Vancouver, British Columbia--(Newsfile Corp. - January 26, 2026) - Cabral Gold Inc. (TSXV: CBR) (OTCQX: CBGZF) ("Cabral" or the "Company") is pleased to announce results from six additional diamond drill holes at the Jerimum Cima target within the Cuiú Cuiú Gold District, Brazil.

Highlights

- Drilling at the Jerimum Cima target returned 9.5m @ 5.74 g/t gold, 14.4m @ 0.62 g/t gold and 15.1m @ 1.04 g/t gold in hole DDH359 and has extended the eastern limit to the mineralized zone by 175m and the body remains open to the east. Gold mineralization at Jerimum Cima has now been traced over an E-W strike length of 750m

- In addition, DDH365 returned 3.8m @ 10.80 g/t including 0.5m @ 80.51 g/t. This was a reconnaissance hole drilled 250m southeast of DDH359 and cut a previously unrecognized high grade zone south-east of the main mineralized zone at Jerimum Cima

- Additional results include 2.0m @ 15.29 g/t gold from DDH355, and 0.5m @ 34.87 g/t gold and 0.6m @ 68.04 g/t gold in DDH356 from the current western limit of the Jerimum Cima target. The high-grade zones intersected in DDH356 were also previously unknown and are believed to be peripheral and parallel to the main mineralized zone

Alan Carter, Cabral's President and CEO, commented, "The Jerimum target is emerging as an important discovery at Cuiú Cuiú. These latest drill results are very encouraging and significant for two reasons: Firstly, they extend the main E-W trending mineralized zone by at least 175 meters to the east where it remains open and extends the current known strike length of the main zone to 750 meters. Secondly, the presence of several previously unrecognised narrow high-grade structures intersected in two reconnaissance holes drilled 600 meters apart and immediately south of the main mineralized zone, is also highly encouraging and augers well for the calculation of an initial resource in the primary material at Jerimum Cima.

"Jerimum Cima has a deep weathering profile to 70 meters depth and is characterized by a strong gold-in-soil geochemical anomaly that is comparable with the MG and Central and gold deposits. Not only do the drilling and trenching results thus far indicated the presence of an important gold-in-oxide blanket but also a significant underlying gold deposit in the primary intrusive rocks. Further drilling is planned and aimed at establishing the size of both the gold-in-oxide zone, and the underlying zones of primary mineralization in the intrusive rocks."

Brian Arkell, Vice President of Exploration and Technical Services, commented, "It's very exciting to drill out this recent discovery where we've now hit gold in drill holes over a strike length of 750 meters within a major fault zone at least 200 meters wide in places. We see potential improving to the east where the structure takes a major bend heading into the TZ fault. Currently we are flying detailed magnetics with our recently acquired drone system, as we continue diamond drilling, and we have plans to bring in a second rig soon."

Jerimum Cima Drill Results

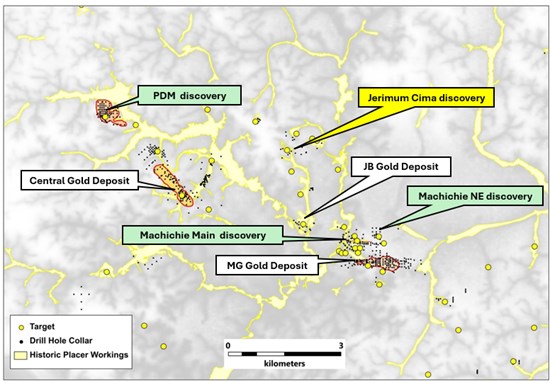

The Jerimum Cima target is located 3 kilometres ("km") ENE of the Central gold deposit and 3.5km NW of the MG gold deposit (Figure 1). The target is characterized by a very strong gold-in-soil anomaly of +100 parts per billion ("ppb") gold covering an area of 900 meters ("m") x 1000m and is comparable with the gold-in-soil anomalies above the MG and Central gold deposits, and the PDM and Machichie gold discoveries. As with the MG gold deposit and the Machichie Mian gold discovery, gold mineralization at Jerimum Cima is centered on a major east-west fault zone, which forms a splay off the regional scale Tocantinzinho fault system.

