at least $10,000,000, Axo Copper will issue to OR International such number of Axo Shares that would result in OR International retaining its 4.99% interest in Axo Copper on the initial $10,000,000 raised.

In connection with the Axo Shares to be issued under the Transaction, each of Osisko Development and OR International have agreed to: (i) enter into a lock-up agreement providing for restrictions on the transfer of such Axo Shares for 12 months following the completion of the Transaction; and (ii) provide voting support for certain matters presented at meetings of the shareholders of Axo Copper for 24 months following the completion of the Transaction.

In addition, in connection with the Transaction, Axo Copper has agreed to provide a non-interest bearing loan to Sapuchi Minera in order for it to satisfy any payments or obligations to the ejido community in respect of any parcel of the Project subject to ejidal or communal ownership that may become due or payable prior to the completion of the Transaction.

Axo Copper anticipates that the completion of the Transaction will occur in Q4 2025. Completion of the Transaction is subject to certain conditions, including, among other things, receipt of all required regulatory approvals (including the approval of the TSX-V) and other customary closing conditions for a transaction of this nature.

Advisors

Stifel Canada is acting as financial advisor to Axo Copper and Fasken Martineau DuMoulin LLP is acting as legal counsel to Axo Copper in connection with the Transaction.

Contact Information

Jonathan Egilo

President and CEO

613 882 5126

egilo@axocopper.com

Technical Disclosure & Qualified Persons

The full report, "NI 43-101 Technical Report For The 2022 Mineral Resource Estimate On The San Antonio Project Sonora, Mexico", dated July 12, 2022 and effective June 24, 2022, authored by William J. Lewis P.Geo., et al (the "San Antonio Report")is available for download from Osisko Development's SEDAR+ profile at www.sedarplus.ca.

Charles Spath, P. Geo., has reviewed the San Antonio Report on behalf of the Company. To the best of Axo Copper's knowledge, information, and belief, there is no new material scientific or technical information that would make the disclosure of the mineral resources included in such technical reports inaccurate or misleading.

Mineral Reserves & Resources Information For San Antonio

On July 22, 2022, Osisko Development filed on SEDAR+ (www.sedarplus.ca) the San Antonio Report which included a NI 43-101 reserve and resource estimate for its San Antonio Project. Excerpts from the report are noted below.

Summary of In-Pit Mineral Resource Estimate by Deposit for San Antonio Project

Category | Deposit | Zone | Tonnes (Mt) | Au Grade (g/t) | Ag Grade (g/t) | Cont. Au (koz) | Cont. Ag (Moz) |

