Brisbane, Australia--(Newsfile Corp. - January 13, 2026) - Adyton Resources Corporation (TSXV: ADY) ("Adyton" or the "Company") is pleased to announce an updated NI 43-101 Mineral Resource Estimate (MRE) for its Wapolu gold project on Fergusson Island, Papua New Guinea (PNG). The updated MRE is comprised of 1.0 million tonnes grading 1.00 g/t Au for an indicated resource of 33 koz Au and 12.7 million tonnes grading 0.97 g/t Au for an inferred resource of 393 koz Au. The estimate was prepared by Mining One under the authorship of Louis Cohalan (MAIG), an independent mining consultant and "qualified person" as defined in NI 43-101.

The restart of the Wapolu gold project is an important pillar to Adytons strategy to achieve near term production and cash flow. The proposed initial Wapolu operation would be a shallow open pit ~300kt ROM operation with a simple crush, grind, float flow sheet to produce and market a gold rich concentrate. On the 10th of December 2025, Adyton announced it had received a non-binding Letter Of Intent (LOI) from Korean trading group Hyosung TNC Corporation to purchase its Wapolu concentrate.

KEY HIGHLIGHTS

- Inferred Resource increases 197% - Wapolu MRE increases Indicated Resources to 33 koz and Inferred Resources to 393 koz, adding 226 koz versus the prior estimate, confirming strong growth potential at Fergusson Island.

- Attractive grade profile - Near-surface, open pit resource grading ~1.0 g/t Au (1.00 g/t Indicated; 0.97 g/t Inferred), supportive of simple, low-cost open-pit mining development scenarios.

- Advances project toward permitting - Updated MRE represents a key milestone for the Mining Lease Application, materially de-risking the pathway to development.

"The updated Wapolu Mineral Resource materially strengthens the foundation of our Fergusson Island development strategy and exceeds our internal expectations," said Tim Crossley, Chief Executive Officer of Adyton. "The combination of a near-1.0 g/t gold grade and a more than doubled resource base enhances the potential for a larger, more flexible operation beyond the initially planned 300,000 tpa Run Of Mine scenario as we push towards a targeted start-up later this year. Additionally, development work is fully funded to production through our joint venture with EVIH. With this updated MRE increasing the total gold resources across Fergusson and Feni Islands, and further MRE updates at Gameta and Feni planned for 2026, Adyton is entering a clear growth and execution phase."

"EVIH is currently focused on supporting Adyton to restart operations at the Wapolu Mine," commented Gary Wang, Chief Executive Officer of EVIH. "This MRE is very positive for the project and will enable us to finalize the feasibility and financial modelling required to submit the Mining Lease application."

Table 1: Fergusson Island Mineral Resource Estimates:

| Project | Indicated | Inferred |

Au

(g/t) | Tonnes

(million) | Au

(koz) | Au

(g/t) | Tonnes

(million) | Au

(koz) |

| Gameta exploration licence | 1.33 | 4.0 | 173 | 1.01 | 10.5 | 340 |

| Wapolu exploration licence | 1.00 | 1.0 | 33 | 0.97 | 12.7 | 393 |

| Fergusson Island Gold Project | 1.28 | 5.0 | 206 | 0.99 | 23.2 | 733 |

Gameta and Wapolu resources at 0.5g/t gold cut-off (see "About Adyton" for technical report references)

Notes to Table:

1. The effective date of the Wapolu Mineral Resource is 12 December 2025.

2. This Mineral Resource update only affects the Wapolu Exploration Licence, there has been no change to Gameta.

3. The Mineral Resource was estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee and adopted by CIM Council.

4. The estimate was prepared by Louis Cohalan, MAIG, an independent Qualified Person as defined in NI 43-101.

5. It is envisaged that the Wapolu deposit will be mined using open-pit mining methods.

6. The Mineral Resources are reported within an optimised pit shells and are considered to have reasonable prospects for eventual economic extraction based on these assumptions: gold recoveries of 90%, a gold price of 3500 A$/oz (Australian dollars per ounce), mining costs of 3.0 A$/t (Australian dollars per tonne), slope angle of 35 OSA, processing cost of 23 A$/t and G&A costs of 7 A$/t.

7. A cut-off grade 0.5 g/t Au was applied to the reported resource.

8. Gold grades were estimated within each of five modelled mineralisation domains using capped 1m composites applying Ordinary Kriging and Inverse Distance Squared estimation method.

