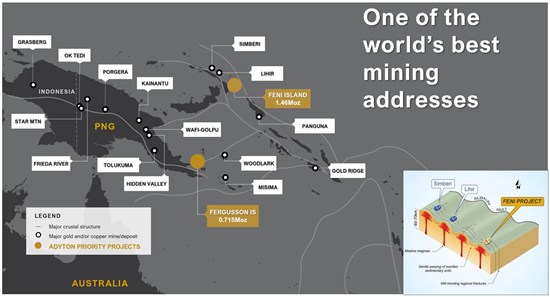

Brisbane, Australia--(Newsfile Corp. - February 18, 2026) - Adyton Resources Corporation (TSXV: ADY) ("Adyton" or the "Company") is pleased to announce successful results from its ongoing drill program at the 100% owned Feni Island Gold-Copper Project, located within the gold-prolific Lihir Island Chain, Papua New Guinea (PNG).

To date, 10,663m of the ongoing drill program have been completed, successfully achieving its objectives: to confirm high-grade extensions to the north; and to identify significant new scale potential to the south.

KEY HIGHLIGHTS

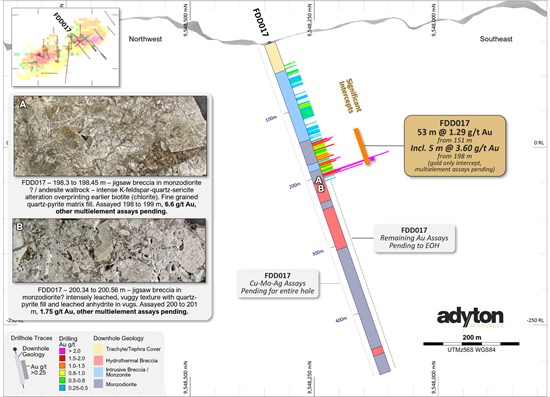

- High-Grade Northern Expansion: Hole FDD017 returned 1.29g/t Au over 53m, including a high-grade interval of 3.6g/t Au over 5m with a peak grade of 6.6 g/t Au over 1 m, further defining a northern expansion zone trending beyond the current resource model. Approximately 35% of gold assays and 100% copper assays remain pending for the hole;

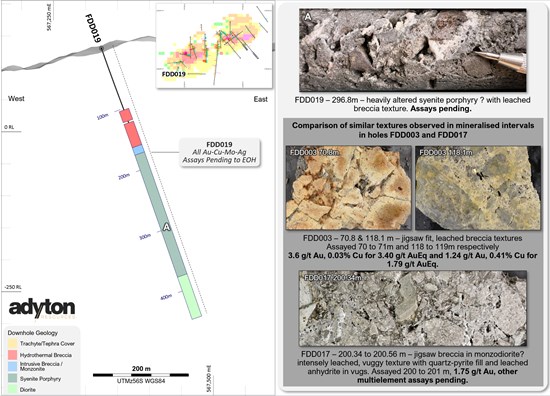

- Major Southern Scale Potential: Geological logging from the south-southwest (SSW) corridor (Holes FDD019, FDD021, and FDD028) highlights strong vectors toward expansion of the epithermal gold-copper system and reinforces links to a potential porphyry source, significantly increasing the system's prospective footprint;

- Resource De-Risking & Connectivity: Step-out drilling in "The Gap" (Holes FDD004 & FDD005) demonstrates continuous mineralization linking key zones, while twin drilling (Holes FDD001, FDD002 & FDD026) validates historical results, advancing confidence toward upgrading inferred resources to indicated; and

