VANCOUVER, British Columbia, Feb. 10, 2026 (GLOBE NEWSWIRE) -- Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to announce an update to the independent Mineral Resource Estimate (the “Resource” or “MRE”) at its Black Pine Gold Project (“Black Pine”), located in southeastern Idaho, USA.

- The Resource is reported at a cut-off grade (“COG”) of 0.10 grams per tonne (“g/t”) gold (“Au”) and consists of:

- Indicated Resource of 502.7 million tonnes (“Mt”) at an average grade of 0.30 g/t Au totalling 4,882,000 ounces (“oz”) Au; and

- Inferred Resource of 157.1 Mt at an average grade of 0.21 g/t Au totalling 1,050,000 oz Au.

- A high-grade subset of the Resource contained within the 0.10 g/t Au resource pit, applying a COG of 0.50 g/t Au consists of:

- Indicated Resource of 60.1 Mt at an average grade of 0.99 g/t Au totalling 1,907,000 oz Au; and

- Inferred Resource of 6.4 Mt at an average grade of 0.74 g/t Au totalling 152,000 oz Au.

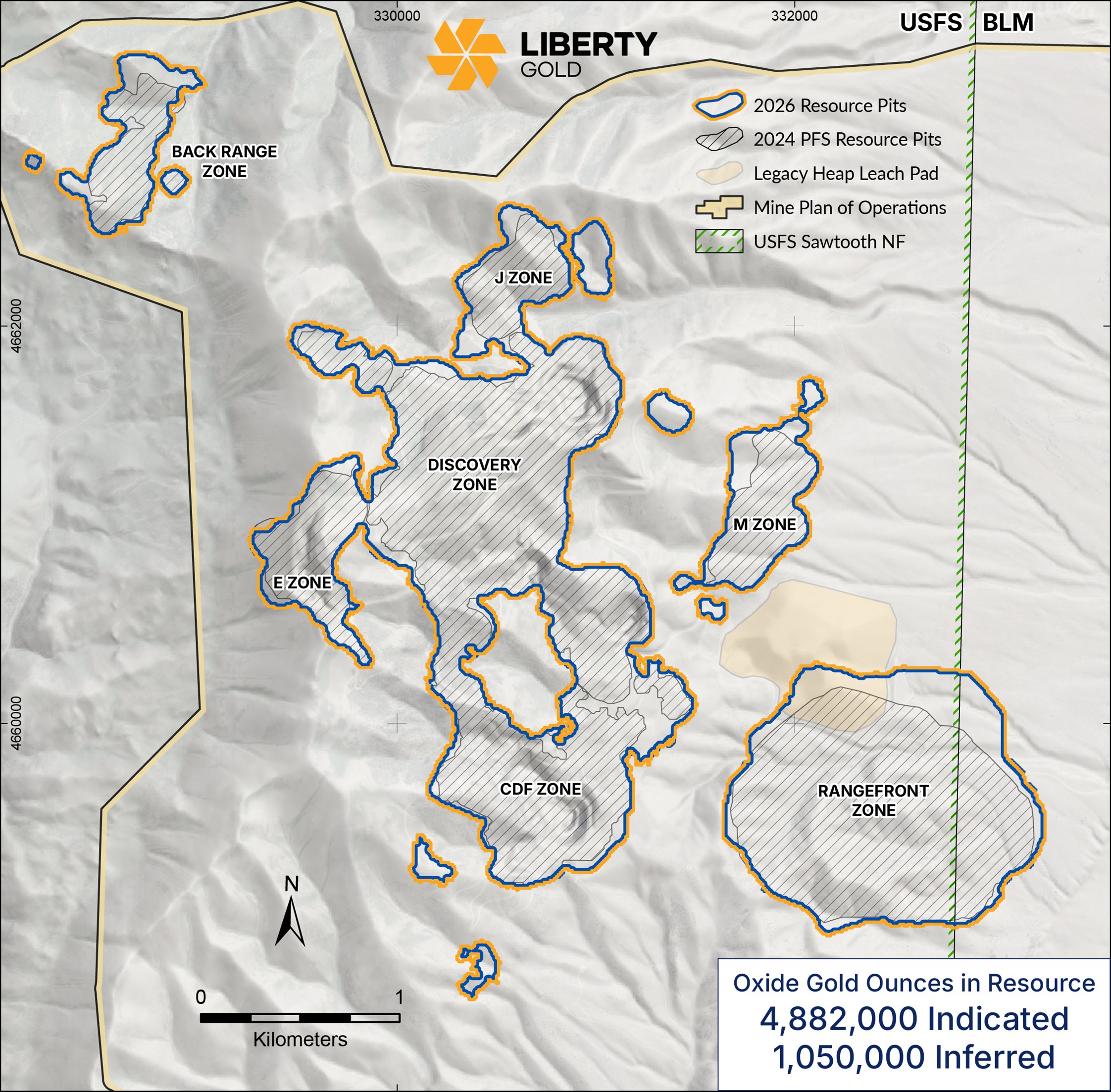

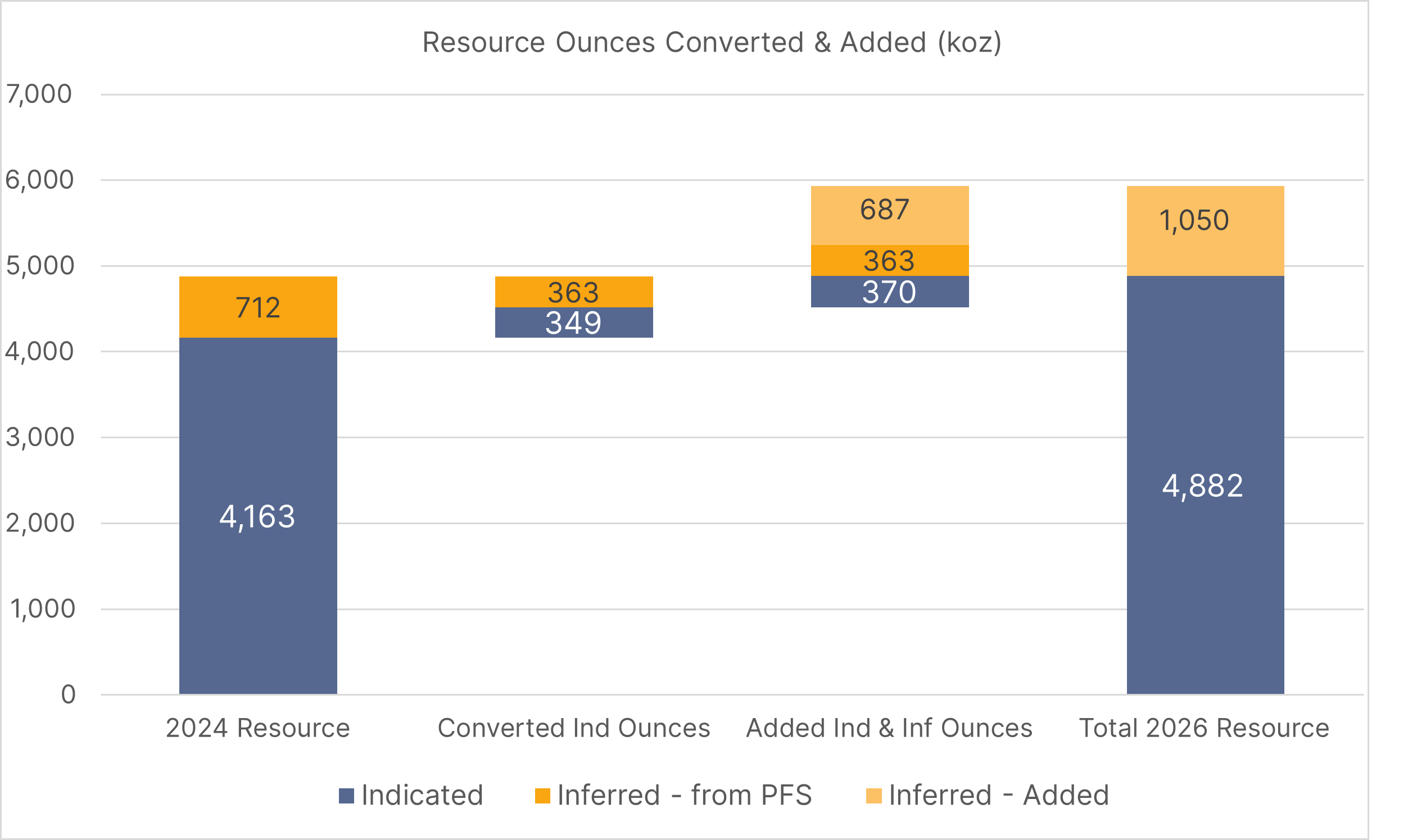

The updated 2026 MRE has an effective date of January 31, 2026, and represents oxide-only Au mineralization; there is no sulfide Au mineralization contained in the MRE. This update includes a 17% increase of 719,000 oz Au in the indicated category, and a 47% increase of 338,000 oz Au in the inferred category compared to the 2024 preliminary feasibility study (“PFS”) MRE (Figure 2 below, see press release dated October 10, 2024). See Table 1 below for the updated Mineral Resource estimate by Zone.

