OREM, Utah, Jan. 20, 2026 (GLOBE NEWSWIRE) -- SunPower Inc. (herein “SunPower,” the “Company,” or Nasdaq: “SPWR”), a solar technology, services, and installation company, will present its Q4’25 results via webcast today, Tuesday, January 20, at 1:00pm ET. Interested parties may access the webcast by registering here or by visiting the Events page within the IR section of the company website: https://investors.sunpower.com/news-events/events.

Fellow Shareholders:

The preliminary Q4’25 report is shown below compared to our Q3’25 SEC 10Q report. SPWR’s Q4’25 and full-year 2025 SEC 10K report are scheduled to be filed by March 30, 2026.

SunPower Q4’25 Revenue & Operating Income Statement1

|

| | | | | |

| | GAAP2

| NON-GAAP3

|

| ($1000s, except gross margin) | Q4 2025 | Q3 2025 | Q4 2025 | Q3 2025 |

| Revenue | 88,488 | 70,005 | 88,488 | 70,005 |

| Gross Profit | 48,848 | 32,040 | 50,873 | 33,636 |

| Gross Margin | 55% | 46% | 57% | 48% |

| Operating Expense (Opex) | 49,963 | 35,484 | 47,328 | 31,613 |

| Opex (less commission) | 28,757 | 27,950 | 26,122 | 24,079 |

| Stock Comp. and Intangibles | 4,660 | 5,467 | 0 | 0 |

| Operating Income (loss) | (1,115) | (3,444) | 3,545 | 2,0234 |

| Cash Balance5 | 9,279 | 5,072 | 9,279 | 5,072 |

| | | | | |

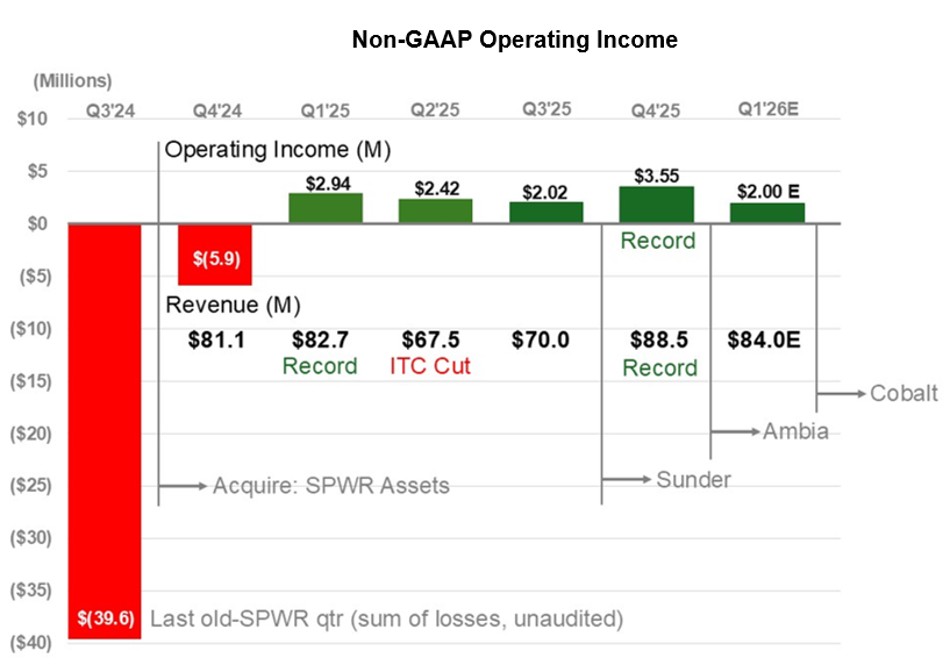

- Our revenue set a record of $88.5 million, up from $70.0 million in Q3’25, due to new revenue from two acquisitions: Sunder (full quarter) and Ambia (partial quarter)

- Our operating income is a post-acquisition record $3.5 million (4.0% of revenue versus our near-term target of 10%), up from $2.0 million in Q3’25

- Our ending cash balance was $9.3 million, up from $5.1 million in Q3’25. We increased our Equity Line of Credit (ELOC) with White Lion Capital LLC, of Woodland Hills, California, to $55 million on January 11

__________________________

1Non-GAAP Operating income is based on the preliminary unaudited non-GAAP results used to run the company and posted on the IR section of our website under “News” [us.sunpower.com].