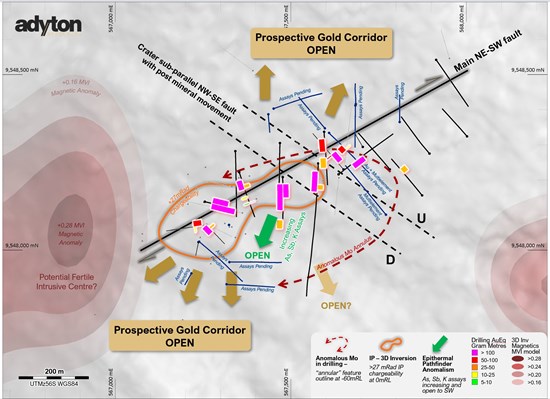

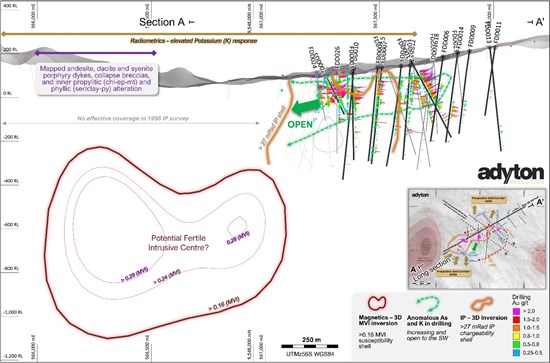

- District-Scale Upside: New modelling and reprocessed geophysics define a compelling system-scale "blueprint" likely linking the Kabang epithermal resource to the deeper Danmagal porphyry target and unlocking multiple high-priority drill targets.

"Drill hole FDD017 delivered the highest gold grade (peak grade of 6.6 g/t Au) of the current campaign within a broad highly mineralized interval, providing compelling evidence that the Kabang system remains open to the north and continues to grow," said Tim Crossely, CEO. "In addition, integrated interpretive work by Global Ore Discovery, combined with results from our recent magnetic survey and reprocessed IP data has defined what we believe to be a key south westerly fluid-flow corridor linking the Kabang epithermal gold system to a deeper porphyry source. This is a major step forward for the project. It not only strengthens the expansion potential of the existing epithermal resource but also opens the door to testing a potentially significant porphyry target at depth. We believe we are just beginning to unlock the full scale of the system."

NORTHERN EXPANSION: High-Grade Structures Confirmed

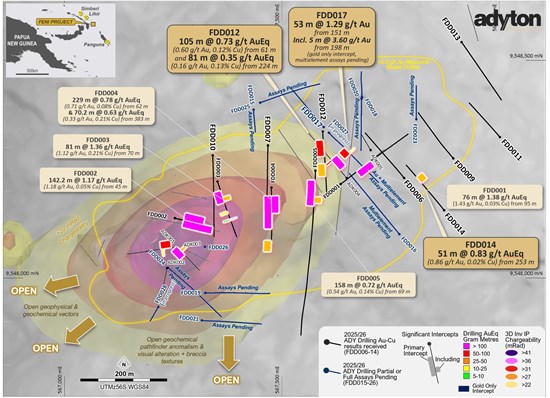

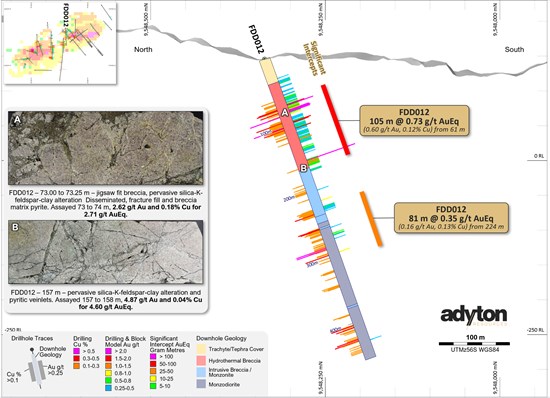

Drilling has successfully identified a new mineralized corridor trending north-northeast (NNE), highlighted by assays from FDD017 and FDD012, as well as visual logging from surrounding later holes (pending assays) FDD018, FDD020, FDD025. This area represents a high-priority target for resource grade improvement.

- Geology: FDD017 intersected phreatic breccia in monzodiorite and intense K-feldspar-quartz-sericite alteration overprinting earlier biotite. This distinct alteration assemblage is associated with high-grade mineralization and is indicative of a robust and widespread hydrothermal system.