For maps, cross sections and sensitivity analysis tables of the Black Pine Mineral Resource block model and resource pits, use this link: https://libertygold.ca/wp-content/uploads/BP2026MineralResourceEstimate.pdf for a 3D-enabled VRIFY version, use this link: https://vrify.com/decks/21397

Jon Gilligan, President and CEO of Liberty Gold stated,“This updated Mineral Resource Estimate has achieved indicated resource growth and expanded the total resource footprint which are important steps for the Black Pine project as we move closer to mine development. The addition of over 700,000 indicated gold ounces, coupled with an expansion of 338,000 inferred gold ounces, as compared to the 2024 PFS Resource, shows that 2025 drilling produced strong results. With totals of just under 5 million gold ounces of resource in the indicated class, and just over 1 million gold ounces of inferred mineralization, Black Pine is solidly positioned to deliver a Feasibility Study in the fourth quarter of this year. Building on our 2025 results, strategically planned drilling in 2026 has the potential to add robust near-term resource upgrades and continue the expansion of oxide mineralization across the project.”

Figure 1: Plan map of the Black Pine Mineral Resource Pits

Table 1: Black Pine Updated Mineral Resource Estimate by Zone

| Zone | Classification | Tonnes

(Mt) | Avg Grade

(g/t Au) | Gold Ounces

(koz)1 | % tonnes by

MRE class | % Indicated

MRE oz/area |

DISCOVERY ZONE

| Indicated | 189 | 0.35 | 2,109 | 84% | 43% |

| Inferred | 37 | 0.21 | 250 | 16% | |

RANGEFRONT ZONE

| Indicated | 241 | 0.26 | 2,016 | 79% | 41% |

| Inferred | 65 | 0.19 | 401 | 21% | |

CDF ZONE

| Indicated | 44 | 0.28 | 403 | 71% | 8% |

| Inferred | 18 | 0.21 | 123 | 29% | |

M ZONE

| Indicated | 7 | 0.51 | 120 | 58% | 3% |

| Inferred | 5 | 0.21 | 36 | 42% | |

BACK RANGE

| Indicated | 8 | 0.44 | 114 | 63% | 2% |

| Inferred | 5 | 0.26 | 39 | 37% | |

E ZONE

| Indicated | 10 | 0.26 | 82 | 45% | 2% |

| Inferred | 12 | 0.22 | 82 | 55% | |

J ZONE

| Indicated | 4 | 0.33 | 38 | 19% | 1% |

| Inferred | 15 | 0.25 | 119 | 81% | |

Total Resource

| Indicated | 503 | 0.30 | 4,882 | | |

| Inferred | 157 | 0.21 | 1,050 | |

(1) koz = thousands of contained gold ounces

Table 1 Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported within conceptual open pits estimated at a gold cut-off grade of 0.10 g/t Au, using a long-term gold price of US$2,800 per ounce and a variable gold leach recovery model derived from extensive metallurgical studies.