2Our 2025 GAAP financial statements for Q3 are in the SEC 10Q filing posted on our website.

3Our non-GAAP financial policy allows for only three differences from the GAAP report: a) no non-cash amortization of intangibles, b) no employee stock compensation charges and c) no one-time restructuring M&A gains or losses.

4Reduced from prior reported $3.123 million by a $1.1 million aged-debt reserve agreed to by auditors.

5Cash balances exclude restricted cash and issued but uncashed checks.

- SunPower posted its fourth consecutive profitable quarter, making the full year 2025 profitable, after four consecutive old-SunPower loss years

- Our Q4’25 revenue and operating income were records at $88.5 million and $3.5 million, respectively

- Our 2025 revenue totaled $308.8 million, with $10.9million in operating income, including the added $1.1 million bad-debt reserve taken in Q3’25

- Our Q1’26 revenue is expected to be $84 million, with $4 million of uncertainty, due to the usual 10%-15% winter-quarter solar slump and the ITC solar tax credit shutdown

- Our Q1’26 operating income is expected to be $2.0 million, and we expect to remain profitable throughout 2026

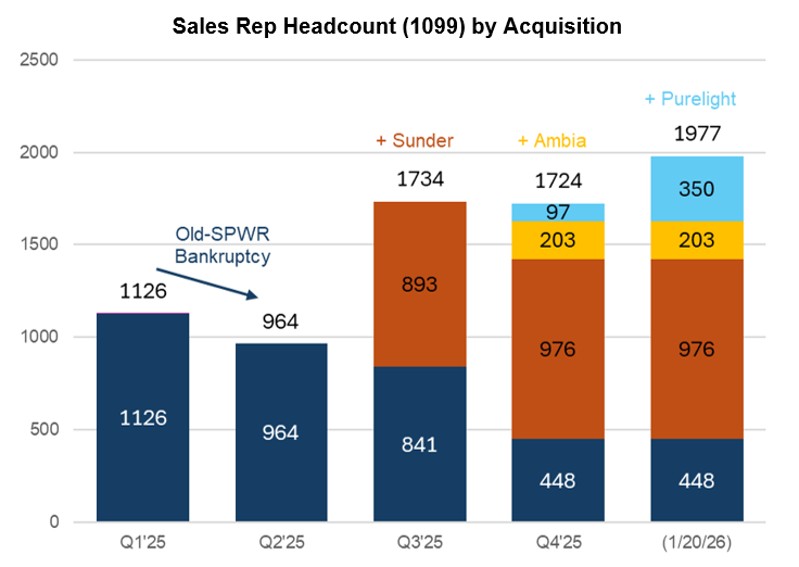

Representative Salesforce Growth (1099 “Sales Reps”)

SunPower CEO, T.J. Rodgers commented, “Our revenue increased in Q4’25 to a record $88.5 million due to the Sunder and Ambia acquisitions. We expect revenue in Q1’26 to reflect the usual 10%-15% winter quarter solar slump as well as the ITC solar subsidy cut. However, our onboarding of 893 sales reps from Sunder in September ‘25, 203 sales reps from Ambia in November ‘25, and 350 previously unannounced sales reps from Purelight in January ‘26 brought our rep salesforce to 1977 representatives at quarter end – which should provide us with a market share gain in each quarter of 2026.