Previous reconnaissance drilling at Jerimum Cima returned 39m @ 5.1 grammes per tonne ("g/t") gold in primary intrusive rock material as well as 49m @ 2.0 g/t gold (see press release dated May 21, 2025). In addition, a number of surface trenches returned gold intercepts of very good grade in gold-in-oxide material, and include 14m @ 1.6 g/t gold, 20m @ 1.2 g/t gold, 10m @ 1.3 g/t gold, and 24m @ 0.7 g/t gold and 18m @ 1.9 g/t gold (see press release dated November 14, 2024).

Figure 1: Map showing location of known gold deposits at Central, MG and JB. The location of new discoveries at PDM, Machichie NE and Machichie Main as well as the Jerimum Cima discovery are also shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/281546_6a1d54e7943a4bf8_002full.jpg

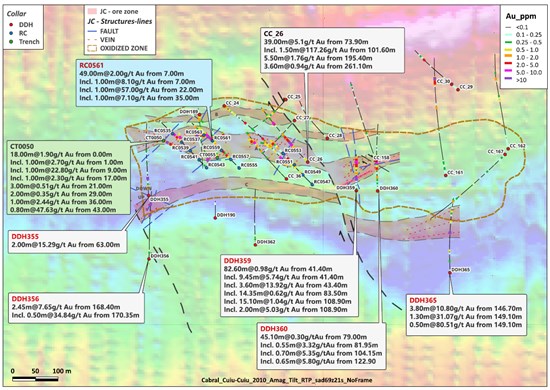

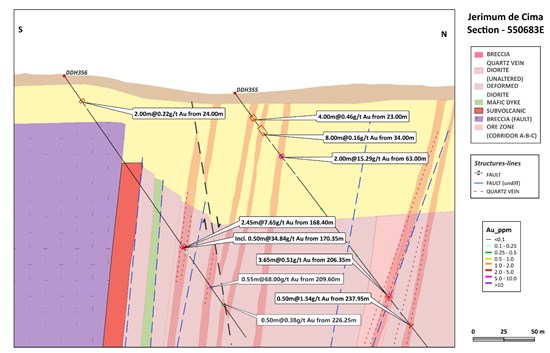

DDH355 and DDH356 were drilled on section 550683E on the western limit of the Jerimum Cima target. DDH355 was designed to test the western limit of the main mineralized zone (Figures 2 and 3) and intersected several mineralized intervals including 2.0m @ 15.29 g/t gold from 63.0m depth in saprolite (Table 1). The zone remains open to the west.

DDH356 was drilled directly south of DDH355 to test a magnetic low south of the main E-W mineralized trend and cut several mineralized intervals including 2.4m @ 7.65 g/t gold from 168.4m depth which includes 0.5m @ 34.87 g/t gold, and 0.6m @ 15.29 g/t gold from 63.0m depth. (Figures 2 and 3, Table 1). These narrow high-grade zones were previously unrecognized and are open in every direction. They may represent subordinate zones of high-grade mineralization which occur parallel to, and 125m south of the main mineralized zone.

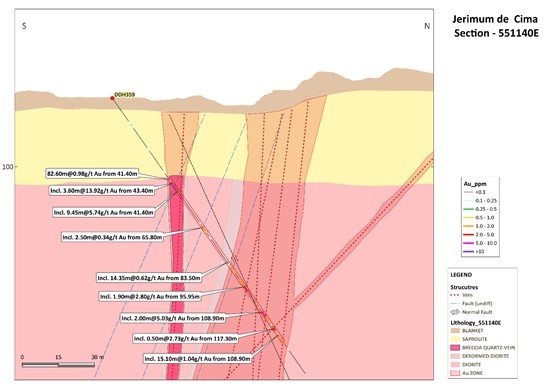

DDH359 and DDH360 were drilled on the eastern end of the main mineralized zone at Jerimum Cima near a cross-cutting NE trending fault zone which is interpreted to have displaced the main mineralized zone 50-100m to the south (Figure 2). DDH359 cut multiple mineralized intervals including 9.5m @ 5.74 g/t gold from 41.4m depth including 3.6m @ 13.92 g/t gold, 14.4m @ 0.62 g/t gold from 83.5m depth and 15.1m @ 1.04 g/t gold from 108.9m depth all in intrusive rocks (Figures 2 and 4, Table 1).