Indicated | California | Oxide | 0.6 | 0.93 | 2.8 | 17 | 0.05 |

Transition | 0.2 | 0.79 | 3.3 | 6 | 0.02 |

Sulphide | 3.1 | 1.31 | 2.4 | 130 | 0.23 |

Total | 3.9 | 1.22 | 2.5 | 153 | 0.31 |

Golfo de Oro | Oxide | 0.2 | 1.07 | 2.8 | 7 | 0.02 |

Transition | 0.1 | 1.19 | 2.8 | 6 | 0.01 |

Sulphide | 5.3 | 1.46 | 2.5 | 249 | 0.42 |

Total | 5.7 | 1.44 | 2.5 | 262 | 0.46 |

Sapuchi | Oxide | 1.9 | 0.85 | 3.6 | 53 | 0.22 |

Transition | 1.4 | 1.04 | 3.6 | 47 | 0.16 |

Sulphide | 2.1 | 0.94 | 3.4 | 62 | 0.22 |

Total | 5.4 | 0.93 | 3.5 | 162 | 0.61 |

Total | Oxide | 2.7 | 0.89 | 3.4 | 77 | 0.30 |

Transition | 1.8 | 1.02 | 3.5 | 59 | 0.20 |

Sulphide | 10.4 | 1.31 | 2.6 | 441 | 0.88 |

Total | 14.9 | 1.20 | 2.9 | 576 | 1.37 |

Inferred | California | Oxide | 0.4 | 0.68 | 2.1 | 8 | 0.02 |

Transition | 0.1 | 0.85 | 2.6 | 4 | 0.01 |

Sulphide | 1.1 | 1.27 | 3.8 | 46 | 0.14 |

Total | 1.6 | 1.10 | 3.3 | 58 | 0.17 |

Golfo de Oro | Oxide | 0.5 | 0.80 | 3.0 | 12 | 0.04 |

Transition | 0.2 | 0.93 | 3.4 | 5 | 0.02 |

Sulphide | 5.7 | 1.29 | 2.5 | 237 | 0.46 |

Total | 6.4 | 1.24 | 2.5 | 254 | 0.52 |

High Life | Oxide | 0.5 | 0.84 | 4.2 | 14 | 0.07 |

Transition | 0.2 | 0.73 | 4.5 | 4 | 0.02 |

Sulphide | 0.1 | 0.90 | 8.3 | 4 | 0.04 |

Total | 0.8 | 0.83 | 4.9 | 22 | 0.13 |

Sapuchi | Oxide | 3.2 | 0.74 | 3.7 | 75 | 0.37 |

Transition | 1.6 | 0.92 | 3.6 | 48 | 0.19 |

Sulphide | 2.8 | 0.92 | 4.1 | 84 | 0.37 |

Total | 7.6 | 0.85 | 3.8 | 208 | 0.94 |

Calvario | Oxide | 0.1 | 0.53 | 0.0 | 2 | 0.00 |

Transition | 0.0 | 0.55 | 0.0 | 0 | 0.00 |

Sulphide | | | | | |

Total | 0.1 | 0.53 | 0.0 | 2 | 0.00 |

Total | Oxide | 4.6 | 0.74 | 3.5 | 111 | 0.51 |

Transition | 2.1 | 0.90 | 3.6 | 61 | 0.24 |

Sulphide | 9.8 | 1.18 | 3.2 | 371 | 1.00 |

Total | 16.6 | 1.02 | 3.3 | 544 | 1.76 |

Notes:

1. Rodrigo Calles, of Servicios Geológicos IMEx, S.C., William Lewis and Alan J San Martin, of Micon International Limited have reviewed and validated the mineral resource estimate for Sapuchi, Golfo de Oro, California, High Life and Calvario deposits. All are independent "Qualified Persons" (as defined in NI 43-101) responsible for auditing the 2022 mineral resource estimate. The effective date of the mineral resource estimate is June 22, 2022.

2. Specific extraction methods are used only to establish reasonable cut-off grades for various portions of the deposit. No Preliminary Economic Analysis, Pre-Feasibility Study or Feasibility Study has been completed to support economic viability and technical feasibility of exploiting any portion of the mineral resource, by any particular mining method.

3. The mineral resources disclosed in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") standards on mineral resources and reserves definitions, and guidelines, prepared by the CIM standing committee on reserve definitions and adopted by the CIM council.

4. The calculated economic cut-off grade for the resource in Oxides (70% recovery) is 0.27 g/t Au, Transition (90% recovery) is 0.44 g/t Au, and Fresh Rock (90% recovery) is 0.44 g/t Au.

5. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

6. Geologic modeling was completed by Osisko Development geologist Gilberto Moreno. The resource estimation was completed by Talisker Exploration Services Geologist Leonardo Souza, MAusIMM (CP).

7. The estimate is reported for a potential open pit scenario and USD. The cut-off grades were calculated using a gold price of $1,750 per ounce, a CAD:USD exchange rate of 1.3; mining cost of $2.95/t; processing cost of $4/t for oxides and $13.0/t for transition and sulphides; and general and administration costs of $2.50/t. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rate, mining cost, etc.).

8. A density of 2.55 g/cm3 was established for all oxide zones, 2.69 g/cm3 for transition zones and 2.74 g/cm3 for the sulphide zones.

9. Resources for Sapuchi, Golfo de Oro, California, High Life and Calvario were estimated using Datamine Studio RM 1.3 software using hard boundaries on composited assays (3.0 m for all zones). Ordinary Kriging interpolation was used with a parent block size = 10 m x 10 m x 5 m.

10. Results are presented in-situ. Ounce (troy) = metric tons x grade / 31.10348. Calculations used metric units (metres, tonnes, g/t). The number of metric tons was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects; rounding followed the recommendations as per NI 43-101.

11. Neither the Company, Servicios Geológicos IMEx, S.C., nor Micon International Limited. is aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect the mineral resource estimate other than disclosed in this Technical Report.

Qualified Persons

Charles Spath, P. Geo., is the Qualified Person for Axo Copper Corp., as defined under National Instrument 43-101. Mr. Spath has reviewed and approved the scientific and technical information in this press release.

About Axo Copper

Axo Copper Corp. is a Canadian mineral exploration company engaged in the exploration and development of the La Huerta property, a new copper discovery in Jalisco, Mexico. Initial exploration has yielded high-grade copper both at surface through sampling programs, and at depth through initial drilling. The Company is focused on continuing to define near-surface mineralization along the La Huerta Trend, expanding mineralization at depth, and targeting new discoveries in an underexplored district.

Additional information can be found at the Company's website: www.axocopper.com.

Caution Regarding Forward-Looking Information

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Transaction, the Company's plans in respect of the La Huerta property and the San Antonio property and receipt of all necessary regulatory approvals, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "will", "propose", "may", "is expected to", "subject to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective", "focus" and "outlook" and other similar words. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, general business and economic conditions will not change in a materially adverse manner; the potential of high grade copper mineralization at the Company's properties; the results (if any) of further exploration work to define and expand mineral resources; the ability of exploration work (including drilling) to accurately predict mineralization; and the ability to generate additional drill targets. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include environmental risks, limitations on insurance coverage, risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility including as a result of tariffs, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking information, other than as required by applicable securities laws.

SOURCE: Axo Copper Corp.

View the original press release on ACCESS Newswire

© 2026 Canjex Publishing Ltd. All rights reserved.