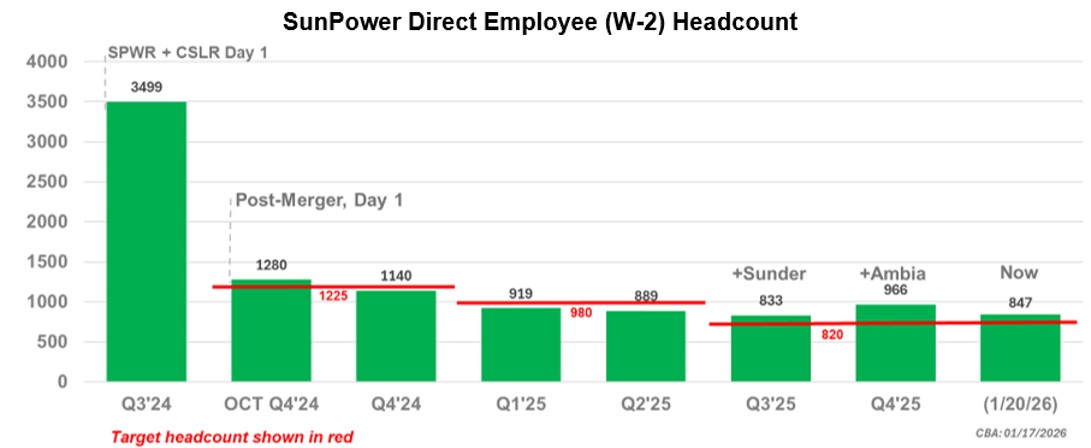

Although our rep salesforce grew during the year, we used acquisition synergies to keep our current direct full-time employee headcount almost flat at 847, despite acquisitions.

The reduction in direct headcount to 847 along with revenue growth led to record employee productivity of $445,000 revenue per employee per year, our overarching efficiency metric. This compares favorably to solar industry leader Sunrun’s $217,037 ($2.40 billion in 2025 revenue with 11,058 employees). We have a clear line of sight to $500,000 revenue per employee-year.

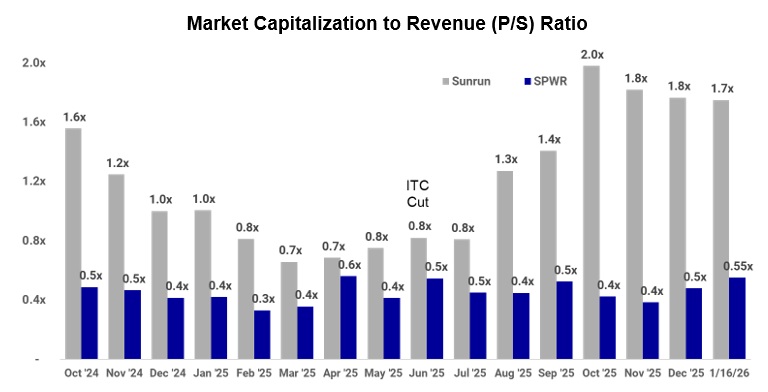

Our market capitalization to revenue (P/S) ratio has lingered near only 0.5 for all of New SunPower’s five-quarter life. Solar industry-leader Sunrun’s 2025 P/S ratio is about 1.75 and our high-tech index has a P/S ratio of 2.2.

Rodgers commented, “So, we’re working on what needs to get done to raise our current 0.55 P/S ratio to match the leader at 1.75, a level at which SPWR would trade at about 3x its current price:

($88.488 million x 4) x (P/S = 1.75) ÷ 111.9 million shares = $5.54/share

The question is why did Sunrun recover from the ITC cut news quickly in June while SunPower did not? I believe there are three main reasons:

Cash. Institutional investors see our share price potential but want proof that we will not run out of cash. The first of our current three cash-security initiatives was announced on January 13 – to raise our Equity Line of Credit (“ELOC”) with White Lion Capital LLC of Woodland Hills, California, to $55 million. We chose an ELOC as the vehicle because it did not force us to raise expensive money immediately, while it provides a backstop to keep cash above the $10 million level promised in our Q3’25 report. We still have three other funding deals in progress.