- Bulk density is variable by rock type.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are inclusive of Mineral Reserves

- Rounding as required by reporting guidelines may result in apparent discrepancies between estimated tonnes, grades, and contained gold content.

- The effective date of the MRE is January 31, 2026.

The MRE was prepared by SLR Consulting (Canada) Ltd., Toronto, Canada (“SLR”). The Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) responsible for the Mineral Resource estimate is Valerie Wilson, M.Sc., P.Geo., Principal Resource Geologist, an employee of SLR and independent of Liberty Gold. The Qualified Person is not aware of any environment, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant factors that could materially affect the Mineral Resource estimate.

Resource Estimate – Cut-off Grade Sensitivity

The average grade of the deposit within the limits of the 0.10 g/t Au resource pit shell reflects a wide range of block grades. Table 2 below displays the robust nature of the deposit at successively higher cut-off grades. At a block COG of 0.50 g/t Au, 1,907,000 Indicated ounces at an average grade of 0.99 g/t Au represents approximately 40% of the indicated resource. This higher-grade core of mineralization has grown with each successive drill program.

Table 2: Resource grade distribution at successively higher COGs within the 0.1 g/t Au reporting pit*

| Block cut-off grade | Classification | Tonnes

(Mt) | Average Grade

(g/t Au) | Gold Ounces

(koz) | Waste:Ind+Inf

Tonnes ratio |

0.06 g/t

| Indicated | 570 | 0.28 | 5,061 | 0.35

|

| Inferred | 284 | 0.15 | 1,360 |

0.10 g/t

| Indicated | 503 | 0.30 | 4,882 | 0.75

|

| Inferred | 157 | 0.21 | 1,050 |

0.20 g/t

| Indicated | 244 | 0.47 | 3,663 | 2.9

|

| Inferred | 53 | 0.34 | 577 |

0.31 g/t

| Indicated | 128 | 0.67 | 2,748 | 6.8

|

| Inferred | 20 | 0.50 | 318 |

0.50 g/t

| Indicated | 60 | 0.99 | 1,907 | 16

|

| Inferred | 6 | 0.74 | 152 |

1.00 g/t

| Indicated | 18 | 1.72 | 980 | 61

|

| Inferred | 0.8 | 1.40 | 33 |

*Please refer to the Notes accompanying Table 1 for additional information. The Black Pine updated MRE is bold and italicized.

Key Points

- The addition of drill results from 2024 and 2025 served to increase the MRE by 719,000 Indicated Au oz compared to the 2024 MRE. The updated Indicated Resource totals 4,882,000 gold ounces and will form the basis of the Feasibility Study (“FS”) currently being conducted on Black Pine. A completed FS is expected early Q4 2026.

- The additional of 338,000 Au oz in the Inferred class brings the total to 1,050,000 Inferred Au oz, which provides potential for resource classification upgrades. Any such upgrades would be subject to future drilling and technical studies.

- The 2026 MRE includes 178 new Reverse Circulation (“RC”) drill holes totalling 39,520 meters (“m”) drilled by Liberty Gold in 2024 and 2025. This additional drilling brings the total drilling defining the Black Pine deposit to 462,662 m in 3,010 holes.

- Approximately 21,000 m of drilling in 93 drill holes completed in 2025 are not included in this MRE.

- The 2026 MRE is supported by metallurgical testing on 216 composites encompassing all ore types.