- Multi-Element Support: Hole FDD012, also in the NNE corridor, in addition to gold and copper (see Table 1), returned significant silver and molybdenum values, including: 5m @ 21.16g/t Ag and 7m @ 211ppm Mo (both from 266m), further validating the presence of a fertile, multi-phase mineralized system in this north-northeast zone.

SOUTHERN EXPANSION: Expanded Gold-Copper and Vectors Toward Porphyry Source

Drilling to the south-southwest (SSW), specifically holes FDD019, FDD021 and FD028, have opened another major corridor outside the current MRE block model.

- Geological Visuals: Logging and geochemical zonation in this area show distinct vectors trending southwest (SW) and to depth-directly towards the Danmagal porphyry target.

- Porphyry Link: Drilling has encountered apophyses of porphyry-style intrusives and related copper mineralization (qtz-cpy-mt veins, B,C-veins); geochemistry shows a highly anomalous molybdenum halo (Mo); and recently for the first time recognised at Kabang, centreline quartz-sulphide veins (B-veins) in the southern drilling at Kabang - all of these support the geological model that the Danmagal porphyry is the likely driving source of the Kabang epithermal system. This provides confidence of the scale potential of Feni to host a Tier-1 deposit similar to neighbours in the Lihir Island Chain.

RESOURCE DE-RISKING & CONNECTIVITY

The current drill program continues to feed into our understanding of the resource, and is successfully de-risking the resource, specifically increasing confidence and geological continuity.

- Closing "The Gap": Holes FDD004 and FDD005 tested a previously undrilled zone between major resource blocks. Results confirmed continuous mineralization, linking previously disparate zones.

- Data Validation: Twin holes FDD001, FDD002, and FDD026 showed a strong correlation with historical drilling. This validation will be critical for converting a significant proportion of inferred resources to the higher-confidence indicated category.

FUTURE CATALYSTS & OUTLOOK

Adyton is well-funded (ca. CA$17m, 100% for Feni Project) and executing a systematic growth strategy. Upcoming milestones include:

- Pending Assays: Results pending for FDD017 (all Cu and Au to EOH), plus FDD018 and above. Key holes upcoming:

- NNE: balance of FDD017, plus FDD018, FDD020, FDD023, FDD025

- SSW: FDD019, FDD021, FDD024, FDD026, FDD028.

- Ongoing Drilling: focused on expanding the MRE footprint at Kabang, and testing new targets.

- Advanced Geophysics: A new, high-power (100kVa) IP/MT survey is being scoped to detect additional across island and deeper drill targets, 20x more powerful than the previous IP only system (and very limited previous footprint) used at Feni.

- Spectral Mapping: Deployment of pXRF and spectral mineral mapping (1Q 2026) to generate a 3D alteration model for precise vectoring of future high-grade drilling.

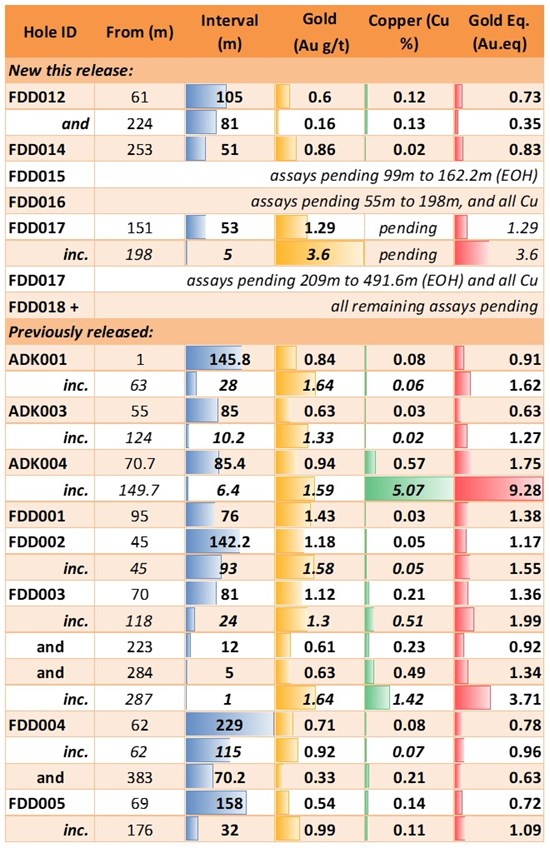

SIGNIFICANT INTERCEPTS

Table 1 shows the Significant Intercepts for gold and copper assay results received to date. Figures 1 through 6 show plan maps and cross sections of the drilling and assay results to date. Table 2 provides a summary of the current status of the Feni drill program (28 drillholes for 10,663m).