Late SEC report. Our financial system is currently a mix of acquired systems and therefore highly manual, which slows down our review cycles with our auditor, BDO. We are improving in two ways: we have appointed Cal Hoagland, a well-known Silicon Valley financial consultant, to unify and upgrade our financial systems, and we have launched a formal CFO search, given that my network has not yet produced a Salt Lake City candidate.

Disinformation from financial services. Our share price also suffers from the negativedisinformation from retail market data companies that use bots to post erroneous bankruptcy data from the “old” SunPower, a defunct company, often without any disclaimers.” We have retained a law firm specializing in this area.

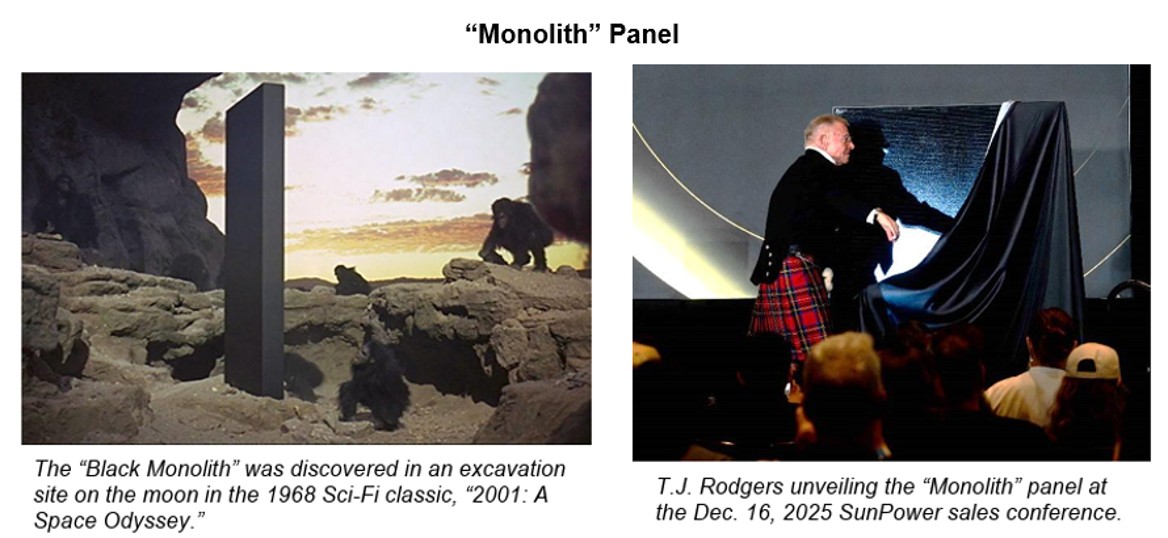

Rodgers continued, “We were proud to announce that we recently signed a JDA with solar panel market leader REC to develop, and commercialize a high-wattage, frameless bifacial solar panels for the residential and light commercial solar markets. Our internal name for the first offering is “Monolith,” a solid-black panel that produces a record 470 watts of power from the one-man, 50-pound weight limit enforced by OSHA (officially, the REC Alpha Pure-RX 470W). We are working to upgrade this panel to become ‘bifacial’, collecting light from both sides, which will increase its output to over 500 watts.”

Cobalt

SunPower announced on January 16, that it had signed a Letter of Intent to acquire Cobalt Power Systems Inc. – Silicon Valley’s premier solar company (here). Cobalt will soon install the first Monolith panels made by our partner REC on a 111-kilowatt project at the historic Fortinet building in Sunnyvale, California, in the heart of Silicon Valley.