DDH360 was drilled 75m further to the east of DDH359 and similarly cut several mineralized intervals of lower grade including 45.1m @ 0.30 g/t gold in intrusive rocks from 79.0m depth including 0.5m @ 3.32 g/t gold, 0.7m @ 5.35 g/t gold and 0.6m @ 5.80 g/t gold (Figure 2, Table 1).

The presence of significant mineralization in both DDH359 and DDH360 at the eastern end of the known mineralized zone at Jerimum Cima is highly encouraging and extends the main mineralized zone an additional 175m to the west. The main mineralized zone has now been defined over a strike length of approximately 750m and remains open to both the east and the west.

DDH365 was drilled 250m southeast of DDH359 into the same broad magnetic low that sits south of the main mineralized zone at Jerimum Cima and was tested by DDH355 and DDH356 drilled 750m to the east. It was a reconnaissance hole and cut a highly altered zone within multiple intrusive rocks with a high-grade interval which returned 3.75m @ 10.80 g/t including 0.5m @ 80.51 g/t. This zone was previously unrecognized and may represent the eastward continuation of the high-grade zone cut by DDH355 which returned 2.0m @ 15.29 g/t gold. Additional drilling is planned.

Figure 2: Map showing the location of trenches and certain drill holes with airborne magnetic RTP data as background at the Jerimum Cima target. The location of diamond drill holes DDH355, 356, 359, 360, 362 and 365 are also shown together with previous significant drill and trench results including CC26 which cut 39m @ 5.1 g/t gold and RC561 which returned 49m @ 2.0 g/t gold. Note that three parallel mineralized zones in the underlying intrusive rocks have now been identified at Jerimum Cima extending over at least 750m E-W. The limit to the oxide banket as currently known is also shown. Terms: g/t = grams / tonne, m = metres, Au = gold. True widths may be 50% of actual drill intercepts.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/281546_6a1d54e7943a4bf8_003full.jpg

Figure 3: Cross section showing section 550683E at the Jerimum Cima discovery showing results from DDH355 and DDH356. DDH355 cut a previously unrecognised zone of high-grade mineralization 125m south of the main E-W trending mineralized zone at Jerimum Cima. The mineralized zone remains open to the east and west and down-dip. True widths may be 50% of actual drill intercepts. Terms: g/t = grams / tonne, m = metres, Au = gold

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/281546_6a1d54e7943a4bf8_004full.jpg

Figure 4: Cross section showing section 551140E at the Jerimum Cima discovery showing results from DDH359 which returned 9.5m @ 5.74 g/t gold, 14.4m @ 0.62 g/t gold and 15.1m @ 1.04 g/t gold and extends the main mineralized zone at Jerimum Cima towards the east. True widths may be 50% of actual drill intercepts. Terms: g/t = grams / tonne, m = metres, Au = gold

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3900/281546_6a1d54e7943a4bf8_005full.jpg

Table 1: Drill results from diamond drill holes DDH355, 356, 359, 360, 362 and 365, at the Jerimum Cima discovery. All of the diamond holes were drilled at a dip of 55 degrees on a bearing of 0 degrees. Terms: g/t = grams / tonne, m = metres, Au = gold, EOH = end of hole. True widths may be 50% of actual drill intercepts