Table 1: Gold and Copper Significant Intercepts from Adyton's 2021 (ADK) and 2025/2026 (FDD) drilling at the Feni Island Au-Cu Project (gold, copper and gold equivalent). See footnotes to table: 1 2 3 4

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_adytbl0118022026.jpg

Figure 1: Plan view of the Kabang target with Significant Intercepts on drill traces (noting numerous drillholes pending assays), with re-processed IP anomaly, and outline of >0.5g/t Au from the current MRE (yellow line).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_003full.jpg

Figure 2: Plan view overview of recent improved geological and structural understanding at Kabang, and confirming multiple vectors (geochemistry, geophysics and visuals) towards newly discovered prospective gold-copper corridors.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_004full.jpg

Figure 3: Cross section of FDD012. Highlighting the significant and broad gold-copper intercepts. Note: 5m @ 21.16g/t Ag and 7m @ 211ppm Mo (both from 266m).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_005full.jpg

Figure 4: Cross section of FDD017. Highlighting the high-grade gold intercepts (all copper pending, plus >200m to EOH pending Au & Cu assays).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_006full.jpg

Figure 5: Cross section of FDD019. Highlighting the visual correlation between leached breccia textures in FDD019 as identical to mineralized intervals in FDD003 and FDD017.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_007full.jpg

Figure 6: This long section utilizing recently reprocessed mag and IP data shows the now apparent close correlation of the Danmagal porphyry system evidenced at depth by magnetics data (red polygon >0.16MVI) and the close spatial relationship of the Kabang epithermal system (orange 27mRad IP anomaly) and known gold grades. Of note, geochemical zonation is vectoring towards a hydrothermal fluid source to the SW and to depth - exactly where the Danmagal porphyry is located. Furthermore, the Kabang drilling has encountered smaller apophyses of porphyry style intrusives and copper mineralization, and the current geological model suggests that Danmagal is the likely source of these.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_dda6ddf80443d83a_008full.jpg

Table 2: Feni Island Gold-Copper Project: drillhole details and status (as of Feb 11th).