Rodgers concluded, “As I projected in my June 9 “Free at Last” press release on the ITC shutdown, we are now taking advantage of that opportunity to consolidate privately held solar companies into our public company: 1) to rapidly grow our rep salesforce, and 2) to upgrade but not grow our 847 person workforce – everyone an option holder.”

About SunPower

SunPower Inc. (Nasdaq: SPWR) is a leading residential solar services provider in North America. The Company’s digital platform and installation services support energy needs for customers wishing to make the transition to a more energy-efficient lifestyle. For more information visit www.sunpower.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “preliminary,” “will,” “goal,” “prioritize,” “plan,” “target,” “expect,” “in the process,” “focus,” “forecast,” “look forward,” “opportunity,” “believe,” “estimate,” “continue,” “anticipate,” and “pursue” or the negative of these terms or similar expressions. Forward-looking statements in this press release include, without limitation, our Q4’25, 2025 and 2026 revenue and operating profit projections, our expectations regarding our Q4’25 and fiscal 2025 and 2026 financial performance; our forecasted revenue per employee; the anticipated timing for the filing of the 2025 Form 10-K; expectations relating to the monolith panel and related JDA; expectations related to our contemplated acquisition of Cobalt, including that we expect to enter into binding definitive agreements and our expectations regarding the benefits of such acquisition; our expectations regarding the timing of and our ability to raise additional capital, including with respect to debt and equity deals currently in progress; expectations relating to the integration of Sunder Energy and Ambia Solar, and anticipated benefits of these acquisitions, the anticipated benefits of the Purelight salesforce acquisition; expectations and plans relating to further cost control efforts; expectations relating to forecasted revenue-to-employee metrics; our work to raise our P/S ratio; expectations relating to our cash balances. Actual results could differ materially from these forward-looking statements as a result of certain risks and uncertainties, including, without limitation, our ability to implement further headcount reductions and cost controls, our ability to integrate and operate the combined business with Sunder and Ambia, our ability to achieve the anticipated benefits of acquisitions (including Sunder, Ambia and Cobalt), our ability to raise capital and maintain expected cash balances, global market conditions, any adjustments, changes or revisions to our financial results arising from our financial closing procedures, the completion of our financial statements for 2025 and the filing of the related Form 10-K, and other risks and uncertainties applicable to our business. For additional information on these risks and uncertainties and other potential factors that could affect our business and financial results or cause actual results to differ from the results predicted, readers should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our annual report on Form 10-K filed with the SEC on April 30, 2025, our quarterly reports on Form 10-Q filed with the SEC and other documents that we have filed with, or will file with, the SEC. Such filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements in this press release speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and SunPower assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Preliminary and Unaudited Financial Results

The selected unaudited financial results for the Q4’25 and fiscal 2025 are preliminary and subject to our quarter and year-end accounting procedures. As a result, the financial results presented in this press release may change in connection with the finalization of our closing and reporting processes and financial statements for Q4’25 and fiscal 2025 and may not represent the actual financial results for such period. In addition, the information in this press release is not a comprehensive statement of our financial results for Q4’25 and fiscal 2025, should not be viewed as a substitute for financial statements prepared in accordance with generally accepted accounting principles, and are not necessarily indicative of our results for any future period.

Non-GAAP Financial Measures

In addition to providing financial measurements based on generally accepted accounting principles in the United States of America ("GAAP"), SunPower provides additional financial metrics in this press release that are not prepared in accordance with GAAP ("non-GAAP"). Management believes the non-GAAP financial measures in this press release, in addition to GAAP financial measures, are useful measures of operating performance because the non-GAAP financial measures do not include the impact of items that management does not consider indicative of SunPower’s operating performance, such as amortization of goodwill and expensing employee stock options in addition to accounting for their dilutive effect, which facilitates the analysis of SunPower’s core operating results across reporting periods. The non-GAAP financial measures do not replace the presentation of SunPower’s GAAP financial results and should only be used as a supplement to, not as a substitute for, SunPower’s financial results presented in accordance with GAAP. Descriptions of and reconciliations of the non-GAAP financial measures used in this press release are included in the financial table above and related footnotes. We encourage investors to carefully consider our preliminary results under GAAP, as well as our preliminary non-GAAP information and the reconciliations between these presentations, to more fully understand our business. Non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (PRELIMINARY) | |