Table 3: 2026 MRE compared to the 2024 PFS MRE

Classification

| Tonnes

(kt)1

| Average Grade

(g/t Au)

| Gold Ounces

(koz)

| |

| |

| PFS 2024 Resource2 | |

| Indicated | 402,564 | 0.32 | 4,163 | |

| Inferred | 97,680 | 0.23 | 712 | |

| 2026 Resource3 | |

| Indicated | 502,680 | 0.30 | 4,882 | |

| Inferred | 157,092 | 0.21 | 1,050 | |

| 2026 compared to PFS 2024 Resource | |

| | Δ Tonnes | Δ Avg Grade | Δ Oz | |

| Indicated | 100,116 | -0.018 | 719 | |

| Inferred | 59,412 | -0.022 | 338 | |

| | Δ % Tonnes | Δ Avg Grade | Δ % Oz | |

| Indicated | 25% | -6% | 17% | |

| Inferred | 61% | -10% | 47% | |

(1)kt = thousand metric tonnes.

(2) The 2024 MRE was prepared by SLR and had an effective date of June 1, 2024. See the company’s news release dated October 10, 2024 for additional disclosure regarding the 2024 MRE.

(3) Please refer to the Notes accompanying Table 1 for additional information regarding the 2026 MRE. The Black Pine updated MRE is bold and italicized.

Figure 2: Indicated and Inferred Resource Conversion and Growth

This waterfall chart showing converted indicated ounce (349 koz), added indicated ounces (370 koz), added Inferred ounces (687 koz), and residual inferred ounces from the PFS (363 koz), along with the new 2026 MRE totals. The addition of 719 koz to Indicated category is a 17% growth compared to the 2024 PFS MRE, and the increase to 1,050 koz the Inferred category is a 47% increase compared to the 2024 MRE.

Estimation Methods

The resource estimate was prepared by Valerie Wilson, M.Sc., P.Geo., Principal Resource Geologist at SLR. Ms. Wilson is an Independent Qualified Person as defined by NI 43-101. The resource estimate was prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. Estimation methods are summarized below:

- The gold mineral resources at the Black Pine Project were modeled and estimated by:

- Developing a geological model, in Leapfrog Geo reflecting low-angle fault control and stratigraphic control of mineralization hosted in receptive carbonate host rocks;

- Evaluating the drill data statistically;

- Interpreting medium- (0.1 g/t Au) and high-grade (0.3 g/t Au for Rangefront and 0.5 g/t Au for all other areas) gold-domains, and low-grade gold-domain buffer using Leapfrog Geo;

- Compositing data to 3.048 m (10 feet) within the gold domains;

- Coding a series of area specific block models comprised of 10 x 10 x 5 (x,y,z) m blocks and sub-blocked to 2.5 x 2.5 x 1.25 m blocks to the domains.

- Analyzing the modeled mineralization geostatistically to aid in the establishment of interpolation and classification parameters;

- Interpolating gold grades using inverse distance cubed (ID3) and a three-pass interpolation strategy into the model blocks in Leapfrog Edge using the mineral domain coding to explicitly constrain the gold grade estimations;

- Stitching and unifying area block models to a regularized model of 10 x 10 x 5 m; and

- Evaluating, statistically and visually, the resulting model in detail prior to finalizing the mineral resource estimation.

- The Black Pine Deposit mineral resource has been constrained by optimized pit shells created using a gold price of US$2,800 per ounce and pit slopes ranging from 45 to 47 degrees. Mining costs of $2.47 per tonne mined and heap leaching plus G&A costs of $2.76 per tonne processed, based on an assumed processing rate of 18 Mt per year. Gold recoveries are based on equations derived from metallurgical test work and vary by grade and rock unit.

- A 0.25% net smelter return royalty has been applied, reflecting the exercise of a buyback right.

- The Company has concluded that a Technical Report update is not required with this new Mineral Resource and will include the resource estimate update into the Feasibility Technical Report expected to be completed in Q4 2026.