| Drill Hole # | Weathering |

| From | To | Thickness | Grade |

|

|

| (m) | (m) | (m) | g/t gold |

| DDH355 | Saprolite |

| 23.0 | 27.0 | 4.0 | 0.46 |

|

|

| 34.0 | 42.0 | 8.0 | 0.16 |

|

|

| 63.0 | 65.0 | 2.0 | 15.29 |

| Intrusive rock |

| 206.4 | 210.0 | 3.7 | 0.51 |

|

|

| 238.0 | 238.5 | 0.5 | 1.54 |

|

| EOH 261.85 |

|

|

|

|

| DDH356 | Saprolite |

| 24.0 | 26.0 | 2.0 | 0.22 |

|

|

| 31.0 | 32.0 | 1.0 | 0.10 |

| Intrusive rock |

| 168.4 | 170.9 | 2.4 | 7.65 |

|

| incl. | 170.4 | 170.9 | 0.5 | 34.87 |

|

|

| 174.2 | 175.9 | 1.7 | 0.11 |

|

|

| 177.7 | 178.2 | 0.5 | 0.17 |

|

|

| 209.6 | 210.2 | 0.6 | 68.04 |

|

|

| 226.3 | 226.8 | 0.5 | 0.38 |

|

| EOH 259.55 |

|

|

|

|

| DDH359 | Saprolite |

| 5.3 | 6.0 | 0.7 | 0.43 |

| Intrusive rock |

| 41.4 | 124.0 | 82.6 | 0.98 |

|

| incl. | 41.4 | 50.9 | 9.5 | 5.74 |

|

| incl. | 43.4 | 47.0 | 3.6 | 13.92 |

|

| and | 65.8 | 68.3 | 2.5 | 0.35 |

|

| and | 83.5 | 97.9 | 14.4 | 0.62 |

|

| and | 96.0 | 97.9 | 1.9 | 2.80 |

|

| and | 104.2 | 104.7 | 0.5 | 0.83 |

|

| and | 108.9 | 124.0 | 15.1 | 1.04 |

|

| and | 108.9 | 110.9 | 2.0 | 5.03 |

|

| and | 117.3 | 117.8 | 0.5 | 2.73 |

|

| EOH 139.95 |

|

|

|

|

| DDH360 | Blanket |

| 1.0 | 4.0 | 3.0 | 0.17 |

| Saprolite |

| 11.0 | 12.0 | 1.0 | 0.23 |

|

|

| 22.0 | 22.0 | 0.0 | 0.14 |

|

|

| 27.0 | 32.0 | 5.0 | 0.18 |

|

|

| 39.0 | 42.0 | 3.0 | 0.13 |

|

|

| 47.0 | 50.0 | 3.0 | 0.70 |

|

|

| 65.0 | 66.0 | 1.0 | 0.20 |

| Intrusive rock |

| 79.0 | 124.1 | 45.1 | 0.30 |

|

| incl. | 82.0 | 82.5 | 0.5 | 3.32 |

|

| and | 104.2 | 104.9 | 0.7 | 5.35 |

|

| and | 122.9 | 123.6 | 0.6 | 5.80 |

|

|

| 150.7 | 151.7 | 1.0 | 0.19 |

|

|

| 162.4 | 163.6 | 1.3 | 0.13 |

|

|

| 202.0 | 203.4 | 1.4 | 0.25 |

|

| EOH 207.85 |

|

|

|

|

| DDH362 | Blanket |

| 0.0 | 1.2 | 1.2 | 0.15 |

| Saprolite |

| 8.0 | 9.0 | 1.0 | 0.13 |

|

|

| 18.0 | 19.0 | 1.0 | 0.20 |

|

|

| 21.0 | 23.0 | 2.0 | 0.29 |

|

|

| 35.0 | 36.0 | 1.0 | 0.13 |

| Intrusive rock |

| 77.0 | 79.0 | 2.0 | 0.16 |

|

|

| 172.7 | 173.4 | 0.7 | 0.74 |

|

| EOH 243.45 |

|

|

|

|

| DDH365 | Blanket |

| 6.3 | 8.8 | 2.5 | 0.13 |

| Saprolite |

| 42.2 | 45.1 | 2.9 | 0.27 |

| Intrusive rock |

| 73.1 | 73.7 | 0.6 | 0.13 |

|

|

| 84.0 | 84.5 | 0.5 | 0.63 |

|

|

| 146.7 | 150.4 | 3.8 | 10.80 |

|

| incl. | 149.1 | 150.4 | 1.3 | 31.07 |

|

| incl. | 149.1 | 149.6 | 0.5 | 80.51 |

|

|

| 185.6 | 186.1 | 0.5 | 0.16 |

|

|

| 189.3 | 190.3 | 1.0 | 0.42 |

|

|

| 210.8 | 211.3 | 0.5 | 0.11 |

|

|

| 217.8 | 218.7 | 0.8 | 0.27 |

|

|

| 224.1 | 224.8 | 0.8 | 0.51 |

|

|

| 236.3 | 236.8 | 0.5 | 0.10 |

|

|

| 263.3 | 264.0 | 0.6 | 0.37 |

|

| EOH 269.85 |

|

|

|

|

Grant of Options / RSU's

Cabral's Board of Directors has also approved the granting of stock options and Restricted Share Units ("RSU's") pursuant to the Equity Incentive Plan to 53 employees, directors and consultants to the Company. The stock options entitle the holders to purchase a total of 7,685,000 common shares in the capital stock of the Company at a price of $0.75 per common share and are exercisable for five years and are subject to vesting over 24 months. A total of 1,786,593 RSU's have also been granted with a one-year vesting period.