| | | | | | | | | | | | | | | | | | | |

| (In Thousands) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | SUNPOWER INC. - AS REPORTED Unaudited | | SPWR - Unaudited | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Q1 2024 | | | Q2 2024 | | | Q3 2024 | | | Q4 2024 | | | Q1 2025 | | Q2 2025 | | | Q3 2025 | | | Q4 2025 | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| GAAP operating Income(loss) from continuing operations | | (7,544 | ) | | (9,494 | ) | | (29,970 | ) | | (21,501 | ) | | 1,042 | | (2,718 | ) | | (3,444 | ) | | (1,115 | ) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | Note | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | A | | 357 | | | 329 | | | 305 | | | 1,745 | | | 1,582 | | 1,419 | | | 1,293 | | | 1,942 | | |

| | | | | | | | | | | | | | | | | | | |

| Stock based compensation | B | | 1,341 | | | 1,229 | | | 1,516 | | | (1,019 | ) | | 314 | | 3,717 | | | 4,174 | | | 2,718 | | |

| | | | | | | | | | | | | | | | | | | |

| Restructuring charges | C | | 406 | | | 2,603 | | | 21,072 | | | 14,835 | | | - | | - | | | - | | | - | | |

| | | | | | | | | | | | | | | | | | | |

| Total of Non-GAAP adjustments | | | 2,104 | | | 4,161 | | | 22,893 | | | 15,561 | | | 1,896 | | 5,136 | | | 5,467 | | | 4,660 | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-GAAP net Income (loss) | | | (5,440 | ) | | (5,333 | ) | | (7,077 | ) | | (5,940 | ) | | 2,938 | | 2,418 | | | 2,023 | | | 3,545 | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Notes: | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| (A) | Depreciation and amortization: Depreciation and amortization related to capital expenditures.

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (B) | Stock-based compensation: Stock-based compensation relates to our equity incentive awards and for services paid in warrants. Stock-based compensation is a non-cash expense.

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (C) | Acquisition Costs: Costs primarily related to acquisition, headcount reductions (i.e. severence), legal, professional services (i.e. historical carveout audits) and due diligence.

| |

| | | | | | | | | | | | | | | | | | | |

Source: SunPower Inc.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e09bebd9-e69d-4e4d-9205-5263916b6da3

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa989ccf-0211-4d07-8c0f-167ffb712df8

https://www.globenewswire.com/NewsRoom/AttachmentNg/2586e534-5afa-4d05-a2c5-f915f79a5f77

https://www.globenewswire.com/NewsRoom/AttachmentNg/75550927-3c9f-46b8-9783-80da1489a7fb

https://www.globenewswire.com/NewsRoom/AttachmentNg/8600f9dc-bbbd-4753-ba93-e74ac88f20f9

https://www.globenewswire.com/NewsRoom/AttachmentNg/eafacd88-ca2d-472f-803e-f380aeb884ab

This press release was published by a CLEAR® Verified individual.

SunPower Non-GAAP Operating Income

SunPower Non-GAAP Operating Income

SPWR Sales Rep Headcount (1099) by Acquisition

Sales Rep Headcount (1099) by Acquisition

SunPower Direct W2 Employee Headcount

SunPower Direct W2 Employee Headcount

Full Time Direct Employee - Revenue Per Employee Per Year

Full Time Direct Employee - Revenue Per Employee Per Year

Market Capitalization to Revenue (P/S) Ratio

Market Capitalization to Revenue (P/S) Ratio

"Monolith" Panel

"Monolith" Panel

© 2026 Canjex Publishing Ltd. All rights reserved.