9. An average density of 1.8 t/m3 was assigned for the Oxide zone while 2.5 t/m3 was assigned for the Fresh zone.

10. The CIM definitions were followed for the classification of Indicated and Inferred Mineral Resources on a lens by lens basis. The Indicated category was assigned for blocks in areas of 50mx50m grid drilling from the 2025 campaign, where surrounding diamond core had recoveries >85%. The Inferred category was assigned for blocks within 50m of drilling in areas of 100m x 100m grid drilling.

11. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves in the future. The MRE may be materially affected by considerations including, but not limited to, permitting, legal, sociopolitical, environmental issues, market conditions or other factors.

12. Tonnes have been rounded to the nearest 100,000 t and ounces to the nearest 1000 ounces to reflect the relative accuracy of the estimate.

Resource Estimate

The existing Gameta and updated Wapolu Mineral Resource Estimates are highlighted in Table 1. The current drill programs at both Wapolu and Gameta are in part designed to test depth and strike extensions (with resources open at depth and along strike) but also importantly to increase resource confidence to enable progress to establish reserve estimates and Mining License (ML) applications.

Project Update and Key Next Steps

Adyton's JV partner, EVIH, has completed the current phase of drilling at both Wapolu and Gameta. While lab turnaround times in PNG have faced delays, Gameta samples have been dispatched to an international laboratory.

Key activities currently underway include:

- Finalizing work streams, reports and compensation agreements for the Mining Lease (ML) application.

- Submission of the Wapolu ML application.

- Responding to information requests from government departments.

- Finalizing equipment selection for long-lead items.

- Gameta, located only 30km away is being fast-tracked to leverage the Wapolu production infrastructure.

At Adyton's projects, numerous local jobs have been created, providing employment opportunities in areas with limited job prospects.

The Wapolu Restart Advantage

The Wapolu gold project is a proposed restart of the past-producing Wapolu mine which operated in the mid 1990's before shutting down due to low gold prices. The restart of Wapolu is expected to be significantly less complex than a greenfield development, supported by substantial existing infrastructure including airstrips, workshop and warehouse facilities, basic wharf infrastructure and established tailings impoundments.

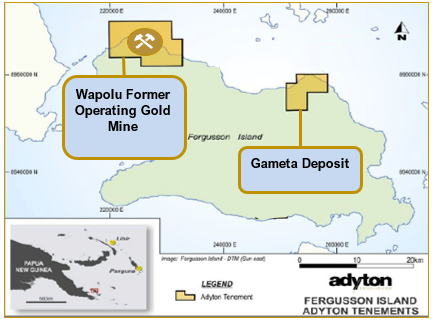

Figure 1: Fergusson Island Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/280210_figure1.png

Further Background

Adyton's gold projects are on easily accessible island locations in PNG. The Gameta and Wapolu projects (in JV with EVIH) are located on Fergusson Island in the Milne Bay province of PNG which also hosts the Woodlark and Misima projects (see Figure 1 and refer to map of PNG deposits at end of document).

The neighboring Gameta project represents an advanced exploration opportunity moving toward permitting and development. Located just 30 km from Wapolu, Gameta benefits from proximity to existing infrastructure, including the Wapolu airstrip, providing potential development and operating synergies.

EVIH Joint Venture

As previously reported, (see news release dated May 13, 2024) the Fergusson projects are under an earn-in Joint Venture Agreement with EVIH, granting EVIH the right to acquire up to 50% ownership interest in the project. This interest is contingent on the achievement of certain development milestones and a total investment of up to US$9.5 million, allocated as follows:

- US$8.5 million to fund project expenditures; and

- US$1.0 million as a direct payment to the Company (US$500,000 paid).

- Once the projects are permitted and a financial investment decision made by the JV, the agreement provides for EVIH to provide a shareholder loan (8% interest charge) to the JV to fund the project development capital which would carry Adyton to production on the Fergusson projects.

At full earn-in, the JV positions Adyton with a 50% interest at Fergusson while delivering a fully carried funding solution that advances the Fergusson projects through development and into production, preserving capital and minimizing risk for Adyton shareholders.

Qualified Persons

Louis Cohalan (MAIG), an independent mining consultant and "qualified person" as defined in NI 43-101, has reviewed and approved the contents of this news release.

The Technical Report, "NI 43-101 updated Mineral Resource Estimate for the Wapolu Project effective December 12, 2025 will be filed within 45 days of this news release.