| Hole ID | Easting | Northing | RL | DIP | AZI | Depth (m) | Status |

| FDD001 | 567,648 | 9,548,228 | 156 | -60 | 50 | 396.0 | Completed |

| FDD002 | 567,245 | 9,548,135 | 91 | -60 | 100 | 195.4 | Completed |

| FDD003 | 567,348 | 9,548,221 | 105 | -70 | 160 | 421.7 | Completed |

| FDD004 | 567,469 | 9,548,209 | 126 | -70 | 180 | 453.2 | Completed |

| FDD005 | 567,571 | 9,548,247 | 136 | -70 | 180 | 839.6 | Completed |

| FDD006 | 567,782 | 9,548,230 | 184 | -70 | 320 | 412.6 | Completed |

| FDD007 | 567,469 | 9,548,305 | 111 | -70 | 180 | 468.2 | Completed |

| FDD008 | 567,886 | 9,548,273 | 193 | -70 | 320 | 67.9 | Abandoned |

| FDD009 | 567,895 | 9,548,275 | 199 | -70 | 320 | 401.2 | Completed |

| FDD010 | 567,342 | 9,548,282 | 108 | -70 | 180 | 541.2 | Completed |

| FDD011 | 568,005 | 9,548,323 | 211 | -70 | 320 | 199.9 | Completed |

| FDD012 | 567,582 | 9,548,332 | 138 | -70 | 180 | 455.9 | Completed |

| FDD013 | 567,908 | 9,548,541 | 207 | -70 | 180 | 501.3 | Completed |

| FDD014 | 567,874 | 9,548,156 | 202 | -70 | 320 | 172.9 | Completed |

| FDD015 | 567,436 | 9,548,387 | 166 | -70 | 180 | 145.8 | Completed |

| FDD016 | 567,771 | 9,548,101 | 237 | -70 | 320 | 532.1 | Completed |

| FDD017 | 567,609 | 9,548,334 | 206 | -70 | 140 | 491.6 | Completed |

| FDD018 | 567,684 | 9,548,412 | 226 | -70 | 180 | 327.1 | Completed |

| FDD019 | 567,325 | 9,547,966 | 204 | -70 | 90 | 446.8 | Completed |

| FDD020 | 567,685 | 9,548,416 | 226 | -80 | 360 | 346.6 | Completed |

| FDD021 | 567,317 | 9,547,903 | 189 | -70 | 90 | 405 | Completed |

| FDD022 | 567,800 | 9,548,350 | 247 | -70 | 12 | 34 | Abandoned |

| FDD023 | 567,810 | 9,548,365 | 247 | -70 | 360 | 228.1 | Completed |

| FDD024 | 567,239 | 9,548,024 | 158 | -70 | 125 | 501 | Completed |

| FDD025 | 567,451 | 9,548,403 | 226 | -70 | 70 | 452 | Completed |

| FDD026 | 567,324 | 9,548,072 | 175 | -90 | 360 | 367.8 | Completed |

| FDD027 | 567,597 | 9,548,347 | 125 | -70 | 320 | 340.3 | In progress |

| FDD028 | 567,217 | 9,547,934 | 83 | -70 | 210 | 113.4 | In progress |

| TOTAL (m) |

|

|

|

|

| 10,663m |

|

Table notes: FDD008 & FDD022 were abandoned at a shallow depth while still in post-mineral cover due to operational issues, redrilled as FDD009 & FDD023 respectively. FDD002 was terminated prematurely due to ground conditions while still in visual mineralisation.

WGS 84 Zone 56S UTM coordinates.

FERGUSSON ISLAND PROGRESS UPDATE

EVIH our JV partner continues to progress in parallel permitting for the Wapolu mine restart along with purchasing commitments to long lead items and project logistic solutions. In early February, Adyton Managing Director, Tim Crossley, and EVIH Project lead, Louis Wang, jointly presented the projects restart plans to the Mineral Resources Authority (MRA). Adyton and EVIH remain confident that a H2 restart of Wapolu will be achieved.

QUALITY ASSURANCE / QUALITY CONTROL

Adyton adheres to industry-recognized standards of Best Practice and Quality Assurance/Quality Control (QA/QC). Drill core samples were submitted in batches to Intertek Laboratory in Lae, which include a field blank, certified reference materials (CRMs) and staged duplicates. Samples were sealed using single-use tie-locks ensuring Chain of Custody. To date, all batches have passed QA/QC, and blanks and CRMs were within acceptable tolerance limits. All drill holes were drilled and sampled predominantly from PQ and HQ diameter drill core, and to a much lesser extent, also NQ core. Core recovery is considered to be appropriate.

Qualified Person

The scientific and technical information contained in this press release has been prepared, reviewed, and approved by Dr Chris Bowden, PhD, GCMEE, FAusIMM(CP), FSEG, the Chief Operating Officer and Chief Geologist of Adyton, who is a "Qualified Person" as defined by National Instrument 43‐101 ‐ Standards of Disclosure for Mineral Projects.

ABOUT THE FENI GOLD-COPPER PROJECT

The Feni Project is 100% owned by Adyton and is a key asset in Adyton's portfolio, located in a highly prospective region of Papua New Guinea on the Lihir Island chain known for world-class gold-copper deposits, including Lihir (owned and operated by Newmont). The Company has confirmed significant gold-copper mineralization at Feni, with a focus on expanding its existing resource and identifying new high-grade targets.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company's mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company's Feni Island project.

Adyton has a total Mineral Resource Estimate inventory within its PNG portfolio of projects comprising indicated resources of 206,000 ounces gold and inferred resources of 2,193,000 ounces gold (need grade and tonnes).

