Vancouver, British Columbia--(Newsfile Corp. - January 20, 2026) - Daura Gold Corp. (TSXV: DGC) ("Daura" or the "Company") is pleased to announce the successful completion of 27 line-kilometers of Induced Polarization (IP) profiling at the Cerro Bayo Gold–Silver Project ("Cerro Bayo" or the "Project"), located in Santa Cruz Province, Argentina.

The completed IP program provides a robust geophysical framework that will be used to define and prioritize drill targets for the Company's planned Phase 1 drilling program totaling approximately 1,500 meters.

Key Project Highlights Include:

Completion of seven IP profiles across the project for an aggregated 27 line-kilometers of pole-dipole survey

The 7 profiles were sited over previously identified drill target areas to define targets for the Phase 1 drill program, slated to begin in mid-February

The IP responses aided in the delineation of structurally controlled zones interpreted to represent silicified veins and mineralizing conduits

Mark Sumner, CEO of Daura Gold commented: "The completion of seven Pole–Dipole IP survey lines marks an important milestone for Daura, providing valuable insight into the geometry and extent of potential mineralization across 15 priority targets within both our northern and southern target areas. The results have clearly delineated structurally controlled zones, which we interpret as potential mineralizing conduits and feeder structures. This data will play a key role in refining and prioritizing drill targets ahead of our planned Phase 1 drill program."

Cerro Bayo: Electrical Induced Polarization (IP) Surveys and Preparation for Drilling:

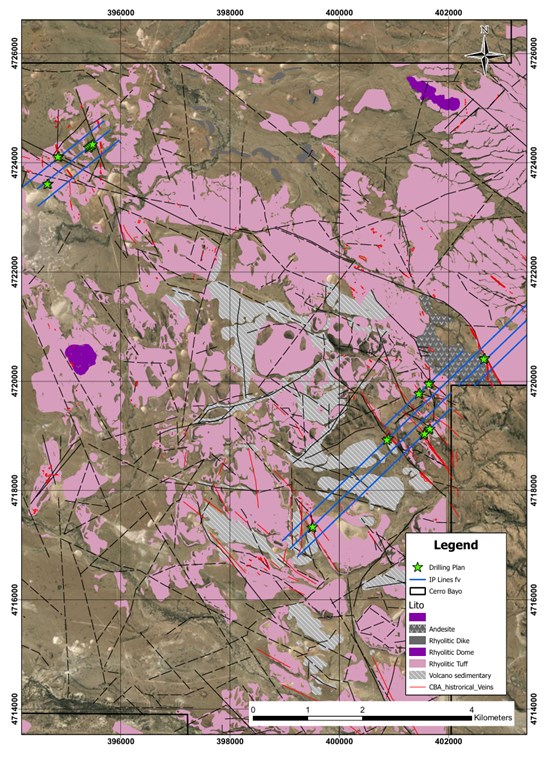

A Pole–Dipole IP profiling program has been completed, consisting of four lines in the southeastern area and three additional, shorter lines in the northwestern area, for a total of approximately 27 line-kilometers. 15 drill targets were generated from the integration of previous geochemical sampling and a Previous Gradient Array IP survey covering the southern area of the license area.

A Phase 1 program of 22 diamond drill holes for approximately 1,500m aims to test the 15 targets for approximately 1,500m diamond drilling. In the northern target area, three IP profile lines were completed and 8 drill targets have been identified, of which 3 targets will be tested with 8 diamond drill holes for 500m. In the southern area 7 drill targets will be tested with 14 drill holes for 1,000m of diamond drilling.

Figure 1. Phase 1 IP Pole – Dipole Profile survey lines spaced 200 m apart.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6523/280849_07377d315426ea74_001full.jpg

Next Steps

In parallel with the Q1, 2026 drill program, Daura has initiated a regional Gradient Array IP survey in the northern part of the license area. Results from this work will be integrated with existing geological and geochemical datasets to support the second phase of the drill program.

Awareness Campaign

Daura Gold has also entered into an awareness campaign service agreement (the "Service Agreement") with Resource Stock Digest ("RSD"), under the terms of which RSD will create in-depth reports on behalf of the Company and distribute such reports to its existing database. It will also purchase media to generate new interest in the Company, including display advertisements, native advertisements and email dedicated advertisements. The term of the Service Agreement is for one year starting February 1, 2026, with a one-time fee of US$100,000. All fees payable by the Company to RSD pursuant to the terms of the Service Agreement will be paid out of general working capital of the Company.

RSD is owned and operated by Nicholas Hodge and Gerardo Del Real and is based in Texas, USA. The Company and RSD act at arm's length, and RSD has no present interest, directly or indirectly, in the Company or its securities, or any right or present intent to acquire such an interest, except that Nicholas Hodge owns or controls 250,000 common shares of the Company ("Shares") and 250,000 Share purchase warrants.

The Service Agreement is subject to the approval of the TSX Venture Exchange (the "Exchange"). RSD has agreed to comply with all applicable securities laws and the policies of the Exchange in providing the services to the Company under the Service Agreement.

Qualified Person

Stuart Mills, QP, is the Company's Qualified Person as defined by NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release. Mr. Mills is not independent of the Company, as he is the Company's Vice President of Exploration.

ABOUT DAURA GOLD CORP.

Listed on the TSX Venture Exchange, Daura is exploring in Peru and Argentina.

In Peru, Daura is advancing high-impact exploration projects in Peru's renowned Ancash region, where it owns a 100% undivided interest in over 15,900 hectares of exploration concessions in Ancash, including the 900-hectare Antonella target and the 2,900-hectares of contiguous concessions at Libelulas, which is the primary focus of Daura's current exploration efforts.

In Argentina, Daura have entered into a binding Letter Agreement with Latin Metals Inc., for the right to earn up to an 80 % interest in the Cerro Bayo / La Flora Project. The project is located within the prolific Deseado Massif that hosts more than 30 mines and advanced exploration projects, including Newmont's Cerro Negro Mine, Hochschild/McEwen's San Jose Mine, and Patagonia Gold's Cap Oeste Mine. Cerro Bayo / La Flora are advantageously positioned within this world-class mining region, with strong community support and well-developed logistics.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

Information set forth in this news release contains forward-looking statements. These statements reflect management's current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Daura cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond Daura's control. Such factors include, among other things: future prices and the supply of gold and other precious and other metals; future demand for gold and other valuable metals; inability to raise the money necessary to incur the expenditures required to retain and advance the property; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; risks of the mineral exploration industry; delays in obtaining governmental approvals; adverse weather conditions and failure to obtain necessary regulatory or shareholder approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Daura disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280849

© 2026 Canjex Publishing Ltd. All rights reserved.