ABOUT BLACK PINE

Black Pine is located in southeastern Idaho, near the Utah border, within the northern Great Basin of the western United States. The project hosts a large, district-scale Carlin-style oxide gold system in a stable, mining-friendly U.S. jurisdiction.

Black Pine is analogous in style to Nevada’s Carlin-type deposits, but occurs outside the main Carlin and Cortez trends, highlighting the significant exploration potential of underexplored areas of the Great Basin. The historical Black Pine Mine operated from 1992 to 1997 during a period of low gold prices, producing approximately 435,000 ounces of gold from shallow open pits at an average grade of 0.63 g/t Au, demonstrating the amenability of the mineralization to open-pit, oxide mining.

Gold mineralization is hosted within a thick sequence of receptive, faulted carbonate rocks of the Pennsylvanian Oquirrh Formation and exhibits extensive decalcification and clay alteration typical of Carlin-style systems. The mineralized system is strongly oxidized across the exposed footprint, supporting the potential for efficient heap leach processing.

Metallurgical testing to date has demonstrated rapid gold recoveries with limited sensitivity to crush size, supporting a simple, scalable, and low-cost processing approach.

Black Pine is being advanced with a disciplined focus on technical rigor, permitting clarity, and long-term value creation.

QUALIFIED PERSONS

Valerie Wilson, M.Sc., P.Geo, Principal Resource Geologist for SLR, has reviewed and approved the updated Mineral Resource estimate and the technical information pertaining to it contained in the release is accurate. Ms. Wilson has verified the data disclosed including sampling, analytical, and test data underlying the drill results, using a variety of techniques including comparison against independently sourced assay certificates, site visit investigations, and digital based verification tests, and consents to the inclusion in this release of said data in the form and context in which it appears. Ms. Wilson experienced no limitations with respect to data verification activities related to the Black Pine project.

All scientific and technical information contained in this new release, including the updated Mineral Resource estimate, has been reviewed and approved by Owen Nicholls, P.Geo., Director of Technical Services, an employee of Liberty Gold, who is for the purposes of this new release, the designated Qualified Person within the meaning NI 43-101 and has reviewed and validated that the information contained in this news release is accurate. Mr. Nicholls has verified the data disclosed including sampling, analytical, and test data underlying the drill results, using a variety of techniques including implementing quality assurance/quality control (“QA/QC”) sampling measures, review and validation of the geological models, and review of the geostatistical approaches in the Mineral Resource estimation.

ABOUT LIBERTY GOLD

Liberty Gold is a U.S. focused gold development company building and advancing a pipeline of gold assets in the Great Basin, one of the world’s most productive and mining friendly gold regions. The Company’s flagship asset is the 100% owned Black Pine Oxide Gold Project in southern Idaho, a large scale, past-producing run-of-mine heap leach system being advanced through feasibility and permitting toward a modern open-pit mining operation. Liberty Gold also controls the Goldstrike Project in Utah, which remains an important part of the Company’s U.S. gold asset portfolio. The Company’s strategy is to responsibly develop high quality, long-life gold projects in supportive jurisdictions, led by an experienced team with a track record of discovery, development and delivering long term value.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

info@libertygold.ca

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; future updates to the mineral resource, the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; potential additions to the resource through additional drill testing; potential upgrade of the mineral resources; proposed exploration and development of Liberty Gold’s exploration property interests; the timing and results of a feasibility study; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, results or timing of any mineral resources, results or timing of any baseline studies, resource conversion, pre-feasibility study, mineral reserves, or feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab021282-2190-42c4-a3cc-bc0fcbb539b6

https://www.globenewswire.com/NewsRoom/AttachmentNg/4315211d-40e9-4451-8929-9d4ba22b8fa7

Figure 1

Plan map of the Black Pine Mineral Resource Pits

Figure 2

Indicated and Inferred Resource Conversion and Growth

© 2026 Canjex Publishing Ltd. All rights reserved.