Dr. Chris Bowden, PhD, GCMEE, FAusIMM(CP), FSEG, the Chief Operating Officer and Chief Geologist of Adyton is a qualified person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release on behalf of the Company.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

ABOUT ADYTON RESOURCES CORPORATION

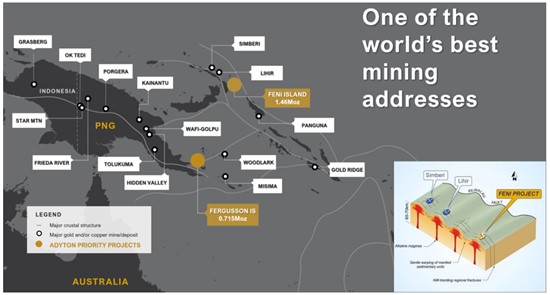

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company's mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company's Feni Island project.

Adyton has a total Mineral Resource Estimate inventory within its PNG portfolio of projects comprising indicated resources of 206,000 ounces gold and inferred resources of 2,193,000 ounces gold.

The Feni Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which has outlined an initial inferred mineral resource of 60.4 million tonnes at an average grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces, assuming a cut-off grade of 0.5 g/t Au. See the NI 43-101 technical report entitled "NI 43-101 Technical Report on the Feni Gold-Copper Property, New Ireland Province, Papua New Guinea prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and "qualified person" as defined in NI 43-101,available under Adyton's profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

The Fergusson Island Project currently has a mineral resource prepared in accordance with NI 43-101, which outlined an indicated mineral resource of 5.0 million tonnes at an average grade of 1.28 g/t Au for contained gold of 206,000 ounces and an inferred mineral resource of 23.2 million tonnes at an average grade of 0.99 g/t Au for contained gold of 733,000 ounces, both inferred and indicated resources used a 0.5g/t Au cut-off grade.

See the technical report dated October 14, 2021, entitled "NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea" prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and "qualified person" as defined in NI 43-101, available under the Company's profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

See the technical report dated January 7, 2026, entitled "NI 43-101 Technical Report on Wapolu Gold Project" prepared for Adyton Resources by Louis Cohalan (MAIG), an independent mining consultant and "qualified person" as defined in NI 43-101. This report will be filed on SEDAR+ at www.sedarplus.ca within 45 days of this release. Mineral resources are not mineral reserves and have not demonstrated economic viability.

For more information about Adyton and its projects, visit www.adytonresources.com

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7416/280210_image_550.jpg

Forward-looking statements

This press release includes "forward‐looking statements", including forecasts, estimates, expectations, and objectives for future operations that are subject to several assumptions, risks, and uncertainties, many of which are beyond the control of Adyton. Forward‐looking statements and information can generally be identified by the use of forward‐looking terminology such as "may", "will", "should", "expect", "intend", "estimate", "anticipate", "believe", "continue", "plans" or similar terminology. Forward-looking statements in this news release include plans pertaining to the drill program, the intention to prepare additional technical studies, the timing of the drill program, uses of the recent drone survey data, the timing of updating key findings, the preparation of resource estimates, and the deeper exploration of high-grade gold and copper feeder systems. The forward‐looking information contained herein is provided for the purpose of assisting readers in understanding management's current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward‐looking information are based on management of the parties' reasonable assumptions, estimates, expectations, analyses, and opinions, which are based on such management's experience and perception of trends, current conditions and expected developments, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the projects in a timely manner; the availability of financing on suitable terms for the development; construction and continued operation of the Fergusson Island Project and the Feni Island Project; the ability to effectively complete the drilling program; and Adyton's ability to comply with all applicable regulations and laws, including environmental, health and safety laws.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Adyton's management's expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of managements considered reasonable at the date the statements are made. Although Adyton believes that the expectations reflected in such forward-looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Adyton. Among the key risk factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: impacts arising from the global disruption, changes in general macroeconomic conditions; reliance on key personnel; reliance on Zenex Drilling; changes in securities markets; changes in the price of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave‐ins and flooding); discrepancies between actual and estimated metallurgical recoveries; inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and changes in the costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward‐looking statements. Such forward‐looking information represents management's best judgment based on information currently available. No forward‐looking statement can be guaranteed, and actual future results may vary materially. Readers are cautioned not to place undue reliance on forward-looking statements or information. Adyton Resources Corporation undertakes no obligation to update forward‐looking information except as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280210

© 2026 Canjex Publishing Ltd. All rights reserved.