Vancouver, British Columbia--(Newsfile Corp. - December 5, 2025) - Adelayde Exploration Inc. (CSE: ADDY) (OTCID: SPMTF) (WKN: A41AGV) (the "Company" or "Adelayde") is pleased to announce that, further to its News Release dated November 12, 2025, it has closed a non-brokered private placement financing of 9,675,000 non-flow-through units (each, a "NFT Unit") at a price of $0.10 per NFT Unit for gross proceeds of $967,500 (the "NFT Offering") and 8,073,078 flow-through units (each, a "FT Unit") at a price of $0.13 per FT Unit for gross proceeds of $1,049,500 (the "FT Offering" and together with the NFT Offering, the "Offering").

James Nelson, President of Adelayde stated, "We would like to thank our shareholders for their support in closing these financings, enabling the Company to proceed with multiple work programs. Adelayde will be very active in 2026."

Each NFT Unit consists of one non-flow-through common share (each, a "NFT Share") and one transferable common share purchase warrant (each, a "NFT Warrant"), with each NFT Warrant entitling the holder to acquire one NFT Share (each, a "NFT Warrant Share") at a price of $0.20 per NFT Warrant Share for a period of five years from the closing of the NFT Offering. Each FT Unit consists of one flow-through common share (each, a "FT Share") and one transferrable NFT Share purchase warrant (each, a "FT Warrant"), with each FT Warrant entitling the holder to acquire one NFT Share (each, a "FT Warrant Share") at a price of $0.25 per FT Warrant Share for a period of two years from the closing of the FT Offering.

In connection with the closing of the Offering (the "Closing"), the Company paid aggregate cash finder's fees of $71,160, issued 618,000 non-transferable NFT Share purchase warrants (each, a "NFT Finder's Warrant"), with each NFT Finder's Warrant entitling the holder thereof to acquire one NFT Share (each, a "NFT Finder's Warrant Share") at a price of $0.20 per NFT Finder's Warrant Share for a period of two years from the date of Closing, issued 72,000 non-transferable NFT Share purchase warrants (each, a "FT Finder's Warrant"), with each FT Finder's Warrant entitling the holder thereof to acquire one NFT Share (each, a "FT Finder's Warrant Share") at a price of $0.25 per FT Finder's Warrant Share for a period of two years from the date of Closing, and issued 540,000 common shares (each, a "Finder's Share").

All securities issued in connection with the Offering are subject to a statutory hold period expiring four months and one day after the date of Closing. Proceeds from the FT Offering will be used on the Company's existing properties in Canada. Net proceeds from the NFT Offering will be used towards the Company's general working capital.

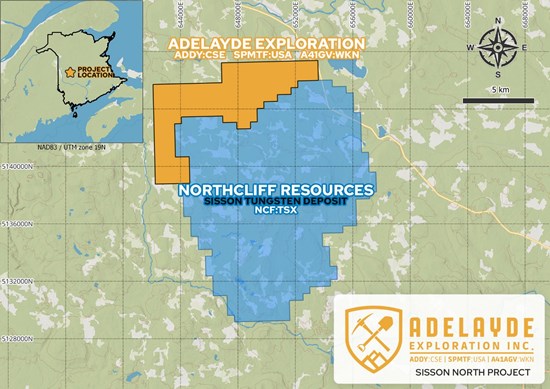

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4360/276996_e642cd5cd4010914_002full.jpg

Qualified Person for mining disclosure:

The technical contents of this release were reviewed and approved by Frank Bain, PGeo, a director of the company and qualified person as defined by National Instrument 43-101.

None of the securities sold in connection with the private placement will be registered under the United States Securities Act of 1933, as amended, and no such securities may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Adelayde Exploration Inc.

"James Nelson"

James Nelson

President, Chief Executive Officer and Director

For more information regarding this news release, please contact:

Adelayde Exploration Inc.

The CSE has neither approved nor disapproved of the contents of this press release.

Forward-Looking Statements

Certain information in this news release may contain forward-looking statements that involve substantial known and unknown risks and uncertainties. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact included in this news release are forward-looking statements that involve risks and uncertainties such as the proposed use of proceeds from the private placements. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Adelayde. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and Adelayde disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Not for distribution to United States newswire services or for release publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276996

© 2026 Canjex Publishing Ltd. All rights reserved.