About Cabral Gold Inc.

The Company is a junior resource Company engaged in the identification, exploration, and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Three main gold deposits have so far been defined at the Cuiú Cuiú project which contain National Instrument ("NI") 43-101 compliant Indicated resources of 12.29Mt @ 1.14 g/t gold (450,200oz) in fresh basement material and 13.56Mt @ 0.50 g/t gold (216,182oz) in oxide material. The project also contains Inferred resources of 13.63Mt @ 1.04 g/t gold (455,100oz) in fresh basement material and 6.4Mt @ 0.34 g/t gold (70,569oz) in oxide material. The resource estimate for the primary material is based on the NI 43-101 technical report dated October 12, 2022. The resource estimate for the oxide material at PDM and MG is based on a NI 43-101 technical report dated October 21, 2024. The resource estimate for the oxide material at Central and Machichie is based on a NI43-101 technical report ("Updated PFS") dated July 29, 2025.

The Tapajós Gold Province is the site of the largest gold rush in Brazil's history which according to the ANM (Agência Nacional de Mineração or National Mining Agency of Brazil) produced an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

Quality Assurance / Quality Control

Cabral maintains a Quality Assurance / Quality Control ("QAQC") program for all its exploration projects using industry best practices. Key elements of the QAQC program include verifiable chain of custody for samples, regular insertion of certified reference materials, blanks, and duplicates, as well as check assays on results. RC samples are split, collected in plastic sample bags, and sealed on drill hole location. Drill core is halved by saw cut or slicer (in soft saprolite). RC and core samples are shipped in sealed bags by independent contractor to SGS GEOSOL Laboratorios in Vespasiano, Brazil, an independent analytical services provider with global certifications for Quality Management Systems (ISO 9001:2015 and ISO 14001:2015 (ABS Certificates 32982 and 39911) and ISO/IEC 17025:2017 accreditation (CRL-0386)). Gold analyses are routinely performed via 50g fire assay with secondary assay techniques applied on higher grade samples. Final assay results are validated by Cabral Geological Staff prior to insertion into the database. Additional information regarding the Company's data verification processes is set out in the CBR, 43-101, PFS Technical Report, July 2025, which can be found on the Company's website.

Qualified Person and Technical Information

Technical information included in this release was supervised and approved by Brian Arkell, B.S. Geology and M.S. Economic Geology, SME (Registered Member), AusIMM (Fellow) and SEG (Fellow), Cabral Gold's Vice President, Exploration and Technical Services, and a Qualified Person under NI 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively "forward-looking statements"). The use of the words "will", "expected" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281546

© 2026 Canjex Publishing Ltd. All rights reserved.