Feni Island Au-Cu project

The Feni Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which has outlined an initial inferred mineral resource of 60.4 million tonnes at an average grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces, assuming a cut-off grade of 0.5 g/t Au. See the NI 43-101 technical report entitled "NI 43-101 Technical Report on the Feni Gold-Copper Property, New Ireland Province, Papua New Guinea prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and "qualified person" as defined in NI 43-101,available under Adyton's profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

Fergusson Island Au project

The Fergusson Island Project currently has a mineral resource prepared in accordance with NI 43-101, which outlined an indicated mineral resource of 5.0 million tonnes at an average grade of 1.28 g/t Au for contained gold of 206,000 ounces and an inferred mineral resource of 23.2 million tonnes at an average grade of 0.99 g/t Au for contained gold of 733,000 ounces, both inferred and indicated resources used a 0.5g/t Au cut-off grade.

See the technical report dated October 14, 2021, entitled "NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea" prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and "qualified person" as defined in NI 43-101, available under the Company's profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

See the technical report dated January 7, 2026, entitled "NI 43-101 Technical Report on Wapolu Gold Project" prepared for Adyton Resources by Louis Cohalan (MAIG), an independent mining consultant and "qualified person" as defined in NI 43-101. This report will be filed on SEDAR+ at www.sedarplus.ca within 45 days of this release. Mineral resources are not mineral reserves and have not demonstrated economic viability.

For more information about Adyton and its projects, visit www.adytonresources.com

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/284304_adymap18022026.jpg

Forward looking statements

This press release includes "forward‐looking statements", including forecasts, estimates, expectations, and objectives for future operations that are subject to several assumptions, risks, and uncertainties, many of which are beyond the control of Adyton. Forward‐ looking statements and information can generally be identified by the use of forward‐looking terminology such as "may", "will", "should", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology. Forward looking statements in this news release include plans pertaining to the drill program, the intention to prepare additional technical studies, the timing of the drill program, uses of the recent drone survey data, the timing of updating key findings, the preparation of resource estimates, and the deeper exploration of high-grade gold and copper feeder systems. The forward‐looking information contained herein is provided for the purpose of assisting readers in understanding management's current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward‐looking information are based on management of the parties' reasonable assumptions, estimates, expectations, analyses, and opinions, which are based on such management's experience and perception of trends, current conditions and expected developments, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the projects in a timely manner; the availability of financing on suitable terms for the development; construction and continued operation of the Fergusson Island Project and the Feni Island Project; the ability to effectively complete the drilling program; and Adyton's ability to comply with all applicable regulations and laws, including environmental, health and safety laws.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Adyton's management's expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of managements considered reasonable at the date the statements are made. Although Adyton believes that the expectations reflected in such forward- looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Adyton. Among the key risk factors that could cause actual results to differ materially from those projected in the forward- looking statements are the following: impacts arising from the global disruption, changes in general macroeconomic conditions; reliance on key personnel; reliance on Zenex Drilling; changes in securities markets; changes in the price of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave‐ins and flooding); discrepancies between actual and estimated metallurgical recoveries; inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and changes in the costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward‐looking statements. Such forward‐looking information represents management's best judgment based on information currently available. No forward‐looking statement can be guaranteed, and actual future results may vary materially. Readers are cautioned not to place undue reliance on forward looking statements or information. Adyton Resources Corporation undertakes no obligation to update forward‐looking information except as required by applicable law.

1 Interval widths are "apparent" widths downhole, subject to true width determination.

2 ADK series drilling (2021) reported previously to TSX.V. Au.eq recalculated here.

3 Gold equivalent calculated as: Au.eq = ((Au g/t *0.93) + (Cu% *1.71 * 0.90)). Based on: metal prices of US$2,000/oz Au and US$5/lb Cu; and recoveries of 93% Au and 90% Cu. Recovery assumptions are speculative as no metallurgical test work have been completed at Feni but are based on comparable deposits.

4 FDD002 & FDD004 ended in mineralisation.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284304

© 2026 Canjex Publishing Ltd. All rights reserved.